Reply To:

Name - Reply Comment

Last Updated : 2024-04-26 20:44:00

Points out govt.’s debt overhang left limited fiscal space for public investment and increased financial market stress

In the absence of an International Monetary Fund (IMF) -backed programme to address the country’s worsening debt dynamics, Sri Lanka’s economic growth prospects are forecasted to falter, according to the research arm of global bank, Standard Chartered (StanChart). StanChart projects Sri Lanka’s economic growth to fall below the government target and potential, stabilising at 4.5 percent in mid-term, after rebounding to 3.8 percent this year from the 4 percent estimated contraction last year.

“If Sri Lanka meets its external financing requirements via reserves, and continues with its current policies of import suppression and yield curve control, this could exacerbate its economic challenges and weigh on the eventual recovery,” StanChart said in its recent Credit Alert titled ‘Sri Lanka - Coming down to the wire,’while highlighting that external financing as the key near-term challenge for the country.It pointed out that the government is in fact suppressing growth by resorting to interest rate and capital controls to manage the current debt crisis, in the absence of an IMF-backed credible debt

management strategy.

“The extended use of such strategies would weigh on growth by suppressing the import multiplier and causing capital flight via the current account, putting further pressure on the exchange rate. Moreover, rising global commodity prices and UST yields pose challenges to CBSL’s yield curve control strategy,” it said. StanChart noted that country’s foreign exchange reserves declined to US$ 4.8 billion (around three months of import payments) as of January this year, from US$ 5.7 billion in December 2020 due to debt servicing.

Foreign exchange reserves were estimated to have further dwindled to US$ 4.5 billion following the settlement of India’s US$ 400 million swap line early this month.

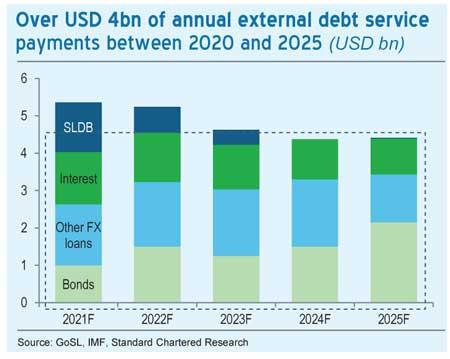

The government’s external debt service amounts to US$ 4 billion (US$ 1.3 billion of interest and US$ 2.7 billion of principal service) in 2021. Further, it has US$ 1.3 billion of Sri Lanka Development Bond (SLDB) maturities to be funded.

Following the rating downgrades by all three international credit rating agencies due to poor debt dynamics, the government plans to meet most external debt servicing via bilateral credit flows. StanChart expects Sri Lanka to end this year with foreign reserves of US$ 4 billion if the country secures US$ 3.5 billion in bi-lateral credit lines to finance external debt servicing, and attracts US$ 800 million in FDI inflows.

The Central Bank recently said discussions were ongoing with the People Bank of China (PBoC) to secure US$1.5 billion swap line. StanChart cautioned that a delay in confirmation of the US$ 1.5 billion PBoC swap line could raise investor concerns.

“However, if strong FDI and debt inflows from China do not materialise, reserves could dip below two months of import cover (US$ 3bn), which would put Sri Lanka in a difficult situation,” StanChart warned.

Despite likely strong nominal GDP growth this year, StanChart also cautioned that Sri Lanka’s government debt (including public-sector debt guaranteed by the government) could rise to 110.5 percent this year from estimated 105 percent of GDP at end-2020.

Further, it estimated the interest costs of the government to have reached record levels at 6.3 percent of GDP, or 70 percent of revenue in 2020.

Although, interest costs are expected to fall to around 5.8 percent of GDP (or 55 percent of revenue) this year, StanChart stressed that it still remains at unsustainable levels for the country impacting growth prospects.

“The government’s debt overhang has left limited fiscal space for public investment and increased financial market stress. While growth could be supported in the near term by base effects and exogenous factors, strong long-term growth will require investment, which the government’s current debt load does not allow for,” it pointed out.

While the Central Bank expects the economic growth to return to 6 percent similar to the post-war period under the government’s alternative policy, StanChart is of the opinion that growth could only reach 4.5 percent in the medium-term under the current policy framework. “Our estimates suggest that the government needs to run a primary surplus of 2 percent of GDP or more to stabilise debt; this seems challenging in the near term given the current revenue strategy and the muted growth outlook,” it pointed out. Therefore, StanChart believes that IMF engagement to be necessary to resolve Sri Lanka’s economic and debt sustainability challenges.

“While a structural reform programme would improve debt sustainability only in the medium term, engagement with the IMF would give investors comfort that the government is on the economic reform path. An IMF programme would also likely unlock other multilateral assistance,” it elaborated.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

3 hours ago

4 hours ago