Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 08:14:00

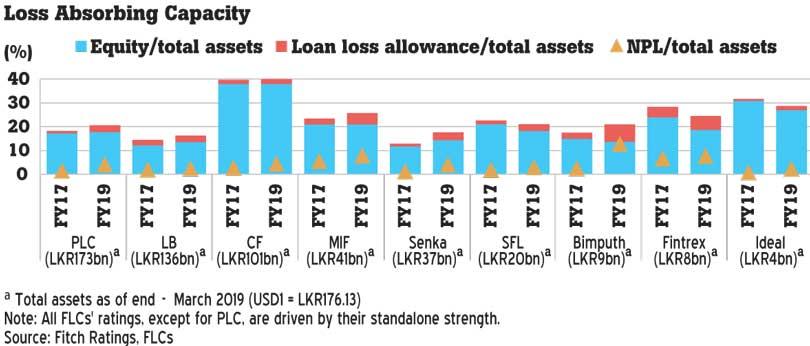

Sri Lankan Finance and Leasing Companies’ (FLCs) credit profiles are likely to remain under pressure amid rising non-performing loans (NPLs), weakening profitability and erosion of capital buffers, Fitch Ratings said.

“Sri Lankan finance and leasing companies’ (FLCs) loss- absorbing capacity is likely to deteriorate further in the medium term due to high asset-quality risks and weakening profit buffers as a result of a prolonged slowdown in economic activity,” Fitch said in its latest Sri Lankan Finance and Leasing Companies Dashboard.

Fitch Ratings sees capital-impairment risk as more acute across the small- to mid-sized FLCs due to pre-impairment operating profit buffers which are already weak; a small absolute capital base; and high share of unprovisioned.

“We feel that significant capital impairment from sustained deterioration in asset quality would exert downward pressure on the ratings of standalone-driven Sri Lankan FLCs,” Fitch Ratings said.

The rating agency noted that seven out of 16 Fitch-rated FLCs require at least Rs.6.7 billion as of financial year-end March 2019 to meet the Central Bank’s enhanced capital requirements of Rs.2.5 billion by January 1, 2021. “The inability of some small- and mid-sized FLCs to meet interim regulatory requirements has exposed them to regulatory risks, which include having to face deposit caps, lending caps and issuance of Notice of Cancellation of the License,” Fitch Ratings said.

The Central Bank of Sri Lanka has already taken regulatory action in 2019 on several FLCs, which were non-compliant with capital requirements.

The rating agency expects FLCs’ asset-quality pressure to persist into FY20, given expectations of slow economic growth. However, the deceleration in loan growth in the last 18 months may reduce the accumulation

of incremental NPLs.

“Asset-quality deterioration of the FLC sector is profound compared with that of the banking sector due to FLCs’ predominant exposure to vulnerable market segments, which are highly susceptible to economic cycles,” Fitch Ratings said.

FLCs’ profitability measures are likely to remain modest in the next 12 months due to rising credit costs and declining operating profit from the slowdown in lending volumes, according to the rating agency,

Higher taxes on financial institutions would be a further drag on profitability, limiting internal capital generation.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul