Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 20:38:00

The annual budget for year 2022 presented in parliament on November 12, 2021 by Finance Minister (FM) Basil Rajapaksa was wholly condemned at its second reading by Dr, Harsha de Silva MP based on his economic learning. Young “social activists” were also making fun out of the budget presentation on social media promoting their anti-Rajapaksa memes. They apart, there are mixed and critical observations in Colombo middle-class circles as with all budgets adopted in the past.

The annual budget for year 2022 presented in parliament on November 12, 2021 by Finance Minister (FM) Basil Rajapaksa was wholly condemned at its second reading by Dr, Harsha de Silva MP based on his economic learning. Young “social activists” were also making fun out of the budget presentation on social media promoting their anti-Rajapaksa memes. They apart, there are mixed and critical observations in Colombo middle-class circles as with all budgets adopted in the past.

This budget has several proposals for new taxes and tax increases to improve revenue by about 45% in year 2022, that some observe as ambitious beyond imagination. They seem to feel these proposals would not help increase revenue and claim that “tax cuts as well as the attempt to keep rates down despite the deficit has led to cascading policy errors involving import controls, exchange controls and forex surrender requirements as well as the seeking of credit lines for consumption imports which tend to push up external debt.” (Economy Next – 15 November 2021)

Some nevertheless seem to think, there is domestic demand led growth accommodated in the budget at macro level. There are also those who appreciate FM’s remarks on the crisis and on the failure of the State as very realistic. The FM made these remarks listing 05 “major issues” as 1. The richer becoming richer while the poor becomes poorer 2. Slow progress in achieving SDGs 3. Environmental catastrophes 4. Limitations in bi-lateral and multi-lateral assistance and then 5. the challenge of reaching the post-COVID “new normal”.

Some nevertheless seem to think, there is domestic demand led growth accommodated in the budget at macro level. There are also those who appreciate FM’s remarks on the crisis and on the failure of the State as very realistic. The FM made these remarks listing 05 “major issues” as 1. The richer becoming richer while the poor becomes poorer 2. Slow progress in achieving SDGs 3. Environmental catastrophes 4. Limitations in bi-lateral and multi-lateral assistance and then 5. the challenge of reaching the post-COVID “new normal”.

Are we going to accept that argument after 40 years of total failure? Do we want to continue with this free market economy when the FM accepts a “recurring fiscal deficit resulted in the creation of an unbearable stock of debt” over the past years?

Faced with these challenges, the FM said we have “10 strengths” that can meet those issues successfully. All of which don’t have to be “fact checked” for the truth is in the open. Sadly, he then follows with a long list of “failures” that prove we neither have the strengths he is proud of, nor have a “developmental vision and a programme” to face those challenges. Sadly too, critics of this budget do not question the logic of funding projects in an economy that in FM’s own words have borne a “recurring fiscal deficit resulted in the creation of an unbearable stock of debt. The debt to GDP ratio exceeded 100% for the first time during the period 1988-89 due to the island wide insurgency and terrorist activities. The debt to GDP ratio exceeded 100% again several times during the period 1998 to 2004.” While he attributes the debt going beyond 100 percent in 1988-90 period to JVP insurgency, no reasons were given for the much longer period when debt raced beyond 100% during 1998-2004.

This trend of accumulating debt beyond bearable levels posed serious difficulties and problems to successive governments in budgeting finances annually other than by borrowing more. Debt kept increasing with funding required to bridge the gap between income generation and expenditure incurred during the year. Basil Rajapaksa stressed on this in his maiden budget speech when he said, “It is a fact that every government since the independence has pursued a deficit budget policy. This deficit, which was about 6% of the national income in the 1960s, has exceeded 10% from time to time from 1978. During the period 2010-2018, this has been around 7% and again has exceeded 10%.”

It was pressure from IMF and this harrowing budget deficit that compelled the UNP government of Ranil Wickramasinghe to present in parliament in year 2002 and adopt Act No.3 of 2003 in January titled “Fiscal Management (Responsibility) Act”. Forgotten by its architects too, it is a unique piece of legislation that sets benchmarks on budget deficits and lays down responsibilities and objectives to “Ensure that the financial strategy of the Government is based on Principles of Responsible Fiscal Management and to facilitate public scrutiny of fiscal policy and performance”.

Thus, the Act lays down a legal barrier in continuing with ever-growing budget deficits and debts. It says, the government should adhere to, “reduction of government debt to prudent levels, by ensuring that the budget deficit at the end of the year 2006, shall not exceed five per centum of the estimated gross domestic product and to ensure that such levels be maintained thereafter.” (Section 03(a) of Act) in honouring objectives that define “responsible financial management”. And that is “law of the land” now.

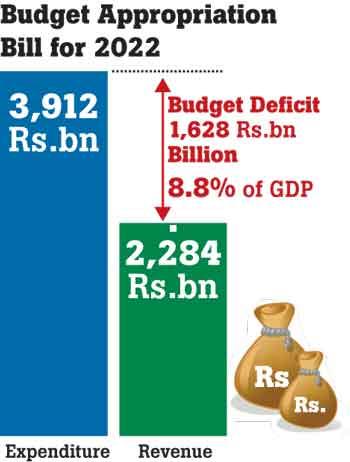

The Act again says, the government is responsible for “03(c) adoption of policies relating to spending which do not increase government debt to excessive levels”. From what FM Basil Rajapaksa read out in parliament, while the deficit has exceeded 10% from time to time from 1978, during the second term of President Rajapaksa from 2010 January and during the tenure of Wickramasinghe as PM from 2015 January to end 2019, the “Fiscal Management (Responsibility) Act No.3 of 2003 had been openly violated with deficits been around 7% and then exceeding 10%. His own budget for 2022 has a deficit of 9.8% with an imaginary income of over 12% of the GDP. In fact, the debt percentage of 9.8% is worked out with a heavily bloated income of Rs. 2,274 billion, up 46% from Rs. 1,556 billion in 2021. It only means, if the expected revenue had been realistically calculated, the debt percentage in this budget could be well over 12%.

Since 2004 these two main coalitions in government have together for 17 years violated the “Fiscal Management (Responsibility) Act” with no objections and opposition from any quarter. Even civil and human rights campaigners and activists in Colombo who register their presence over any trivial issue, have not bothered to stand against this serious violation for 17 years, that had dumped massive loads of debts on citizens and generations to come.

Accumulation of debt began with Jayawardne’s free market economy from 1978. When he threw open the economy for import – export trade, Sri Lanka’s debt in 1977 was a mere 1.1 billion USD on current rate. From there it rose to US$ 5.6 billion by 2019. Roughly, from US$ 1,000 million in 1977 to 56,000 million in 2019. During the past two years of this government it has increased further, with COVID-19 also having a role in disrupting the economy.

Two inter-locked issues arise from this. First, providing tax concessions, tax rebates, tax holidays and waivers since 1978 to bring in “Foreign Direct Investments” (FDI) have proved a total fraud. Export oriented manufacture left dependent on FDIs has not provided even half the import trade cost anytime during the past 40 years. And to say they would bring more income, if more benefits and concessions are given, is a bigger lie than even the debt accrued.

Are we going to accept that argument after 40 years of total failure? Do we want to continue with this free market economy when the FM accepts a “recurring fiscal deficit resulted in the creation of an unbearable stock of debt” over the past years?

We need to now accept this free market economy with FDIs deciding the size of their profits, leads to all mega and minor corruption at every level of socio-political life. Accept we need to talk in terms of a new economic model now. One that could generate an income within our “national economy” geared for national development on our own priorities.

The second factor that comes immediately linked to the first is, these budgets have to be publicly challenged on provisions of the Act No.03 of year 2003, the “Fiscal Management (Responsibility) Act”. This budget would be illegal with a 9.8% deficit that violates Sections 03(a) and (c) with total disregard for Sections 10 and 11 of the Act.

The call therefore has to be to amend awfully wasteful and meaningless allocations like Rs.5,000 million for shifting small and medium scale industries to rural areas with no identification of facilities and logistics required, Rs.42,063 million for GN divisions for village development, Rs.19,668 million for LG bodies also for rural development, Rs.3,375 million allocated to all 225 MPs topping their annual De-centralised Budget allocations for “district development” when legislators should never handle finances, Rs.19,894 million to all Divisional and District Secretariats for rural development and another Rs.85,000 million for “Gama Samaga Pilisandara” (Discussion with the Village) for village development. Without the De-centralised Budget allocations counted, there is a total Rs.175,000 million allocated for the same unidentified and unplanned “rural development” through different agencies that no doubt would be pilfered away by henchmen.

Thus, to sum up this short essay, these budgets do not demand analysing any more. They have not been of any benefit for People all these 40 plus years and they will not, within this free market economy. Governments should be stopped from heaping massive debts on People for the “Corrupt” to loot and pilfer public funds. People have to therefore compel the government to amend the budget and adhere to the “Fiscal Management (Responsibility) Act” No.03 of 2003 to make the first turnaround for rational budgeting. To adopt it as it is, will be a continuation of an illegal tradition of national budgeting.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul