Reply To:

Name - Reply Comment

Last Updated : 2024-05-21 17:21:00

Sri Lanka Customs

All imported and exported goods brought into Sri Lanka are regulated by the Customs Ordinance. The Director General of Customs has been authorised to enforce this ordinance. The Customs Ordinance grants the authority to impose customs duties on imported and exported goods. Additionally, it delegates the power to collect VAT, cess, and other taxes. This article has been prepared based on a discussion with Sudath De Silva, Senior Director and Media Spokesperson of Customs.

Gold and mobile phones smuggled into the country by MP Ali Sabri Raheem

Powers of the Customs Ordinance

The Customs Ordinance prohibits and restricts certain goods from being brought into Sri Lanka, in accordance with the country’s laws. It is the responsibility of customs to prevent the entry of such goods. However, some individuals choose to violate this law. The Customs Ordinance specifies the penalties for such offenses. Those who comply with tax regulations and import appropriate goods face no issues. On the other hand, those who break the law commit an offense under the Customs Ordinance, and the necessary measures against them are also outlined in the ordinance.

Penalties for customs offenses are imposed by customs

Customs duties are imposed in accordance with Section 10 of the Customs Ordinance. Prohibited and restricted goods are governed by Section 12 of the Customs Ordinance. Customs is responsible for operating as per these provisions. The Sri Lanka Customs enforces the law by imposing penalties on individuals who violate these regulations and by making arrests. Customs has the authority to investigate offenses related to customs. Custom officers have the power to arrest individuals, conduct body searches, seize vehicles or goods, and question individuals.

The fine imposed on this individual was around 100%. But a 10% fine was imposed on MP Raheem. The fines and punishment depends on the discretion of the Customs officer appointed by the Customs Director General to handle the case. Since he failed to pay the fine he was produced at the Negombo Magistrate Court

- Sudath De Silva Customs media spokesperson

Individuals arrested by customs do not appear in court

When customs officials apprehend suspects, they are not presented before a court. Under the authority granted by Section 8 of the Customs Ordinance, the Director General of Customs can initiate an inquiry against the accused to see if he or she has committed an offense. An officer appointed by the Director General of Customs, who holds the rank of Deputy Director General or higher, questions both customs officials and the accused party. The accused may also have legal representation present including President’s counsels. These inquiries are conducted similarly to a case being heard in a magistrate’s court. On concluding the investigation, the officer conducting the inquiry has the power to release the individual if found innocent. If the person is found guilty, the officer can confiscate the goods and impose a fine.

Determining the increase or decrease of fines

If an offense is committed by a passenger, the goods they brought can be confiscated under Section 107A. In addition to the confiscation, additional fines or further confiscation may be imposed under Article 129. In the case of further confiscation, the penalty can amount to three times the value of the goods or a fine of 100,000 rupees, at the discretion of the inspector.

According to Section 166B of the Customs Ordinance, fines imposed on individuals found guilty must not exceed the appropriate level. In that case, an additional loss of three times the value of the goods will not be imposed. The Customs Ordinance outlines the implementation of Section 166B, stating that the amount of tax lost to the government due to an individual’s offense should be calculated. Accordingly, it should be considered whether the offense was intentional and any additional concerns should be addressed. This approach recognises the importance of businesses for the country’s economy. If a businessperson is punished for a wrongdoing, they may not be able to continue as a law-abiding citizen and pay taxes. Instead, the punishment should be similar to disciplining a child who has made a mistake, starting with a warning and gradually increasing severity. The Customs Ordinance does not allow for the destruction of a person’s business after a mistake has been made.

The customs law is a comprehensive and well-thought-out legislation. Customs inspector imposed punishments that he deems satisfactory. Illegally imported goods are confiscated, causing a financial loss to the person. Additionally, fines that are three times the value of the goods or amounting to 100,000 rupees can be detrimental to some businesses, potentially leading to their collapse. It is important for the fine to have a significant impact on the individual. To address this, the Director General of Customs has the authority, under Section 163, to reduce the fines imposed under Section 129. If the fine remains unpaid, the concerned person has the option to appeal to the minister responsible for the subject. The Customs Ordinance empowers the minister to grant relief to goods under Sections 164 and 165.

