Reply To:

Name - Reply Comment

Sri Lanka is in the midst of a sharp economic downturn, the proximate causesowing to its long-standing problems of twin deficits on both the external accounts and domestic government budgets.

Sri Lanka is in the midst of a sharp economic downturn, the proximate causesowing to its long-standing problems of twin deficits on both the external accounts and domestic government budgets.

The country now cannot afford essential imports due to a severe foreign exchange shortage, forcing the government to curb non-essential imports.

Government revenues too were hit considerably by the sweeping tax cuts introduced in late 2019, with widening budget deficits compelling the government to seek fiscal adjustments. Limiting non-urgent imports and increasing tax revenue are now necessaryto bridge the current budget deficit and the trade deficit to restore a semblance of economic stability.

Against this backdrop, beedi taxation is a low-hanging fruit to boost government revenue and reduce the foreign exchange outflow with the added benefit of improving the health of Sri Lankans. Beedi smoking is widespread, accounting for nearly 23 percent of the country’s smokers, each of whom smokes around 12 beedi sticks daily, on average.

The absence of a filter makes it an unsafe product exposing its users to nicotine, tar, and carbon monoxide. As such, this tobacco productis possibly more harmful to human health than other forms of smoking. However, beedi remains an underregulated product notwithstanding the provisions of the Tobacco Tax Act No. 8 of 1999.

The absence of a filter makes it an unsafe product exposing its users to nicotine, tar, and carbon monoxide. As such, this tobacco productis possibly more harmful to human health than other forms of smoking. However, beedi remains an underregulated product notwithstanding the provisions of the Tobacco Tax Act No. 8 of 1999.

This article argues that an excise tax on beedi can benefit the economy in several ways.It would directly increase government revenue, lower beedi consumption, and decrease raw material import costs thus reducing dollar outflows. Lower beedi use would also lower smoking-related health issues, thereby reducing the government’s expenditure on health.

Present tax structure

According to the Department of Excise (DOE), beedi is not taxed at the production level despite the requirement imposed by Section 2 of the Tobacco Tax Act No. 8 of 1999. The raw materials used for beedi production are taxed and the total tax on raw materials per beedi stick is just Rs. 0.27.

Further, no tax regulation is available to directly regulate the beedi price and consumption, and additionally, no excise duty is imposed on imported beedi. This makes the price of beedi low and affordable even for the poorest income category.

An excise tax is widely recognised as the most cost-effective method to reduce tobacco consumption. It is a selective tax imposed on the producers. The DOE registers and annually collects production data from the manufacturers.Therefore, it would be feasible to impose and administer an excise tax at the production level to yield a stable revenue. A cess tax can also be levied onbeedi leaves(known as tendu) to generate the same impact indirectly.

