Reply To:

Name - Reply Comment

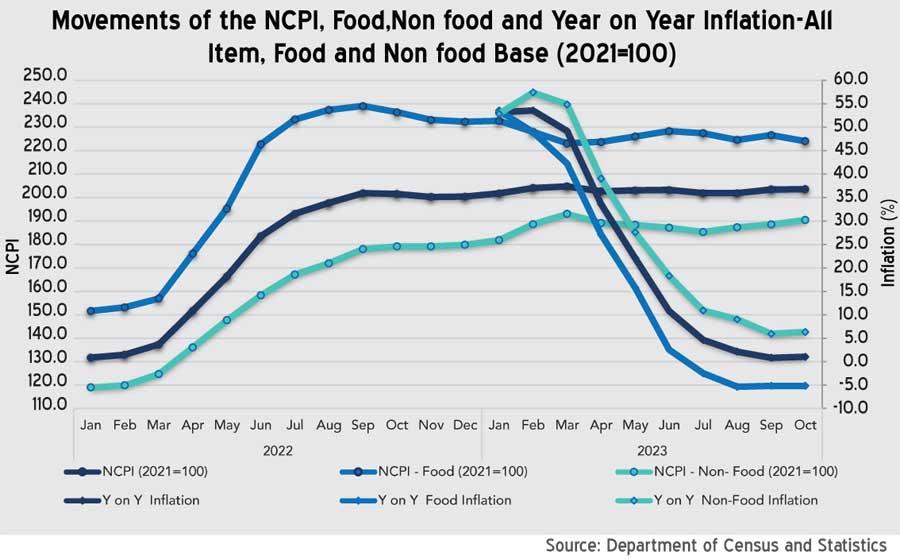

Consumer prices, as measured by the National Consumer Price Index rose 1 percent in the 12 months through October 2023, a slight uptick from the 0.8 percent in September as inflation, having reached its lowest point last month due to higher base effects last year, may have bottomed out.

On a monthly basis, the broader consumer price index remained unchanged in October, following a 0.8 percent rise in September.

Colombo inflation, a closely watched measure released three weeks before the national index, stood at 1.5 percent for October compared to a year ago, a slight increase from 1.3 percent in September.

While recent inflation readings have cooled, this doesn’t mean prices have decreased from the levels observed either a year ago or a month ago. Instead, they indicate that prices are rising at a slower rate than the rapid increases seen until recently.

The Central Bank recently declared victory over the severe inflation spiral experienced in Sri Lanka, where consumer prices peaked at nearly 70 percent in September last year.

The bank raised interest rates to historic highs and tightened liquidity to combat inflation by curbing demand when the rupee lost nearly 80 percent of its value last year.

The Central Bank anticipates that inflation after September this year will show a turnaround in the disinflation process as it won’t face the substantial higher base effects of last year and will converge towards the target inflation level.

Inflationary readings until September this year were distorted due to extremely high base effects last year, peaking in September.

The Central Bank forecasts headline inflation to hover around mid-single-digit levels or 5 percent in the medium term, though there may be a temporary uptick due to upward revisions in energy and utilities prices and taxes.

The government’s approval of a 3 percent increase in Value-Added Tax from January next year to 18 percent and the proposed removal of exemptions on certain categories may contribute to inflation, though temporarily.

The Central Bank a month ago said Sri Lanka is yet to see any demand-driven price pressures giving more space to cut policy rates.

Meanwhile, food prices fell 1.1 percent in October from a month earlier but the deflation path continued on a year-on-year basis as such prices fell by 5.2 percent.

The non-food inflation accelerated to 1.0 percent in October from 0.6 percent in September while the annual prices too followed suit, rising by 6.3 percent, up from 5.9 percent.

This is predominantly because of the repeatedly increased fuel and gas prices and electricity tariffs.

The so-called core inflation, measured stripping out often volatile food, energy and transport prices rose by 0.6 percent in the twelve months to October 2023 compared to 1.7 percent through September.

Despite the repeated softer inflation readings and slack demand conditions, the Monetary Policy Board, gathering later this week for their eighth monetary policy meeting, may consider delivering another rate cut to spur economic growth.