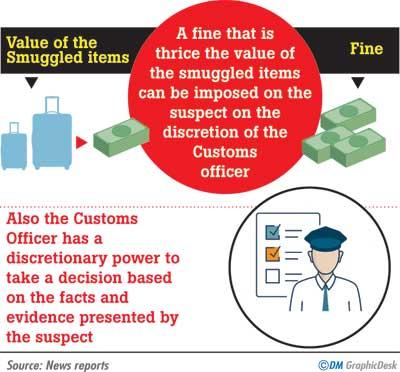

One is the usual punishment given. Secondly, a fine that is thrice the value of the smuggled items can be imposed on the suspect on the discretion of the Customs officer. Thirdly, the Customs Officer has a discretionary power to take a decision based on the facts and evidence presented by the suspect. Therefore as per section 166 of the Ordinance, the Officer has the power to reduce the fine

- Prof. Prathiba Mahanamahewa

Fine imposed on MP Ali Sabri Raheem

During the investigation of MP Ali Sabri Raheem, his goods were confiscated under Section 107A. Subsequently, the three times fine imposed under Section 129 was reduced under Section 163. MP Ali Sabri Raheem is not a businessman. I have no answer to your question whether there are any relaxations in fines for someone who misused the VIP terminal. That question should be answered by the investigating officer. In the past 10 years, when looking at investigations related to gold, the fines imposed were within the range that could be paid. MP Ali Sabri Raheem was not given any special treatment. The fine was imposed according to the established procedure.

Gold smuggling involves individuals other than legitimate gold business owners

Legitimate owners of gold businesses do not engage in or support gold smuggling activities. However, there are individuals who are willing to take risks when it comes to smuggling gold worth millions of rupees. These businessmen often involve others in their fraudulent schemes. These contracted individuals are apprehended by customs authorities when attempting to illegally import gold. Upon confiscating the smuggled goods, fines are imposed on these individuals. They are like Natamis (labourers) and they are unable to pay the three-fold fines.

Consequences for non-payment of fines

If an individual fails to pay a fine, a case is filed in the District Court under Section 145 of the Customs Ordinance. In such cases, another property owned by the person is sold to settle the outstanding fine. If the person does not possess any property, they will be brought before the Magistrate’s Court and prosecuted under Section 146. If found guilty they may face imprisonment.

MP Ali Sabri Raheem was fined 7 million rupees as the value of the goods he brought amounted to 78 million rupees. He incurred a loss of more than 85 million rupees. The government received a gold reserve.

Decisions and double standards of Customs Officers

While MP Ali Sabri Raheem was released on a 10% fine for the gold items he smuggled in, another incident of smuggled gold was reported from Katunayake. On June 6, Sri Lanka customs arrested a French national who arrived in Sri Lanka from Paris on the UL 501 flight. Officers of the Gem and Jewellery Valuation Division of Sri Lanka Customs had apprehended the individual who had been carrying gold biscuits and jewellery in his luggage weighing over 4.611 kilos worth over Rs. 85 million.

Once the French national was taken into custody, the Customs Director General filed a case against him. In conclusion a Rs. 70 million fine was imposed on the suspect. Both MP Ali Sabri Raheem and this French national committed the same crime. The weight and value of the smuggled gold in both cases too are similar. MP Ali Sabri Raheem smuggled 3.99 kilograms of gold and 79 mobile phones worth Rs. 78 million. The fine imposed on MP Raheem was Rs. 7.5 million which is 10% of the value of items he smuggled into the country.

But the Customs officers imposed a 100% fine on the French national. Since he failed to pay this fine the Customs Officers produced him at the Negombo Magistrate Court. According to

|

MP-Ali-Sabri-Raheem |

the Customs Ordinance, any item that is smuggled into the country will be confiscated as per clause 107 A. Section 129 states that a fine of Rs. 100,000 or a fine three times more than the value of smuggled items could be imposed on the suspect. The Ordinance further states that under section 166B, the Customs Director General can exercise his powers to make changes to the fine under Section 163. As such, the Customs Officers calculated the worth of items smuggled in by MP Raheem, multiplied by 3 and brought the total fine to 10%. However the Customs officials claim that they applied the same formula to the fine imposed on the French national as well.

“Therefore the fine imposed on this individual was around 100%”-Sudath De Silva

When inquired Customs media spokesperson Sudath De Silva opined that the French national was fined following clauses 107A, 129 and 166 of the Customs Ordinance. “Therefore the fine imposed on this individual was around 100%. But a 10% fine was imposed on MP Raheem. The fines and punishment depends on the discretion of the Customs officer appointed by the Customs Director General to handle the case. Since he failed to pay the fine he was produced at the Negombo Magistrate Court,” explained De Silva.

“For example, a murder convict would be given a death sentence or lifelong imprisonment or 20 years rigorous imprisonment depending on the evidence and facts presented. This is a similar situation. We cannot challenge this decision. If required you can inquire from the Customs Director General,” he said. . But Mr. Silva said that the Director General cannot be contacted as he is currently overseas.