Impact of Excise Tax Benefits

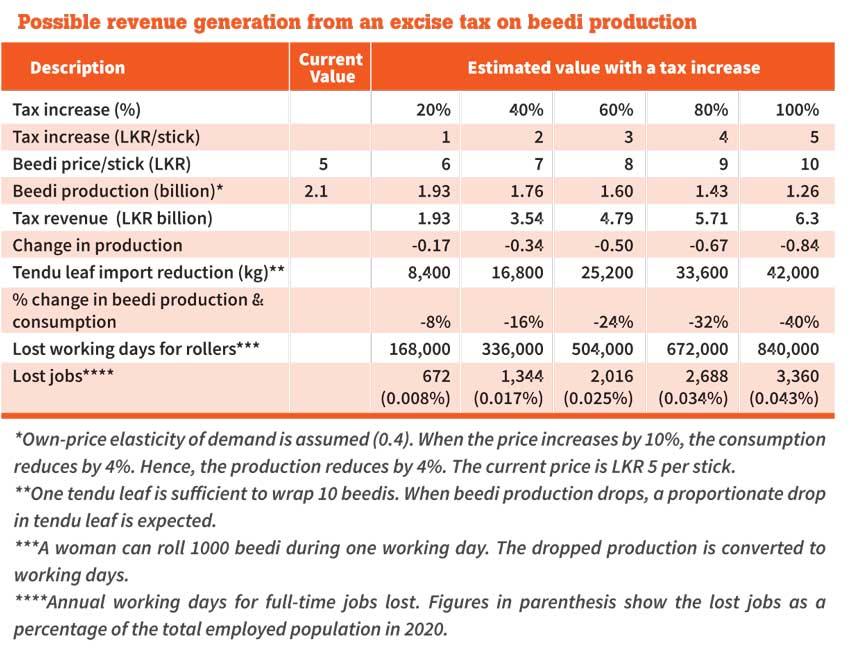

First, an excise tax would directly increase the price of a beedi stick. Previous IPS research on cigarette taxation shows that inflation and income-adjusted taxes are effective in reducing consumption. A study conducted in India has shown that low-income populations are more price responsive to beedi; a 10 percent increase in beedi price can cut down consumption by nearly 4 percent. Assuming the same price responsiveness for Sri Lanka, a tax of Rs. 1 per stick would reduce consumption by 8 percent (see Table) which is equivalent to 1 stick per day considering the daily per capita consumption of 12.4 sticks by nearly 463, 910 beedi smokers. This would also reduce the risks to human health and healthcare costs to individuals.

Second, an excise tax would increase government revenue. According to the DOE, beedi production in 2020 was around 2.1 billion sticks. Imposing a minimum excise tax of Rs. 1 per stick would generate nearly Rs. 2.1 billion (see Table).

Additionally, when the beedi production drops, the required tendu leaves will be lower and fewer tendu leaves and beedi tobacco will be imported. The indirect benefits are the saved health costs from reduced use. Given its prevalence, nearly 23 percent of tobacco smoking-related health costs can be attributed to beedi. For example, the economic cost of tobacco smoking-related cancers in 2015 was US$ 83.8 million and US$ 19.3 million (23 percent) can be attributed to beedi/cigar smoking.

Burdens

An excise tax on beedi may result in income and job losses. There are 589 registered manufacturers under the DOE. According to a recent IPS study on beedi consumption in Sri Lanka, beedi is the main income source for nearly 68 percent of them. This represents 0.01 percent of private sector employers in the country.

Notably, around 42 percent of manufacturers are willing to shift to alternative income sources. Nearly 49 percent of the respondents answered that their children will not continue. This provides reasonable grounds to adopt economically viable alternatives.

Around 81 percent of beedi manufacturers offer subcontracts, 76 percent of which are offered to women. Due to that, beedi production is mainly considered a cottage industry that employs women. They represent a smaller fragment (0.1 percent) of the labour force and can be directed towards alternate employment. In addition, globally, beedi sector employees encounter occupational health hazards, and the industry also poses risks to minors due to child labour and unhealthy tobacco exposure.

The industry has a network of input suppliers as well. There are 18 registered tobacco importers and some of them import beedi tobacco and tendu leaves. Farming households in Jaffna, Puttalam, Matale and Vavuniya districts cultivate around 578.1 hectares for beedi and chewing tobacco. Previous studies confirmed the social and environmental cost of tobacco cultivation. Thus, facilitating other income sources or alternative crops is necessary.

The last segment affected is beedi sellers who constitute wholesalers and retailers. They are involved in the trade of other goods and beedi partially contributes to their income.

Way Forward

Imposing an excise tax on production would benefit the Sri Lankan economy in numerous ways, including increased government revenue, decreased import expenditure, and reduced health costs. However, reduced beedi production causes a parallel income loss for beedi manufacturers and rollers. Yet, these contribute to employment in a negligible way. Beedi manufacturers represent a mere 0.01 percent of private-sector employers in Sri Lanka whereas beedi rollers represent only 0.1 percent of the country’s total labour force.

Importantly, nearly 42 percent of manufacturers are willing to shift to alternative forms of employment. Directing these segments to other income generating opportunities is possible while redirecting the tax revenue to finance alternative income opportunities for the affected parties. Meanwhile, an excise duty should be introduced on imported beedi to avoid substitution.

(Erandathie Pathiraja is a Research Fellow at IPS with research interests in the analysis of industries and markets, competitiveness and SMEs. She holds a BSc in Agriculture from the University of Peradeniya, an MPhil in Agricultural Economics from the Postgraduate Institute of Agriculture, and a PhD in Agricultural Economics from The University of Melbourne, Australia. Talk with Erandathie – [email protected])