Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 09:27:00

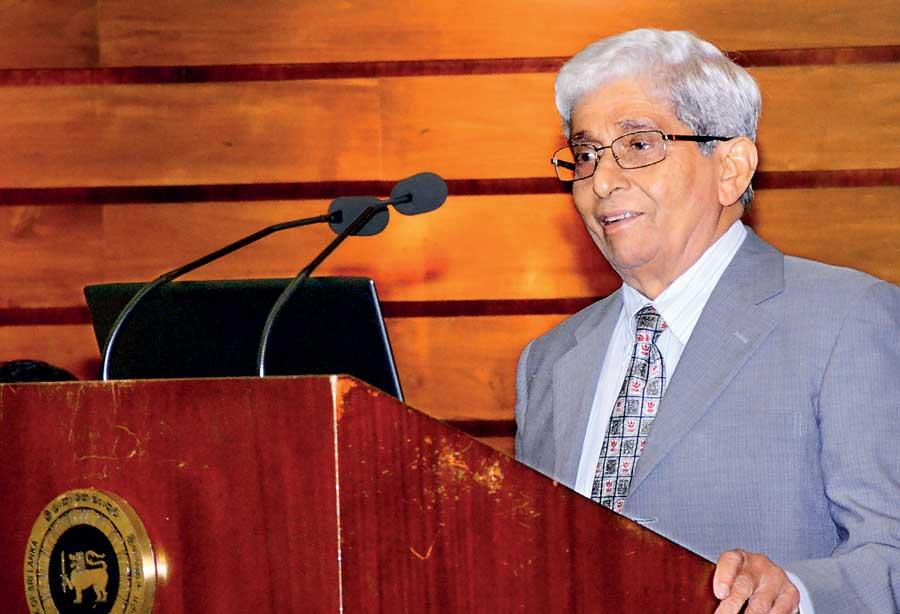

Prof. W.D. Lakshman

Following is the full text of the speech made by new Central Bank Governor Deshamanya Prof. W.D. Lakshman at the Monetary Policy Review press conference held last Friday. He is the 15th Governor of the Central Bank.

A privilege – an honour to have been appointed to the esteemed and celebrated position of great consequence, coming as the 15th in the wake of a long succession of great men who decorated this position over the last 69 years.

This succession of governors started indeed from John Exeter, the author of the Monetary Law Act of 1949, the enabling legislation of the Central Bank and Sri Lanka’s pioneer Central Bank head. The Central Bank was established, replacing its predecessor, the Currency Board System, in the 1950s, with the objective of adding to the country’s regained sovereignty, the independent decision-making authority in monetary and financial affairs.

It is now an institution carrying a great deal of prestige, respect and credibility, having managed the monetary affairs of Sri Lanka with responsibility for six decades. I am committed to sustain and add to this institutional greatness. I hope to do my best to uphold the great traditions of the Central Bank built up over nearly seven decades.

I must make particular reference to my immediate predecessor, Dr. Indrajit Coomaraswamy, who has contributed a great deal to re-establish the Central Bank’s respect within our socioeconomic system in general and the country’s financial community in particular. His contribution to firmly establish procedures and practices in the Central Bank governance is acknowledged to be extremely helpful and facilitating for his immediate successor.

Let me express my thanks and gratitude to the President, Prime Minister and Secretary to President for selecting and appointing me to this highly responsible and exalted position. As expected of me, I will make every effort to safeguard its reputation and prestige and to fulfil the confidence placed on me by appointing authorities.

My work experience has so far been academic. Studied and taught central banking as part of courses in economics and development studies both at undergraduate and graduate levels. I am therefore familiar with central banking theory and practice as academic disciplines. I am also familiar with the historical debates covering the role of central banking and how different schools of thought viewed that role. This is however, the first time I am trying my hand as a practical central banker.

I very much look forward to learn from my colleagues within the Central Bank, while working and hope, will also be able to, in the process, make my own contribution to Sri Lankan central banking. The Central Bank’s large pool of competent, committed and highly trained human resources, I am sure, will provide me the required support in carrying out the functions of my office as the head of the apex financial authority in the country.

The objectives of the Central Bank as specified in the MLA in 1949: 1. The stabilisation of domestic monetary values (maintenance of price stability). 2. The preservation of the par value or the stability of the exchange rate of the Sri Lankan rupee (maintenance of exchange rate stability). 3. The promotion and maintenance of a high level of production, employment and real income in Sri Lanka. 4. The encouragement and promotion of the full development of the productive resources of Sri Lanka.

However, in keeping with (i) the worldwide trends in central banking and (ii) the rapid changes in international financial markets, the Central Bank embarked on a modernisation programme in 2000. The objectives were adjusted accordingly, bringing them down to two core objectives reflecting the abandonment of the real economy objectives 3 and 4 in the MLA of 1949: 1. Maintaining of economic and price stability 2. Maintaining of financial system stability.

These statutory objectives show that the Central Bank has an important stabilisation role as well as a facilitation role in the economy. The country has been struggling with below 5 percent growth for several years and growth has now slowed down to below 3 percent. Although inflation has been contained from the demand side, weather-related food price volatility and dependence on imported commodities constantly threaten cost of living.

Statistics on unemployment appear acceptable but they hide issues such as underemployment, low labour force participation, high unemployment amongst educated youth, an ageing labour force and low productivity and these need to be addressed if the government is to realise its goal of eliminating poverty through effective utilisation of labour resources.

In the external sector, sluggish export performance, large trade deficits, persistent current account deficits, dependence on debt inflows in the absence of alternative levels of FDI inflows, as well as high foreign financing needs are major concerns. In addition, we need to be watchful of developments in the global economy and financial markets as well.

In this context, we hope to engage with the IMF and other multilateral agencies while remaining within the framework of national policy to ensure that the country reverts to a sustainable path of reserve accumulation a prerequisite for exchange rate stability as well.

The government is aware of the need for fiscal consolidation and in addressing long-standing issues in the fiscal sector while supporting the revival of the economy.

In the monetary sector, we have seen credit flows coming to virtually a standstill. Monetary and regulatory measures taken so far, as well as the measures that are being contemplated by the government, including the moratorium on capital repayments of bank loans by SMEs, supported by improving business confidence, will result in an acceleration of credit flows in the period ahead. This will also help address the increased NPL ratios of the financial sector.

With the revival of economic activity, we expect economic growth to accelerate to around 4-4.5 percent and inflation to remain below 4 percent in 2020. Beyond 2020, with the necessary reforms, annual growth is expected to accelerate to over 6.5 percent while inflation will be managed between 4-6 percent.

In the present context of subdued growth and development, continuing prevalence of poverty pockets despite poverty alleviation policies of over several decades in the past and prevalence of unemployment and underemployment at worrying levels, the fiscal and monetary authorities and decision makers in different real sectors of the economy are confronted with the challenge of searching and identifying alternative policy sets of greater efficacy than the neo-liberal policy set.

I hope to be able to make my contribution in this search for alternatives, together with the other authorities. The monetary policy announcements made today, we hope, will be of positive impact, helping and supporting the various measures announced from time to time by fiscal and other authorities.

It is in this overall context that the Monetary Board decided to maintain its accommodative policy stance unchanged at yesterday’s meeting. We hope to be proactive and the Central Bank will assess the developments in the market and the economy closely and take appropriate action as necessary to maintain economic and price stability as well as financial system stability, which is our mandated objective, within the overall policy framework of the government.

This is a time of important changes in Sri Lankan development policy and practice. Questions are being raised extensively about the validity and relevance of Washington Consensus type or neoliberal type policies to achieve the desired goals of inclusive, sustainable and shared development. This questioning may also apply to central banking nowadays. I am extremely excited about the opportunity I have gained at a time like this to make my active contribution to Sri Lanka’s search for an alternative policy approach to achieve the desired development objectives.

Let me also recognise the important role of mass media in educating the public and improving economic and financial literacy. Media has performed the vital role of questioning the governments and the Central Bank’s actions in the economy and the financial market and we hope media will continue to play the role of a balanced intermediary between the government and the public, which will help us achieve the ultimate goal of improved social welfare through appropriate policy measures.

Thank you very much.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024