President Ranil Wickremesinghe raised this matter in Parliament recently and requested the Speaker in writing to carry out an impartial investigation on why two punishments were given for committing a similar crime. When inquired from retired Customs officials they denied making comments on the Customs Ordinance and requested the writer to speak to the Director General.

“A natural justice investigation should be conducted by the investigating Customs officer”- Prof. Mahanamahewa

On June 6, Sri Lanka customs arrested a French national who arrived in Sri Lanka carrying gold biscuits and jewellery in his luggage

In his comments, Prof. Prathiba Mahanamahewa said that as per the Customs Ordinance there are three ways in which a person can be punished when smuggling gold into the country. “One is the usual punishment given. Secondly, a fine that is thrice the value of the smuggled items can be imposed on the suspect on the discretion of the Customs officer. Thirdly, the Customs Officer has a discretionary power to take a decision based on the facts and evidence presented by the suspect. Therefore as per section 166 of the Ordinance, the Officer has the power to reduce the fine. Out of these three types of punishments they imposed a minimum fine on MP Raheem. Since it became a controversial decision, the Customs Director General announced that a suspect apprehended for smuggling gold or any item into the country would be imposed a fine that is thrice the value of the

smuggled items.

“Since two punishments were given to the same crime as per the orders of the Customs Director General, one party will have their human rights violated. Section 12 of the 1978 Constitution states that all citizens should be treated fairly and equally. In that case an investigation needs to be conducted based on the principals of natural justice. A natural justice investigation should be conducted by the investigating Customs officer. But with new orders given by the Customs Director General the investigating officer cannot use his discretionary power. Therefore the maximum fine has to be imposed.

Constitution states that all citizens should be treated fairly and equally. In that case an investigation needs to be conducted based on the principals of natural justice. A natural justice investigation should be conducted by the investigating Customs officer. But with new orders given by the Customs Director General the investigating officer cannot use his discretionary power. Therefore the maximum fine has to be imposed.

“In this case, human rights have been violated. If the punishments differ for a similar crime, the individual’s human rights will be violated as per section 12 of the 1978 Constitution. All new regulations were introduced following MP Raheem’s case. This shows that section 12 of the Constitution has been violated again. No individual should receive preferential treatment based on political reasons. In this case the French national can file a lawsuit challenging the decision to punish him. The case can be filed against the discretionary power of the Customs Officer and the new regulations introduced by the Customs Director General. The French national can write to the Human Rights Commission or file a case at the Supreme Court,” said Prof. Mahanamahewa.

The new regulations were introduced by the Customs Director General following MP Raheem’s incident. While Customs officials should be appreciated for confiscating smuggled items, it is unfortunate that two different fines and two different punishments were given for a similar crime. Hereafter, any suspect caught with smuggled items has to pay a fine thrice the value of the smuggled items. But it seems that the Customs Director General has only informed his officers about these new regulations, ignoring the public.

Tissa Fernando Wednesday, 21 June 2023 05:53 PM

It appears that the Customs ordinance has been created in such a way to flex the muscle of the individual custom officers who take can take massive bribes for enforcement of lower fines. The French was given a bigger fine because there was probably no opportunity to take a massive bribe from him. Custom officers live in massive mansions and drive luxury cars just after 3 years from joining the customs .Similar ranked officers in other government institutions are riding in public transport even after 40 to 50 years of service. So, what is the secret? Every one knows the secret and every one wants to be in the Customs. Ha ha.

Mahila Saturday, 24 June 2023 02:46 PM

If my recollection is correct, the customs Officers are paid a percentage of the Fine accrued to the state on Customs detection those officers were involved in successfully!!?? That's an incentive payment!!! That is in addition to their Salary!!??? Not always bribery, and all officers shouldn’t be tainted with corruption!!!l Unlike the Politicians and Bureaucrats, who demand 10-20% from possible Investors when they visit Sri Lanka and having dinner at 5 star Hotels, before approval is given!!!! Kill the proverbial Goose, before it lays the ‘GOLDEN EGG’!!!???

UMAS ALI Thursday, 29 June 2023 02:36 PM

MY NEIGHBOUR IN NEGOMBO IS A RETIRED CUSTOM OFFICEr AND HE HAS A 2 STOREY MANSION AND 2 BENZ CARS

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

The state-run loss-making State Mortgage & Investment Bank (SMIB) has reveale

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

20 May 2024 - 0 - 182

7 hours ago