Reply To:

Name - Reply Comment

Last Updated : 2024-04-16 21:36:00

Impact to be mixed on banks

Increasing fiscal deficit, reducing liquidity in the market, exchange rate pressure, US rate hike and inflationary expectations are likely to exert upward pressure on domestic interest rates during 2016.

Increasing fiscal deficit, reducing liquidity in the market, exchange rate pressure, US rate hike and inflationary expectations are likely to exert upward pressure on domestic interest rates during 2016.

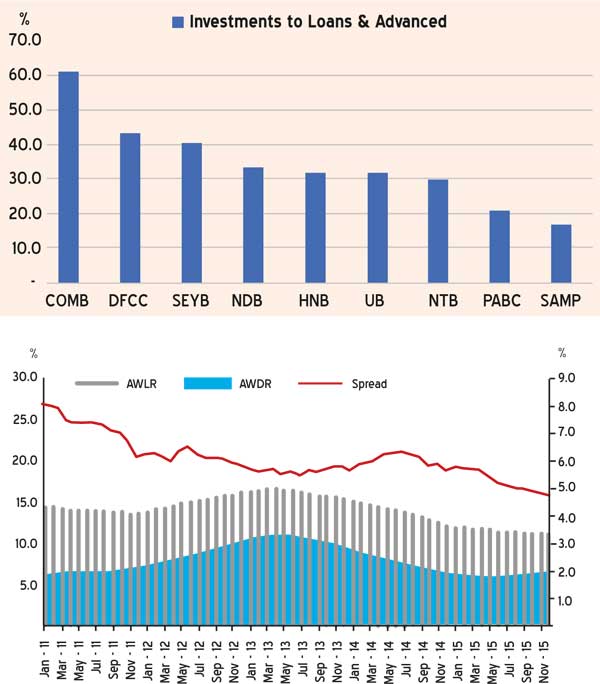

As per the latest available data from Central Bank of Sri Lanka (CBSL), average weighted lending rates of banks had started to rise in December 2015 by 4 basis points over the previous month to 11 percent. This was vis-à-vis average lending rates witnessing a downward slope since May 2013.

However more pressure was seen on deposit rates with liquidity constraints in the market, where average weighted deposit rates continued to rise for the fourth consecutive month in January 2016 by 6 basis points to 6.26 percent.

Shrinking rate spreads have already resulted in diminishing net interest margins for commercial banks. Average spreads were on a downward slope since July 2014 (6.4 percent) and narrowed to 4.8 percent in

December 2015. Rise in interest rates is expected to cushion net interest margins of banks. But this improvement could only be towards the latter part of the year. A policy rate hike is also

largely expected.

Strategies such as maintaining a lag between the revision of lending and deposit rates by the local banks have been successful in the past. Further, increased taxes by Budget 2016 and changing regulations by the Central Bank will also push the banks to improve margins, in order to mitigate pressure on profitability.

However, on a negative note, increasing rates will have a negative impact on banks’ investment portfolio, which mainly consists of government securities and listed equities. Increasing domestic rates will generally affect the share market performance while government securities such as treasury bills and bonds will incur fair value or trading losses.

Banks such as Sampath Bank which hold short term treasury bills will have relatively a low impact while other banks invested in longer term treasury bonds may see relatively a higher loss.

However, the banks who have categorized its investment as ‘available for sales’ (AFS) will be able to avoid the loss to income statement by holding treasuries until the maturity.

But banks such as Nations Trust Bank (NTB) which allocated its bond investments as ‘held for trading’ will be on a negative side where the mark-to-market losses related to the bond portfolio required to be recognized into the profit and loss account immediately.

Despite the loss evading option, banks such as Commercial Bank which has invested heavily in government securities are vulnerable to report significant losses if bonds were traded before maturity.

(The writer is a Research Manager at a leading Colombo-based stockbrokerage)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024