21 Mar 2019 - {{hitsCtrl.values.hits}}

On 12 January 2019, The Island newspaper quoted the following statement made by MP Mahinda Rajapaksa:

“In the past four years, the UNP-led government has borrowed the equivalent of 50% of the total national debt that was outstanding as at the end of December 2014 from the loans taken in the six decades after gaining independence in February 1948.”

An analysis of the data shows that MP Rajapaksa is incorrect about this claim.

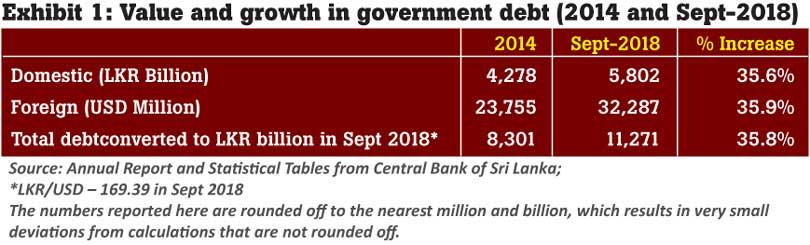

Exhibit 1 shows, in both LKR and USD, the total domestic and foreign debt as at end of 2014 (end of Mr. Rajapaksa’s presidency) and also at the end of Sept-2018 (the latest month for which data was available at the time Mr. Rajapaksa made the statement). Our calculations show that the increase in total outstanding debt accumulated under the current government was 35.9 per cent of the total national debt as at December 2014, and not 50 per cent, as claimed by MP Rajapaksa.

Thus, we have categorised MP Rajapaksa’s statement as FALSE.

This is an extract from a fact check published on www.factcheck.lk. FactCheck is platform run by Verité Research. For feedback, please write to [email protected].

Right of Reply from NATA

The National Authority on Tobacco and Alcohol wishes to respond to the article in your esteemed newspaper on 14th March under Fact Check titled, “Minister of Health overestimates....”, to clarify the situation with regard to taxation of cigarettes.

The Minister of Health has been working continuously to reduce tobacco consumption as a key public health measure despite heavy resistance from the tobacco trade. We have succeeded in setting in place one of the most comprehensive tobacco control laws in the world. We have obtained Cabinet approval to further strengthen this law, bringing in new restrictions for smoking in public places, tobacco sales near schools and introducing plain packaging.

Taxation is one of the most effective ways of reducing tobacco consumption. When the tax on cigarettes is increased, the consumption drops as affordability is reduced particularly among the young and the poor, but the government income increases as the reduction in smoking is usually a fraction of the tax increase.

The Ministry has been steadfastly lobbying to keep increasing the taxes on cigarettes, to bring the tax component to 90% of the price of a cigarette. With this objective, the Ministry of Health has since 2015 recommended to the Cabinet tax increases based on this percentage and the tax increase in 2016 did result in bringing the tax per cent close to 90 %.

However, unfortunately, as the fact-check column on the 14th March states, the tobacco company which determines the final price of a cigarette increased the prices of cigarettes far beyond this tax increase. This has resulted in bringing down the final tax percentage of the retail price of cigarettes. We consider this a major challenge, and the Minister of Health has been strongly advocating with the responsible Ministries and continuing the fight to maintain the percentage of tax on cigarettes around 90%.

We are encouraged that the Minister of Finance has in his budget speech this year stated that he would adopt a pricing formula which takes into account affordability and the increase in per capita income. When this happens it will help Sri Lanka to maintain the desired tax percentage and thereby further reduce the harm from the deadly tobacco menace.

26 Apr 2024 5 hours ago

26 Apr 2024 5 hours ago

25 Apr 2024 7 hours ago

25 Apr 2024 7 hours ago

25 Apr 2024 8 hours ago