In his speech, MP Pasqual argues that only a small fraction (10%) of students have the opportunity to attend university and that everybody else, after completing school, is “left to drift aimlessly.” FactCheck.lk interprets the MP’s larger claim to refer to making a case for more state universities.

In his speech, MP Pasqual argues that only a small fraction (10%) of students have the opportunity to attend university and that everybody else, after completing school, is “left to drift aimlessly.” FactCheck.lk interprets the MP’s larger claim to refer to making a case for more state universities.

This fact-check focuses on the statistics cited and the argument made by the MP to support his claim. There may be other arguments in support of his claim that are therefore not evaluated.

To check this claim, FactCheck.lk consulted the Annual School Census of Sri Lanka, statistics presented by the Chairman of the University Grants Commission (UGCPresentation), and the UNESCO Institute of Statistics.

The MP’s claim that students who do not gain entrance to state universities in Sri Lanka are “left to drift aimlessly” is misleading for three reasons:

1.It undercounts the percentage of students enrolled in state universities.

2.It neglects to account for students enrolled in non-state universities and universities abroad.

3.It neglects to account for students pursuing higher education in institutions other than universities.

First, according to the UGC presentation, 43,927 students were admitted to state universities in 2021. This figure is approximately 13% of the 330,488 students that entered Grade 1 in 2008, 13 years prior. This figure is somewhat higher than the share of 10% claimed by MP Pasqual.

Second, the MP limits the number of students pursuing university degrees to university education provided by the state. The UGC presentation reports that in 2021, approximately 25,000 students were enrolled in non-state institutions providing local or foreign-affiliated university degrees. An additional 29,000 students are reported to be pursuing university education abroad. Assuming that annual admissions are one-fourth of total enrollment, this increases the percentage of students admitted to universities yearly by another four percentage points.

Third, the MP also limits the number of students receiving higher education to those pursuing university education. Higher education is a broader category encompassing degrees provided by state and non-state universities, diplomas, and technical and vocational education. The UGC presentation reports that in 2021, almost 16,000 students were enrolled in diploma programmes provided by state and non-state institutions. 35,700 students were also enrolled in technical and technological colleges providing training across diverse vocational trades.

Assuming the average length of all these diploma and vocational programmes is two years, this increases the share of students admitted to higher/further education programmes each by another 8 percentage points. The count may still leave out those enrolled in professional education programmes such as banking and accounting.

The MP supports his larger position by claiming that 90% of those who enter school are “left to drift aimlessly” after school leaving age (without opportunities for higher education). However, the available statistics show that about 25% (13+4+8) of that group are admitted to higher education institutions, making the 90% figure a highly overstated estimate of those who might not have recourse to higher education.

Therefore, we classify the MP’s statement as FALSE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In his speech, MP Pasqual argues that only a small fraction (10%) of students have the opportunity to attend university and that everybody else, after completing school, is “left to drift aimlessly.” FactCheck.lk interprets the MP’s larger claim to refer to making a case for more state universities.

In his speech, MP Pasqual argues that only a small fraction (10%) of students have the opportunity to attend university and that everybody else, after completing school, is “left to drift aimlessly.” FactCheck.lk interprets the MP’s larger claim to refer to making a case for more state universities.

This fact-check focuses on the statistics cited and the argument made by the MP to support his claim. There may be other arguments in support of his claim that are therefore not evaluated.

To check this claim, FactCheck.lk consulted the Annual School Census of Sri Lanka, statistics presented by the Chairman of the University Grants Commission (UGCPresentation), and the UNESCO Institute of Statistics.

The MP’s claim that students who do not gain entrance to state universities in Sri Lanka are “left to drift aimlessly” is misleading for three reasons:

1.It undercounts the percentage of students enrolled in state universities.

2.It neglects to account for students enrolled in non-state universities and universities abroad.

3.It neglects to account for students pursuing higher education in institutions other than universities.

First, according to the UGC presentation, 43,927 students were admitted to state universities in 2021. This figure is approximately 13% of the 330,488 students that entered Grade 1 in 2008, 13 years prior. This figure is somewhat higher than the share of 10% claimed by MP Pasqual.

Second, the MP limits the number of students pursuing university degrees to university education provided by the state. The UGC presentation reports that in 2021, approximately 25,000 students were enrolled in non-state institutions providing local or foreign-affiliated university degrees. An additional 29,000 students are reported to be pursuing university education abroad. Assuming that annual admissions are one-fourth of total enrollment, this increases the percentage of students admitted to universities yearly by another four percentage points.

Third, the MP also limits the number of students receiving higher education to those pursuing university education. Higher education is a broader category encompassing degrees provided by state and non-state universities, diplomas, and technical and vocational education. The UGC presentation reports that in 2021, almost 16,000 students were enrolled in diploma programmes provided by state and non-state institutions. 35,700 students were also enrolled in technical and technological colleges providing training across diverse vocational trades.

Assuming the average length of all these diploma and vocational programmes is two years, this increases the share of students admitted to higher/further education programmes each by another 8 percentage points. The count may still leave out those enrolled in professional education programmes such as banking and accounting.

The MP supports his larger position by claiming that 90% of those who enter school are “left to drift aimlessly” after school leaving age (without opportunities for higher education). However, the available statistics show that about 25% (13+4+8) of that group are admitted to higher education institutions, making the 90% figure a highly overstated estimate of those who might not have recourse to higher education.

Therefore, we classify the MP’s statement as FALSE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In parliament, MP Vijitha Herath made two claims about expenditure allocations related to the president: (1) the budget line item titled president’s expenditure head (to discharge duties as the head of state) has increased to LKR 3,779 million, and (2) seven ministries headed by the president have been allocated 66.7% of the total budget expenditure.

In parliament, MP Vijitha Herath made two claims about expenditure allocations related to the president: (1) the budget line item titled president’s expenditure head (to discharge duties as the head of state) has increased to LKR 3,779 million, and (2) seven ministries headed by the president have been allocated 66.7% of the total budget expenditure.

To verify the MP’s claim, FactCheck.lk referred to the draft Budget Estimates for 2024 (which were available at the time the MP made the statement), the Constitution of Sri Lanka, the Parliament Hansard, and Gazette No. 2304/58 to determine the ministerial portfolios of the cabinet ministers.

Claim 1: Draft budget estimates show that the budget recurrent (non-capital) component of the president’s expenditure head has increased from LKR 2,812 million (in 2023) to LKR 3,779 million for the year 2024. A majority of that increase is from increased allocations for utilities and wages. There is almost no change in the capital component of the budget.

Claim 2: The total expenditure in the budget is LKR 6,558.44 billion, with LKR 3,859.97 billion allocated to ministries under the president. The higher figures cited by the MP are probably derived from adding to expenditure the capital debt repayments of LKR 1,268.39 billion (which is handled by the Ministry of Finance). However, these capital repayments on debt are not classified as expenditure according to public accounting standards (see Additional Note). Therefore, the budgeted expenditure for the ministries headed by the president is 58.9% of the total expenditure in the budget, not the 66.7% figure cited by the MP. However, 40.4% of the budgeted expenditure is to pay interest on debt. Outside of that, only 18.4% of the budgeted expenditure is under the president.

