Reply To:

Name - Reply Comment

Last Updated : 2024-05-22 23:16:00

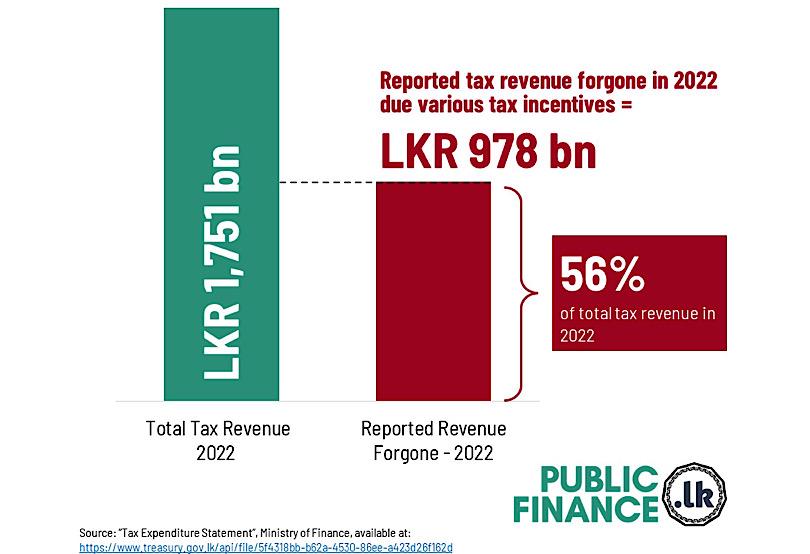

Colombo, April 01 - For the fiscal year 2022/23 (April to March), tax concessions resulted in a total of LKR 978 billion in foregone revenue, the government reported yesterday (31 March).

The foregone revenue amounts to 56% of the total tax revenue collected by the government in 2022.

This was highlighted by PublicFinance.lk, Sri Lanka’s premier economic insights platform, maintained by Verité Research.

The source was a document titled “Tax Expenditure Statement” published on March 31, 2024 by the Ministry of Finance of Sri Lanka.

The document reports the government’s estimates of the total revenue foregone due to various special targeted tax concessions provided by the country. The disclosure states its purpose as “to improve transparency in Sri Lanka’s financial reporting, aligned with international best practices”.

The government also committed in the IMF programme to publish on a semi-annual basis “a list of all firms receiving tax exemptions through the Board of Investment and the SDP [Strategic Development Projects Act], and an estimation of the value of the tax exemption”.

Gabriella Monday, 01 April 2024 10:01 PM

Geez !!! Stop whining, it’s only 978 million. My grocery bill exceeded this amount last week.

Grocery Bill Monday, 01 April 2024 11:07 PM

:) 978 billion, not million; but still… I am bigger than that.

Tissa Fernando Monday, 01 April 2024 11:09 PM

Your weekly Groceries cost 978 millions. ? What are you eating these days? By the way it is 978 billions as per news article.

Gt Tuesday, 02 April 2024 12:52 AM

978billion all concessions given to friends and family of politicians

Onlooker Tuesday, 02 April 2024 05:31 AM

Geez. You may have bought over the entire ownership of the supermarket for that price.

Mahila Wednesday, 03 April 2024 07:29 AM

Sovereign "Gold BISCUITS" soaked in 'AQUA REGIA', to soften them!!!??

Jude Tuesday, 02 April 2024 12:26 AM

NOT even a fraction of what Rajapaksa family stole!!!

Ram Tuesday, 02 April 2024 02:20 AM

This is a huge concession given to the rich. Investigate the Finance Minister and the officials behind the decision and have them charged in court. The culprits must not be allowed to escape

Rex Jarkie Tuesday, 02 April 2024 05:36 AM

tax the senior citizen tax from lively hood income their small FDS SAME

Sambo Tuesday, 02 April 2024 07:43 AM

This is called friendship revenue between the politicians and the importer.

Nirmal Tuesday, 02 April 2024 08:37 AM

Sirge Keruwawa.....

Moon Walker Tuesday, 02 April 2024 09:17 AM

Ok then what other attractions or benefits are available for investors to invest in Sri Lanka.

joshua Tuesday, 02 April 2024 09:18 AM

Tax concessions will cost a country. Any fellow knows it. You need to weigh the benefits we got by availing these concessions, rather than looking at it as layman who does not understand the pros and cons.

Jackie Tuesday, 02 April 2024 09:25 AM

Does this include exporter's tax revenue?

Who are you lying to Tuesday, 02 April 2024 09:32 AM

Ensure recovery of unpaid taxes and fraudulent debts amounting to 904 billion from wealthy businessmen. Additionally, address losses incurred from contractor profit income sharing projects, particularly in mining and quarry operations on government lands, such as those involving Maga Engineering (with a debt of 650 million) and Basil Rohana Rajapaksha. It is imperative to scrutinize the ethical implications when cabinet ministers are involved as contractors and justify the decision to grant a 75% waiver on owed sums to the government. Furthermore, prioritize the retrieval of funds owed by individuals like Daya Gamage and Dammika Perera to banks. Accountability is paramount; those responsible should face legal consequences to uphold justice and alleviate the burden on taxpayers.

Dilshan Tuesday, 02 April 2024 09:46 AM

who received these tax concessions? certainly not me and people like me on a salary, we have been paying taxes through our orifices with nothing in return

Premalal Perera Tuesday, 02 April 2024 01:23 PM

Who got these consessions and why?

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

For a long time, accusations have been made against Urban Development and Hou

The state-run loss-making State Mortgage & Investment Bank (SMIB) has reveale

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal