Reply To:

Name - Reply Comment

Last Updated : 2024-04-17 02:11:00

Sri Lanka is presently facing the most severe economic crisis in its history. The main problem is that Sri Lanka’s debt has become unsustainable. That means, the expected revenues of the government are not adequate to meet the expected expenditure to run government and pay interest on government debt. One of the critical adjustments required for economic recovery is to substantially increase government revenue.

Sri Lanka is presently facing the most severe economic crisis in its history. The main problem is that Sri Lanka’s debt has become unsustainable. That means, the expected revenues of the government are not adequate to meet the expected expenditure to run government and pay interest on government debt. One of the critical adjustments required for economic recovery is to substantially increase government revenue.

In order to achieve an increase in revenue, a pricing formula on fuel and electricity has been mooted. The benefit of a formula is that it adjusts prices in line with economic fundamentals on a timely and sustained basis, overcoming the delays and inconsistencies created by leaving price adjustments to discretionary, ad-hoc policy action.

However, presently, there has been forgetfulness in terms of another pricing formula that has been presented in previous budgets. That is the formula on the pricing and taxation of cigarettes.

Several past insights by Verité Research and similar research interventions by the Institute of Policy Studies as well as the National Authority on Tobacco and Alcohol Taxation (NATA) have repeatedly pointed out that the failure to engage in the proper taxation of cigarettes has a significant consequence on revenue.

A previous insight by Verité research calculated that the government would have raised an extra 20 billion in revenue from cigarette taxes in 2020 if taxes had been adjusted in keeping with the indexation policy articulated in the 2019 Budget; and if these tax adjustments were calibrated and applied rationally according to the length of the cigarette, to all the different brands of cigarettes in the market.

The present insight sets out the calculation of that revenue consequence from 2021 to 2023. It finds that that Sri Lanka will have forgone Rs. 85 billion from 2020 to 2022 due to the failure to implement the formula, and rectifying this failure would increase revenue from cigarette taxation by Rs. 45 billion in 2023.

Will the new budget pick up cigarette taxation, from where it was left in 2019?

The budget speech in March 2019 announced a policy aimed at systematically indexing the prices of cigarettes in line with nominal GDP growth.

In the words of the then Finance Minister “Excise duty on cigarettes will now be based on indexation with a minimum annual duty increase capturing annual inflation and GDP growth. This will ensure revenue protection and control affordability.”

The methodological guidance necessary for implementing the cigarette taxation formula has been published and is accessible to the government (Verité Research, A Technical Case for Affordability Based Pricing of Cigarettes, September 2014). However, Sri Lanka has since failed to apply this policy announced in the budget.

With Sri Lanka about to announce a new budget, in the mids of its economic crisis, it would do well to implement the cigarette taxation formula, and recover the significant revenue lost from failing to do so.

The calculations find that if the indexation formula is implemented the government can increase its revenue by 45 billion in 2023.

To put the revenue collection in perspective, this additional revenue can double the support in the form of Samurdhi payments which are intended to provide relief to the poorest and most vulnerable bottom three income deciles in Sri Lanka. In addition to the revenue benefits, social benefits in the form of reducing the heath related harm from cigarette consumption are an additional welfare benefit that will also result in lower health care costs, if the formula on cigarette taxation is implemented properly.

How to apply the formula on cigarette taxation?

The methodological and technical guidance for pricing and taxation of cigarettes in Sri Lanka based on Verité Research’s working paper (A Technical Case for Affordability Based Pricing of Cigarettes, September 2014) resolves three critical analytical issues: (1) Finding the benchmark price for the most consumed type of cigarette (2) Specifying the criteria on which the benchmark price of cigarettes should be updated (3) Applying a coherent method for price differentials between different types of cigarettes.

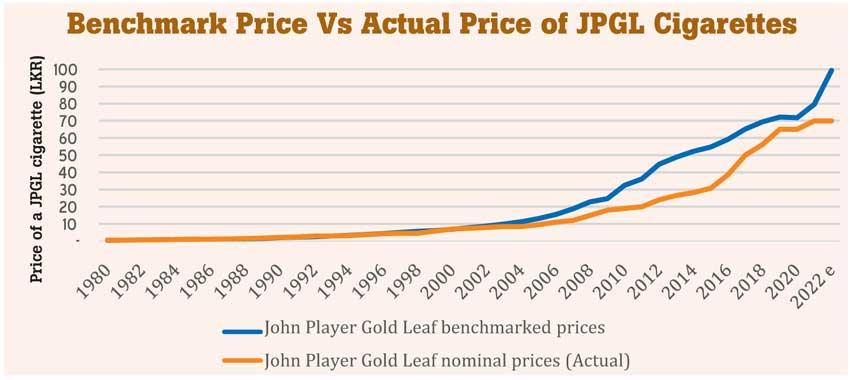

Applying the methodology as per the working paper, shows that the current price of the JPGL cigarettes is Rs.29 below the benchmark price (see graph). Applying the criteria of 75 percent tax in price for cigarettes, the targeted taxation per cigarette by brand is given in the table.

The methodology requires an estimation of the benchmark price for JPGL which is calculated to maintain the same level of affordability as the cigarette brand had from 1981 to 2000.

Affordability is maintained by growing the price of JPGL cigarettes by the growth in nominal GDP. This is estimated to be 25 percent in 2022 and 20 percent in 2023 (this is a conservative estimate as explained later).

Prices for the other cigarette brands are then calculated by adjusting the benchmark price relative to the length of the other brands in order to prevent substitution between cigarettes.

A 75 percent tax in price is applied to the price estimates which then provide the target tax rates. The calculated revenue loss is the difference between the estimated tax revenue and taxes and the estimated tax revenue under the policy, for the quantity sold.

The quantity sold is calculated by applying a price elasticity of demand of 0.5 (based on the international norm for cigarette demand calculations)on the quantity sold in 2019, to predict sales.

Calculating revenue lost from failing to implement the formula

The present insight updates these calculations and finds that the recurring repercussions of the failure to implement the formula on cigarette pricing and taxation has resulted in a revenue forgone of Rs. 29 billion for 2021 and will result in a further revenue foregone of Rs. 36 billion in 2022.

Therefore, extrapolating from 2019 forward, the cumulative foregone revenue from 2020 to 2022 will be Rs. 85 billion, because the formula was not applied. This is equivalent to almost two years of expenditure on Samurdhi welfare payments, which are provided to over a quarter of Sri Lankan households.

The calculations for the price and tax formula result from applying a cumulative cigarette price inflation of 50 percent for the two years from December 2021 to December 2023. The annualized rate of inflation for the first four months of 2022 is 49.5 percent.

For food inflation the annualized rate is 60 percent. Therefore, the estimation for cigarette prices is based on a applying a conservative inflation projection to the formula for the next 20 months.

That is, the actual increase in price and taxes required by the formula may well turn out to be higher, when evaluated at the end of this period.

Failure of cigarette taxation since 2020

A previous insight,“Cigarette Tax Indexation, Getting It Right and Getting it Wrong” (Verité Research,August 2019) showed how the cigarette taxation formula, despite being announced, was not properly implemented in 2019.

That pattern of failure has continued and accumulated momentum in the years that followed. There were three instances in which cigarette taxation and prices were amended since November 2019 (when a presidential election was held in Sri Lanka).

In the first instance (December 2019): Excise taxes on cigarettes were increased by amounts ranging from Rs.13.36 to Rs. Rs. 48.35 per stick for different cigarettes. However, this only offset the removal of VAT and NBT taxes from cigarettes, and therefore did not increase either the price or the tax in price of cigarettes.

In the second instance (2021): The price of the most consumed cigarette brand in Sri Lanka, JPGL increased from Rs.65 in 2020 to 70 rupees in 2021, without any change in the taxation until November 2021.

As of May 2022, it remained at the same price. As of May 2022, the price of the rest of the cigarette brands with exception of Capstan, which is less than 60mm and Bristol, shows an increase compared to the prices in 2021.

In the third instance (November 2021): The 2021 budget speech proposed an increase in the price of cigarettes by Rs. 5. The total tax rate on theprice of cigarettes was, however, reduced in this budget.

And, for the cigarettes of less than 60mm, which had the second highest market share,while the tax rate on the price did not reduce, the absolute amount of tax was reduced by almost 50 percent along with a similar reduction in its price. That is, the tax per cigarette stick was reduced from Rs. 13.36 to Rs. 6.75.

The failure to implement indexation means that the government has forgone and continues to forgo a significant stream of revenue. The cumulative foregone revenue since 2020 up to end of 2022 amounts to Rs.85 billion.

If indexation is implemented properly it is expected to generate additional revenue of Rs. 45 billion in 2023. In times of rising cost of living and severe economic hardship this revenue can be used to provide relief via welfare transfers to the poorest in society.

The benefits of the implementation of the formula also extend to substantial reduction in health-related harm from cigarette consumption.

At a time when the government is required to increase revenue to ensure debt sustainability, and is looking to increase VAT despite the annualized inflation being over 50 percent, there is a strong case for applying the cigarette price and tax formula to increase government revenue and reduce the tax burden on other forms of essential consumption.

(Verité Research is an independent think tank based in Colombo that provides strategic analysis to high level decision makers in economics, law, politics and media.

Comments are welcome. Email publications@veriteresearch.org)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024