The MP also made an error in referring to seven ministries being under the President. Gazette No. 2304/58 and the Parliament Hansard dated 22 November 2023 (which were available at the time the MP made the statement) show that there are 28 ministries, and that the president is the minister for only five of them.

The MP’s numbers align with the increase in the recurrent (not total) allocation of the budget line item of the president’s expenditure head. However, he makes a significant error in interpreting the proportion of expenditure that is disbursed under the ministries headed by the president, and also overstates the number of ministries under the president.

Therefore, we classify the MP’s statement as PARTLY TRUE.

Additional note 1: This interpretation error with regard to what constitutes expenditure has been previously highlighted by FactCheck.lk in the fact check titled “AKD mis-categorises expenditure in assessing Rajapaksa budget” in December 2021.

]]>

]]>

In parliament, MP Vijitha Herath made two claims about expenditure allocations related to the president: (1) the budget line item titled president’s expenditure head (to discharge duties as the head of state) has increased to LKR 3,779 million, and (2) seven ministries headed by the president have been allocated 66.7% of the total budget expenditure.

In parliament, MP Vijitha Herath made two claims about expenditure allocations related to the president: (1) the budget line item titled president’s expenditure head (to discharge duties as the head of state) has increased to LKR 3,779 million, and (2) seven ministries headed by the president have been allocated 66.7% of the total budget expenditure.

To verify the MP’s claim, FactCheck.lk referred to the draft Budget Estimates for 2024 (which were available at the time the MP made the statement), the Constitution of Sri Lanka, the Parliament Hansard, and Gazette No. 2304/58 to determine the ministerial portfolios of the cabinet ministers.

Claim 1: Draft budget estimates show that the budget recurrent (non-capital) component of the president’s expenditure head has increased from LKR 2,812 million (in 2023) to LKR 3,779 million for the year 2024. A majority of that increase is from increased allocations for utilities and wages. There is almost no change in the capital component of the budget.

Claim 2: The total expenditure in the budget is LKR 6,558.44 billion, with LKR 3,859.97 billion allocated to ministries under the president. The higher figures cited by the MP are probably derived from adding to expenditure the capital debt repayments of LKR 1,268.39 billion (which is handled by the Ministry of Finance). However, these capital repayments on debt are not classified as expenditure according to public accounting standards (see Additional Note). Therefore, the budgeted expenditure for the ministries headed by the president is 58.9% of the total expenditure in the budget, not the 66.7% figure cited by the MP. However, 40.4% of the budgeted expenditure is to pay interest on debt. Outside of that, only 18.4% of the budgeted expenditure is under the president.

The MP also made an error in referring to seven ministries being under the President. Gazette No. 2304/58 and the Parliament Hansard dated 22 November 2023 (which were available at the time the MP made the statement) show that there are 28 ministries, and that the president is the minister for only five of them.

The MP’s numbers align with the increase in the recurrent (not total) allocation of the budget line item of the president’s expenditure head. However, he makes a significant error in interpreting the proportion of expenditure that is disbursed under the ministries headed by the president, and also overstates the number of ministries under the president.

Therefore, we classify the MP’s statement as PARTLY TRUE.

Additional note 1: This interpretation error with regard to what constitutes expenditure has been previously highlighted by FactCheck.lk in the fact check titled “AKD mis-categorises expenditure in assessing Rajapaksa budget” in December 2021.

]]>

]]>

The MP argued at a press conference that Sri Lanka’s tax policies don’t take adequate account of the huge inequality existing among Sri Lankan citizens, when designing the distribution of the tax burden. In support of this larger argument, he provided the above statistics highlighting inequality.

The MP argued at a press conference that Sri Lanka’s tax policies don’t take adequate account of the huge inequality existing among Sri Lankan citizens, when designing the distribution of the tax burden. In support of this larger argument, he provided the above statistics highlighting inequality.

To check this claim, FactCheck.lk consulted the World Inequality Database (WID) and the 2019 Human Development Report (HDR) by the UNDP. The most recent figures are reported for 2022.

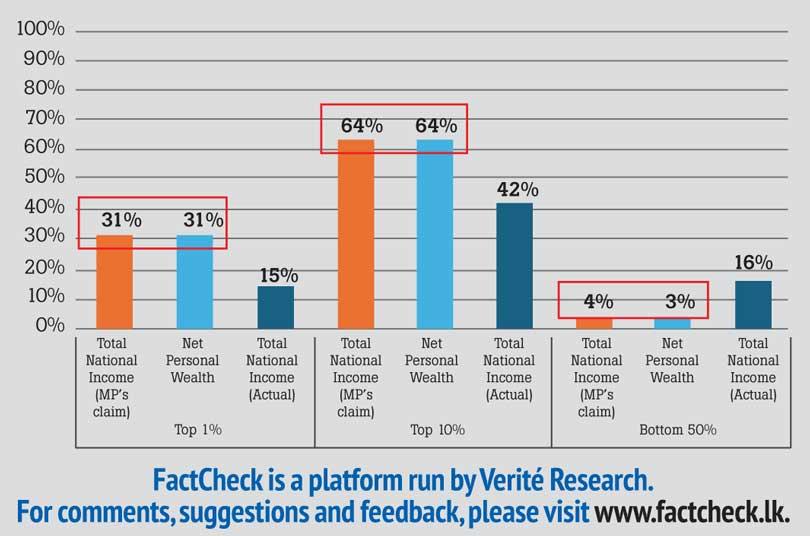

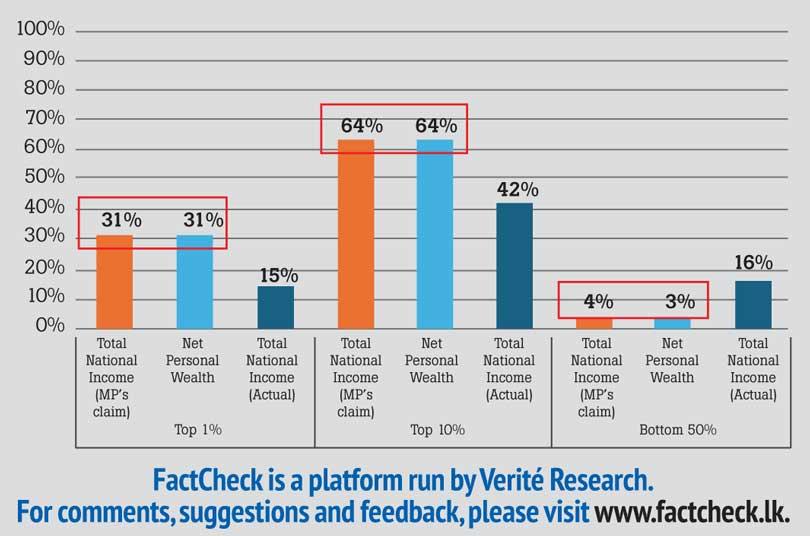

According to the available data, distribution of national income in Sri Lanka is different from the figures cited by the MP, and the inequality of income is notably less than what is cited. The top one percent are recorded as having received 15% of the total income, and not 31% as cited by the MP. Likewise, the top ten percent received only 42%, not 64% of the income, and the bottom fifty percent received 16% and not just 4% of the income.

In attempting to understand how the MP had arrived at his numbers, FactCheck.lk found that the MP had cited figures related to wealth inequality in Sri Lanka, and not income inequality.

Inequality can be quantified both in terms of income or wealth across different strata of society; but they are quite different measures/statistics. According to the HDR, income is measured as wages, salaries, profits, and earnings over a given period. By contrast, wealth is measured as the total current value of accumulated assets owned by individuals (e.g., savings, properties, investments) minus all debts.

The MP’s cited figures align with the distribution reported of net personal wealth across society, and not the distribution of total national income as he claimed (see Exhibit 1). Overall, the MP is setting out to highlight inequality in society, and arguing for taxes that take more from those who are better off and less from those who are worse off. Wealth inequality that he cites correctly (though mislabeling it as income inequality) is an important measure of inequality, and a valid focus of tax policy. The MP’s statement is not correct, as he mislabels the “wealth” inequality statistics as “income” inequality statistics. However, if correctly labelled that statistic on wealth inequality does support the argument he is making.

Therefore, we classify the MP’s statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Source: World Inequality Database 2022

]]>

]]>

The MP argued at a press conference that Sri Lanka’s tax policies don’t take adequate account of the huge inequality existing among Sri Lankan citizens, when designing the distribution of the tax burden. In support of this larger argument, he provided the above statistics highlighting inequality.

The MP argued at a press conference that Sri Lanka’s tax policies don’t take adequate account of the huge inequality existing among Sri Lankan citizens, when designing the distribution of the tax burden. In support of this larger argument, he provided the above statistics highlighting inequality.

To check this claim, FactCheck.lk consulted the World Inequality Database (WID) and the 2019 Human Development Report (HDR) by the UNDP. The most recent figures are reported for 2022.

According to the available data, distribution of national income in Sri Lanka is different from the figures cited by the MP, and the inequality of income is notably less than what is cited. The top one percent are recorded as having received 15% of the total income, and not 31% as cited by the MP. Likewise, the top ten percent received only 42%, not 64% of the income, and the bottom fifty percent received 16% and not just 4% of the income.

In attempting to understand how the MP had arrived at his numbers, FactCheck.lk found that the MP had cited figures related to wealth inequality in Sri Lanka, and not income inequality.

Inequality can be quantified both in terms of income or wealth across different strata of society; but they are quite different measures/statistics. According to the HDR, income is measured as wages, salaries, profits, and earnings over a given period. By contrast, wealth is measured as the total current value of accumulated assets owned by individuals (e.g., savings, properties, investments) minus all debts.

The MP’s cited figures align with the distribution reported of net personal wealth across society, and not the distribution of total national income as he claimed (see Exhibit 1). Overall, the MP is setting out to highlight inequality in society, and arguing for taxes that take more from those who are better off and less from those who are worse off. Wealth inequality that he cites correctly (though mislabeling it as income inequality) is an important measure of inequality, and a valid focus of tax policy. The MP’s statement is not correct, as he mislabels the “wealth” inequality statistics as “income” inequality statistics. However, if correctly labelled that statistic on wealth inequality does support the argument he is making.

Therefore, we classify the MP’s statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Source: World Inequality Database 2022

]]>

]]>

To check this claim, FactCheck.lk consulted the Weekly Economic Indicators of the Central Bank of Sri Lanka (CBSL), IMF’s Balance of Payments Manual sixth edition (BPM6), and IMF Country Report No. 23/12.

To check this claim, FactCheck.lk consulted the Weekly Economic Indicators of the Central Bank of Sri Lanka (CBSL), IMF’s Balance of Payments Manual sixth edition (BPM6), and IMF Country Report No. 23/12.

The assistant governor’s figure aligns with the CBSL’s weekly economic indicators, which cite the Official Reserve Asset at USD 4.3 billion by the end of December 2023. However, upon closer examination of the criteria for reserve reporting, the accuracy of this figure is contested.

Since March 2021, the CBSL has had a swap facility with the People’s Bank of China (PBoC) of RMB 10 billion (approximately USD 1.4 billion). However, an examination of the CBSL reports’ footnotes from November 2021 to March 2022 reveals that this facility, which was not previously counted as reserves, has only been counted as part of the reserves since December 2021. The late inclusion of the swap suggests that the criteria used to report reserves had been adjusted.

According to international standards (BPM6), the reserve assets must be under the direct and effective control of the monetary authority and readily available without condition. The PBoC swap, by these standards, does not qualify as a reserve asset due to not fulfilling several of these conditions.

The IMF’s recent staff report distinguishes between reported gross official reserves and usable reserves, highlighting the discrepancy between the two. It also does not recognise the PBoC swap as part of usable reserves. Definitionally, “unusable reserves” is an oxymoron on the basis of the definition of a reserve asset in BPM6. Likewise, even government ministers and President Ranil Wickremesinghe have stated that reserves were close to “zero” in April 2022. In doing so, they have also asserted the international standard (BPM6) under which the PBoC swap does not constitute reserves.

As such, the amount of reserve assets of the CBSL, assessed according to the relevant reporting standards, is only USD 3.0 billion. This figure is significantly below the assistant governor’s claim of USD 4.4 billion. The assistant governor is using the official reporting of the CBSL, even though on the above analysis that reporting is flawed.

Therefore, we classify this statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

]]>

]]>

To check this claim, FactCheck.lk consulted the Weekly Economic Indicators of the Central Bank of Sri Lanka (CBSL), IMF’s Balance of Payments Manual sixth edition (BPM6), and IMF Country Report No. 23/12.

To check this claim, FactCheck.lk consulted the Weekly Economic Indicators of the Central Bank of Sri Lanka (CBSL), IMF’s Balance of Payments Manual sixth edition (BPM6), and IMF Country Report No. 23/12.

The assistant governor’s figure aligns with the CBSL’s weekly economic indicators, which cite the Official Reserve Asset at USD 4.3 billion by the end of December 2023. However, upon closer examination of the criteria for reserve reporting, the accuracy of this figure is contested.

Since March 2021, the CBSL has had a swap facility with the People’s Bank of China (PBoC) of RMB 10 billion (approximately USD 1.4 billion). However, an examination of the CBSL reports’ footnotes from November 2021 to March 2022 reveals that this facility, which was not previously counted as reserves, has only been counted as part of the reserves since December 2021. The late inclusion of the swap suggests that the criteria used to report reserves had been adjusted.

According to international standards (BPM6), the reserve assets must be under the direct and effective control of the monetary authority and readily available without condition. The PBoC swap, by these standards, does not qualify as a reserve asset due to not fulfilling several of these conditions.

The IMF’s recent staff report distinguishes between reported gross official reserves and usable reserves, highlighting the discrepancy between the two. It also does not recognise the PBoC swap as part of usable reserves. Definitionally, “unusable reserves” is an oxymoron on the basis of the definition of a reserve asset in BPM6. Likewise, even government ministers and President Ranil Wickremesinghe have stated that reserves were close to “zero” in April 2022. In doing so, they have also asserted the international standard (BPM6) under which the PBoC swap does not constitute reserves.

As such, the amount of reserve assets of the CBSL, assessed according to the relevant reporting standards, is only USD 3.0 billion. This figure is significantly below the assistant governor’s claim of USD 4.4 billion. The assistant governor is using the official reporting of the CBSL, even though on the above analysis that reporting is flawed.

Therefore, we classify this statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

]]>

]]>

In his briefing to the press, the MP interprets Article 31(3) of the constitution to say that a presidential election must certainly be conducted between 18 September and 18 October 2024.

In his briefing to the press, the MP interprets Article 31(3) of the constitution to say that a presidential election must certainly be conducted between 18 September and 18 October 2024.

To evaluate this claim, FactCheck.lk consulted Articles 31, 32 and 40 of the Constitution of Sri Lanka, and the Presidential Elections Act No. 15 of 1981.

The MP’s statement as elaborated is based on interpreting (A) the term of office of former President Gotabaya Rajapaksa, and (B) Article 31(3) of the constitution.

On (A) the expiration of the term of office of the President is defined through Article 31(3A)(d)(ii). It states that the person declared elected as President, if not the incumbent, “holds office, for a term of five years commencing on the date on which the result of such election is declared”.

The 2019 Presidential Election results were formally declared by the Elections Commission on 17 November 2019. Accordingly, former President Gotabaya Rajapaksa’s term commenced on this date, even though he took his oaths only on 18 November 2019, and will expire on 17 November 2024.

On (B) the MP cites Article 31(3) of the constitution: “The poll for the election of the President shall be taken not less than one month and not more than two months before the expiration of the term of office of the President in office.” From the above analysis, the dates relevant to this article would be between 17 September 2024 (not more than two months before expiration) and 17 October 2024 (not less than one month before expiration).

However, the MP does not mention Article 31(3A)(a)(i) which has a provision that supersedes the above restriction. It allows the presidential election to be called earlier by the elected President, after four years of his term.

Nevertheless, Article 31(3A)(e) restricts that freedom stating that a person succeeding to the office of the President under the provisions of Article 40(1) shall not be entitled to seek an early election.

President Ranil Wickremasinghe was elected to the presidency by parliament, under the provisions of Article 40(1) of the constitution. Accordingly, President Wickremasinghe is unable to call for a presidential election on a date earlier than 17 September 2024.

On the above analysis, no provisions exist in the constitution or the law for the next Presidential election to be held later than 17 October, or earlier than 17 September 2024. Accordingly, MP Gammanpila is correct on the constitutionally determined time frame for holding the next presidential election, even though slightly off, by one day, on the applicable dates.

Therefore, we classify the MP’s statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In his briefing to the press, the MP interprets Article 31(3) of the constitution to say that a presidential election must certainly be conducted between 18 September and 18 October 2024.

In his briefing to the press, the MP interprets Article 31(3) of the constitution to say that a presidential election must certainly be conducted between 18 September and 18 October 2024.

To evaluate this claim, FactCheck.lk consulted Articles 31, 32 and 40 of the Constitution of Sri Lanka, and the Presidential Elections Act No. 15 of 1981.

The MP’s statement as elaborated is based on interpreting (A) the term of office of former President Gotabaya Rajapaksa, and (B) Article 31(3) of the constitution.

On (A) the expiration of the term of office of the President is defined through Article 31(3A)(d)(ii). It states that the person declared elected as President, if not the incumbent, “holds office, for a term of five years commencing on the date on which the result of such election is declared”.

The 2019 Presidential Election results were formally declared by the Elections Commission on 17 November 2019. Accordingly, former President Gotabaya Rajapaksa’s term commenced on this date, even though he took his oaths only on 18 November 2019, and will expire on 17 November 2024.

On (B) the MP cites Article 31(3) of the constitution: “The poll for the election of the President shall be taken not less than one month and not more than two months before the expiration of the term of office of the President in office.” From the above analysis, the dates relevant to this article would be between 17 September 2024 (not more than two months before expiration) and 17 October 2024 (not less than one month before expiration).

However, the MP does not mention Article 31(3A)(a)(i) which has a provision that supersedes the above restriction. It allows the presidential election to be called earlier by the elected President, after four years of his term.

Nevertheless, Article 31(3A)(e) restricts that freedom stating that a person succeeding to the office of the President under the provisions of Article 40(1) shall not be entitled to seek an early election.

President Ranil Wickremasinghe was elected to the presidency by parliament, under the provisions of Article 40(1) of the constitution. Accordingly, President Wickremasinghe is unable to call for a presidential election on a date earlier than 17 September 2024.

On the above analysis, no provisions exist in the constitution or the law for the next Presidential election to be held later than 17 October, or earlier than 17 September 2024. Accordingly, MP Gammanpila is correct on the constitutionally determined time frame for holding the next presidential election, even though slightly off, by one day, on the applicable dates.

Therefore, we classify the MP’s statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

This claim by the State Minister Siyambalapitya was reported differently in the press. However, FactCheck.lk evaluated only his associated social media post. He can be understood as claiming that 4 million individuals will be receiving monthly payments from the government in 2024. He bases this figure on two groups: (i) 2 million who are government employees or pensioners, and (ii) 2 million who receive monthly welfare payments.

This claim by the State Minister Siyambalapitya was reported differently in the press. However, FactCheck.lk evaluated only his associated social media post. He can be understood as claiming that 4 million individuals will be receiving monthly payments from the government in 2024. He bases this figure on two groups: (i) 2 million who are government employees or pensioners, and (ii) 2 million who receive monthly welfare payments.

To verify this claim, FactCheck.lk consulted the Welfare Benefit Board website, Ministry of Finance Annual Report 2022, and the Budget Estimates for 2024.

Group 1: The total number of public sector employees (1,393,883) and pensioners (676,430) for 2022 aligns with the state minister’s cited figure for group 1.

Group 2: The state minister refers to those who have been admitted to the Aswesuma programme. The only available data for the Aswesuma program indicates 1,792,265 eligible beneficiaries in 2023, but this may not accurately represent the actual number of recipients.

Nevertheless, according to the 2024 budget estimates, the government ‘expects’ to provide Aswesuma to 2 million households—which may be the basis for the figure cited by the state minister for group 2.

Consequently, the state minister’s estimation of 4 million as the number expecting to receive monthly payments from the government aligns with the government’s data and budget projections.

Therefore, we classify the state minister’s claim as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

This claim by the State Minister Siyambalapitya was reported differently in the press. However, FactCheck.lk evaluated only his associated social media post. He can be understood as claiming that 4 million individuals will be receiving monthly payments from the government in 2024. He bases this figure on two groups: (i) 2 million who are government employees or pensioners, and (ii) 2 million who receive monthly welfare payments.

This claim by the State Minister Siyambalapitya was reported differently in the press. However, FactCheck.lk evaluated only his associated social media post. He can be understood as claiming that 4 million individuals will be receiving monthly payments from the government in 2024. He bases this figure on two groups: (i) 2 million who are government employees or pensioners, and (ii) 2 million who receive monthly welfare payments.

To verify this claim, FactCheck.lk consulted the Welfare Benefit Board website, Ministry of Finance Annual Report 2022, and the Budget Estimates for 2024.

Group 1: The total number of public sector employees (1,393,883) and pensioners (676,430) for 2022 aligns with the state minister’s cited figure for group 1.

Group 2: The state minister refers to those who have been admitted to the Aswesuma programme. The only available data for the Aswesuma program indicates 1,792,265 eligible beneficiaries in 2023, but this may not accurately represent the actual number of recipients.

Nevertheless, according to the 2024 budget estimates, the government ‘expects’ to provide Aswesuma to 2 million households—which may be the basis for the figure cited by the state minister for group 2.

Consequently, the state minister’s estimation of 4 million as the number expecting to receive monthly payments from the government aligns with the government’s data and budget projections.

Therefore, we classify the state minister’s claim as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In his statement, the MP claims that Sri Lanka’s debt-to-GDP ratio reduced from 90% at the end of 2005 to 69% by the end of 2014.

In his statement, the MP claims that Sri Lanka’s debt-to-GDP ratio reduced from 90% at the end of 2005 to 69% by the end of 2014.

To check this claim, FactCheck.lk referred to the Annual Reports of the Central Bank of Sri Lanka (CBSL) and the Ministry of Finance.

The accounting of national debt involves (1) Central Government Debt (CD), which is limited to debt held by the government Treasury, and (2) Public Debt (PD), which, in addition to CD, includes the debt in the books of State-Owned Enterprises (SOEs). Globally, including by the IMF, the debt burden of a country is evaluated based on PD, not CD only, because it is PD that gives a fuller accounting of a nation’s debt obligations.

The PD-to-GDP ratio at the end of 2005 was 92.1% and was 76.5% at the end of 2014. This does not align with the MP’s figures. However, his figures align with the CD-to-GDP figures of 90.8% and 69.5% in 2005 and 2014, respectively.

By citing only the part of the debt that is accounted for as CD, the MP (a) misrepresents the overall debt exposure in 2014, and (b) suggests a larger reduction in debt-to-GDP ratio (of 21.3 percentage points) from 2005 than the actual decrease of 15.6 percentage points in terms of PD.

The MP’s use of CD figures is further misleading because former President Mahinda Rajapaksa’s administration was found to manipulate and understate CD by transferring debt that was originally in the books of the central government into the books of SOEs. This accounting manoeuvre artificially reduced the reported CD without making any reduction in PD. For instance, in 2014, the loan balances for the Puttalam Coal Power Plant, Hambantota Port Development, and Mattala Rajapaksa International Airport, amounting to LKR 309 billion (or 3 % of the GDP in 2014), were removed from the books of CD and moved to the books of various SOEs (see Additional Note).

The MP’s figures on debt-to-GDP reduction are not only citing a partial accounting of total debt by using CD figures instead of PD figures, but he is also citing a CD figure that was manipulated during his presidency to report a lower figure in 2014. The actual reduction of debt-to-GDP in that time period was significantly less (less than three-fourths in percentage points) than what the MP had claimed. However, the reduction in PD-to-GDP by 15.6 percentage points does support perhaps the larger claim of the MP that there was a substantial reduction in debt-to-GDP during that period.

Therefore, we classify the MP’s statement as PARTLY TRUE.

Additional Note: For more details on this manipulation of debt reporting refer to Verité Research, ‘Navigating Sri Lanka’s Debt: Better reporting can help – a case study on China debt’, 2021, p.5.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In his statement, the MP claims that Sri Lanka’s debt-to-GDP ratio reduced from 90% at the end of 2005 to 69% by the end of 2014.

In his statement, the MP claims that Sri Lanka’s debt-to-GDP ratio reduced from 90% at the end of 2005 to 69% by the end of 2014.

To check this claim, FactCheck.lk referred to the Annual Reports of the Central Bank of Sri Lanka (CBSL) and the Ministry of Finance.

The accounting of national debt involves (1) Central Government Debt (CD), which is limited to debt held by the government Treasury, and (2) Public Debt (PD), which, in addition to CD, includes the debt in the books of State-Owned Enterprises (SOEs). Globally, including by the IMF, the debt burden of a country is evaluated based on PD, not CD only, because it is PD that gives a fuller accounting of a nation’s debt obligations.

The PD-to-GDP ratio at the end of 2005 was 92.1% and was 76.5% at the end of 2014. This does not align with the MP’s figures. However, his figures align with the CD-to-GDP figures of 90.8% and 69.5% in 2005 and 2014, respectively.

By citing only the part of the debt that is accounted for as CD, the MP (a) misrepresents the overall debt exposure in 2014, and (b) suggests a larger reduction in debt-to-GDP ratio (of 21.3 percentage points) from 2005 than the actual decrease of 15.6 percentage points in terms of PD.

The MP’s use of CD figures is further misleading because former President Mahinda Rajapaksa’s administration was found to manipulate and understate CD by transferring debt that was originally in the books of the central government into the books of SOEs. This accounting manoeuvre artificially reduced the reported CD without making any reduction in PD. For instance, in 2014, the loan balances for the Puttalam Coal Power Plant, Hambantota Port Development, and Mattala Rajapaksa International Airport, amounting to LKR 309 billion (or 3 % of the GDP in 2014), were removed from the books of CD and moved to the books of various SOEs (see Additional Note).

The MP’s figures on debt-to-GDP reduction are not only citing a partial accounting of total debt by using CD figures instead of PD figures, but he is also citing a CD figure that was manipulated during his presidency to report a lower figure in 2014. The actual reduction of debt-to-GDP in that time period was significantly less (less than three-fourths in percentage points) than what the MP had claimed. However, the reduction in PD-to-GDP by 15.6 percentage points does support perhaps the larger claim of the MP that there was a substantial reduction in debt-to-GDP during that period.

Therefore, we classify the MP’s statement as PARTLY TRUE.

Additional Note: For more details on this manipulation of debt reporting refer to Verité Research, ‘Navigating Sri Lanka’s Debt: Better reporting can help – a case study on China debt’, 2021, p.5.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

MP Alawathuwala claims that the food expenses have tripled from 2019 to 2023, increasing from LKR6,000-6,500 to LKR 16,000-17,000.

MP Alawathuwala claims that the food expenses have tripled from 2019 to 2023, increasing from LKR6,000-6,500 to LKR 16,000-17,000.

To verify the above claims, FactCheck.lk referred to multiple publications of the Department of Census and Statistics: (1) Price index data on the Colombo Consumer Price Index (CCPI) and National Consumer Price Index (NCPI), (2) Household Income and Expenditure Survey (HIES).

The MP indicates that the range of values he mentions would be applicable to either the Colombo district or at a national level. FactCheck.lk also found that, though not specified, the MP’s numbers aligned better with monthly (not weekly or annual) expenditure on food.

The 2019 HIES data approximates to average monthly food expenditures being LKR 5,981 per person nationally, and LKR 7,532 in Colombo. The range specified by the MP is in between these two numbers. However, there is no equivalent survey data for 2023 to assess the increase.

Therefore, FactCheck.lk assessed the increase by using the food group index of the CCPI and the NCPI. From January 2019 to October 2023, these indices showed a 2.3-fold and 2.2-fold increase, respectively in the cost of food, which is much less than the MP’s claim of a 3-fold increase.

That is, based on the 2019 HIES data and the changes in the food group index, the 2023 average food expenditure can be estimated at most as LKR 13,320 per person nationally (well below the MP’s range of numbers), and LKR 17,324 per person in Colombo (only slightly above the upper end of the MP’s range).

The MP’s figures for average food expenses in 2019 are inside the range of national level and Colombo district expenses, and his 2023 figures are approximately correct for Colombo. However, he significantly overstates his overarching claim: the extent of the increase in food expenses between 2019 and 2023. He states it as 3-fold (200% increase) when it is 2.3-fold (130% increase) at most.

Therefore, we classify his statement as PARTLY TRUE.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

]]>

]]>

MP Alawathuwala claims that the food expenses have tripled from 2019 to 2023, increasing from LKR6,000-6,500 to LKR 16,000-17,000.

MP Alawathuwala claims that the food expenses have tripled from 2019 to 2023, increasing from LKR6,000-6,500 to LKR 16,000-17,000.

To verify the above claims, FactCheck.lk referred to multiple publications of the Department of Census and Statistics: (1) Price index data on the Colombo Consumer Price Index (CCPI) and National Consumer Price Index (NCPI), (2) Household Income and Expenditure Survey (HIES).

The MP indicates that the range of values he mentions would be applicable to either the Colombo district or at a national level. FactCheck.lk also found that, though not specified, the MP’s numbers aligned better with monthly (not weekly or annual) expenditure on food.

The 2019 HIES data approximates to average monthly food expenditures being LKR 5,981 per person nationally, and LKR 7,532 in Colombo. The range specified by the MP is in between these two numbers. However, there is no equivalent survey data for 2023 to assess the increase.

Therefore, FactCheck.lk assessed the increase by using the food group index of the CCPI and the NCPI. From January 2019 to October 2023, these indices showed a 2.3-fold and 2.2-fold increase, respectively in the cost of food, which is much less than the MP’s claim of a 3-fold increase.

That is, based on the 2019 HIES data and the changes in the food group index, the 2023 average food expenditure can be estimated at most as LKR 13,320 per person nationally (well below the MP’s range of numbers), and LKR 17,324 per person in Colombo (only slightly above the upper end of the MP’s range).

The MP’s figures for average food expenses in 2019 are inside the range of national level and Colombo district expenses, and his 2023 figures are approximately correct for Colombo. However, he significantly overstates his overarching claim: the extent of the increase in food expenses between 2019 and 2023. He states it as 3-fold (200% increase) when it is 2.3-fold (130% increase) at most.

Therefore, we classify his statement as PARTLY TRUE.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

]]>

]]>

In his speech, the MP sets out a standard monetary poverty measure of the World Bank as 25% of the Sri Lankan population; and argues that when multidimensional factors such as education and health are considered, the poverty level is much greater. He cites multidimensional poverty as 56% of the population.

In his speech, the MP sets out a standard monetary poverty measure of the World Bank as 25% of the Sri Lankan population; and argues that when multidimensional factors such as education and health are considered, the poverty level is much greater. He cites multidimensional poverty as 56% of the population.

To check this claim, FactCheck.lk consulted the Department of Census and Statistics (DCS) Multidimensional Poverty Index 2019 and the United Nations Development Programme (UNDP) policy report based on the Multidimensional Vulnerability Index (MVI) 2023.

Conceptually, multidimensional poverty differs from official monetary poverty statistics, which focus either on income or the ability to purchase a particular basket of goods. By contrast, multidimensional poverty considers multiple deprivations that people experience simultaneously – such as health status, years of schooling, etc. Earlier this year, a previous fact-check (linked here), assessed as correct, the claims on the level of monetary poverty as measured by the World Bank and cited by the MP. Official statistics on multidimensional poverty in Sri Lanka have not been calculated since 2019. The previous statistic, derived from the DCS Multidimensional Poverty Index (MPI), estimated that 16% of Sri Lankans were multidimensionally poor in 2019. However, the DCS estimate of the monetary poverty measure was 14.3%, and the World Bank measure, using a different criterion, was 13% in 2019.

In 2023, the UNDP developed Sri Lanka’s first-ever MVI to provide a more comprehensive and nuanced picture of the population’s vulnerabilities. According to the MVI, 55.7% of people in Sri Lanka are multidimensionally vulnerable. It is from this MVI figure that the MP has extrapolated his claim that 56% can be categorised as poor.

The MP’s interpretation of the statistic is incorrect, because despite the similarities between multidimensional ‘poverty’ and ‘vulnerability’, they are designed to capture conceptually different concerns. According to the UNDP, ‘vulnerability is a broader concept than poverty. It considers a person’s exposure to potential risks and shocks, which can lead to adverse outcomes even if they are not currently in poverty.’ This means that even if a person is not categorised as multidimensionally poor according to the MPI, their household could be considered multidimensionally vulnerable for several reasons. For instance, because they experienced a natural disaster in the previous year, or if a household member works as a domestic or unpaid worker.

The MP is correct in what seems to be the broader claim that more people would be classified as poor when accounting for multidimensional factors than would be recognised in monetary poverty measures. But his interpretation of the UNDP’s MVI statistic is incorrect—it cannot be extrapolated that 56% of Sri Lanka’s population is multi-dimensionally ‘poor’. Therefore, we classify the MP’s statement as PARTLY TRUE.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

In his speech, the MP sets out a standard monetary poverty measure of the World Bank as 25% of the Sri Lankan population; and argues that when multidimensional factors such as education and health are considered, the poverty level is much greater. He cites multidimensional poverty as 56% of the population.

In his speech, the MP sets out a standard monetary poverty measure of the World Bank as 25% of the Sri Lankan population; and argues that when multidimensional factors such as education and health are considered, the poverty level is much greater. He cites multidimensional poverty as 56% of the population.

To check this claim, FactCheck.lk consulted the Department of Census and Statistics (DCS) Multidimensional Poverty Index 2019 and the United Nations Development Programme (UNDP) policy report based on the Multidimensional Vulnerability Index (MVI) 2023.

Conceptually, multidimensional poverty differs from official monetary poverty statistics, which focus either on income or the ability to purchase a particular basket of goods. By contrast, multidimensional poverty considers multiple deprivations that people experience simultaneously – such as health status, years of schooling, etc. Earlier this year, a previous fact-check (linked here), assessed as correct, the claims on the level of monetary poverty as measured by the World Bank and cited by the MP. Official statistics on multidimensional poverty in Sri Lanka have not been calculated since 2019. The previous statistic, derived from the DCS Multidimensional Poverty Index (MPI), estimated that 16% of Sri Lankans were multidimensionally poor in 2019. However, the DCS estimate of the monetary poverty measure was 14.3%, and the World Bank measure, using a different criterion, was 13% in 2019.

In 2023, the UNDP developed Sri Lanka’s first-ever MVI to provide a more comprehensive and nuanced picture of the population’s vulnerabilities. According to the MVI, 55.7% of people in Sri Lanka are multidimensionally vulnerable. It is from this MVI figure that the MP has extrapolated his claim that 56% can be categorised as poor.

The MP’s interpretation of the statistic is incorrect, because despite the similarities between multidimensional ‘poverty’ and ‘vulnerability’, they are designed to capture conceptually different concerns. According to the UNDP, ‘vulnerability is a broader concept than poverty. It considers a person’s exposure to potential risks and shocks, which can lead to adverse outcomes even if they are not currently in poverty.’ This means that even if a person is not categorised as multidimensionally poor according to the MPI, their household could be considered multidimensionally vulnerable for several reasons. For instance, because they experienced a natural disaster in the previous year, or if a household member works as a domestic or unpaid worker.

The MP is correct in what seems to be the broader claim that more people would be classified as poor when accounting for multidimensional factors than would be recognised in monetary poverty measures. But his interpretation of the UNDP’s MVI statistic is incorrect—it cannot be extrapolated that 56% of Sri Lanka’s population is multi-dimensionally ‘poor’. Therefore, we classify the MP’s statement as PARTLY TRUE.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

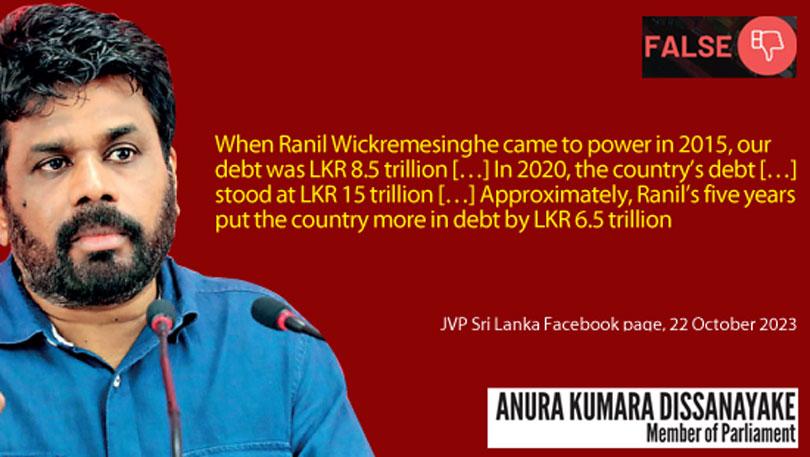

MP Dissanayake claimed that debt had increased to unprecedented levels during Ranil Wickremesinghe’s tenure as prime minister (PM) from 2015 to 2019. In support of his argument, the MP cited that between 2015 and 2020, debt had increased by LKR 6.5 trillion to LKR 15 trillion (a 76.5% increase). To verify these claims, FactCheck.lk consulted the 2022 CBSL Annual Report. FactCheck.lk understands, from his numbers and calculations, that he is referring to central government debt and not total public sector debt (where the increase would be a little smaller).

MP Dissanayake claimed that debt had increased to unprecedented levels during Ranil Wickremesinghe’s tenure as prime minister (PM) from 2015 to 2019. In support of his argument, the MP cited that between 2015 and 2020, debt had increased by LKR 6.5 trillion to LKR 15 trillion (a 76.5% increase). To verify these claims, FactCheck.lk consulted the 2022 CBSL Annual Report. FactCheck.lk understands, from his numbers and calculations, that he is referring to central government debt and not total public sector debt (where the increase would be a little smaller).

The MP’s main argument is that there was an unprecedented increase in debt during Wickremesinghe’s five-year tenure as PM. This is incorrect and misleading for three reasons.

First, the MP makes a mistake in the years considered and thereby gets the wrong numbers. The numbers he has used are from end-2015 to the end-2020; whereas end-2014 to end-2019 is the relevant period for when Wickremesinghe was PM. The increase in that period was LKR 5.5 trillion to a total of LKR 13 trillion.

Second, there is a distinction between ‘net new debt taken’ and the increase in the LKR value of existing foreign currency debt due to currency depreciation. What the MP presents as net new debt taken, mistakenly conflates these two things.

A publication by Verité Research shows that the increase in just the ‘net new debt taken’ from 2014 to 2019 was 42.8%. The result is about the same for central government debt as well.

The 76.5% increase claimed by the MP is incorrect because (1) it considers the incorrect years, and (2) it includes not just net new debt but the revaluation of existing debt due to rupee depreciation.

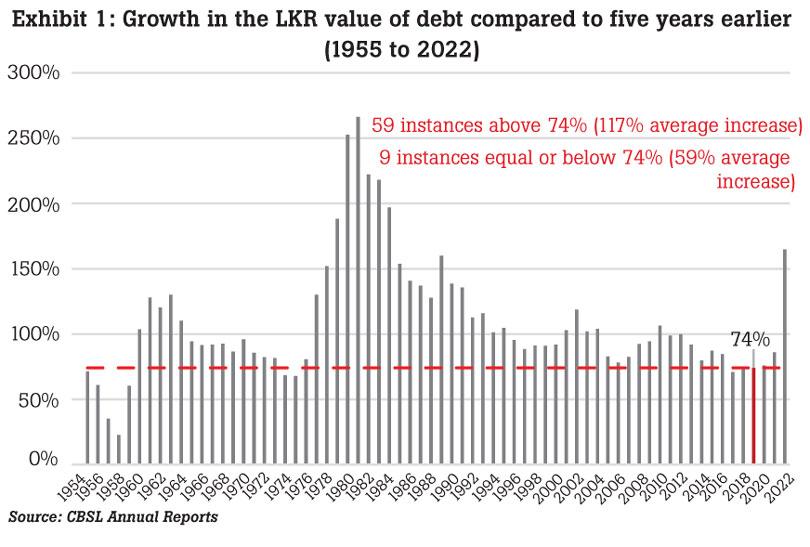

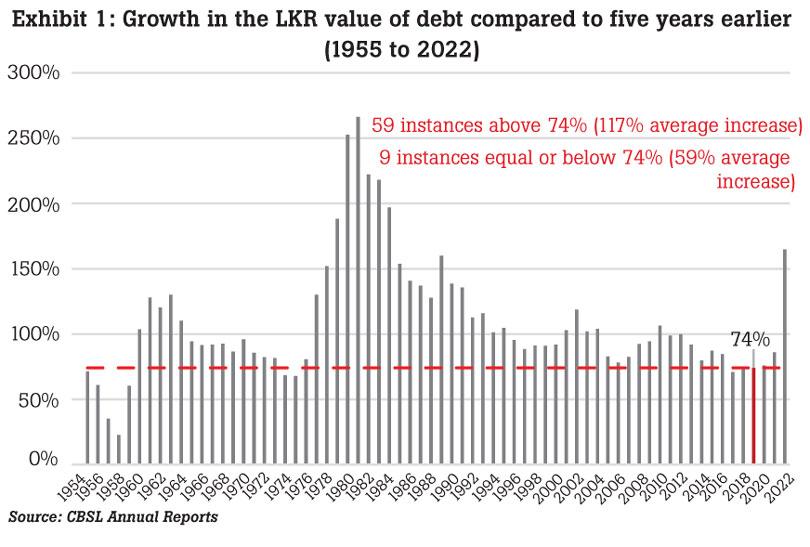

Third, even the increase in the LKR value of debt from 2014 to 2019 (calculated on corrected years), with the rupee depreciation impact conflated (as the MP does), does not support the MP’s claim. That increase was 74.1% but it is not an exceptional increase as claimed by the MP. In fact, it is one of the lowest rates of increase in the LKR value of debt in a five-year period since 1950 (see Exhibit 1).

