25 Nov 2020 - {{hitsCtrl.values.hits}}

A typical advertisement run on social media

@Piyumi_Fonseka on Twitter

hile many Sri Lankans are suffering financially due to the Coronavirus pandemic with loss of employment and salary cuts, the pandemic has created new opportunities for loan sharks. Unregulated online lenders which target struggling borrowers for loans with triple-digit interest rates have mushroomed since the pandemic.

hile many Sri Lankans are suffering financially due to the Coronavirus pandemic with loss of employment and salary cuts, the pandemic has created new opportunities for loan sharks. Unregulated online lenders which target struggling borrowers for loans with triple-digit interest rates have mushroomed since the pandemic.

Some unregulated app-based or web-based lenders are remotely taking control of phones of those unable to repay loans, misusing personal and confidential data of the borrowers, threatening to leak photos, shaming them among all their contacts, spamming them with calls and texts, an investigation by Daily Mirror Eye found.

The investigation also found that these online lenders target middle class people who are particularly concerned about tarnishing their reputation. The majority of the victims have a permanent source of income. Operating through social media and mobile-based applications, the online money lenders have used the Coronavirus pandemic as an ideal opportunity to victimise many people who approached them, at times they were desperate for money and were willing to overlook warning signs.

Over the past few weeks, the Daily Mirror gathered complaints from individuals, accusing online lending apps of malicious ways of recovering dues. Complainants said the harassment and shaming started when they failed to pay their balances on time.

‘Payday loans’ is a common phrase around the world, but in Sri Lanka, it was unheard of until 2017 when the first online lender Singapore based Cashwagon Co. Ltd (Lendtech Co. Ltd.) kicked off operations in the country. Since then, online lenders that provide payday loans -- small credits, typically disbursed by online websites or mobile apps -- have mushroomed.

Although a quick-fix small loan could be a relief for a financial emergency, it has been a vicious circle to many who sought this option. Even if you borrow a small amount, by the time you finish repaying that loan with very high interest, you have no money left, so you borrow again. Thus the interest keeps adding.

When defaulting, the lenders take a shotgun approach, where the people behind the lending apps and websites call or text people in phone contact lists of the borrowers about their inability to return the money, causing them embarrassment and emotional stress. There are also concerns that these platforms could be conduits for money laundering and thus highlights the need to regulate them.

In most cases, victims are introduced to the lender either through social media where they heavily market their products. Some of these lending companies are based in Southeast Asian countries like Singapore. They accept no deposits from customers. Hence, they are not a bank, finance company or a micro finance entity and are therefore not licensed with any Government entity.

They get themselves registered as a company in Sri Lanka, and remotely carry out the business that banks and finance companies are licensed to do. These lenders target people who have low credit scores and are unable to provide attested documents to fulfill their short term financial needs such as utility bill payments, health emergencies or any other personal requirement.

Most of these companies operate through 7 days of the week, even during public holidays to cater to emergency fund requirements. Through real-time transfers, when the loan is approved, money is transferred to the bank account of the borrower.

Depending on the nature of business, a person/company who engages in the business of deposits taking and lending is required to be licensed by CBSL, under the Banking Act, No.30 of 1988 (as amended), Finance Business Act, No. 42 of 2011 or the Microfinance Act, No.6 of 2016. In addition, any person engaged in finance leasing business is required to obtain a registration from CBSL under the Finance Leasing Act, No. 56 of 2000 (as amended). However, the existing legal framework does not require registration/licensing of other money lenders by the CBSL.

The Director Supervision of Non-Bank Financial Institutions at CBSL confirmed to the Daily Mirror that none of these online lending entities are registered/licensed by CBSL to lending and therefore, their activities are not currently being monitored/regulated by CBSL.

There is no record of them in the Credit Information Bureau (CRIB) which maintains a credit information database  of all authorised national lending institutions. A CRIB report gives details of all credit facilities used by an individual or corporate entity from any authorised lending institution.

of all authorised national lending institutions. A CRIB report gives details of all credit facilities used by an individual or corporate entity from any authorised lending institution.

Kelum Amarasinghe, the Convener of Consumers for Rights has been raising his voice in an attempt to shed light on this developing crisis. Speaking to the Daily Mirror, he said many of these financial scams are designed to dupe consumers.

“There is nobody holding them accountable. They can do what they like. Poor people have no idea these organisations are not regulated, have no idea that they have no recourse. We need to broaden access to mediation and other forms of justice so that people have somewhere else to go if a non-bank lender does the wrong thing,” he said.

