29 Jun 2022 - {{hitsCtrl.values.hits}}

Sri Lanka is currently experiencing a foreign currency sovereign debt default for the first time in the country’s post-independent history. On April 12, Sri Lanka announced that due to severe foreign currency shortages, it would suspend foreign debt repayments, except for repayments to multilateral organisations such as the World Bank and Asian Development Bank (ADB).

Sri Lanka is currently experiencing a foreign currency sovereign debt default for the first time in the country’s post-independent history. On April 12, Sri Lanka announced that due to severe foreign currency shortages, it would suspend foreign debt repayments, except for repayments to multilateral organisations such as the World Bank and Asian Development Bank (ADB).

Sri Lanka’s Central Bank Governor Nandalal Weerasinghe stressed that Sri Lanka intends to enter into an International Monetary Fund (IMF) programme and restructure the foreign debt, for which repayments were suspended. Sri Lanka started discussions with the IMF in April and on May 24, appointed legal and financial advisors for the debt restructuring process.

While Sri Lanka’s debt obligations to China have often been misinterpreted, the fact remains that China is Sri Lanka’s largest bilateral creditor. For this very reason, China plays a key role in Sri Lanka’s debt restructuring process. A review of Chinese lending history in the country, particularly its recent offering of direct budgetary financing in 2018 and during the pandemic, also demonstrates China’s understanding of Sri Lanka’s situation and its potential to intervene as a major creditor. Whether and how China chooses to act in the current crisis will shape the process of finalising external debt restructuring for the island nation.

Understanding scale of China’s lending to Sri Lanka

According to estimates, of the approximately US $ 26.4 billion in outstanding external foreign currency debt of the public sector by the end of 2021, for which repayments were suspended on April 12, 2022 (Author approximation based on data from the Central Bank of Sri Lanka and the External Resources Department of the Finance Ministry), about US $ 7.1 billion was debt from China (based on data obtained via Right to Information requests from the External Resources Department of the Finance Ministry, Sri Lanka).

In other words, about 26 percent of the foreign debt to be restructured are owed to Chinese creditors. About US $ 4.3 billion of the outstanding payments are owed to EXIM Bank of China (ChEXIM) and US $ 2.8 billion to China Development Bank (CDB), China’s two biggest policy banks. Other Chinese lenders have negligible exposures to the Sri Lankan sovereign.

Providing an accurate picture of China’s lending to Sri Lanka involves dispelling a couple of myths. First is the common overestimation of China’s contribution to Sri Lanka’s debt build-up. This belief is often the basis of the Chinese ‘debt trap’ narrative in which Sri Lanka is cited as a victim.

Data shows, however, that the biggest foreign lending source during the last decade was International Sovereign Bonds (ISBs), also referred to as Eurobonds. By the end of 2021, ISBs accounted for 36.5 percent of total foreign debt in Sri Lanka and ISB repayments accounted for 47 percent of total foreign debt repayments in the same year. In this context, China’s lending is much smaller.

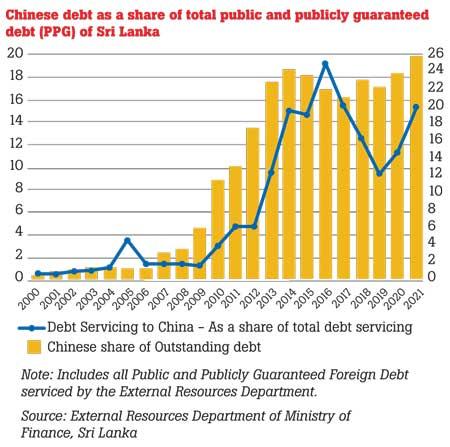

But it can still be underestimated due to the use of certain headline numbers, a popular one being that only 10 percent of Sri Lankan government debt is from China. In reality, when China’s commercial lending to the government and lending to Sri Lankan state-owned enterprises (SOEs) are considered, using a wider definition called public and publicly guaranteed (PPG) debt, the share rises to 19.9 percent at the end of 2021 and debt service on that debt stock was 20 percent of total PPG debt service.

Post-2000 Chinese lending

Despite China’s 70-year economic relationship with Sri Lanka, Chinese debt-driven public infrastructure development is a new phenomenon in the country. Sri Lanka’s economic relationship with the People’s Republic of China (PRC) began in 1952, when it became one of the few countries to enter into a trade agreement with the PRC via the Rice-Rubber Pact during the Korean War. It was not a pact of friendship. It was a barter agreement born out of necessity amidst a rice shortage for Sri Lanka and lack of willing sellers of rubber to China, due to international sanctions.

Following that, from the 1950s to 1970s, there was some Chinese bilateral lending to Sri Lanka but it became an insignificant lender after Sri Lanka’s 1977 shift to being a Western bloc-oriented ‘open economy’. At the beginning of the 2000s, Sri Lanka’s debt to China was less than one percent of total foreign debt and the biggest lenders were Japan, the World Bank and ADB. Until 2001, Chinese bilateral lending to Sri Lanka was on a no-interest payment basis.

The modern story of Chinese lending begins in 2001 when Ceylon Petroleum Corporation, a state-owned enterprise, obtained a US $ 72 million ChEXIM loan for financing the Muthurajawela Oil Tank Farm project. This loan was interest payable, carrying a maturity of 20 years and a grace period of five years.

After 2001, there were three clearly identifiable phases through which China became a major creditor to Sri Lanka. During these three phases, China’s role as a creditor also evolved from a purely bilateral lender to a project-based lender and finally to a balance of payments supporter.

Total PPG debt disbursements from China between 2001 and 2021 was at least US $ 9.95 billion, with debt service repayments of US $ 4.5 billion in the same period. This increase of Chinese debt was a major reason for the misconception of ‘Sri Lanka as a victim of Chinese debt trap’. However, it was specifically the Hambantota Port deal, which was inaccurately interpreted as an asset seizure, that made Sri Lanka’ Chinese debt stories into global headlines.

Understanding China’s current financial involvement in Sri Lanka therefore requires looking at the post-2000 history of Chinese lending in more detail.

2005 to 2010: The boom

The first phase of Chinese lending to Sri Lanka can be identified as the rapid increase in disbursements, which occurred between 2005 and 2010. During this period, China transformed from a small, predominantly non-commercial lender to a large-scale commercial lender for infrastructure project financing.

Underlying the transformation was the Sri Lankan government’s embarking on a number of big-ticket infrastructure projects with borrowings from ChEXIM, namely the Norochcholai Puttalam Coal Power Plant (US $ 1.3 billion), Hambantota Port (US $ 372 million), Mattala International Airport (US $ 191 million) and Colombo-Katunayake Expressway (US $ 248 million).

A total of about US $ 1.4 billion was disbursed for these projects in this period. High interest rates persist in some of these loans, as high as 6.5 percent, given Sri Lanka was still engaged in a civil conflict until 2009 and the global economy was embroiled in the Global Financial Crisis. However, the average effective interest rate on the Sri Lankan government’s external debt in the 2006-2010 period was only 3.1 percent (Author calculation based on Central Bank of Sri Lanka annual reports), given the predominance of concessional borrowings in the outstanding debt stock at that point in time. The decision to embark on such debt-financed projects, despite the prevailing economic conditions, was part of the then Mahinda Rajapakse government’s political vision of state-led infrastructure-driven development. It was willing to flout criteria on financial viability, environment and social concerns to achieve this political vision. ChEXIM and Chinese SOEs involved in these projects facilitated that vision, even as multilateral lenders were increasing their scrutiny on such criteria and reducing their concessional lending to Sri Lanka following graduation to lower-middle-income country status in 1997.

2011 to 2014: Consolidation

The second phase of rapid increase in Chinese lending occurs from 2011 to 2014, when the Sri Lankan government borrowed further from ChEXIM to expand the above projects and for some new transport sector projects, including railways, expressways and rural roads. This period saw the inclusion of ongoing projects under the umbrella of China’s Belt and Road Initiative.

It also coincided with the end of grace periods on principal repayments of some of the initial loans obtained during 2005-2010, with principal payments increasing significantly from 2013 onwards. US $ 3.1 billion was disbursed during this consolidation period, while total debt servicing amounted to US $ 0.6 billion (compared to just US $ 0.1 billion in the 2005-2010 boom period).

2017 to 2021: Rescue effort

While Sri Lanka’s foreign debt stock piled up, the country’s balance of payment (BOP) vulnerabilities grew fast as the island nation’s export performance continued to stagnate while foreign debt repayments increased. Against this backdrop, 2017 saw the emergence of a new phase of Chinese lending, following a slowdown in disbursements in 2015-2016.

ChEXIM Bank increased its disbursements towards new expressway projects from 2017 onwards and in October 2018, CDB provided a US $ 1 billion Foreign Currency Term Financing Facility (FCTFF) as direct budgetary financing. This eight-year facility, with a three-year grace period on principal payments, was the first large-scale Chinese lending not earmarked for particular project financing in the form of export credit or buyers’ credit.

