Reply To:

Name - Reply Comment

Last Updated : 2024-04-26 20:37:00

A stock market is one of the most vigorous sectors that plays an important role in contributing to the wealth of the economy. There is a strong positive relationship between stock market development and economic growth. On the one hand, stock markets are expected to accelerate household wealth creation by providing individuals with additional financial instruments that may better meet their risk preferences and liquidity needs. On the other hand, stock markets play an even more pivotal role in economic development.

A stock market predominantly promotes efficient mobilization of savings towards investments and thereby generates economic growth. Differently stated, it assists to allocate the necessary capital needed for the consistent growth of the economy. It is in this light that the stock market acts as a barometer for economic development.

Investors spend most of their time looking out for opportunities that could maximize their returns in the market. Seldom do they realize that their investment decisions and behaviour in the market would collectively contribute to the growth saga of the country. Hence, it is timely to infer into the salient role of the stock market. The nexus between stock markets and economic growth is indeed complex. However, the article would focus on a few pivotal factors that require the attention of investors.

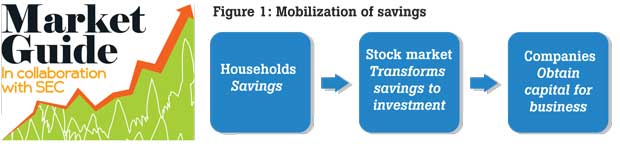

Mobilization of savings

Savings is seen as the core process by which all other aspects of growth is made possible. It is also an important prerequisite for capital accumulation and stock market development. Yet, savings will be able to accelerate economic growth in a considerable manner only if the savings are mobilized to efficient investment projects.

The stock market acts as a platform that creates a conducive environment to direct savings to the most efficient investments in a country. Market infrastructure and the existing legal framework in the market promote key attributes (transparency, accountability) required for efficient mobilization of savings. A nation that adopts prudent economic policy as the foundation for development will definitely entail a growing appetite to boost investment via the stock market. It will be an ideal financial tool to attract foreign direct investments and integrate with international markets.

Low-cost capital formation

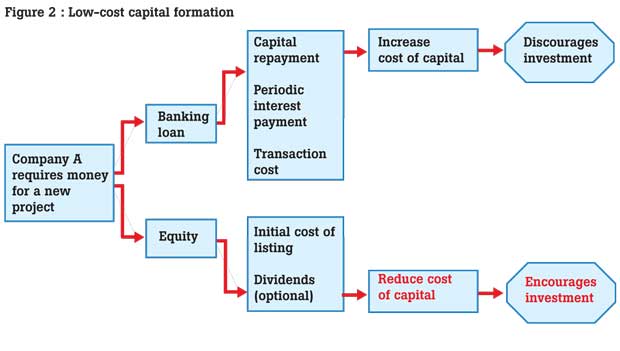

What do we mean by capital formation? Capital formation is the net addition to the existing stock of capital in the economy. In a capitalist economic framework, capital is the prime driver of economic development. It is noteworthy that stock markets are recognized as cost-effective avenues of generating capital.

Let’s explain it with an example. Imagine that company ‘B’ wants to start on a profitable venture and is currently on the watch to raise capital. He may opt for a traditional mode of obtaining a long-term loan from a lending institution. Loans require both capital and interest repayment. It will increase the cost of investment and reduce the appetite of undertaking the new business.

In comparison, raising capital through the capital market is less costly. The company may only have to incur the preliminary cost involved in listing and pay dividends to its shareholders based on its financial position if desired by the management. Many countries, especially in the South Asian region, focus on increasing gross domestic product (GDP) by boosting government expenditure due to the absence of private investments. It is needless to say that stock markets would be an ideal financial instrument to foster private investment.

Efficient price discovery mechanism

Efficient stock markets facilitate access to information. All exchanges entail rules on mandatory disclosure requirements. Listed companies are legally bound to share material information that will be used in investment decision-making. Information that would usually be in the private domain and inaccessible to the public will be brought to the public domain through a stock market. Access to information promotes an efficient price discovery mechanism and better allocation of funds among corporations.

