11 Jun 2020 - {{hitsCtrl.values.hits}}

Advertising is the meaningful connecting bridge of brands and consumers! Building familiarity, awareness, increase sales and brand building are some of the key responsibilities of advertising. Even in an era when the media landscape is getting fragmented with fast innovation of digital media touch points, traditional media still becomes the choice of many brand owners as well as advertisers.

Advertising is the meaningful connecting bridge of brands and consumers! Building familiarity, awareness, increase sales and brand building are some of the key responsibilities of advertising. Even in an era when the media landscape is getting fragmented with fast innovation of digital media touch points, traditional media still becomes the choice of many brand owners as well as advertisers.

Further, digital media platforms have been used as enabler to increase reach of traditional media content. In this context, Advertisers’ as well as brand owners’ attention is still an increasing trend and spends on traditional media advertising top the list for most of the businesses. As much as the brand dependency on advertising is high, it has got impacted significantly during Covid-19, hence this effort is to explore the level in which Covid-19 had changed the advertising spend by brands in Sri Lanka. Survey Research Lanka (Pvt) Ltd, widely known as SRL as the oldest Sri Lankan Research and Consultancy Company maintains a large database of media spend data with its Media Research arm.

This article is written based on real time data that are collected by SRL on media spend during Covid-19 and a comparative analysis of it with the same period in 2019. This is an exploration of advertisement spend on TV and radio only. Although the advertising spend on print media had been captured in SRL AdEx project, it is not considered for this analysis given most of the newspapers did not print during Covid-19.

The general trend of advertising spends in April and December months of the year are very different from the other ten months for obvious reasons. Due to heavy media spends in the seasonal months; brands definitely would have had the same plans for this April as well. Covid-19 changed all the plans, unexpectedly. The impact made on advertising spends due to the calamity of Easter Sunday attackin 2019 was negligence when compared to the impact of Covid-19 pandemic which is universal. In April 2020, we could see a drastic drop in brands’ spending pattern on TV and Radio Advertisements as a result of Pandemic

Covid-19.

Some of the data points to understand the level of COVID-19 impact to the advertising industry in Sri Lanka that are extracted from the ‘SRL ad expenditure and Media Tracking project’ are;

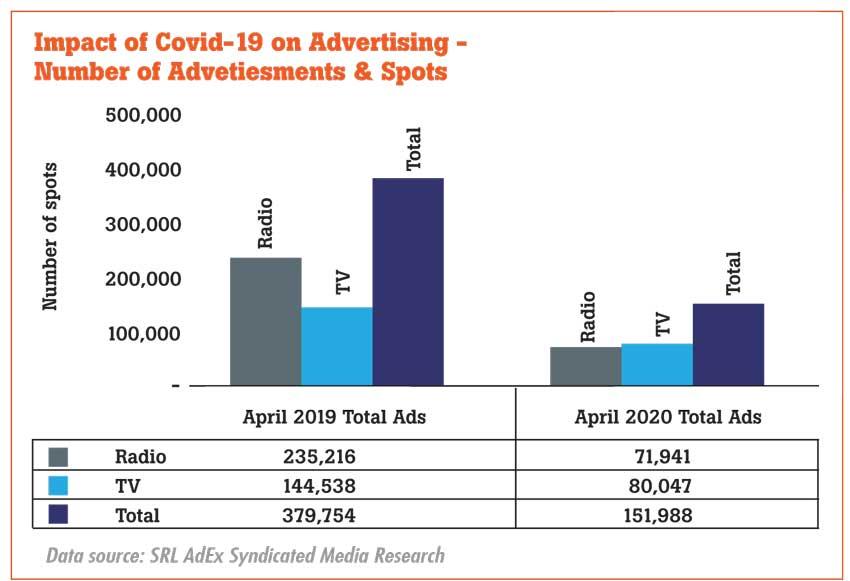

1. Covid-19 impact on utilization of air time of mass media by brands - total number of advertisements & other spots aired on TV in the month of April 2019 was 144,538 and it had dipped to 80,047 in April 2020. This is a 45 percent drop compared to April 2019. When it comes to radio, the total of 235,216 advisements had been aired in April 2019, the corresponding number for this year April was 71,941 and it was a 69 percent drop. It clearly shows thatPandemic Covid-19 has a significant impact on air time utilization by advertisements and the impact made on Radio commercials is significant.

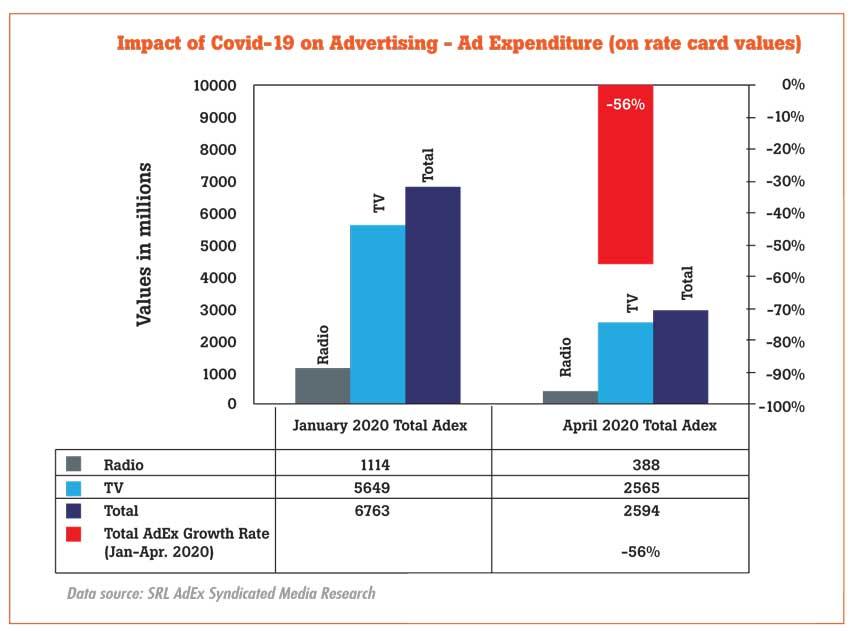

2. Covid-19 impact on advertising spend on mass media - Total spend for the month of April 2020 on TV and Radio advertisements was Rs.2.9 bn (based on the rate card values) and this parallel in January 2020 (three months before), was Rs.6.7bn which is nearly 56 percent drop of advertising expenditure in the two main mass medias, TV and Radio. TV contributed for around 80-85 percent from the total Ad Expenditure (AdEx). In a normal situation, AdEx in April and December months is higher than other months of the year; for an example, increased of total AdEx (TV & Radio) January 2019 vs. April 2019 was 11.5 percent (With one week impacted from Easter Attack). But, in this year (2020), Total AdEx of TV and Radio has decreased by 56 percent compared to January 2020. Furthermore, TV AdEx has decreased by 55 percent while Radio AdEx decreased by 65 percent with Covid-19.

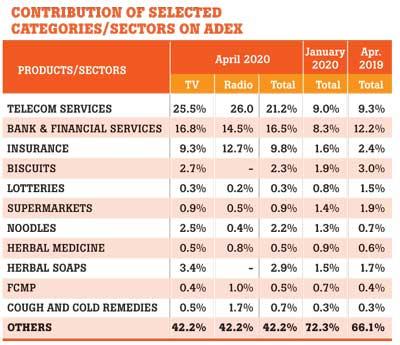

3. More prominent Ad spender during Covid-19 - From the total TV and Radio Ad expenditure of April 2020, 47.5 percent have been shared by only three sectors which are Telecommunication services (21.2 percent), Bank & Financial services (16.5 percent) and Insurance (9.8 percent). Total Balance 52.5 percent is shared by more than 100 product categories. The above mentioned three sector representation in ad expenditure in January 2020 was just 18.9 percent and same was 23.8 percent in April 2019 comparatively. This clearly demonstrates that Telecommunication, Bank and Insurance sectors had established a higher representation in the reduced Ad expenditure during April 2020 with Covid-19 and market uncertainty created around it.

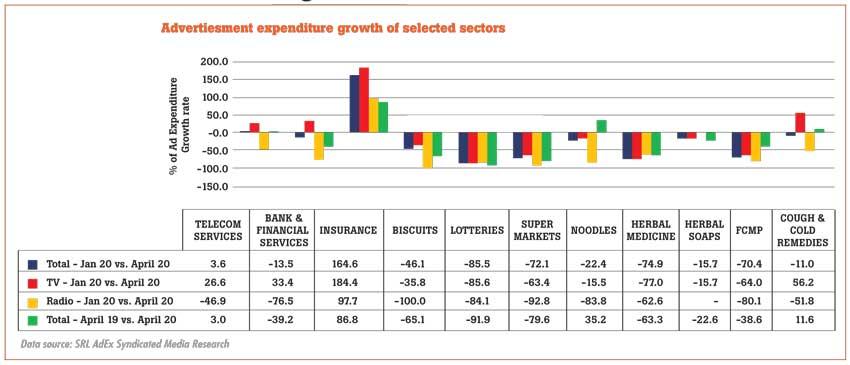

4. Covid-19 impact on advertising spend by different sectors - It was not just the representation but the absolute Ad expenditure by Telecommunication, Bank & Financial Services, Insurance and Cough & Cold Remedies on TV has increased in April 2020 when comparing with the Ad expenditure by these sectors in January 2020.

The above discussed trend of Ad expenditure contribution by Telecommunication was necessary given the whole country had to depend on voice and data connectivity during the locked down period. It was not just consumers but the entire country including the government and businesses operated mostly via online connectivity. Therefore, telecommunication service sector was a prominent spender in media space during Covid-19 which will continue to be for the next couple of months too. Banking services as an essential service for communities had increased their presence in media in order to educate people on usage of banking and finance facilities during pandemic.

As per the instruction given by the health sector, people had to follow social distancing. This created good market opportunity to bankers to aggressively promote their digital / online products during Covid-19 pandemic and we could see banks and financial institutes trying to promote their digital services using ATL and BTL activities during this Pandemic period.

Further, many banking and finance regulations that are useful for communities during this difficult time were aired by many brands and regulation bodies. Covid-19 has impacted the financial capability of individuals as well as organizations. Therefore, government did lot of policy (temporary) decisions to provide reliefs for loans and leasing installments. We could see that banks communicated and provided important information such as policy changes, interest and loan reliefs etc. rather than promoting their products. With these interventions, contribution of bank & financial sector on April 2020 ad expenditure has increased.

Many emotions of consumers’ lives such as fear, humor, emotional aspects, trust, sadness, anger, care are used when marketing communication is developed by marketers. As of our observations, most of the companies in the insurance industry based their communication on such emotions and tried to reach their target audience in different ways. Some insurance companies used advertising for communicating health messages which we should follow during this critical period while some were trying to emphasize on heartiest gratitude to all heroes in the healthcare sector, three forces and police.

It was important to note that most of the communications was very informative more than ever which was a very important indication that all of us witnessed through advertisements during Covid-19 period.

Apart from Insurance, Bank & Finance, Telecommunication, Ad expenditure of almost all other product and services have been impacted during this period. Due to lack of production, out of stock situation, distribution issues, difficulty faced by customers in accessing POS (Point of sales) or purchase channels, some products are not so essential during this period. Hence these ones can be identified as possible reasons for lack of advertising during this difficult period.

All elements of supply chain management need to be reinforced and need to be ready to face the future. Certain sectors which have zero/low sales would have reduced the investment they’ve allocated for marketing spend, especially on TV/Radio which are costly in nature. Alternatively, such sectors should drive promotions and campaigns though digital media and other appropriate sources which would tap the right touchpoints which are relatively cost effective and more impactful and has a better reach these days.

This time for marketers, is not about spending as usual on marketing communication, but, the absence of Marketing Communication is also alarming. It’s like a free window they are providing for competition and small/cottage players to grab share off their shelf space. Or may be marketers are making their own consumers condition themselves to be able to survive without their product or service. Hence it is very important that marketers are constantly out there speaking and showing the value and care their products and services have for consumers.

Brands need to focus on creating their equity with messages that are relevant to this situation to expect a healthy impact on brands. It is an opportunity given for brands to earn long term equity than accomplishing short term sales objectives in this difficult time for consumers. Use this time window to show brand empathy towards your consumers. Less clutter in mediaas well as in people’s minds, isn’t it the best time to register our brands? Further, what marketers need to be mindful of is through what medium and touch points are they going to tap in to, with a cautious allocation of budgets to mass media vs other touchpoints including digital platforms.

Depending on the relevance and importance of your product category for consumers these days, marketers need to wisely choose the channels and spend. Essential services like telecom, banking & finance are key sectors which need to go on mass media to drive their usage and share information. But categories which are essentials, while they can focus on mass media given the sudden demand rise during this context, what is more important is to focus on distribution/channel based marketing communication (point of sale based communication) to push their products, because what is key these days for essentials is being available and accessible at the door step of the customers.

If you are not an essential product or service, you need to carefully identify the niche customer group for whom you are an essential, and identify touch points which will enable you to reach out to them easily/directly – in these instances different communication channels, such as social media marketing, SMS marketing, email marketing, etc might be effective. Hence marketers need to wisely and cautiously plan their ad expenditure these days.

On products which are durables, such as electronics, electricals, clothing, home ware products, etc. even though the lockdown has had a drastic impact on their sales and communication. It is important for them to note, despite whether the lock down continues, and if this is the new normal in the coming seasons/months – definitely the need for durables will arise.

Because the usage of these durables at home are higher than before hence depletion and replenishment period will come sooner than before, plus when customers are used to this new normal they will reach out to fulfilling their durable needs as well. Hence marketers of such sectors/product categories, should pre plan and be ready with their supply chain and marketing communication to drive this potentially arising need in the near future. Hence now might be the right time to act on it!

We as a nation has progressed a lot in defeating Covid-19 so far. But, there is more to be done. Our heroes in the Health sector, three forces and Sri Lankan Police who are in the forefront need a lot of support and understanding from our end. Hope, all Sri Lankans would give full corporation to swipe off corona fully from our country…!!!

(Neel De Silva is the Chairman of Survey Research Lanka (Pvt) Ltd (SRL) and Mihirani Dissanayake is CEO/Director of SRL. SRL is the first Sri Lankan full service independent marketing and social research consultancy company and first established media research unit in the country)

30 May 2024 1 hours ago

30 May 2024 3 hours ago

30 May 2024 5 hours ago

30 May 2024 5 hours ago

30 May 2024 5 hours ago