Reply To:

Name - Reply Comment

By First Capital Research

The secondary market continued to experience selling pressure during the day, as the investors chose to book profits for the fourth consecutive session.

Moreover, the market participants displayed moderate movement, as the market witnessed limited activity.

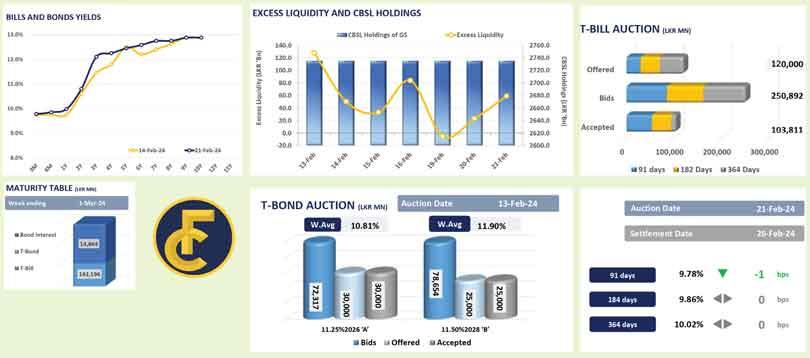

Furthermore, representing the short end of the curve, 2026 tenures traded at 11.10 percent, 2027 tenures traded at 12.15 percent whilst, the mid-end maturities, 2028 traded at 12.40 percent during the day.

Meanwhile, at the weekly Treasury bill (T-bill) auction, the Central Bank partially accepted Rs.103.8 billion, from the total Rs.120.0 billion offered, with majority accepted from 91-day maturity (51.7 percent of total accepted).

Furthermore, the auction yields slightly edged down only on the 91-day maturity, with the weighted average yields declining by one basis point to 9.78 percent, whilst both the 182-day maturity and 364-day yields were unchanged at 9.86 percent and 10.02 percent, respectively.

Moreover, the government securities market has to settle T-bills worth of Rs.142.2 billion and bond interest amounting to Rs.14.9 billion for the week ending on March 1, 2024.

On the external side, the Sri Lankan rupee broadly remained stagnant at 312.0 against the green back, at the end of the day.