Reply To:

Name - Reply Comment

Last Updated : 2024-04-27 04:40:00

The rise in interest rates and the resulting slowdown in the economy could increase the banking sector bad loans marginally but will not be a major concern for the sector stability, according to a banking sector report by a Colombo-based

The rise in interest rates and the resulting slowdown in the economy could increase the banking sector bad loans marginally but will not be a major concern for the sector stability, according to a banking sector report by a Colombo-based

stock brokerage.

“With interest rates on the rise and economic activity slowing down (forecast GDP growth of 5.1 percent for 2016) we might see a marginal increase in NPL, however it would not be a major concern,” said Softlogic Stockbrokers (Private) Limited in a sector note issued last week.

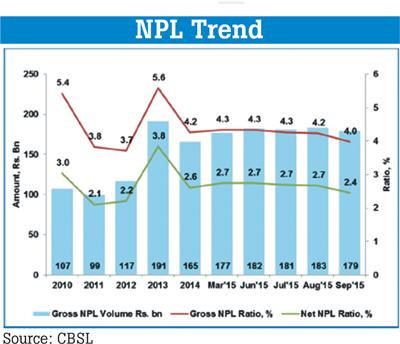

Sri Lanka’s banking sector asset quality improved through 2014 and 2015 as the sector gross non-performing loan (NPL) ratio declined to 4.2 percent by end-September 2015, the Central Bank data showed.

However, it is a common phenomenon for NPLs to go up when the interest rates increase as the floating rate borrowers find tough to service their loans amid falling real incomes.

In a similar situation when the Sri Lankan authorities raised interest rates in 2012 to arrest an overheated economy due to cheap bank credit, the banking sector NPLs reached a peak of 5.6 percent in 2013 (see illustration).

Softlogic’s analysis however observed the two state banks – Bank of Ceylon and People’s Bank – recording an increase in their NPLs as of September 30, 2015, while the others recording an improvement.

Bank of Ceylon’s gross NPL ratio rose to 4.3 percent from 3.8 percent a year ago while People’s Bank’s NPL ratio edged up to 3.3 percent from 3.2 percent a

year ago.

Both banks have a greater exposure to government and state-owned enterprise sector of their assets.

Meanwhile, the stockbrokerage believes the banks would sustain net interest margins (NIM) in the first quarter in 2016 at the current levels before seeing an increase from the second quarter onwards.

The latest Central Bank data up to the September quarter of 2015 show an average NIM of 3.6 percent.

Since the beginning of the year, the banks have been re-pricing both its loans and deposits upwards in response to the hike in reserve requirement and the subsequent increase in key policy rates, which created a liquidity crunch in

the market.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul