Reply To:

Name - Reply Comment

Last Updated : 2024-04-18 14:58:00

Significantly tighter external borrowing conditions are likely to further squeeze Sri Lanka’s debt affordability as the country grapples to rollover its mammoth US $ 17 billion foreign currency debt in the next five years amid tightening international capital market yields and capital outflows from frontier and emerging markets with rising yields in the United States.

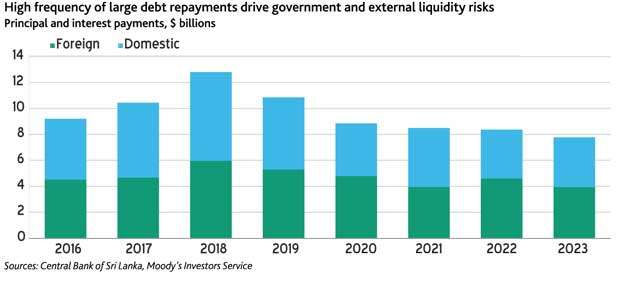

In an annual credit analysis conducted on the government of Sri Lanka, Moody’s said during the five years from 2019 to 2023, Sri Lanka is required to make principle repayments of US $ 3.5 billion every year on the external debt it had taken in addition to financing part of the annual budget deficit externally.

“Sri Lanka faces significantly tighter external refinancing conditions during the next five years, which would quickly lead to much weaker debt affordability, especially if the currency was to depreciate at the same time”, Moody’s said. Moody’s maintains a B1 speculative grade credit rating on the Sri Lankan sovereign and said a rating upgrade is unlikely, given the dominant government credit profile and country’s elevated exposure to debt refinancing risk.

If Sri Lanka’s debt refinancing capacity continues to weaken, Moody’s cautioned that a rating downgrade is possible. “Evidence that the implementation of key policies — including further fiscal consolidation, monetary policy independence from fiscal developments, and the diversification of financing sources or liability management — is not effective and would likely to negatively affect Sri Lanka’s access to and cost of finance.

A marked weakening in reserve adequacy from already low levels, and a stop to or reversal in fiscal consolidation that raises the prospect of higher government debt and prevents the likely decline in gross borrowing requirements could also prompt a rating downgrade”, the rating agency added.

Moody’s will only consider an upgrade in the Outlook to ‘Stable’ if domestic and external refinancing risks are likely to diminish.

According to Moody’s estimates, foreign currency borrowings consist of 46 percent of the total outstanding government debt as of 2017.

This demonstrates the higher dependency on foreign currency borrowings from bilateral and commercial lenders by the Sri Lankan government, exposing the sovereign to increased external vulnerabilities.

The higher reliance on the external financing is due to Sri Lanka’s relatively narrow domestic financing market, Moody’s said.

According to Moody’s estimates, government gross borrowing requirements, incorporating projections on fiscal deficits and maturing government debt repayments, is expected to reach about 18.5 percent of the GDP in 2018, and in the baseline, it is to fall to a still-high level of 13 percent by 2020.

“A significant proportion of the government’s debt is financed at short maturities, including treasury bills equivalent to around 12.5 percent of outstanding domestic debt, or about 5 percent of GDP in 2017”, Moody’s noted.

Meanwhile, the rating agency expects the Active Liability Management Act to provide some headroom for the government to smoothen the timing of its debt refinancing options, “within a given year”.

Lately, the government has shown its willingness to diversify its foreign currency debt refinancing sources as it announced issuance of Chinese renminbi and Japanese yen denominated bonds as well as loans from other bilateral and multilateral lenders.

Further, the government has also shown interest towards local-currency borrowing to finance fiscal deficit given the lower debt repayments on domestic treasury bonds in coming years.

However, higher reliance on domestic funding sources has inherent risks such as pressure on domestic market interest rates and crowding out effect on the private sector from the banks’ loanable funds.

“We expect treasury bond maturities to fall to around 2 percent of GDP on average per year over 2019-23, from about 4 percent of GDP in 2018, providing some space for the government to increase local-currency borrowing to finance the fiscal deficit.

Though this will help reduce exchange rate risks, given local currency interest rates are much higher than the average cost of external debt, debt affordability will remain weak”, Moody’s said.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024