Reply To:

Name - Reply Comment

Last Updated : 2024-04-29 22:32:00

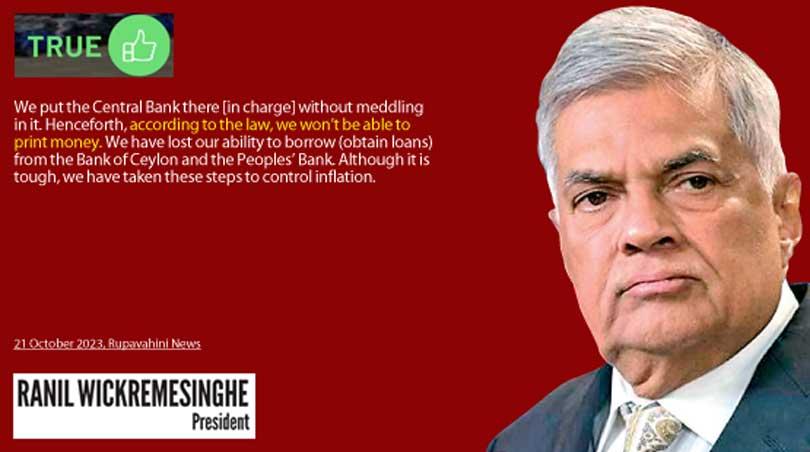

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

In a past fact-check, Central Bank (CBSL) Governor Dr. Nandalal Weerasinghe referred to the amount of “money printed” in the country as being equivalent to the change in the amount of “reserve money”. This statement was verified by FactCheck.lk as correct. In popular media and non-technical usage, however, the term “money printing” is often used to refer to the more limited activity of “monetary financing” of the budget. Monetary financing is one part of the technical definition of “money printing” referred to above. It excludes other means of increasing reserve money, such as lending to the private sector and purchasing foreign assets.

To assess the president’s claim, FactCheck.lk interpreted his use of the term “money printing” in its non-technical sense as referring to “monetary financing”.

Sections 86 and 127 of the recent CBA23 constrains the CBSL from monetary financing in three ways:

(1) prohibits extending credit to the government or government-owned entities (with some exceptions for exigent circumstances)

(2) prohibits purchasing government or government-owned entity securities in the primary market (with secondary market purchases constrained not to circumvent this prohibition)

(3) limits providing provisional advances to the government to the first month of the financial year (up to 10% of the previous year’s revenue)

However, a transitional provision (s.128) in CBA23 allows the CBSL to purchase government securities in the primary market for 18 months from the operational date of the CBA23. Nevertheless, there is a countervailing commitment in the current programme with the IMF, which limits the CBSL from providing net credit to the government to LKR 2,740 billion by December 2023.

Monetary financing is constrained by (a) prohibitions 1 and 2 by CBA23, (b) the limited advances allowed by CBA23 that were only accessible in January, and (c) the transitional provision in monetary financing being nullified by the CBSL already being at the LKR 2.74 trillion IMF programme limit.

Therefore, the president is correct in asserting that it is not possible to secure any further monetary financing (until January 2024).

Therefore, we classify the above statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

Percy Wijenayake Thursday, 09 November 2023 05:27 PM

Money printing is no solution to the present crisis. All Sri Lankans must unite in wiping out corruption, tip off the tax dodgers and the lazy public servants.

Mary Wednesday, 27 December 2023 11:29 AM

@Percy: I fully agree - but I suspect that there are many Sri Lankans (if not the majority), who are not in favour of digitalisation, paying more taxes etc. There are many that earn, and don't declare what they earn. From someone who sells in a Pola, to a three wheeler - to the ultra wealthy who have their companies registered elsewhere and avoid paying the due taxes. Everyone needs to pay tax - like in other countries, but the amount must be proportionate to how much they earn (with a minimum salary established which is exempt from tax). If such a proposal is even mentioned - how receptive do you think the population will be? I think we both know the answer. It would appear that many have been living in what I would call an extended honey moon period. Where they had more spending power - because of ridiculously low income tax and VATs. Now that the different taxes are being increased (so as to be able to cover the running costs of the country) people are complaining.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul