Reply To:

Name - Reply Comment

Last Updated : 2024-04-18 13:32:00

It is essential that businesses today explore other geographies for growth, both in terms of revenue and profitability. Expanding global footprint helps expand the market, access to new technology, cost optimization etc. Globalization and the rapid growth of international trade are a reflection of businesses expanding their geographical presence. Accordingly, intra group cross border transactions are an everyday necessity for Multi-National Enterprises (MNEs).

On the other hand, the continuing priority for governments worldwide is for their tax systems to generate an expected level of revenue. It is a sovereign right of each country to tax the income generated within the country and by its residents. Tax and more importantly Transfer Pricing regulations enable the Revenue Authorities of respective countries to collect their fair share of taxes from the MNEs. At instances these country specific tax regulations do not synchronize appropriately while observing cross border transactions, resulting into double taxation or double non taxation.

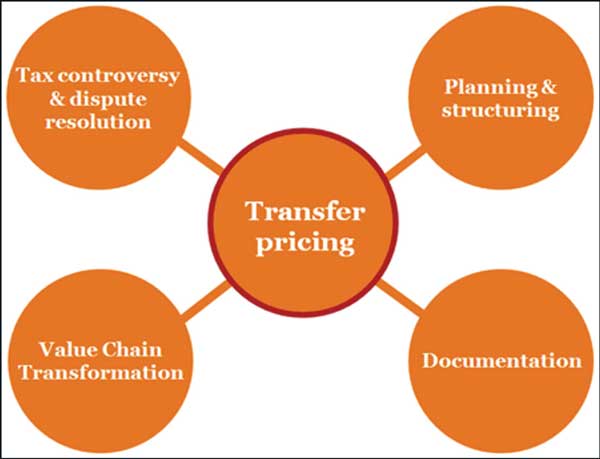

Transfer Pricing regulations support Revenue Authorities to safeguard their tax base by determining the amounts of income, deductions, credits and allowances to be considered for tax purposes by observing and evaluating the Functions performed, Assets deployed and Risks assumed (FAR) by the taxpayer and their related parties, located in the multiple tax jurisdictions in which the MNEs operates. Accordingly, Transfer pricing regulations have been introduced in various parts of the world and has gathered frequent attention of MNEs, in their board rooms. Further, an adjustment proposed to the intercompany transaction because of an erroneous transfer price can lead to the imposition of heavier penalties than the original tax and inviting a huge reputational risk to the MNE/Brand. In an attempt to administer Transfer pricing and collect the appropriate amount of taxes, Sri Lanka Inland Revenue Department (IRD) introduced Transfer Pricing Regulations in 2013 and revisited the same in March 2015 prescribing a certificate to be obtained by the taxpayer from an approved Accountant, which confirms that the taxpayer has maintained proper information and documentation in support of its transactions with associated undertakings and that it meets with the arm’s length standard. In view of this development, what is in it for the MNE’s located in Sri Lanka?

Transfer pricing policy

The tenets of Transfer Pricing go hand in hand with business fundamentals (FAR to be appropriately rewarded); issues would inevitably arise if Transfer Pricing is delinked from business. As MNEs having presence in Sri Lanka are located in jurisdictions having advance Transfer Pricing systems, a sanity check and stress test, from a Sri Lanka transfer pricing regulations perspective on as is basis of the existing business, intercompany transactions and global transfer pricing policy of MNE will prove to be a prudent exercise. Accordingly, the Transfer Pricing policy being followed for existing transactions should be observed, keeping in perspective the Sri Lankan Transfer Pricing regulations (SL TP) and gaps, if any, identified should be addressed appropriately.

For businesses head quartered in Sri Lanka, a proactive approach is prudent to be adopted to identify the pricing policy which meets with the needs of the business and is also compliant with the SL TP regulations.

The journey of price setting to meet with the business need, once understood in detail, can be relayed correctly in the price testing process. This will help the IRD appreciate the basis on which the price of an intercompany transaction is set, in the process of evaluating the arm’s length nature as prescribed in SL TP regulations.

Transfer pricing documentation

The Transfer Pricing documentation required to meet with the SL TP regulations, is to be understood appropriately keeping in perspective each individual transaction, and the mechanism to populate the same on an annual basis should be put in place within the organization. This should include identifying clearly the documents to be collated and the person responsible for such task, along with the list of information/documents required from MNE’s head quarter and other group companies. Further it is also important to ensure that the public documents viz. website, annual report, communications to media etc. reflect the same understanding as factored in the price setting process.

Both the above areas require constant monitoring based on the dynamic business environment and ask from the Revenue authorities on the documentation front keeps evolving based on the learning from the global Transfer pricing environment.

Broadly, Transfer Pricing can be used as an effective tool to support the business decision making / price setting process. Once the same is appropriately factored in the price setting process, it helps strengthen the price testing rationale. The Revenue Authorities in Asia are, to some extent, in competition with their counterparts from other transacting jurisdictions in order to secure what they perceive to be their fair share of taxable profits of MNEs. In such scenario, Sri Lankan MNEs should take an informed and proactive approach towards complying with the SL TP regulations and to start with the alignment of price setting and price testing by harmonizing the working of Tax (Transfer Pricing) team and business team. This would possibly go a long way in relieving Transfer Pricing from becoming a matter of grave concern for MNEs in

Sri Lanka.

(Compiled by PricewaterhouseCoopers Sri Lanka)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024