What do we mean by efficient price discovery? Price discovery is a method of determining the price for a specific security through basic supply and demand factors that are shaped by market sensitive information. In theory, efficient price discovery enables investors to evaluate the intrinsic value of stocks and avoid over valued stocks. Further on, it is believed that an efficient price discovery mechanism would contribute towards strengthening investor confidence.

Greater dispersion of risk

Countries are usually over dependent on the banking sector. Sri Lanka is no exception. Sri Lankans both corporate and households turn towards the banking sector for their financial needs. A country could be much more resilient during times of crisis if risk is dispersed between the money market and capital market.

Equitable wealth distribution

A capital market encourages broader share ownership of productive companies. This promotes equitable ownership of a country’s wealth. Investors are given an opportunity of having a stake in well-performing companies. Similarly listed companies are accountable to the public. Thus, these companies incorporate healthy ruling practices (corporate governance) and it would bring about investor confidence in the corporate sector.

The market also acts as a gateway for the public to have a stake in government assets provided government/semi government institutions are listed.

This could increase the productivity of the government sector. It is impressive to witness the initiatives taken by the government to increase the public stake of certain government institutions with the aim of increasing productivity.

Vote of investor confidence

It was discussed how the stock market acts as a barometer for economic performance. A well-performing market increases investor confidence which would facilitate the inflow of portfolio investments. The stock market affects GDP primarily by influencing financial conditions and consumer confidence. When stocks are in a bull market, there tends to be a great deal of optimism surrounding the economy. This confidence spills over into consumption, which leads to increased sales and earnings for corporations, boosting GDP.

A caveat: Need for liquid capital markets

The salient role of stock markets in accelerating growth is well established. Yet, the pressing dilemma is to question why the local stock market is unable to be a pragmatic and robust driver of growth.

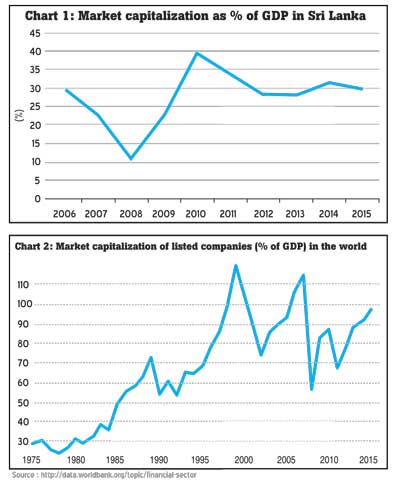

Data reveals that market capitalization as a percentage of GDP (it is the percentage of GDP that represents stock market value) in Sri Lanka has remained lower than 40 percent for a prolonged period of time. In comparison, market capitalization of listed companies (percent of GDP) in the world stipulates a healthier trend. The contribution of equity (world) to the world GDP was recorded above 50 percent for the past

30 years. Low liquidity is a painstaking impediment towards maintaining an efficient market in Sri Lanka. The market for a stock is said to be liquid if the shares can be rapidly sold and the act of selling has little impact on the stock’s price. Liquidity is a crucial factor taken to account when foreign investors consider the Colombo Stock Exchange as a suitable investment.

Addressing liquidity may require certain underlying changes in the market. It is suggested that liquidity could be increased by attracting local and international institutional investors, increasing the number of listings and by investing in market infrastructure.

The Securities and Exchange Commission of Sri Lanka is at present spearheading certain pragmatic initiatives geared at developing the market while addressing the existing impediments. These policy initiatives could be identified as follows:

Amending the Securities and Exchange Commission of Sri Lanka Act No. 36 of 1987 as amended by Act No. 26 of 1991, Act No. 18 of 2003 and Act No. 47 of 2009. The amendments are expected to encapsulate rapid changes required for a robust market.

Demutualization of the Colombo Stock Exchange. Demutualization is expected to increase visibility and accountability in the market.

Introduction of the Central Counterparty System with the aim of minimizing risk.

Further on, the government of Sri Lanka is currently exploring the avenues of enabling the public to obtain a stake in government entities through the stock market. It is expected to increase productivity in the government sector and have a positive impact on the market. Creating an efficient market is indeed ambitious but achievable. It requires a long-term policy framework coupled with a suitable macro, political and socio-economic environment.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

2 hours ago

4 hours ago