Reply To:

Name - Reply Comment

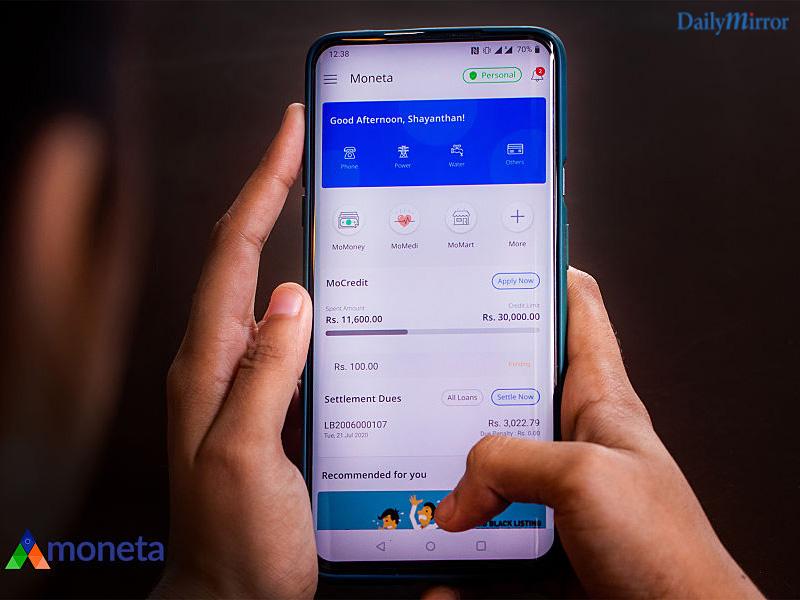

FinTech Hive, a homegrown start-up company founded through PickMe’s incubation programme, introduced their tech-enabled, futuristic and secure financial assistance platform ‘Moneta’ to the Sri Lankan market recently. Moneta is an on-demand, versatile personal financial assistance ‘Lifestyle App’ which enables discerning users make prudent financial decisions with regard to saving and spending. Moneta is working with Sri Lanka’s leading Banks to provide fast, reliable and secure services to fulfill customers’ emergency financial requirements at any given time. Customers can choose a flexible repayment method based on their preference and at their convenience. Interested individuals can access Moneta Service by downloading the Moneta App from Google Playstore.

Ideally positioned to cater to young working executives, Moneta’s brand-promise is aptly titled ‘Life beyond Limits’.

"Moneta works with three pillars: Speed, Innovation, and Positive Social Impact. Our innovative solution allows customers to enjoy fast and personalized services. As a truly Sri Lankan brand, we strive to create a positive social impact on the lives of Sri Lankans. Moneta is a personal friend to young executives, enabling them to cherish life’s finer things,” commented Shayanthan Kanaganayagham, Founder & CEO of Moneta.

Moneta provides young executives the opportunity to enjoy a comfortable, appealing social lifestyle with access to credit on-demand.

Customers can access Moneta Lifestyle as soon as they register with Moneta by providing their name and mobile number. Anyone can use the Moneta lifestyle services whileMoneta Premium service is currently only available to salaried employees.

Moneta Premium Service allows fulltime,salaried employees to access on-demand credit facility up to LKR 100,000 through MoCredit and MoEMI (Equally divided Monthly Installment) based on their credit worthiness.

To access Moneta Premium service, customers need to provide proof-of-identity, home address and proof-of-employment. But this process merely takes 5 minutes of their time. Once Moneta Premium is enabled, customers can make use of the on-demand credit facility in MoCreditforutility bill payments and enjoy access to personalised instant loans. Moreover,they will be ableto purchase lifestyle products such as electronic devices, home appliances and clothes through MoEMI. Customers can personalize their repayment method at their convenience.

“Moneta promises to be a fellow traveller in our customers’ journey, a constant companion to help them enjoy life beyond limits,” added Shayanthan.

At the moment, Moneta is prepared to assist employees who have had to endure financial distress due to unavoidable salary cuts in the face of COVID – 19 restrictions on businesses. Accordingly, Moneta facilitates a special relief program called “Employee CARE Programme” available for 3 monthsfor employees who were affected by temporary salary reductions. Such employees can apply for emergency financial assistance by providing details of their salary reductionafter enabling Moneta Premium Service.

Moneta is ready to serve customer requirements today, tomorrow and in future.