Reply To:

Name - Reply Comment

Last Updated : 2024-04-23 16:21:00

From left: IMF Resident Representative to Sri Lanka Dr. Eteri Kvintradze and IMF mission chief for

Sri Lanka Todd Schneider

The often repeated pun on the International Monetary Fund’s (IMF) acronym satirically suggests that it prescribes a tighter fiscal policy, whatever an economy’s problem might be. Indeed, lower budget deficits and higher government revenues are central to Sri Lanka’s latest US $ 1.5 billion loan from the IMF. But, the economy’s booms and busts of recent years – including the current economic distress – go beyond merely the fiscal; much of it has manifested in the monetary and exchange rate policy spheres. It is hard, however, to get away from the argument that all roads lead back to the fiscal quandary; the frequent devaluation of the rupee for example, is a reflection in the monetary sphere of fundamental imbalances in the real economy – production, consumption and investment. And fiscal policy is where the adjustments begin.

The often repeated pun on the International Monetary Fund’s (IMF) acronym satirically suggests that it prescribes a tighter fiscal policy, whatever an economy’s problem might be. Indeed, lower budget deficits and higher government revenues are central to Sri Lanka’s latest US $ 1.5 billion loan from the IMF. But, the economy’s booms and busts of recent years – including the current economic distress – go beyond merely the fiscal; much of it has manifested in the monetary and exchange rate policy spheres. It is hard, however, to get away from the argument that all roads lead back to the fiscal quandary; the frequent devaluation of the rupee for example, is a reflection in the monetary sphere of fundamental imbalances in the real economy – production, consumption and investment. And fiscal policy is where the adjustments begin.

The imbalances besetting the Sri Lankan economy produces ‘twin deficits’: budget deficits that mean debt is piling up and current account deficits that indicate overriding reliance on foreign capital inflows. At the heart of it, the imbalances mean a) national expenditure exceeds national income and b) production of tradable goods and services is inadequate. So long as foreigners are willing to finance the external current account deficit, the economy can muddle along. But, if there is a reversal of such flows, as happened in 2015 (that coincided with a sharp increase in fiscal imbalances), painful adjustments have to be made.

A current account deficit can be addressed by either cutting national expenditure or raising income. The latter cannot be increased sufficiently in the short term as gross domestic product (GDP) growth typically increases expenditures and productivity improvements take time. Alternatively, governments can attempt to switch resources to produce more tradable goods and services. This calls for a depreciation of the currency. But, a nominal depreciation alone is insufficient; expenditures must also be reduced to keep domestic cost increases at bay and ensure that a real depreciation of the currency takes place.

Sri Lanka’s IMF programme signed in June 2016 has built all these elements into its framework – fiscal tightening, a soft inflation target, and a flexible exchange rate regime. Within this framework, GDP growth is expected to remain at a modest 5 percent in the medium term, while export earnings are forecast to grow steadily (Table 1). Clearly, imbalances are to be addressed in the short term by ‘switching resources’ (flexible exchange rate) rather than attempting to boost national income.

For a real depreciation of the currency to occur, expenditure (consumption or investment) must be reduced. Therefore, the government and/or private sector (firms and households) must curtail spending. This is being done by cuts in both current public spending as well as tax increases.

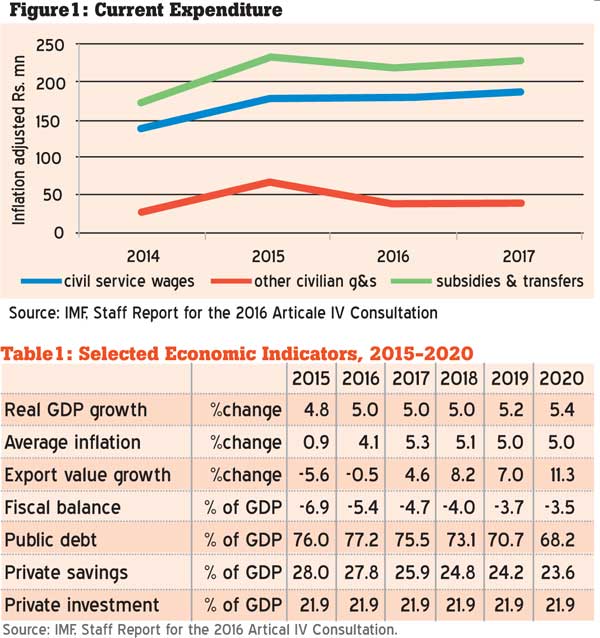

The government’s current expenditure is to reduce from 15.2 percent of GDP in 2015 to 13.9 percent in 2016. Generous relief measures offered in 2015 will take a cut in real rupee terms in 2016-17; household disposable incomes will drop as fiscal expenditures on public sector salaries and wages, expenditures on other civilian goods and services and transfers and subsidies (of which nearly 80 percent go to households) are squeezed (Figure 1). On the revenue side too, households’ disposal incomes and firms’ profits will be impacted with projected increases in collection from value-added tax (VAT) and income taxes (Table 2). Not surprisingly, the overall macroeconomic framework points to declining private savings as a share of GDP, while private investment stagnates at 21.9 percent of GDP in the coming years (see Table 1).

While focusing on fiscal policy, the response of monetary authorities will also be critical to the question of who bears the cost of adjustment. If the rupee is not allowed to float freely, interest rates will rise, increasing the cost of credit to firms and households, and thereby reducing domestic expenditures. The prudent option is to allow the rupee to move freely on underlying economic fundamentals. Monetary policy can then be more stimulative to support growth, discouraging savings and encouraging borrowing (as the predicted savings-investment figures seem to suggest).

Overall though, there is little room to provide a fiscal and/or monetary policy stimulus to accelerate growth in the near term, evident by the IMFs modest 5 percent medium-term growth estimate. It will draw the usual criticism that fiscal austerity leads to a stagnant or shrinking economy, at least in the short run, and exacerbates debt burdens needlessly. However, there is no realistic alternative to fiscal tightening; Sri Lanka has pushed itself to a corner, dragging public finances down with low-tax receipts and unaffordable spending sprees.

What the economy needs most today is a credible fiscal consolidation plan that will restore macroeconomic stability and investor confidence in the country. If the only means of getting there is inking an agreement with the IMF, then it is incumbent on the government to deliver on the terms swiftly. The loan amount, spread over three years, is relatively small. In the circumstances, Sri Lanka needs to act early and decisively to fully leverage the IMF deal as a confidence-restoring measure in its efforts to attract investment flows, both local and foreign.

(Dr. Dushni Weerakoon is Deputy Director of the Institute of Policy Studies of Sri Lanka (IPS). To view the article online and comment, visit the IPS blog ‘Talking Economics’ – www.ips.lk/talkingeconomics)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

21 Apr 2024