Part I of this article, which was published on February 29, laid out the grim fiscal and debt sustainability outlook for Sri Lanka.

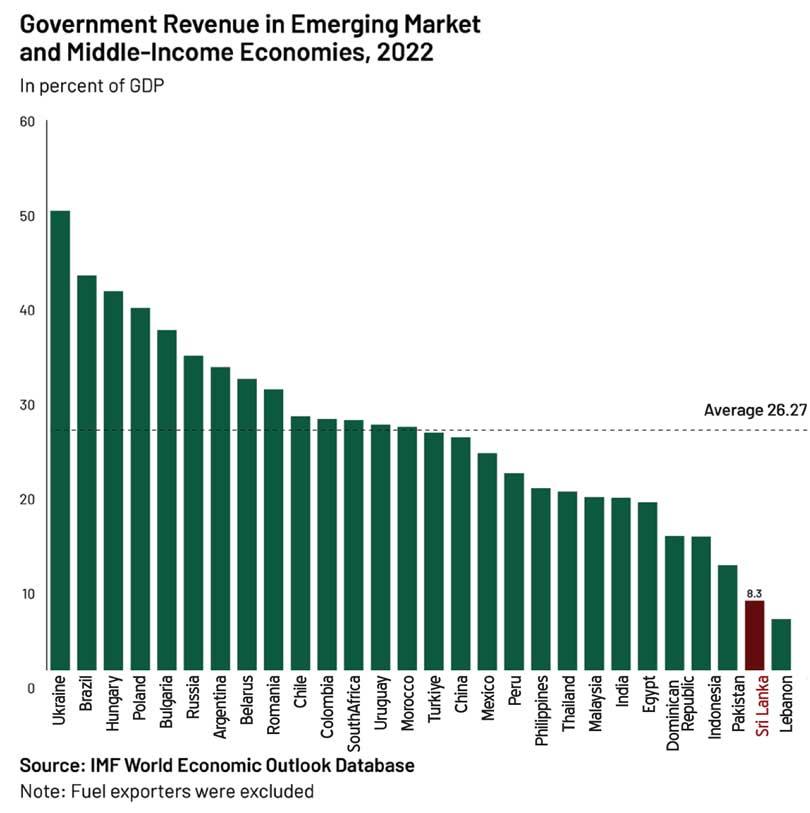

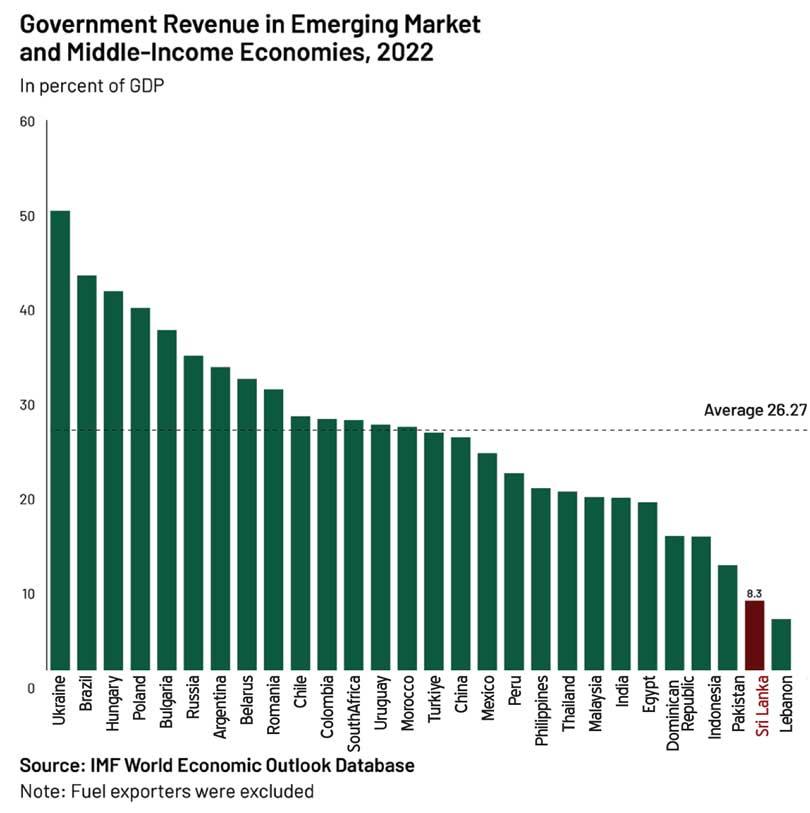

The key driver of debt dynamics is the gap between real GDP growth and real interest rates on government debt. Sustained annual growth of 5-6% and low real interest rates through disciplined fiscal policy would significantly improve debt sustainability. With slowing labour force growth due to an ageing population, sustaining high GDP growth requires increased investment and productivity growth. In addition, raising Sri Lanka’s low tax ratio to 16-18% of GDP, aligning with Asian peers, would support sustainable non-interest spending levels (Figure 1).

