Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 09:49:00

Profits at premier blue chip John Keells Holdings PLC (JKH) during the June quarter (1Q20) plunged as revenues decelerated amid the deterioration in consumer and business sentiments and due to the changes to an accounting standard hitting the finance cost.

Profits at premier blue chip John Keells Holdings PLC (JKH) during the June quarter (1Q20) plunged as revenues decelerated amid the deterioration in consumer and business sentiments and due to the changes to an accounting standard hitting the finance cost.

Earnings at Sri Lanka’s largest conglomerate fell to Rs.994.3 million or 75 cents a share during the April-June period, compared to Rs.2.2 billion or Rs.1.58 a share reported for the same period, last year.

The contraction in the profits between the two periods was 54 percent.

Yesterday, the JKH share closed at Rs.151, down 80 cents or 0.53 percent.

The group finance cost rose by a significant 145 percent year-on-year (YoY) to Rs.1.16 billion. JKH Group Chairman Krishan Balendra attributed it to the impact stemming from the migration into a new lease accounting standard – IAS 17 to IFRS 16.

Under the new accounting standard, Balendra said the impact to the income statement was front-loaded due to the higher finance expense at the inception of the lease.

The new accounting standard affected the group’s supermarket business and the Maldivian resorts segment the most.

Meanwhile, the group’s long-term borrowings also rose quite substantially from Rs.21.3 billion to Rs.36.3 billion within the span of just three months.

The growth in the group’s revenues fell 5.0 percent YoY to Rs.31.7 billion during the period under review while the cost of sales rose by 8.0 percent YoY to Rs.26.5 billion.

This resulted in the gross profit declining by 8.0 percent YoY to Rs.5.3 billion.

The group’s operating profit fell by 34 percent YoY to Rs.450.8 million.

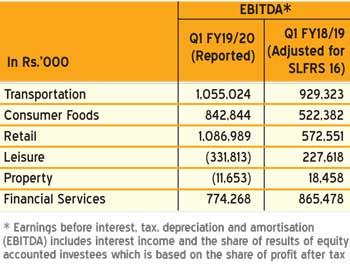

The group’s leisure business suffered the most during the three months due to the Easter attacks affecting the tourist arrivals.

The leisure sector revenue fell to Rs.2.9 billion, from Rs.4.4 billion a year earlier, with the loss widening to Rs.1.1 billion, from Rs.278.4 million.

Balendra expressed optimism on the sector’s recovery with the forward bookings of the company’s Cinnamon-branded hotels reaching to levels of approximately 75 percent, compared to the bookings received during the same period, last year.

“The growth momentum of arrivals is expected to recover to pre-incident levels in the next nine to 12 months, as historically indicated by other travel destinations, which have experienced similar terrorism incidents,” he added.

Meanwhile, the group’s consumer foods and retail sectors performed well during the period with the revenues rising. But the profits of the segment fell.

The group’s consumer foods business reported revenues of Rs.4.5 billion, compared to Rs.3.7 billion a year ago while this segment recorded a profit after tax of Rs.406.6 million, up from Rs.231.5 million a year earlier.

The group’s consumer foods business reported revenues of Rs.4.5 billion, compared to Rs.3.7 billion a year ago while this segment recorded a profit after tax of Rs.406.6 million, up from Rs.231.5 million a year earlier.

The retail arm of the group, which operates the Keells supermarket chain, reported earnings of Rs.141.6 million, compared to Rs.170.5 million a year ago.

The retail business generated revenues of Rs.15.7 billion, compared to Rs.13.1 billion a year ago.

The group’s transport business slightly improved its bottom line to Rs.961.7 million during the quarter on a revenue of Rs.5.5 billion, slightly down from Rs.5.6 billion a year ago.

Meanwhile, the group’s property business turned red with negative earnings of Rs.59 million on revenues of Rs.209.9 million, down from Rs.226.8 million, a year ago.

The group’s financial services business, which mainly houses the licensed commercial bank, Nations Trust Bank and the insurance company Union Assurance PLC, reported lower earnings of Rs.315 million, compared to Rs.550 million a year ago, mainly due to the low profitability of the bank.

As of June 30, 2019, S.E. Captain held a 11.4 percent stake in JKH as the single largest shareholder of JKH while Broga Hill Investments Limited held 10.8 percent. Melstacorp PLC held 9.8 percent being the third largest shareholder.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t

10 Apr 2024

09 Apr 2024