Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 08:14:00

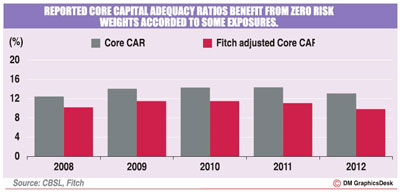

The capital adequacy of the Sri Lankan banking sector to withstand sudden solvency risks is not as healthy as reported statistics, a top Fitch Ratings official told a recent forum in Colombo.

The capital adequacy of the Sri Lankan banking sector to withstand sudden solvency risks is not as healthy as reported statistics, a top Fitch Ratings official told a recent forum in Colombo. “The point taken is that some of these things are low risk. But it does distort some of the capital ratios if you were not to account for them at all,” he pointed out.

“The point taken is that some of these things are low risk. But it does distort some of the capital ratios if you were not to account for them at all,” he pointed out.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul