Reply To:

Name - Reply Comment

Last Updated : 2024-04-20 11:47:00

The Chinese company by registering under its name vehicles imported for government projects has violated one of the main conditions in the duty deferment permit

China Harbour Engineering Company Limited- the contractual company of the Hambantota Port Project (Phase 1 and 2) has come under fire  for allegedly violating conditions stipulated in the duty deferment permits granted to them by the Departments of Fiscal Policy and Trade, Tariff and Investment Policy of the Ministry of Finance and Planning.

for allegedly violating conditions stipulated in the duty deferment permits granted to them by the Departments of Fiscal Policy and Trade, Tariff and Investment Policy of the Ministry of Finance and Planning.

China Harbour Engineering Company (CHEC) was granted duty deferral permit to import five vehicles in 2008; two in 2010 and 17 in 2013. They have violated the permit conditions which resulted Sri Lanka Customs seizing all 24 vehicles in August and September 2019.

Following the seizure, Sri Lanka Customs conducted an investigation (Case No: PREV/2019/184/CCR/01798) to unearth how CHEC had flouted vehicle permit conditions. The inquiry, further revealed how they have sought the intervention of the Finance and Planning Ministry to get these vehicles released, but to no avail.

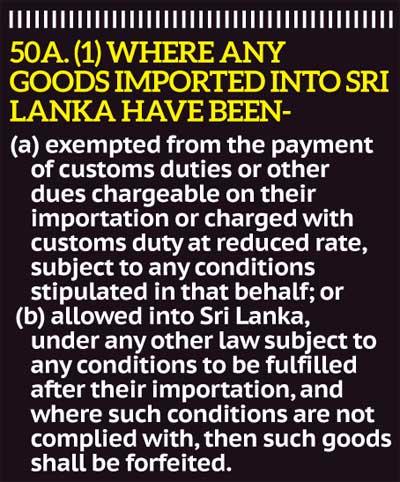

Sri Lanka Customs on January 6 directed CHEC to pay Rs.238 million for violating the permit conditions as per Section 50A (1) for the 24 vehicles in question, but will be releasing only 21 of them. This payment has to be made within 14 days, failing which the vehicles will be forfeited. Further a penalty of Rs.100, 000 has been imposed on Zheng Hao, Director Investment Promotions of M/s CHEC for running the vehicles in question up to the time they were seized, by violating the conditions stipulated in the duty deferment permits in terms of Section 129 of

Customs Ordinance.

Meanwhile, reliable Customs sources told the Daily Mirror, that Sri Lanka Customs is to initiate an investigation as to how CHEC had the vehicles registered under its name by violating one of the main conditions in the duty deferment permit.

According to the Department of Fiscal Policy and Department of Trade, Tariff and Investment Policy, items that are imported to the country under duty deferral permit, should be registered under the subject ministry. Hence in this instance these vehicles should be registered under the Ministry of Ports and Highways. These items should be either re-exported after two years from the date the permits were issued or after the completion of the project; whichever is earlier. If these items cannot be re-exported due to non-completion of the project, an extension has to be obtained from the respective departments.

It also says that if the re-exportation does not take place nor an extension is obtained within the stipulated period, the importer should  either have them released paying all the applicable taxes to the government or should hand them over to the Government based on the conditions laid down by the Department of Fiscal Policy at the time of handing over.

either have them released paying all the applicable taxes to the government or should hand them over to the Government based on the conditions laid down by the Department of Fiscal Policy at the time of handing over.

The conditions laid by the Department of Fiscal Policy states as, ‘Permission is granted for these vehicles only for the use of Hambantota Port Development Project (Phase 1 and 2) subject to the corporate guarantee given by the Secretary Ministry of Ports and Highways to re-export these vehicles. It also says that these vehicles are deferred from VAT, NBT, PAL and Excise (Special Provisions) Duty and should not be used for any other commercial purpose, sold are disposed without the approval of the Department of Fiscal Policy.

The conditions laid by the Department of Trade, Tariff and Investment Policy states that these items are deferred from Customs Import Duty (CID) and in the event, they are not re-exported due to non-completion of the project, an extension should be obtained from the Department of Trade, Tariff and Investment Policy.

Despite these being the conditions, none of them has been followed by CHEC. Meanwhile, it was revealed how the CHEC has failed to register three of these vehicles with the DMT on the grounds that they have misplaced the import documents. Their attention has been drawn to not informing the same to the respective departments until the Customs initiated the inquiry.

Be that as it may, questions have now been raised as to how these 21 vehicles were registered under their name when Sri Lanka Customs, by letters on different occasions, have directed the DMT to register these vehicles (imported on duty deferment permits) under the subject ministry- Ports and Highways.

Sri Lanka Customs, has directed the Department of Motor Traffic (DMT) to register these vehicles under Ministry of Ports and Highways. But this newspaper is in possession of the Certificates of Registration of Motor Vehicles in to these 21 vehicles which have been registered under China Harbour Engineering Company’s name.

When inquired from the Deputy Commissioner of Motor Traffic, W.P.A.C. Weerasooriya as to why th DMT did register these vehicles under China Harbour Engineering Company (CHEC) when Sri Lanka Customs has directed to register the vehicles under the Ministry of Ports and Shipping, the Deputy Commissioner said that he needs a few days to make a comment as he has to obtain the files from the DMT in Werahera.

Later, when this newspaper visited Weerasooriya’s office at Narahenpita, all the files pertaining to the registration of the vehicles, were given for perusal. Contradicting the contents of the  original Customs letter, the DMT files contain a similar letter, but with a few changes which states that the vehicles should be registered under the name of China Harbour Engineering Company.

original Customs letter, the DMT files contain a similar letter, but with a few changes which states that the vehicles should be registered under the name of China Harbour Engineering Company.

In the original letter it says, ‘You may therefore take necessary steps to register these vehicles under the name of Ministry of Ports and Highway’. However the letter in the DMT file, carries ‘You may therefore take necessary steps to register these under the name of the China Harbour Engineering Company’.

This newspaper is in possession of copies of all official documents obtained from Sri Lanka Customs. According to these official documents, Deputy Director of Customs (Long Room) P.R. Atukorale, has directed the Commissioner-General of Motor Traffic to register these vehicles under Ministry of Ports and Highways, but the DMT has registered them under China Harbour Engineering Company Pvt Ltd.

One of the letters, the Deputy Director of Customs (Long Room) has sent to the Commissioner General Motor Traffic further states, ‘This is to inform you that the above mentioned five units of Brand New Toyota land Cruiser Prado 2982CC Diesel imported by China Harbour Engineering Company Ltd, have been cleared on provisional basis on the recommendation of Ministry of Finance and Planning.

‘You may, therefore, take necessary steps to register these five units of brand new Toyota land Cruiser, Prado 2982CC Diesel, under the name of Ministry of Ports and Highway.

CusDec No: 16328 of 3-10-2013,

Type of vehicle: Five units of brand new Toyota land Cruiser Prado 2982CC Diesel,

Chassis Nos: JTEBH3FJ60-K114720, JTEBH3FJ10-K114947, JTEBH3FJ90-K115117, JtEBH3FJXO-K115305, JTEBH3FJ40-K115350, Engine Nos: 1KD2320942,1KD2322568, 1KD2323295, 1KD2323843, 1KD2324084, Fuel Type Diesel,

Engine Capacity-2982CC.

Engine Capacity-2982CC.Conditions- these vehicles should not be sold, hired, transferred, leased or otherwise disposed of without the prior approval of the General Treasury and that these vehicles should be re-exported within two years from 26-9-2013’.

Similarly, all other letters sent by Sri Lanka Customs to the DMT has given directions to register the vehicles under the Ministry of Ports and Highways.

Highly reliable sources from Sri Lanka Customs (SLC), who wished to remain anonymous, confirmed that the documents in their possession directed the Commissioner General Motor Traffic to register these vehicles under the Ministry of Ports and Highways, but not under China Harbour Engineering Company.

All letters have been signed by Deputy Director of Customs (Long Room) P.R. Atukorale. When contacted Atukorale, who is now on retirement, to find out as to whether he issued two letters on the same day under the same reference number, on the same subject, but with two different instructions, Atukorale said that he never issued such a letter to the DMT to register them under CHEC.

“I never gave such instructions to the DMT. If you claim that you saw the original letter in their file, then it is confirmed that some interested party/s have produced a counterfeit letter to the DMT. Under any circumstances, we as public officers cannot issue two different letters under one reference number on the same date. If I had to make any change to the original letter, I would have asked them to ignore the instructions given in the first letter and given new instructions,” Atukorale said.

Meanwhile, Deputy Commissioner DMT, Weerasooriya further said that based on the directions given by Sri Lanka Customs in their letters, which are in their files, the DMT has registered them under the CHEC and that they do not know whether these are counterfeit letters.

When asked as to why they do not check the authenticity of the documents they receive, Weerasooriya said they do not have any method to check the legitimacy of each and every document that is being produced daily at the DMT, but generally register the vehicles under the consignee’s name that is shown in the Customs- DMT link.

“Under CusDec No: 16328, these vehicles have been imported by CHEC. Customs letter to DMT dated October 28, 2013, Ref: No: D/RA/2013/446, also have instructed the Department to register these vehicles under CHEC with two conditions.

Based on the instructions we have registered these vehicles imposing the two requested conditions- these vehicles should be re-exported within two years from September 26, 2013 and they should not sell, hire, transfer, lease or otherwise dispose of without the prior approval of the General Treasury,” Weerasooriya said.

He further said that if the letter sent by Sri Lanka Customs is a fraudulent, the DMT could have identified it had the customs attached the Department of Fiscal Policy and Department of Trade, Tariff and Investment Policy documents that have specified the conditions which include details of under whose name the vehicle registration should be made.

Disputing DMT’s claim that it is bound to register the vehicles under the Consignee’s name given in the CusDec, Customs sources said that if the vehicles are imported under duty deferment permits they cannot be registered under the consignee’s name.

