Reply To:

Name - Reply Comment

Sri Lanka is expected to obtain board level agreement with the IMF on March 20, 2023; 200 days after the staff-level agreement was reached.

The Debt Digest by Verité Research provides analytical commentary on the latest developments in Sri Lanka’s debt crisis.

The Debt Digest by Verité Research provides analytical commentary on the latest developments in Sri Lanka’s debt crisis.

A key milestone in Sri Lanka’s path to recovery was the staff-level agreement with the IMF in September 2022 that outlined a necessary path of fiscal policy to regain macroeconomic stability and access to international credit markets.

Sri Lanka is expected to obtain board level agreement with the IMF on March 20, 2023; 200 days after the staff-level agreement was reached. The agreement is for an Extended Fund Facility (EFF) that will provide US$2.9 billion in foreign reserves support over four years.

The present commentary looks at two recent developments: (1) the increase in Sri Lanka’s debt in 2022 based on the latest figures published by the Ministry of Public Finance, and (2) the letters of assurance received from a set of international sovereign bondholders and several of the major bilateral creditors.

Increase in SL’s debt in 2022

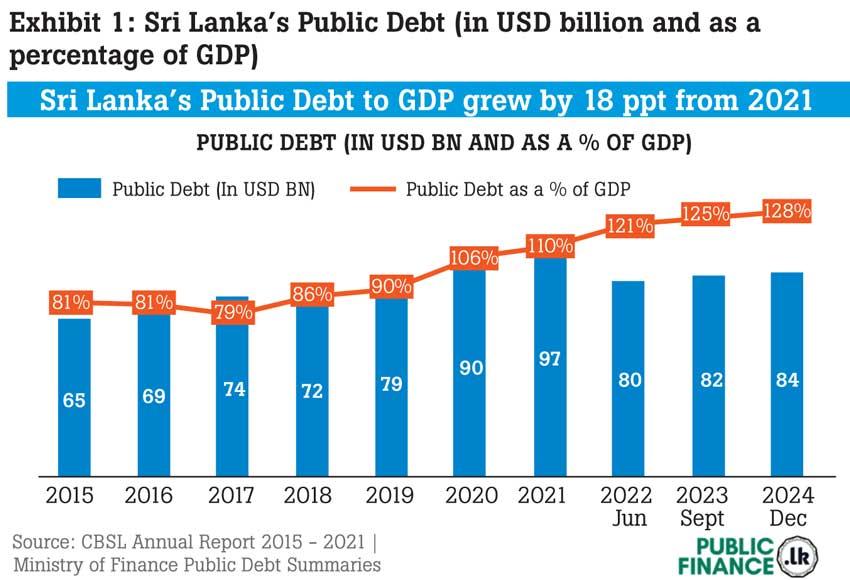

At the end of 2021, Sri Lanka’s total public debt stood at US$ 97 billion, which was 110% of its GDP. By March 2022, when foreign reserves dried up, Sri Lanka suffered a steep currency depreciation. The depreciation resulted in the rupee value of its external debt increasing, and by June 2022, Sri Lanka’s public debt was at 121% of GDP (See Exhibit 1).

Even though Sri Lanka was locked out of the international borrowing markets, and had stopped repaying its debt, the level of debt keeps growing. This is because the interest on the outstanding debt continues to accrue as arrears, and because Sri Lanka continues to increase its debt taken in local currency (LKR). The latest release by the Ministry shows that by December 2022, the total outstanding debt had increased to US$ 84 billion, which was then 128% of GDP.

Exhibit 1: Sri Lanka’s Public Debt (in US$ billion and as a percentage of GDP)

Letters of assurance from creditors

Gaining IMF Board-level Agreement was contingent upon a minimum level of assurance from major creditors and lenders that they would be willing to support the IMF program for Sri Lanka and engage in the process of restructuring their Sri Lankan debt.

In this regard, the IMF and Sri Lanka have received varying assurances from India, China, Private Bondholders, and the Paris Club.

The statement and letter received from the Paris Club and India respectively, support the paths and targets agreed upon with the IMF for Sri Lanka to achieve a sustainable level of debt. This includes requirements for Sri Lanka to: (i) reduce the ratio of public debt to GDP to below 95% by 2032, (ii) limit the central government’s annual gross financing needs below 13% of GDP on average in 2027-32, (iii) limit central government’s annual foreign currency debt service below 4.5% of GDP in every year in 2027-32.

In their letters, India and the Paris Club set out an explicit expectation that all creditors of Sri Lanka will be subject to equitable treatment during restructuring. On March 14, the Sri Lankan president emphasized that Sri Lanka will not conclude debt treatment agreement with any bilateral, commercial or other creditors on terms more favourable than those agreed with official bilateral creditors.

The letters issued by China and the Bondholder Group were less optimistic about the outcome of the IMF program. China explicitly agreed to provide a moratorium on Sri Lanka’s interest and principal payments due in 2022 and 2023. The wording of these creditor letters points to them seeking greater transparency and agency from the Sri Lankan government and the IMF on the overall analysis, actions, and targets as agreed for the program.

Special features of the bondholders’ letter

The letter issued by the Bondholder Group set out a new negotiating position, which favours Bondholder interests in two ways. The pivotal request is that the domestic debt component of Sri Lanka’s annual gross financing needs is capped at 8.5% of GDP, which in turn sets a minimum limit on foreign financing at 4.5% of GDP if total gross financing needs are capped at 13% of GDP. This is a new negotiating position because the IMF targets stated in the Indian letter did not specify a cap on neither the domestic nor foreign debt component of the gross financing needs.

Not having a minimum limit on the foreign debt component of its annual gross financing needs presents Sri Lanka with the opportunity to achieve its macro-fiscal targets with larger haircuts on foreign debt and/or reducing the dependence on foreign debt in the future. However, in the context of this condition introduced by the Bondholder Group, these options are restrained for Sri Lanka. This is because limiting the domestic debt component of Sri Lanka’s annual gross financing needs: (a) limits Sri Lanka’s scope to restructure foreign debt (by setting criteria to increase the scope of domestic debt restructure), and (b) keeps Sri Lanka open to taking more foreign debt in the future (by limiting the domestic debt component of the gross financing needs).

Sri Lanka anticipates board-level agreement from the IMF for its EFF, by March 20, 2023. However, this is neither a “bailout” nor an assurance of economic recovery. It is an important early-stage step towards completing debt restructuring negotiations. After that, for sustainable economic recovery, Sri Lanka will need to regain its credit ratings and regain the ability to access international financial markets.

Follow the Verite Research Sri Lanka Debt Update for more regular and detailed information.