The customer care agents of the online lenders approach the victims in a very friendly and helpful manner, making the victims believe the lenders are offering them a service. But, their behaviour quickly changes if repayments are not met on time.

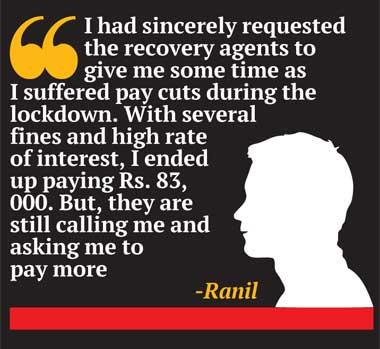

Ranil, a desperate father of two from Kelaniya was driven to the brink of financial -collapse after taking out a Rs. 5,000 loan from an online easy loan provider, as he was drawn into borrowing as much Rs. 40,000 and his debts spiraled out of control.

When he was about to complete the installments of his first loan, the money lender repeatedly sent him text messages offering more loans. The loans increased from Rs. 5000 to Rs. 40, 000. He was trapped. “It was a tough call to make, but when the needs outweighed the costs my choices were limited. I borrowed the money for a medical emergency. I had sincerely requested the recovery agents to give me some time as I suffered pay cuts during the lockdown. With several fines and high rate of interest, I ended up paying Rs. 83, 000. But, they are still calling me and asking me to pay more.”

For the last few months, he has been bombarded with phone calls demanding money. Usually, recovery officers call and remind the guarantors if the borrower fails to pay on time. However, in this case, the threats mounted for Ranil, who is a school teacher by profession. His school staff and the principal too received calls from the money lenders who spoke in a way that tarnished Ranil’s reputation among his co-workers. “They have called me a thief,” Ranil said.

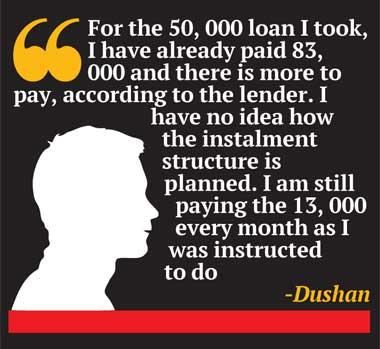

Dushan, hailing from Ratnapura, is living in an annex in Colombo. He is working at a reputed company in Sri Lanka. Due to a financial emergency, he applied for an online loan. He was paying the installments until March when the country faced an island wide curfew due to the pandemic.

He failed to deposit the installments in March. The company he was working at, informed him that the usual payday which is the 25th will be changed thereafter and the salary will be deposited to the employees on the last day of every month until the financial situation of the company returns to normal.

Dushan received the usual reminder from the lender on 24th. That is when he informed the agent about his situation and asked them to change the date to the 1st of every month. The agent, after ‘consultation’ agreed to his request.

Despite the verbal agreement, the recovery agents started on 25th attacking him with repeated calls, asking him to pay the instalment. They also denied having agreed to change the date. He is still receiving calls. “For the 50, 000 loan I took, I have already paid 83, 000 and there is more to pay, according to the lender. I have no idea how the instalment structure is planned. Due to the fear of any repercussions and reputation damage which can be done through using my personal data, I am still paying the 13, 000 every month as I was instructed to do,” said Dushan.

The lack of regulatory oversight in this arena has allowed these online lenders to charge sky-high interest rates, ranging from 60 percent to a high of 500 percent. Another borrower, a female from Kuliyapitiya took a loan from another web-based lender. The initial amount, she applied for was Rs.30, 000 (receiving 28,000 with 2000 service charge) whereas at the end of the month she had to pay 54,000 in respective with the interest added. Initial amount to be paid with interest was 44,500, but she ended up paying 54,000. When she tried to contact the customer care agents to ask why she was charged with an extra interest rate, what she received in return was verbal abuse.

“They threatened me to leak my photos”

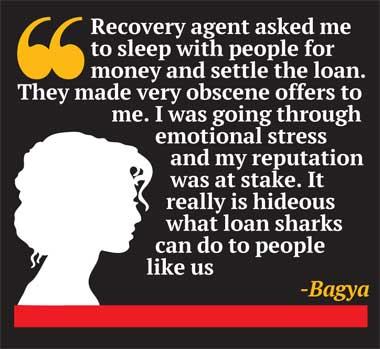

Thirty one year old Bhagya, from Matara who had taken a loan from another online lender revealed the depths of her nightmare in an interview with the Daily Mirror. She was default of Rs. 6000 for a week. After she defaulted, her family, friends and everyone in her entire phonebook received ‘shaming calls’ from the lender.

“Threats of violence started. They threatened me to leak my photos. I said I will definitely pay, but I just wanted a little time. They did not give me any relief. They said they don’t care for my excuses. The recovery agent asked me to sleep with people for money and settle the loan. They made very obscene offers to me. I was going through emotional stress and my reputation was at stake, as everyone started seeing me as someone who purposely avoided the loan installments. It really is hideous what loan sharks can do to people like us,” she said.

“They got access to my Whatsapp and called my contact list”

Upon download, the lending apps like many other mobile applications seek access to contact information, photos, files and documents saved in the borrower’s phone, before processing of the online loan application can proceed. If a borrower fails to pay on time, all of his or her phone contacts receive a collection text message or call stating the borrower’s full name and outstanding balance.

Chamika, is working in the advertising field. The money lender he dealt with, misused his information by disclosing unpaid balances to people in his phone contact list. A female client he has worked mostly with, has received a threatening call from the recovery team.

Chamika narrated his ordeal.

“I have been paying my instalments till March. The curfew and the pandemic caused severe impacts on my livelihood. Therefore, I did not have enough money to pay the lender. I had taken 20, 000 from them. By March, I had already paid 10, 000. I asked them for a grace period. The recovery agent, in response, threatened to call a lady. When he mentioned the name of the lady, it just didn’t ring any bell. Few minutes after the call with the agent, I received a call from the lady, whom the recovery agent mentioned. She is the most contacted client in my contact list. To choose exactly her, the people behind lending app have checked my Whatsapp and Messenger apps through which I maintained communication with my clients.”

Chamika, who learnt about this intrusive and illegal practice, immediately called them and inquired regarding the incident. “While admitting their ‘mistake’, the recovery agents apologised and even later settled my loan, fearing further legal action against them,” said Chamika who did not approach the police as he wanted to be rid of the recovery agents.

Those who work as recovery agents at online lending apps make sure they don’t share any public information about their workplace. However the Daily Mirror interviewed a former Phone Verification Specialist at leading place. Ajith worked there for more than six months before he resigned and joined another leasing company.

Ajith, spilled the beans about the organisational structure of his former workplace which is currently dormant. According to him, there have been around 100 employees who worked at his office located in Borella.

The organisational structure had three main categories including call center, data verification unit and last but not the least, the recovery team. As Ajith revealed, the recovery team had two groups. The first group is assigned to call and text borrowers to remind them about instalments, while the second group are paid to use force, intimidation and abuse as the last resort to recover dues. The job of the second group was to report to work daily and dial a list of telephone numbers and abuse the borrowers.

Attorney-at-law Senaka de Saram, in an interview with Daily Mirror said because of lack of regulation, there might be situations where lending money takes place for illegal purposes. If that illegal purpose is there, the probability of catching it is less, he opined. “When you take money from a registered finance company or a bank, if you default, the lender informs the CRIB whereas if you take money from these online lenders, they cannot report about you to the CRIB because they are not part of the CRIB. The transactions with online lenders take place beyond the regulatory framework of the CBSL. Technically, such organizations are illegal.”

“In the event of default, such unregulated lenders may use extrajudicial methods. In such circumstances, there might be break of law and order. The only reason that banks and finance companies recovering the money in a particular way is the regulation.”

Attorney Saram also shed light on the possibility of such online lenders engaging in money laundering activities.  “When a person who has money earned from an illegal manner which we call black money, lends that money to another person, the money which the borrower pays back to the lender is not purely illegal money. Online lending can be used as a good opportunity for money laundering. The worrying part is that it is not so easy to trace the sources of such online lenders. Whether they operate online or physically, the law is very clear that nobody can do the business of finance companies or banks, unless they are registered with Central Bank. Not that the law is silent on this matter, but it is a matter of complaining to the authorities who should analyse the data and take action which is usually a lengthy process,” Mr. Saram explained.

“When a person who has money earned from an illegal manner which we call black money, lends that money to another person, the money which the borrower pays back to the lender is not purely illegal money. Online lending can be used as a good opportunity for money laundering. The worrying part is that it is not so easy to trace the sources of such online lenders. Whether they operate online or physically, the law is very clear that nobody can do the business of finance companies or banks, unless they are registered with Central Bank. Not that the law is silent on this matter, but it is a matter of complaining to the authorities who should analyse the data and take action which is usually a lengthy process,” Mr. Saram explained.

