04 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

By First Capital Research

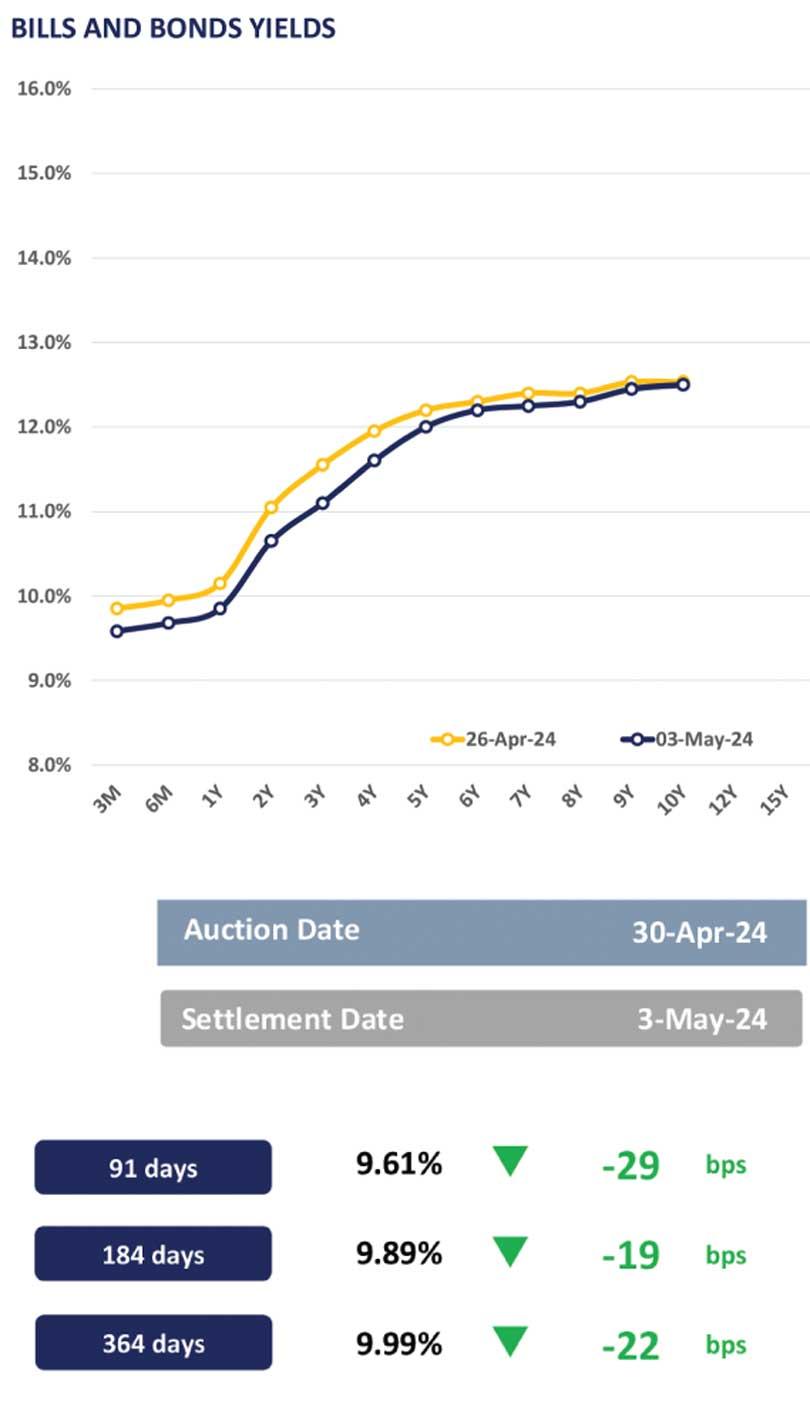

The secondary market continued to see active buying interest across the yield curve during yesterday’s session.

Investor participation was largely centered on the shorter and the mid tenures of the yield curve. Thus, several trades were enticed on the 15.05.26, 01.06.26, 15.12.26 and 15.01.27 maturities between 10.80 percent and 10.55 percent whilst 01.05.27 and 15.09.27 maturities were traded between 11.13 percent-11.00 percent.

Moreover, several trades were also enticed on the 15.03.28, 01.07.28 and 15.12.28 maturities at 11.65 percent-11.45 percent whilst the 15.05.30 maturity saw trades between 12.12 percent and 12.00 percent.