Sri Lanka needs to adopt a new economic paradigm

Given the imperative of fiscal discipline, Sri Lanka can no longer turn to the economic model of the past where growth was driven by public sector spending fueled by borrowing and inward-looking, protectionist trade policies. It needs to adopt a new economic model where growth would be:

n Private sector led because the public sector is constrained by high debt and a low tax ratio. The public sector must shrink and create space for entrepreneurship and new businesses;

n Export-oriented because of the need to service external debt, build international reserves, and finance adequate imports to grow. Domestic producers need to compete in world markets rather than being shielded by protected and controlled domestic markets;

n Inclusive because sustained export-oriented growth requires a healthy, well-educated population. Poverty and excessive inequality are not conducive to high productivity growth.

Clearly, multi-year reforms are needed to achieve such growth. Recognizing the political uncertainties ahead, the priority now is to establish the legal frameworks that will commit future governments to good governance. Sri Lanka lacks robust laws and legal frameworks to ensure sound processes for making and implementing economic policies as well as independent and accountable economic institutions protected from political interference. It will be important this year to:

1.Safeguard the independence of the CBSL:

The Central Bank Act (CBA) of 2023 is an example of a legal framework that promotes good governance—in this instance in monetary and financial policies. Upholding the CBSL’s independence, provided under the CBA, becomes paramount, especially if election promises press for funding fiscal deficits through money printing. Challenges loom for the CBSL, including from VAT, electricity, and energy price hikes, the weak economic recovery, and external shocks. Managing deviations of inflation from the target over the medium term is best left to the Monetary Policy Board’s expertise.

2.Lay the foundation for fiscal sustainability through better governance on tax policy and administration:

On tax policy:

n Abolishing, or at least suspending, the Strategic Development Projects Act—as recommended by the IMF’s Governance Diagnostic Assessment—and the Special Commodity Levy Act would signal an end to granting tax exemptions to corporations and arbitrary changes to commodity levies.

n Establishing a single tax policy department in the Ministry of Finance would enable Sri Lanka to have a coherent and sustainable tax policy. This department should oversee all tax policies, including income, property, customs/trade, excise, and concessions. Tax exemptions, including in Port City, should require approval from this department and undergo transparent cost-benefit evaluations based on defined criteria.

n More fundamentally, an overarching Tax Law should be passed that would:

n provide the legal framework for the Ministry of Finance’s single tax policy department;

n require tax rates to be set according to standard schedules. Any deviations/exemptions should be evaluated and approved by the tax policy department with evaluations published and presented to Parliament for approval;

n abolish ministerial authority and Gazette notifications as a means of changing tax rates;

n mandate the internationally-agreed Global Minimum Tax of 15 percent for all corporations—foreign and domestic—including in Port City, without exception;

n require any revenue losses from tax changes to be offset by new fiscal measures.

On tax administration:

The sharp drop in taxpayer numbers post-2019 tax reductions caused tax revenue to decrease from nearly 12% of GDP in 2019 to 9.2% in 2023. Mandating taxpayer identification numbers for transactions such as property, importing, and professional services and digitizing tax collections by IRD, Customs, Excise, including fully operationalizing the RAMIS system, are essential. Adequate staffing and empowerment of the Large Taxpayers Unit and the new High Net Worth Individuals Unit are critical, possibly through salary bonuses to attract private sector expertise. Parliament should pass legislation for stronger tax administration, including criminal penalties for tax evasion and bribery.

3.Strengthen governance over spending and reduce the role of the public sector:

n Enacting the Public Finance Management Law consistent with IMF recommendations is fundamental to improving the budgeting process.

n Parliament also needs to enact a Public Procurement Law that reflects international good practice. A clear legal framework is essential to interpret the procurement information that the program commits to publish. All public procurement should be moved to an e-Government Procurement System and the National Procurement Commission empowered with a clear mandate and authority, including over all PPP proposals.

n Most importantly, the privatization of state-owned enterprises (SOEs) needs to proceed without delay to both create space for private sector growth and shift government spending from supporting loss-making enterprises towards social spending and growth-enhancing public investment. Parliament needs to pass an SOE Law implementing the SOE Reform Policy that Cabinet approved last year. As envisaged by the Policy, to ensure good governance of the privatization process, control over commercial SOEs should be transferred to a Holding Company and an independent Advisory Committee appointed to recommend Directors to its Board.

n It will also be important to eliminate price controls and extensive regulation in core sectors that privilege connected parties and restrict market-based accountability.

A strong legislative agenda to establish legal frameworks for better fiscal policymaking and a competitive economy needs to be embraced by all political parties. Sri Lanka has no time to waste given the harsh reality of its fiscal predicament (see Part 1). Jumpstarting a growth dynamic that is independent of government and ensuring good governance over fiscal policy are essential if the country is to avoid another, far more painful, debt restructuring. This is not a time for politics as usual.

(Dr. Sharmini Coorey is a Non-resident Fellow at Verité Research. She was a former Department Director at the International Monetary Fund (IMF) and currently a member of the Presidential Advisory Group on Multilateral Engagement and Debt Sustainability advising the Government of Sri Lanka)

Part I of this article, which was published on February 29, laid out the grim fiscal and debt sustainability outlook for Sri Lanka.

Part I of this article, which was published on February 29, laid out the grim fiscal and debt sustainability outlook for Sri Lanka.