When applying for loans, borrowers are required to submit their confidential information such as savings and current account numbers, Internet or mobile banking or e-wallet account usernames/ID and passwords and any other information that could be used to access or verify bank accounts, payment cards or any other account.

According to Sri Lanka Computer Emergency Readiness Team (SLCERT) which is the designated national point of contact for Information Security in Sri Lanka, those who have access to a person’s NIC/Passport number, bank account details, addresses and contact numbers, can even create new bank accounts using those information and engage in illegal transactions and illegal activities through the bank accounts.

Information Security Engineer of the CERT Ravindu Meegasmulla told the Daily Mirror that cyber criminals, who enjoy the impunity of the internet, have equipped themselves with ways and means to escape and the chances to find them, hold them responsible and minimize the damage that is already done is very minimum.

“Unfortunately, the level of technological knowledge of Sri Lankans is very low. Even to secure themselves and be equipped with tools, people need to know about it. Citizens need to know that they should carefully read privacy notices before they give consent to any personal data processing. Upholding data privacy rights by those who process our personal data cannot happen with mere paper compliance. It has to be rooted in a sense of public accountability to data subjects. It is all about owning up to the responsibility of safeguarding

people’s data.”

Central Bank of Sri Lanka (CBSL) repeatedly warned the public to be cautious about online easy loan scams that are stealing confidential bank data from customers in the guise of giving loans and stealing bank deposits. The regulator’s Payments and Settlements Department, issuing a statement in November, 2019 advised customers to immediately inform their bank or other financial institutions of suspicious activity in their accounts.

“The Central Bank has received information regarding several types of financial frauds and scams being operated through social media, and Internet-based applications. Recently, an increase of these types of scams has been observed,” the statement said. The disbursement of loans follows a four-step process completed online while personal details will have to be shared including that of a guarantor. The company has, however, not specified its registered address on its website.

Vietnamese media reported in June, 2020 that Vietnam police launched an investigation into Cashwagon Co. Ltd and Lendtech Co. Ltd., based in Singapore, for lending money at unreasonably high interest rates. Cashwagon has a presence in Sri Lanka, Indonesia and the Philippines, according to its website.

However, Cashwagon Sri Lanka is no longer carrying out any promotions since last month (October, 2020). Its website no longer allows people to apply for loans. When contacted, Samila Fernando, the CEO of Cashwagon who wished to be identified as the ‘former CEO’, said the company is dormant at the time being. As the reason for the abrupt closure, Fernando said it was due to the pandemic.

How it is done

- If it is web-based, the applicants are required to fill an online form submitting confidential information such as savings/ current account numbers, addresses, NIC/Passport numbers, closest contacts, photos, employer's details and many other information

- If it is mobile-app based, the applicants are required to install the application in their mobile devices

- Upon download, the lending apps seek access to contact information, photos, files and documents saved in the borrower’s phone, before processing of the online loan application can proceed

- After verification of the submitted data, the loan is deposited to the borrower's bank account within hours

Think before you apply

When taking out an unregulated loan, you will have less protection in the event of something going wrong. Although you should always undertake due diligence on the lender that you are looking to borrow from, it is even more important when taking out an unregulated loan.

Ways to spot a personal loan scam

Despite much awareness about microfinance organisations which turned out to be a vicious debt cycle for rural communities, resulting more than 150 suicides, the online lenders have become the next trap.

The crisis is a no surprise for a country that is suffering from a tumbling currency, credit rating downgrades, debt-to-GDP levels above 90% and almost 70% of government revenues being spent on interest payments alone.

Names and places of the borrowers who shared their experiances with Daily Mirror have been changed on their request as they fear of reprisals.

| Eye is Dailymirror ’s segment to engage with the public through investigative journalism in order to spark action. If you have any issues which deserve to be told in the Eye and which would otherwise go unreported, write to us [email protected] or Deputy Editor - Investigations, Dailymirror, Wijeya Newspapers, No. 8, Hunupitiya Cross Road, Colombo 02, Sri Lanka. |

05 May 2024 6 minute ago

05 May 2024 22 minute ago

05 May 2024 47 minute ago

05 May 2024 2 hours ago

05 May 2024 2 hours ago