Reply To:

Name - Reply Comment

(1).jpg) An investor’s life is not static. Assuming that you get income from sources other than your investments - like employment or your own business - this income will change as you age. Generally speaking, your income should increase as you get older. This means that, as an investor, you will have the most income when you have the least amount of time to invest. Here we look at what characterizes the various ‘seasons’ of your life as an investor and what actions you should take at each stage.

An investor’s life is not static. Assuming that you get income from sources other than your investments - like employment or your own business - this income will change as you age. Generally speaking, your income should increase as you get older. This means that, as an investor, you will have the most income when you have the least amount of time to invest. Here we look at what characterizes the various ‘seasons’ of your life as an investor and what actions you should take at each stage.

It is important to note that, although the seasons of your investing life are more or less set like the seasons in a year, you must start as early as possible.

If you start investing late in life, you will have a very compressed spring, summer and fall, followed by a very long winter. If you start early, you can enjoy each season to its fullest.

Spring

When you are young and just starting to invest, you probably don’t have enough disposable income to devote Rs.5,000 a month to investments. You may have only Rs 1,000 to spare. What is important is investing this small amount regularly.

Due to the costs associated with investment and the smaller income you have available in the spring of your investing life, the choices available to you will likely be limited. Look for plans or investments at your bank that allows you to invest a small monthly amount with little or no commission or even unit trusts.

Spring is a time of discovery and learning. This is a time to check out companies and learn how to decipher a balance sheet. It is also a good time to start reading about higher level investing, so that you’ll be ready before you enter that phase.

Generally speaking, this is when you do some small-time investing as training for the future. You should avoid any investments with high commission costs because your goal is not only to gain experience, but also to get a return on your investment as you learn.

Summer

You are starting to move up in the world and while your disposable income won’t put you on the Forbes list, you do have up to Rs.5000 a month to devote to investments if your cell phone bill comes in cheap.

This is the time to look at the stock market, unit trusts and other investments such as income-producing investments and retirement plans. Summer can’t last forever, but if you start planning for retirement now, the winter will be much milder.

If you’re like most people, summer is a time when you can be very aggressive with your investments, because your disposable income is fairly high compared to your expenses.

Furthermore, you may not have a mortgage and a family to worry about at this point and this means that you can put a larger portion of your investment capital into high-risk, high-return vehicles.

Fall

This is when you’re in your earning prime. However, this season may also be the most expensive time in your life if you are providing financial support to children.

In the transition between summer and fall, you may have gained some major debt in the form of a mortgage, but you will be paying it down diligently with your increased earning power rather than spending that money frivolously. Right? After all, winter is coming.

In the fall, you will also be making a series of shifts as far as your investing strategy goes. Hopefully, some of the high-risk investing you did in the summer will pay off now and you will be able to put that money into more stable investments.

Your tolerance for risk isn’t what it used to be, but the experience you’ve gained and the capital you control allow you to profit from lower risk investments. You will be buying bonds as well as continuing your investments into stocks and unit trusts.

If you have prepared well in spring and summer, the fall will be the most profitable season as far as investments and income - think of it as bringing in the harvest.

This is when you will feel tempted to overspend because of your relative financial security, but try to be cautious, because income branches such as earned wages will soon be bare.

Winter

Your earning days are over and from your perspective, this winter seems far better than that busy summer long ago. Your bonds and other investments are coming due at important intervals and covering your expenses.

When you have extra money, you look at income-producing investments. If your investments have been especially good to you, you are also looking for a good estate lawyer to help you transfer your unneeded investments to your children and grandchildren, thus sparing your family the burden of estate taxes.

As you sit back in your armchair, basking in the warmth of financial security, you think back to those first steps you took way back in the spring and realize that planning for the seasons of your investing life wasn’t so hard to do. In fact, it was almost natural.

Successful investment journey

The most successful investors were not made in one day. Learning the ins and outs of the financial world and your personality as an investor takes time and patience, not to mention trial and error. Given below are the first six steps of your expedition into investing and what to look out for along the way.

Getting started

Successful investing is a journey, not a one-time event and you’ll need to prepare yourself as if you were going on a long trip. What is your destination? How long will it take you to get there? What resources will you need? Begin by defining your destination and then plan your investment journey accordingly.

For example, are you looking to retire in 20 years at age 55? How much money will you need to do this? You must first ask these questions. The plan that you come up with will depend on your investment goals. ‘Spring’ is the best season of your life to do this.

Know what works

Read books or take an investment course that deals with modern financial ideas. The people who came up with theories such as portfolio optimization, diversification and market efficiency received their Nobel prizes for good reason.

Investing is a combination of science (financial fundamentals) and art (qualitative factors). Once you know what works in the market, you can come up with simple rules that work for you.

For example, Warren Buffett is one of the most successful investors ever. His simple investment style is summed up in this well-known quote: “If I cannot understand it, I will not invest in it.” It has served him well.

Know yourself

Nobody knows you and your situation better than you do. Therefore, you may be the most qualified person to do your own investing - all you need is a bit of help.

Identify the personality traits that can assist you or prevent you from investing successfully and manage them accordingly.

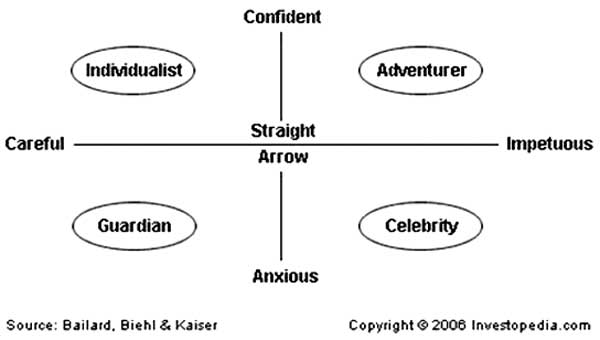

A very useful behavioural model that helps investors to understand themselves was developed by Bailard, Biehl and Kaiser.

The model classifies investors according to two personality characteristics: Method of action (careful or impetuous) and level of confidence (confident or anxious). Based on these personality traits, the BB&K model divides investors into five groups: