Reply To:

Name - Reply Comment

The Central Bank of Sri Lanka (CBSL) in its third monetary policy review that will be announced tomorrow is likely to maintain rates at current levels.

According to First Capital Research (FCR), there is a 80 percent probability for CBSL to maintain rates, allowing further strengthening of key economic indicators.

However, there is a 20 percent probability for CBSL to relax the policy rates, with a probability of 15 percent for a rate cut of 50bps and a lower level of 5 percent for 100bps rate cut. FCR said this would be to further reduce rates and government security yields to facilitate the strengthening the economy.

Further, there is 70 percent probability to keep Statutory Reserve Ratio (SRR) unchanged.

“While considering the improved liquidity levels in the system, we consider a 30 percent probability for a SRR hike of 100bps,” FCR said in its pre-policy analysis released last week.

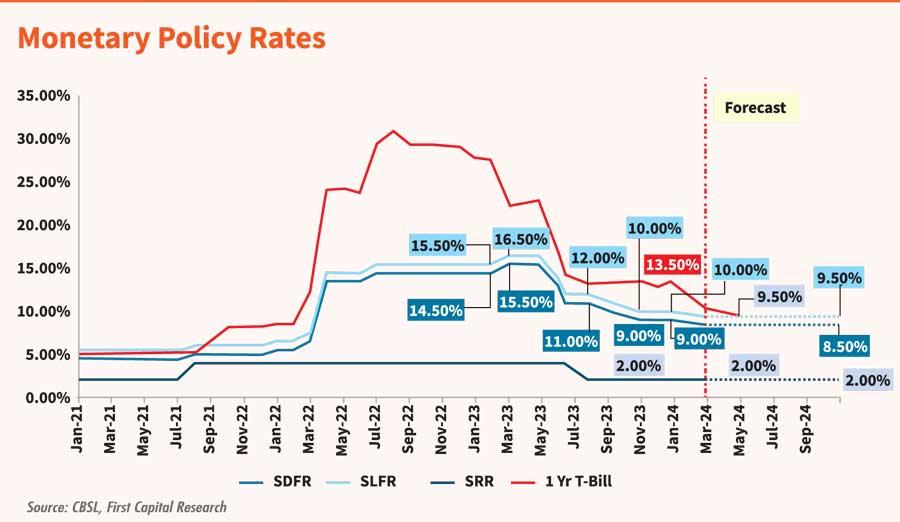

CBSL declared a strategic shift in its monetary policy stance, indicating a transition towards a single policy interest rate mechanism, instead of the existing dual policy interest rates, to improve the monetary policy transmission and signaling effect of the monetary policy stance.

In this context FCR said there is a 50 percent probability for CBSL to relax Standing Lending Facility Rate (SLFR), while there is a 50 percent probability of the CBSL maintaining the SLFR rate at its current level of 9.50 percent.

According to FCR, factors that argue against a relaxation in policy rates are; Private sector credit upsurge while AWPLR dropping to single digits; Overnight liquidity continuing to strengthen and remaining positive; Market rates showing gradual adjustment in response to EDR progression; Strengthening economic activities pointing to solid ground; and Exchange rate fluctuations hinting at forex market equilibrium.

Factors that argue for a relaxation in policy rates are; CBSL adopting a single monetary policy stance; Promising economic trends driving for prudent rate cut; and Global interest rates taking a dip.

In the previous review announced in March, the CBSL decided to reduce the Standing Deposit Facility Rate (SDFR) and SLFR by 50bps to 8.50 percent and 9.50 percent.

The Board reached this conclusion after thoroughly examining the present and anticipated trends in both the domestic and global economy. The objective is to maintain inflation at the targeted level of 5.0 percent over the medium term, all while supporting the economy in reaching and stabilising at its potential level.

The Board acknowledged the subdued demand conditions, the lower than anticipated effects of recent tax adjustments on inflation, favourable near-term inflation trends following the recent adjustment to electricity tariffs, stable inflation expectations, minimal external sector pressures underscored the importance of continuing the downward trend in market interest rates.

The Board also emphasised the importance of financial institutions swiftly and fully passing on monetary easing measures to market interest rates, especially lending rates, to expedite the normalisation of market interest rates in the forthcoming period.