Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 05:18:00

After many months of pessimism, the Colombo Stock Exchange (CSE) appears to be heading towards a bull run. In April 2017, the All Share Price Index (ASPI) has appreciated by 7.8 percent while the S&P SL 20 Index has recorded a growth of 8.6 percent. Further on, foreign contribution to the total market turnover for the current year exceeded 50 percent after nine long years.

Active foreign participation during the last four months is identified as the key contributor towards the current growth momentum. The significant increase in foreign appetite for bargains, especially fundamentally strong stocks, attracted interest back into the market and boosted the market sentiments.

Analysts identify the revival in the market as ‘long overdue’ and local investors are expected towww return to the buying side and sustain the upward trajectory. Thus, it is important to question if our readers are well poised to maximize the returns amidst the current market conditions. The article will shed light on market performance and the role of local investors.

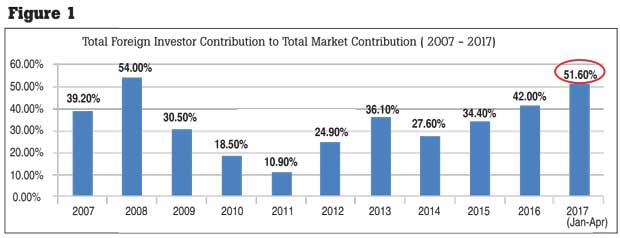

Foreign contribution to the total market exceeded 50 percent, a net foreign inflow of Rs.14.2 billion.

As the overseas appetite for local stocks steadily increase, foreign contribution to the total market turnover has exceeded 50 percent in 2017 for the first time since 2008 (51.1 percent) Further on, net foreign inflow for the current year stands at Rs.14.2 billion. Differently stated, foreign purchases exceed foreign sales by Rs.14.2 billion.

The Sri Lankan stock exchange is seen as a profitable investment destination by the United States of America and Europe. Foreign purchases from the USA exceeded Rs.8 billion while European funds/investors have invested Rs.6 billion during the current year.

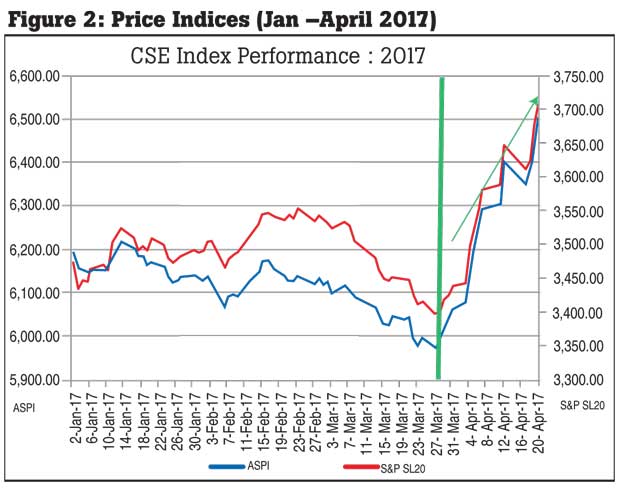

Upward trend in market indices

A structural break in the long losing streak of the ASPI and the S&P SL 20 Index was witnessed during the end of March 2017. By April 2017, the ASPI grew by 7.8 percent while the S&P SL 20 Index followed a similar upward trend and recorded a growth of 8.6 percent. During the current year, the ASPI and S&P SL 20 Index have grown by 5 percent and 6.9 percent, respectively.

The S& P SL 20 Index outperforming the ASPI signals the appetite for fundamentally strong stocks by foreign investors. Such a trend is beneficial in terms of sustaining the current momentum. Further on, the growth of the total value of the market (market capitalization) in 2007 stands at Rs.130 billion.

Maximizing returns in market

The sluggish market performance during the recent past was followed by aimless accusations directed at the government and capital market regulator, the Securities and Exchange Commission of Sri Lanka (SEC). In a bull market, many come forward to claim responsibility but when winds of change divert the direction of the market no one seems to be responsible.

At this juncture, it is important to bear in mind that market downturn was greatly driven by unfavourable global economic conditions, upward movement in interest rates in the country, depreciation of the rupee, uncertainty of introducing a capital gain tax on the capital market, political ambiguity in the domestic arena, etc.

The gradual revival in the global economy, predominantly in the USA coupled with attractive stock prices in the CSE paved the way towards increased foreign investment. It is imperative for the local investor community, both retail and funds to enter the market to grab the opportunities arising from attractive valuations. For example, a stock (one of the largest listed entities) that was trading at Rs.140 in January early this year is currently trading at Rs.159-160.

Drive behind attractive valuations

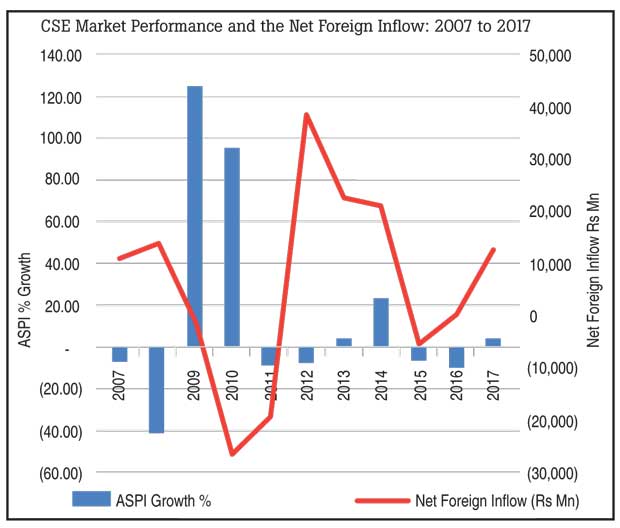

A study on the movement of foreign funds highlights the ability of foreigners to maximize returns in volatile markets. Usually, foreign buying increases during market downturn and selling increases when prices increase. This could be further elucidated with reference to Figure 4.

When the ASPI decreased by 6.7 percent in 2007 foreign purchases increased and net foreign inflow stood at Rs.11.2 billion. When the market continued to be sluggish in 2008 with a negative growth of 42 percent, the market absorbed a net foreign inflow of Rs.14 billion. Subsequently, a reversal in foreign contribution was observed as Sri Lanka marked the end of the civil war and the market experienced an upward trajectory. It was during this period local investors actively participated in the market.

Accordingly, when the market experienced a steep growth of 126 percent and 96 percent in 2009 and 2010, foreigners exited the market and net foreign outflow for the aforesaid period stood at of Rs.789 million (2009) and Rs.26 billion (2010). When prices sky rocketed foreigners exited the market to maximize their returns while local investors blindly purchased such shares at overvalued prices. When foreign investment is driven by attractive valuations and fundamental analysis local investors are overwhelmed by impulsive investing.

At present, analysts believe that valuations at the CSE are close to post-war bottoms. Prudent investing compels local investors to actively participate in the current market momentum. They are expected to base their intelligent investment decisions on solid reasoning and analysis. Remember that intelligent investing is value investing (acquiring more than what you are paying for). You must value the business in order to value the stock.

Price is what you pay; value is what you get

Local funds are expected to play a crucial role in maintaining the growth momentum. Unfortunately local funds including the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) continue to be inactive. It was reported last week that the EPF had purchased stocks of only nine listed companies during last year. Ideally funds should provide direction to the market by purchasing fundamentally strong stocks. Regrettably, certain state-owned funds in the past failed to observe such an approach and instead were driven by ulterior motives.

On the other hand, the retail investors should bear in mind the heavy price the market and its participants paid during 2011/2012. In an upward market price movement of most stocks might seem lucrative. Positive investor sentiments and increased liquidity in the market might pave the way towards realizing short-term gains by entering penny stocks.

At first glance, the reason for this is the fact that penny stocks appear to fluctuate tremendously in price. Investors believe that they might have an opportunity to generate a very high return quickly by artificially manipulating certain stocks. Such unhealthy trading practices will expose one’s portfolio to unwanted risk and above all erode investor confidence. It is pivotal to bear in mind that at the bottom line of a robust market is investor confidence.

Large short-term profits can often entice those who are new to the market. But adopting a long-term horizon and dismissing the “get in, get out and make a killing” mentality is a must for any investor. This doesn’t mean that it’s impossible to make money by actively trading in the short term. But, investing and trading are very different ways of making gains from the market. Trading involves very different risks that buy-and-hold investors don’t experience. As such, active trading requires certain specialized skills.

However, it is noteworthy to mention here that the market has not observed an unusual price movement in penny stocks during the current upward trend.

Salient role of government

The government should play a salient role in introducing policies to maintain the market momentum. It was widely discussed by the government to list certain non-strategic government investments that have potential for growth. The aforesaid stance was restated in the national budgets for the year 2016 and 2017. Market analysts believe that attracting these entities to the market would boost liquidity. Nevertheless, the policy continues to be in the pipeline.

Further on, the government should express its interest in encouraging certain profitable government institutions (Bank of Ceylon, Insurance Corporation, People’s Bank, etc.) to list on the exchange. It is suggested to list around 10 percent of the government’s stake. Such initiatives would not only increase productivity and transparency in the government sector but be beneficial to the market in general. There is a misconception in society that such strategies would amount to privatization. Privatization requires the government to divest a stake of more than 51 percent. Yet, in the given context, the government will continue to retain 90 percent of the ownership.

As the regulator, the mandate of the SEC is not to push up the market up or pull the market down but to adopt prudent measures to curtail market malpractices and create a level playing field where the interest of the investors will be protected. It is important for the SEC to clearly perceive its role and take on stringent measures to avoid the grave mistakes made in 2010/2011.

Wrapping up

As foreign investors continue to benefit from the market, the local investors are expected to optimize the lucrative opportunities in the market. Thereby, the investors are expected to play a prudent role in sustaining the upward growth trajectory by investing wisely and vigilantly.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

50 minute ago

16 Apr 2024

10 Apr 2024