18 Apr 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market enticed a mixed sentiment amid ultra-thin volumes during yesterday’s session, as the investors took a cautious approach, eagerly waiting to see the outcome of the bondholder negotiations, which recommenced on Tuesday, following the March 24 talks, which ended up without a consensus.

Thus, thin trades were observed on the belly-end of the yield curve with 01.07.25 maturity recording trades between 10.55 percent and 10.60 percent whilst 01.06.25 maturity traded at 11.15 percent.

Moreover, trades were also observed on the 15.12.26 maturity, which saw trades at 11.34 percent to 11.32 percent whilst 15.03.28 maturity saw trades taking place between 12.15 percent and 12.10 percent during yesterday’s trading session.

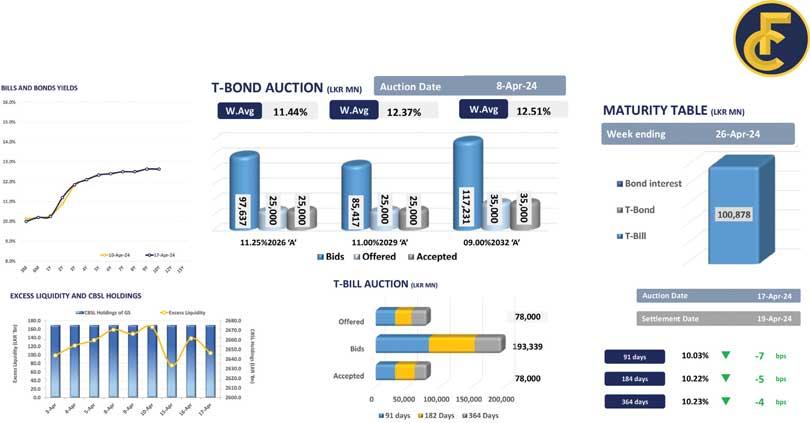

Meanwhile, the Central Bank conducted its weekly bill auction yesterday and fully accepted the total offered Rs.78.0 billion.

The Central Bank accepted Rs.30.0 billion from the 91-day bill, at 10.03 percent (-07 basis points (bps)) whilst Rs.30.0 billion was accepted from the 182-day bill, at 10.22 percent (-05bps).

However, only part of the offered was accepted from the 364-day bill, accepting Rs.18.0 billion from the offered Rs.23.0 billion at 10.23 percent (-04bps).

Meanwhile, on the external front, the Sri Lankan rupee continued to depreciate against the US dollar for the second consecutive day and was recorded at Rs.299.83.

30 Apr 2024 8 hours ago

30 Apr 2024 8 hours ago

30 Apr 2024 9 hours ago

30 Apr 2024 30 Apr 2024

30 Apr 2024 30 Apr 2024