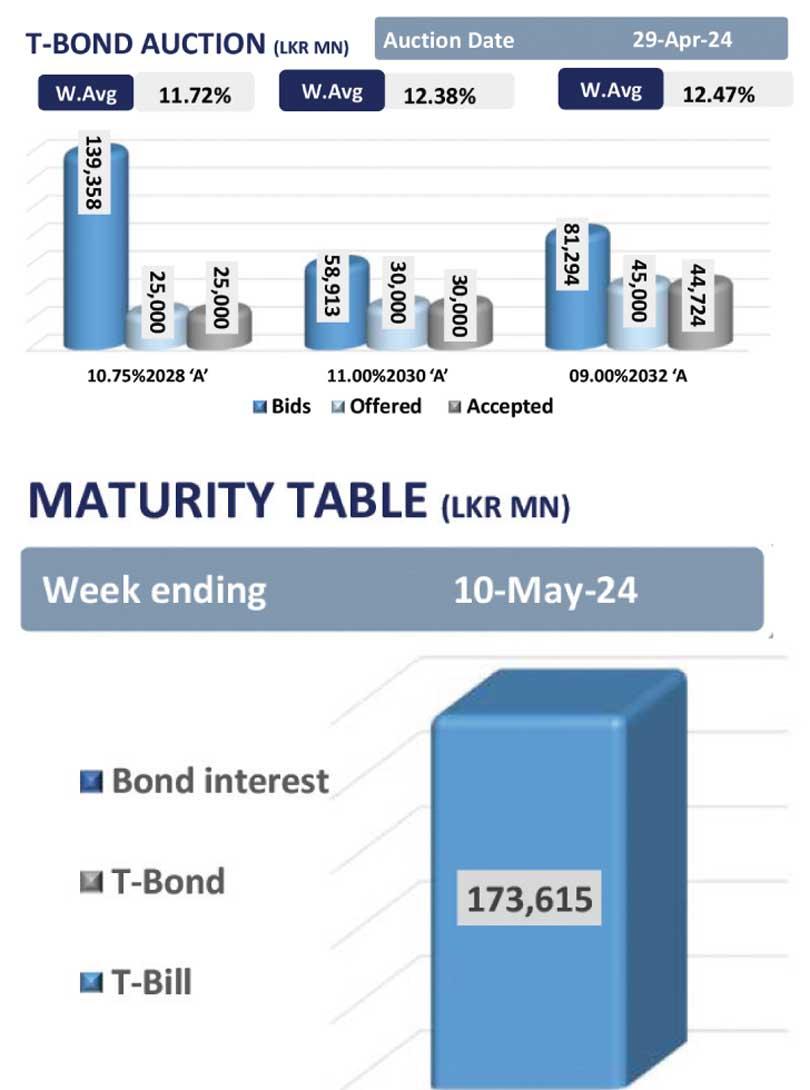

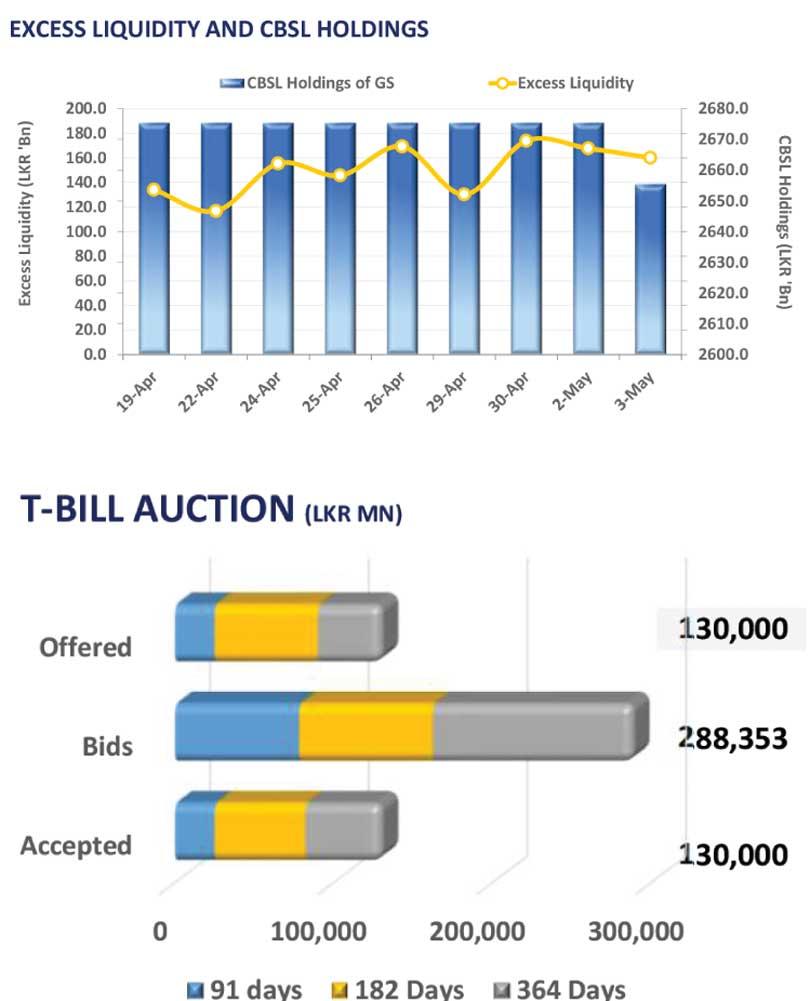

Furthermore, the Central Bank also announced to raised Rs.155.0 billion via the T-bill auction scheduled for May 8, 2024, of which Rs.30.0 billion is expected to be raised from the 91-day whilst Rs.60.0 billion and Rs.65.0 billion is to be raised from 182-day and 364-day bills.

Meanwhile, on the external front, the Sri Lankan rupee continued to appreciate against the greenback and the Central Bank published mid-rate for yesterday stood at Rs.296.80 per US dollar, recording an appreciation of 8.4 percent year-to-date.

Moreover, in line with the reduction in SDF, average weighted fixed deposit rate (AWFDR) continued to slide for the 13th consecutive month and was recorded at 12.12 percent as at April 30, 2024.

18 May 2024 7 hours ago

18 May 2024 9 hours ago

18 May 2024 18 May 2024

18 May 2024 18 May 2024