Further FCTFFs were provided by the CDB in subsequent years and proved vital in tiding over external financing amidst the COVID-19 pandemic impact; US $ 500 million in March 2020 and in April 2021, followed by RMB 2 billion (US $ 310 million) in September 2021. These FCTFF disbursements allowed new debt inflows from China to remain higher than the rising debt service payments to China. In essence, China focused on refinancing its previous lending to Sri Lanka. About US $ 4.4 billion was disbursed during 2017-2021, with US $ 2.3 billion being FCTFFs, while debt servicing was about US $ 3.0 billion.

It was also in this phase that Sri Lanka decided to lease the Hambantota Port for 99-years to China Merchant Port for US $ 900 million in 2017-2018 for a joint-venture with Sri Lanka’s state-owned Port Authority. Contrary to the generalisation by popular media accounts, it was not a debt-to-equity swap. Sri Lanka’s government continues to service the ChEXIM loans obtained to build the Hambantota Port. But the US $ 900 million was integral to Sri Lanka’s foreign reserves management and in its absence, the country might have faced debt distress even before the COVID-19 pandemic.

It also allowed the Sri Lankan government to avoid continuing to support a loss-making state-owned entity amidst strained domestic fiscal balances. This too was an action to tackle the country’s BOP vulnerabilities. It would have been ideal to embark on a joint venture with foreign investment in the first place but that is a separate argument.

Amidst the high public debt-to-GDP levels (115.5 percent at end-2021), Sri Lanka’s government was unable to borrow further for investment purposes in recent years. In providing FCTFFs regularly since 2018 as BOP support, China showed an understanding of Sri Lanka’s situation and its own role as a major creditor to Sri Lanka. The provision of a RMB 2 billion FCTFF in September 2021 reflects this well, as at least 18-20 percent of Chinese debt is denominated in RMB and hence Sri Lanka needs to source RMB for those repayments.

From the perspective of Sri Lanka’s political decision makers, the ability to retain high disbursements from China came with the advantage of not having policy or reform conditionality associated with lending from multilaterals, especially the IMF. Budgetary financing from China via the FTCFFs allowed Sri Lanka to muddle through its fiscal and external deficits during the height of the COVID pandemic in 2020 and 2021 without an IMF programme.

China’s role in Sri Lanka’s debt default

Sri Lanka’s space for muddling through ended in 2022, with the government declaring a unilateral suspension on repayments for all foreign currency external debt obligations of the government, except for bilateral currency swaps and multilateral debt on April 12, 2022.

China will be a major creditor in Sri Lanka’s process of restructuring debt. While the ISBs amount to about US $ 12 billion outstanding and under suspension, given the highly splintered holding of such bonds (individual creditors hold relatively small amounts). In contrast, ChEXIM and CDB, with US $ 4.3 billion and US $ 2.8 billion outstanding, respectively at end-2021, are very large individual creditors, only slightly smaller in exposure compared to ADB and the World Bank. However, while ADB and the World Bank enjoy preferred creditor status, ChEXIM and CDB do not.

Given the controversy around China’s involvement or lack thereof, in facilitating debt restructuring in Zambia recently, there is concern over whether China’s willingness to provide debt relief to Sri Lanka will cause delays in finalising Sri Lanka’s external debt restructuring. A key factor for Sri Lanka is to ensure that the ISB bondholders feel they are being treated with equality relative to other creditors including China’s policy banks.

China’s willingness to provide substantial debt relief to Sri Lanka and future funding assurances will be vital to accelerate the debt restructuring and the IMF negotiations, helping the country get out of its immediate crisis. Sri Lankans can only hope that the 70-year-old spirit of the Rice-Rubber Pact – partners through the hardest of times – still holds.

(Courtesy: https://pandapawdragonclaw.blog)

(Umesh Moramudali is a lecturer and economist, specialising in public finance, currently attached to the University of Colombo. He previously worked at the Finance Ministry as a Research Analyst, supporting policy reforms and the Ceylon Chamber of Commerce as a Senior Researcher. He has an MSc in Economics from University of Warwick, where he was a Chevening scholar (2018/19). He can be reached via [email protected].

Thilina Panduwawala is currently Head of Economic Research at Colombo-based Frontier Research. While providing macro advisory to the private sector, he is interested in public finance and economic history. He holds a Master’s in Financial Economics from the University of Colombo. He can be reached via

[email protected])

19 May 2024 11 minute ago

19 May 2024 39 minute ago

19 May 2024 2 hours ago

19 May 2024 2 hours ago

19 May 2024 3 hours ago