18 Mar 2020 - {{hitsCtrl.values.hits}}

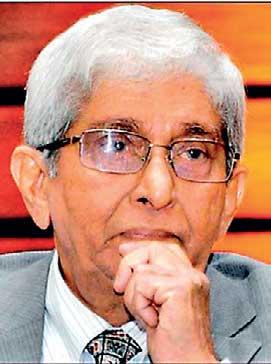

Central Bank, Governor, Prof. W. D. Lakshman requests the financial institutions not to overreact to current disruptions to the economy amid the spread of the COVID-19 pandemic, while urging the banking sector to pass the benefit of the recent policy rate cuts to their customers.

“We have also requested financial institutions to refrain from engaging in speculative activity which could lead to panic in the financial market,” Pof. Lakshman said in a statement yesterday.

At an urgent meeting to review the monetary policy stance on Monday, the Monetary Board of the Central Bank decided to reduce policy interest rates by 25 basis points and the Statutory Reserve Ratio (SRR) by 1 percentage point as a proactive measure to urgently support economic activity with the rapid global spread of the COVID-19 pandemic and its possible further spread in Sri Lanka.

The Governor requested from all financial institutions led by licensed commercial banks to pass the market the full benefit of the cumulative reduction of 75 basis points in policy interest rates thus far during the year as well as the reduced cost of funds through the reduction in SRR without any delay, to ensure that those who are in need of urgent support receive the required timely assistance.

“It is good for financial institutions to keep in mind that the revival of business activity in the country is to their own self interest,” he pointed out.

He said the CB is closely working with the government to ensure coordinated fiscal and monetary policy responses to mitigate the economic impact of the pandemic while monitoring global and domestic market developments.

“As was done yesterday, the well tested business continuity arrangements of the CB will be triggered as and when required to prevent any disruption to cash and electronic transactions of the general public and ensure the timely settlement of liabilities of the government and the Central Bank,” he added.

26 Apr 2024 31 minute ago

26 Apr 2024 40 minute ago

26 Apr 2024 48 minute ago

26 Apr 2024 1 hours ago

26 Apr 2024 2 hours ago