“The usual procedure is to register a vehicle under the consignee’s name declared in the customs declaration document at the time of the importation, unless the consignee is a registered importer that has paid and obtained a license as a registered importer at the DMT. However, there are exceptions. In this scenario, the vehicles are imported on duty deferment permits issued by the Department of Fiscal Policy for a Government sanctioned project under a number of conditions, including the condition that the vehicles should be registered under the Ministry of Ports and Highways.

In such instances, Sri Lanka Customs would issue a letter to the Director General of DMT instructing them to register the vehicle under the relevant ministry. This has been the usual regular procedure over the years,” sources claimed. According to Customs sources, if the DMT files contain a different letter to what it is in Customs files, an investigation should be commenced immediately to find out who was behind these disparate documents.

“We cannot point fingers at any party without knowing who is at fault. This should be handed over to the investigators who can verify the authenticity of the letters in the Customs and DMT files.

The Questioned Document Examiner (QDE) should be able to find out what the fraudulent document is,” sources added. According to the import CusDecs, these 24 vehicles have a total CIF value of Rs.117.289 million and the total payable duties and other levies at the time of importation was Rs. 315.237 million. Therefore the value of these vehicles has been calculated as Rs.432.527 million as per Section 134 of Customs Ordinance.

Meanwhile, the sources further said how the CHEC’s failure to abide by the conditions stipulated in the permits have made the national coffers incur a substantial loss of Rs.245.519 million by way of taxes.

Meanwhile, the sources further said how the CHEC’s failure to abide by the conditions stipulated in the permits have made the national coffers incur a substantial loss of Rs.245.519 million by way of taxes.

“As a result of not paying taxes on time, up to end last year (2019), the Government incurred a loss of Rs.245.519 million and Rs.88.451 million as interest calculated as per Standard Deposit Facility Rate of the Central Bank,” the sources told the Daily Mirror.

CHEC, meanwhile has further allegedly violated the conditions by running these vehicles until they were seized by Customs officials on August 22, September 6 and 9, 2019.

Out of these 21 vehicles, six have been registered under CHEC-SCL a joint venture with China Harbour Engineering Company and Sinohydro Company Ltd, while the other 15 under China Harbour Engineering Company.

At the time of the seizure, Zheng Hao Director Investment Promotion of CHEC has acknowledged that it was aware that these vehicles had to be re-exported after two years and that it is not allowed to use them after that period. However by a letter dated June 7, 2019, Managing Director CHEC, X.Q. Zhang to the Director General Customs has stated that the vehicles imported on re-exportation basis for the Hambantota Port Development Project (Phase 1 and 2), are parked at their work site and that they did not want to re-export them as they were expecting to get into more project in Sri Lanka which were delayed due to the 2015 regime change.

“Permission for these vehicles were granted for them to be used only for the Hambantota Harbour Development Project (Phase 1 and 2), but not for any other commercial purpose. At the time of the seizure, all these vehicles were in use for other commercial purposes not related to the Hambantota Port Project,” customs sources claimed.

According to these sources, the CHEC has not cooperated with the Customs inquiry and some of the senior officers were absent on many occasions submitting false excuses.

“The officer representing the interest of CHEC, Guo Zanhui did not attend the inquiry on November 6, 2019. Hence summons have been served asking him to be present on the date of the next inquiry, which is November 18, 2019. He has informed the inquiring officer that he cannot attend the meeting on November 18 as he would be on a foreign business tour. When the Customs Officers obtained his travel document details from the Department of Immigration and Emigration as of November 18, he was in the country and had not traveled abroad after August 30, 2019,” sources added.

Meanwhile, by letter dated December 3, 2019, X.Q. Zhang the authorised representative for the Customs case, has written to the Additional Director General of Customs requesting to postpone the case temporarily until he receives an official response to the customs case from the Minister of Finance.

Although CHEC has made a request from the Finance Minister, the Daily Mirror learns that the Finance Ministry has not taken any action to grant any relief to the accused company. When this newspaper contacted Guo Zanhui and Associate Director Legal M/s China Harbour Engineering Company, Menik Mendis seeking an appointment to meet them for their comment on the alleged violation of the duty deferment permit conditions and how these vehicles were registered under their name, Guo Zanhul said that he was asked by his superiors not to give an appointment to this newspaper and not to make any comment.

Although the Associate Director Legal promised to return the call after talking to her superior, Mendis did not return the call. All attempts taken thereafter to contact her failed as she did not respond to any of the calls made by the Daily Mirror newspaper. Later attempts were made to contact Ms. Indra, Secretary to the Chairman CHEC, in order to seek her assistance to get an appointment with the Associate Director Legal, but she declined to help.

Elmo de Silva fmr Dy Director General : Customs Friday, 21 February 2020 01:47 PM

1.Was the foreign exchange utilised a part of the Project costs borne by CHEC or borne by the S.L. Government?. 2. Was a Bank guarantee given with conditions / 3. In whose name was the guarantee given and under what conditions. 4. The above also need answers.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t