Reply To:

Name - Reply Comment

Last Updated : 2024-05-29 10:23:00

The Monetary Board, as the custodian of the Employment Provident Fund (EPF), yesterday announced that it has considered the options available and has decided to opt for the Debt Exchange offer with a long-term view in the best interest of the members of the Fund. Accordingly, the EPF tendered Rs. 2,667,512,169,237 face value of Treasury Bonds for Debt Exchange, including an additional Rs. 149,890,740,000 in excess of the minimum participation requirement considering its comparative benefits to the Fund. The government has accepted the same and issued new Treasury Bonds to EPF with an equivalent face value.

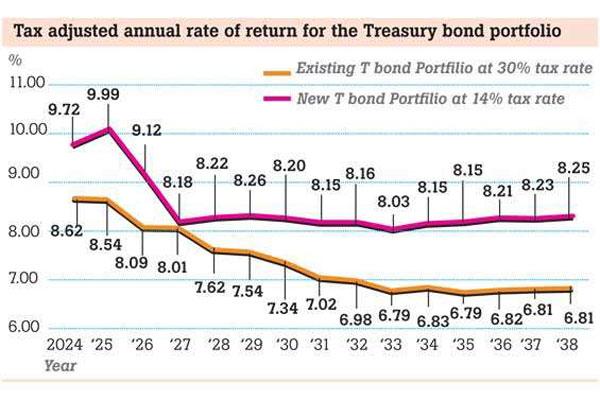

As per the Exchange Memorandum, the following two options were available for EPF under the DDO programme; the Exchange Option, where the EPF would continue to pay income tax at 14 percent per annum on its taxable income’ and the Non-Exchange Option, where if EPF decides not to exchange the existing Treasury bonds a 30 percent tax rate would apply to the taxable income of EPF’s Treasury bond portfolio. In a statement to the media, the Central Bank shared details on the factors/ considerations that were taken into account when making the decision regarding EPF’s participation in the Treasury bond exchange under DDO.

“The Monetary Board envisaged that out of the two options, Debt Exchange is distinctly the better option considering the assessments that have been carried out on the basis of several prudent and realistic assumptions,” the statement highlighted. Further, the Monetary Board stressed that it is of the view that with the proposed Debt Exchange and the other reforms being implemented by the government, the sustainability of public finance will be restored with its ability to service its debt.

“The Monetary Board was also cognizant that unless debt sustainability is restored without undue delay, there is high risk of the government not being in a position to fully service the obligations on the pre-exchange bonds held by the EPF leading to very serious adverse consequences to the EPF,” it added. Therefore, opting for the DDO was in the best interest of the members of EPF based on the two options available, given that a large share of EPF’s assets is invested in Treasury bonds, the Monetary Board said. The Monetary Board went on to assert that after the participation in DDO, the current balances of EPF members will not be reduced and the Fund will be able to distribute at minimum 9 percent per annum return to members in the foreseeable future.

The Ministry of Finance has identified the conversion/exchange of existing Treasury bonds of superannuation funds into new Treasury bonds to constitute the DDO, to avoid superannuation funds incurring a substantially higher tax of 30 percent on taxable income from Treasury bond investments.

This tax will be applied from 01 October 2023, as per the Inland Revenue (Amendment) Act, No. 14 of 2023.

At present, the tax rate applicable to the income of the EPF including the income from Treasury bonds is 14 percent. The continuation of a concessionary tax rate of 14 percent beyond 30 September 2023 is contingent upon the effective participation of the EPF in the DDO as defined in the Act.

Sivalingam Friday, 15 September 2023 08:00 AM

Nandalal EPF scammer, Mahendran BOND scammer.

Kandiah Balendran Friday, 15 September 2023 08:01 AM

Nandalal was the deputy of Arjuna Mahendran during the Bond scams.

Quo vadis Friday, 15 September 2023 08:02 AM

They hit the working mans fund.

Onlooker Friday, 15 September 2023 10:14 AM

Monetary Board and Central Bank are in it together like brothers in crime. Essentially both are the same. So no wonder.

EPF should not have minimum participation requirement Friday, 15 September 2023 10:15 AM

EPF is ruined, so retirement benefits of many are being ruined by these tricks. The minimum participation requirement is wrong and should never have happened. The minimum participation requirement is a devil's trick on it, and the Central Bank is doing unfair towards the superannuation fund by making it get more Government Bonds than legally necessary even. Country or persons retirement options slowly going down the drain with the Central Bank, in hand with the government now wanting to take EPF contributions for even poorer people, which they will then make worth less than if the contributor had kept it in a bank account.

SLEx Friday, 15 September 2023 11:16 AM

There is literally no effect on the current fund. The only effect is that the returns are reduced to 9%. Everyone is crying foul, but have been enjoying the perks of subsidised utilities on the backs of Private companies and tax paying employees for 70 years. Stop being so spoilt and learn to cut down and be self sufficient. Go learn more skills and find getter paying jobs to afford the true costs of commodities in the market without crying for government subsidies.

Kandy Whip Friday, 15 September 2023 05:38 PM

In a bankrupt country if people don't get monthly salary cuts and don't get their investments and income from investments reduced as haircut then we need to applaud the government which running the country

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

For a long time, accusations have been made against Urban Development and Hou

The state-run loss-making State Mortgage & Investment Bank (SMIB) has reveale

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal