Reply To:

Name - Reply Comment

Last Updated : 2024-04-16 15:06:00

The Ceylon Petroleum Corporation (CPC) is a fully State-owned enterprise that engages in the selling and distribution of fuel in Sri Lanka.

The Ceylon Petroleum Corporation (CPC) is a fully State-owned enterprise that engages in the selling and distribution of fuel in Sri Lanka.

The CPC controls 86 percent of market share in the retail petroleum sector.At the end of 2020, the CPC’s debts amounted to Rs. 529 billion – among the highest levels of debt for a state-owned enterprise in Sri Lanka.

Meanwhile, the cumulative net loss of the corporation was Rs. 326 billion at the end of 2018. This is likely to increase further in 2020 as there was an additional loss of Rs. 9 billion in 2019 and 2020. By contrast, Lanka IOC –which also sells and distributes fuel to the retail market in Sri Lanka –made profits every year in the last 10 years, except for 2018.

IOC also had positive retained earnings of Rs. 11.8 billion as at the end March 2020. This raises an important question as to why the CPC could not make profits,while its competitor that charged similar fuel prices, was profitable.

This Insight shows that the CPC has been operationally profitable in the past. However, the recorded accumulated lossescan be entirely attributed to poor treasury and financial management, which is reflected ininterest costs, and large exchange rate losses.

CPC operationally profitable

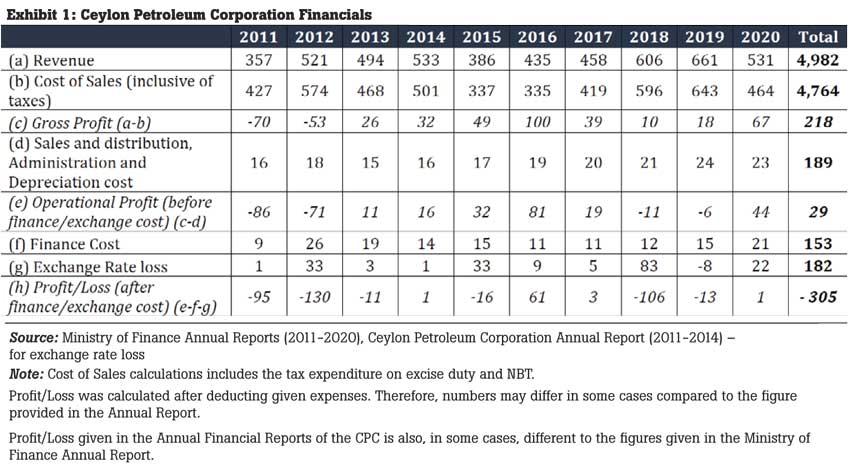

Data from the Ministry of Finance show that the CPC made gross profits every year since 2013. That is, the revenue exceeded the cost of sales including taxes (see Exhibit 1). Over the last 10 years, the CPC recorded a gross profit of Rs. 281 billion. Therefore, the CPC’s losses cannot be attributed to selling fuel at a price lower than its cost plus tax.

Even when including operational costs related to salesand distribution, administration, and depreciation, the CPC still made profitsin most years. The accumulated operational profit amounted to Rs. 29 billion over the last 10 years (2011–2020). Therefore, the substantial accumulated losses cannot be explained by the addition of operational overheads, nor by capital depreciation costs.

CPC’s net profit mainly hindered by exchange rate loss and interest cost

The CPC’s losses materialise when finance costs and exchange rate losses are included in the income statement. Costs arising from finance charges and exchange rate losses add up to Rs. 335 billion over the last 10 years. The accumulated loss— estimated to be Rs. 335 billion up to 2020 —can be attributed to

these costs.

Details on exchange rate loss

The CPC’s exchange rate losses arise out of a currency mismatch in its balance sheet. The corporation has trade receivables predominantly denominated in Sri Lankan rupees.

