Reply To:

Name - Reply Comment

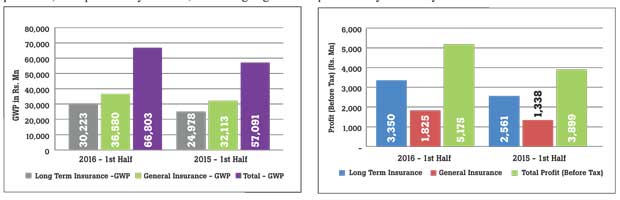

The Sri Lankan insurance industry performed well during the first half of the year 2016 with a commendable growth of 17.01 percent, in terms of gross written premium (GWP), when compared to the same period in the year 2015. This growth is relatively higher than the growth experienced in the first half of 2015, i.e., 11.73 percent and attributable to increased premium incomes in both long-term and general insurance business sectors.

The GWP for long-term insurance and general insurance businesses for the six months up to June 30, 2016 was Rs.66,803 million compared to the first six months of 2015 amounting to Rs.57,091 million. The GWP of long-term insurance business amounted to Rs.30,223 million (first half 2015: Rs.24,978 million) while the GWP of general insurance business amounted to Rs.36,580 million (first half 2015: Rs.32,113 million) during the first half of 2016. Thus, the long-term insurance business and general insurance business witnessed a GWP growth of 21.0 percent and 13.91 percent, respectively when compared to the corresponding period of the year 2015.

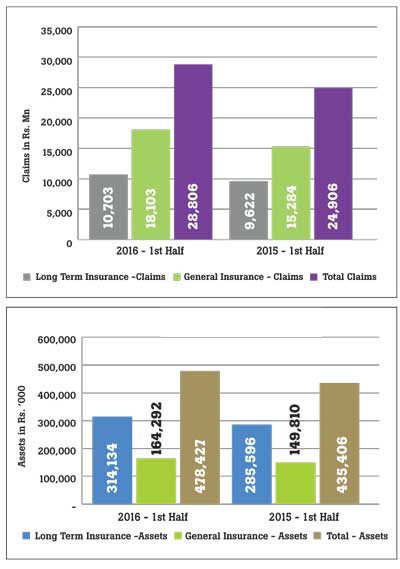

Total assets

The total assets of insurance companies have increased to Rs.478,427 million as at June 30, 2016 when compared to Rs.435,406 million recorded as at June 30, 2015, reflecting a growth of 9.88 percent. This growth rate is significantly higher when compared to the growth experienced in first half of 2015, i.e., 0.84 percent. The assets of long-term insurance business amounted to Rs.314,134 million (first half 2015: Rs.285,596 million) indicating a growth rate of 9.99 percent year-on-year (YoY). The assets of general insurance business amounted to Rs.164,292 million (first half 2015: Rs.149,810 million) depicting a growth rate of 9.67 percent, at the end of first six months of 2016.

Investment in government securities

At the end of the first six months of 2016, the investment in government debt securities amounted to Rs.158,239 million representing 50.37 percent (first half 2015: Rs.120,503; 42.19 percent) of the total assets of long-term insurance business, while such investment compared to the total assets of general insurance business amounted to Rs.31,986 million representing 19.47 percent (first half of 2015: Rs.29,312; 19.57 percent). Accordingly, the total investment of assets of both technical reserve of general insurance business and long-term insurance fund of the life insurance business amounted to Rs.190,224 million representing 39.76 percent (first half of 2015: Rs.149,816; 34.41 percent) as at June 30, 2016.

Profit (before tax) of insurance companies

The profit (before tax) of insurance companies in both long-term insurance business and general insurance business has increased to Rs.5,175 million (first half of 2015: Rs.3,899 million) showing a remarkable growth in profits by 32.73 percent. The profit (before tax) of long-term insurance business amounted to Rs.3,350 million (first half of 2015: Rs.2,561 million) while the profit (before tax) of general insurance business amounted to Rs.1,825 million (first half of 2015: Rs.1,338 million) during the first half of 2016. Thus, profit (before tax) of long-term insurance business and general insurance business witnessed a growth of 30.81 percent and 36.41 percent, respectively, when compared to the corresponding period of the year 2015.

Claims incurred by insurance companies

The claims incurred by insurance companies in both long-term insurance business and general insurance business was Rs.28,806 million (first half of 2015: Rs.24,906 million) showing an increase in total claims amount by 15.66 percent YoY. The long-term insurance claims, including maturity and death benefits, amounted to Rs.10,703 million (first half of 2015: Rs.9,622 million). The claims incurred in general insurance business, including motor, fire, marine and other categories, amounted to Rs.18,103 million (first half of 2015: Rs.15,284 million). Hence, during the first half 2016, there is an increase in claims incurred by 11.24 percent and 18.44 percent for long-term insurance and general insurance businesses, respectively, when compared to the corresponding period of the year 2015.

Dispute resolution and investigations

The Insurance Board of Sri Lanka (IBSL), under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. The IBSL also investigates into any other complaint referred to it against any insurer, broker or agent. During the first six months of 2016, 167 new matters were referred to the IBSL. A total of 158 matters were settled/closed during the period. The aggregate value of the claims settled during the period, due to the intervention of the IBSL, is around Rs.14.0 million.

Insurers

Out of 28 insurance companies (insurers) registered with the IBSL as at June 30, 2016, 12 are engaged in long-term (life) insurance business, 13 companies are engaged in general insurance business and three are composite companies (dealing in both long-term and general insurance businesses).

Insurance brokers

Fifty seven insurance brokering companies, registered with the IBSL as at June 30, 2016, mainly concentrate in general insurance business. The total assets of insurance brokering companies have increased to Rs.3,813 million as at June 30, 2016 when compared to Rs.3,568 million recorded as at June 30, 2015, reflecting a growth of 6.87 percent YoY.