As at 2018, 70 percent of the Rs. 86 billion in trade receivables were denominated in Sri Lankan rupees, and 30 percent were in foreign currency. Trade receivables as at December 2018 primarily arise from (i) Sri Lankan Airlines—Rs. 25. 6 billion, (ii) Ceylon Electricity Board—Rs. 47.6 billion, (iii) Independent Power Producers (IPPs)— Rs. 6.7 billion, and (iv) the armed forces—Rs. 0.82 billion.

However, the CPC’s current liabilities are mainly denominated in foreign currency.It has foreign bills payable to the amount

of Rs. 245 billion.

It also has US dollar-denominated short term bank loans from People’s Bank and the Bank of Ceylon amounting to Rs. 295 billion (backed by a treasury guarantee of US$ 1, 800 million). These loans are used to finance import bills payable to suppliers.

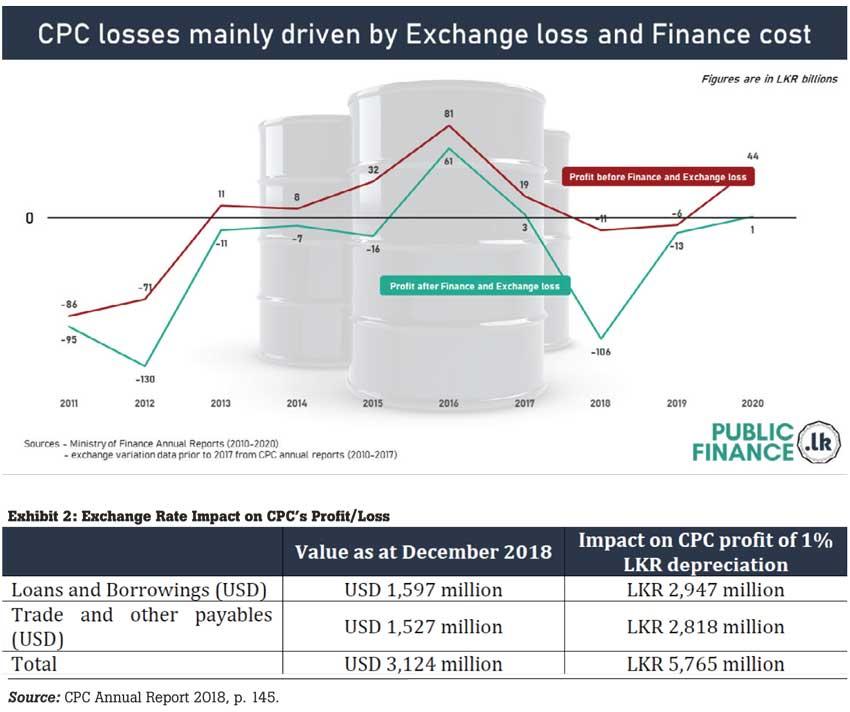

Given the currency mismatch between current assets and current liabilities, every time the Sri Lankan rupee depreciates against the US dollar, there is a significant adverse impact on CPC’s financials, which are reflected in the income statement as a loss to the corporation. For example, when the rupee depreciates by 1 percent in a year, the profit to CPC reduces by Rs. 5,765 million considering the value of liabilities at the end of 2018.

Conclusion

Reducing State-owned enterprises’ (SOEs) financial losses are key to improving the overall fiscal position of the country. In some instances, SOE losses have been justified as necessary for providing goods and services at concessionary pricing to the public.

In the case of the CPC, it is evident that financial losses do not arisefrom concessionary pricing to consumers. Instead, the CPC’sweak treasury and financial management has resulted in a significant loss withoutaccruing benefitsto the public.

(Verité Research is an independent think-tank based in Colombo that provides strategic analysis to high level decision-makers in economics, law, politics and media. Comments are welcome. Email publications@veriteresearch.org)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

09 Apr 2024 - 1 - 1168

10 Apr 2024

09 Apr 2024