The MP’s statement is incorrect on three counts: the period considered, the valuation of net new debt taken, and the framing of the rate of increase from 2014-2019 in the LKR value of debt as being extraordinarily high.

Therefore, we classify the MP’s statement as FALSE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

MP Dissanayake claimed that debt had increased to unprecedented levels during Ranil Wickremesinghe’s tenure as prime minister (PM) from 2015 to 2019. In support of his argument, the MP cited that between 2015 and 2020, debt had increased by LKR 6.5 trillion to LKR 15 trillion (a 76.5% increase). To verify these claims, FactCheck.lk consulted the 2022 CBSL Annual Report. FactCheck.lk understands, from his numbers and calculations, that he is referring to central government debt and not total public sector debt (where the increase would be a little smaller).

MP Dissanayake claimed that debt had increased to unprecedented levels during Ranil Wickremesinghe’s tenure as prime minister (PM) from 2015 to 2019. In support of his argument, the MP cited that between 2015 and 2020, debt had increased by LKR 6.5 trillion to LKR 15 trillion (a 76.5% increase). To verify these claims, FactCheck.lk consulted the 2022 CBSL Annual Report. FactCheck.lk understands, from his numbers and calculations, that he is referring to central government debt and not total public sector debt (where the increase would be a little smaller).

The MP’s main argument is that there was an unprecedented increase in debt during Wickremesinghe’s five-year tenure as PM. This is incorrect and misleading for three reasons.

First, the MP makes a mistake in the years considered and thereby gets the wrong numbers. The numbers he has used are from end-2015 to the end-2020; whereas end-2014 to end-2019 is the relevant period for when Wickremesinghe was PM. The increase in that period was LKR 5.5 trillion to a total of LKR 13 trillion.

Second, there is a distinction between ‘net new debt taken’ and the increase in the LKR value of existing foreign currency debt due to currency depreciation. What the MP presents as net new debt taken, mistakenly conflates these two things.

A publication by Verité Research shows that the increase in just the ‘net new debt taken’ from 2014 to 2019 was 42.8%. The result is about the same for central government debt as well.

The 76.5% increase claimed by the MP is incorrect because (1) it considers the incorrect years, and (2) it includes not just net new debt but the revaluation of existing debt due to rupee depreciation.

Third, even the increase in the LKR value of debt from 2014 to 2019 (calculated on corrected years), with the rupee depreciation impact conflated (as the MP does), does not support the MP’s claim. That increase was 74.1% but it is not an exceptional increase as claimed by the MP. In fact, it is one of the lowest rates of increase in the LKR value of debt in a five-year period since 1950 (see Exhibit 1).

The MP’s statement is incorrect on three counts: the period considered, the valuation of net new debt taken, and the framing of the rate of increase from 2014-2019 in the LKR value of debt as being extraordinarily high.

Therefore, we classify the MP’s statement as FALSE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

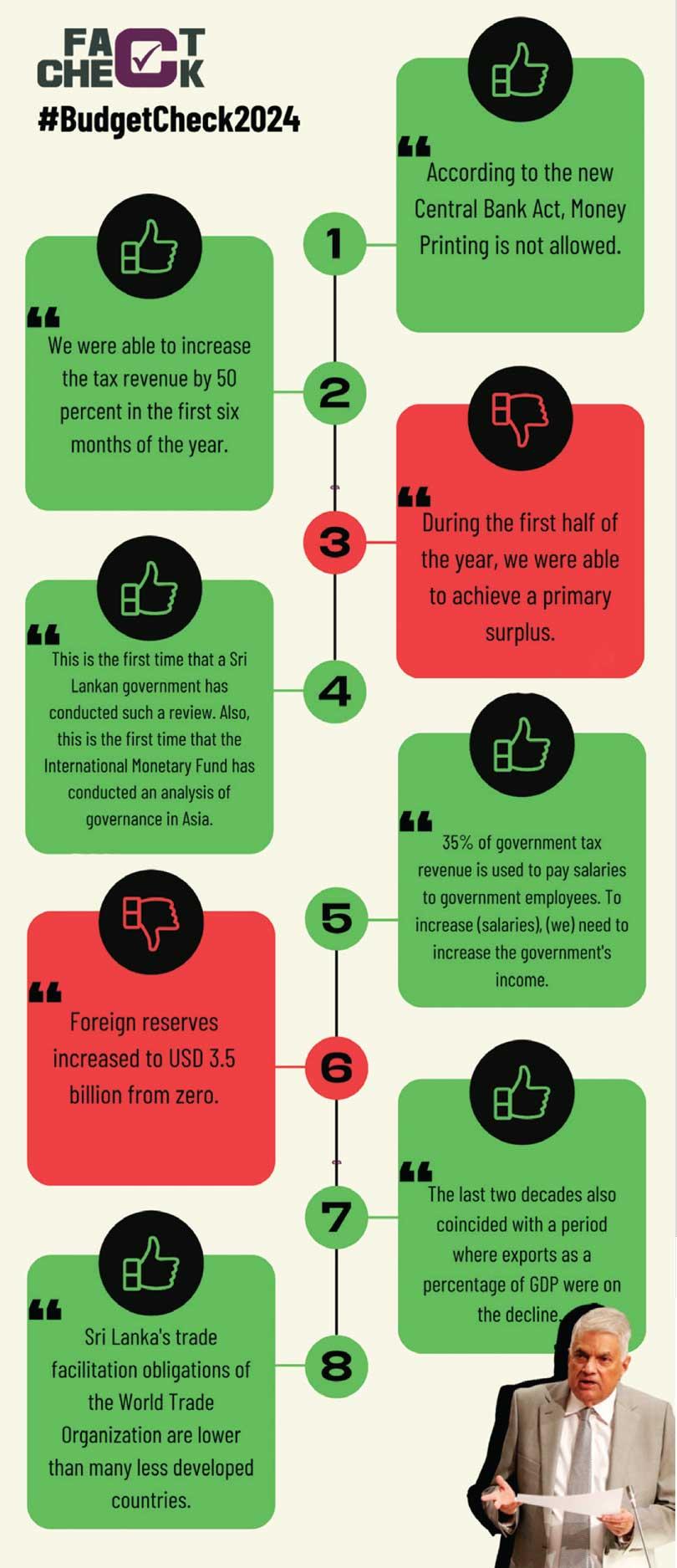

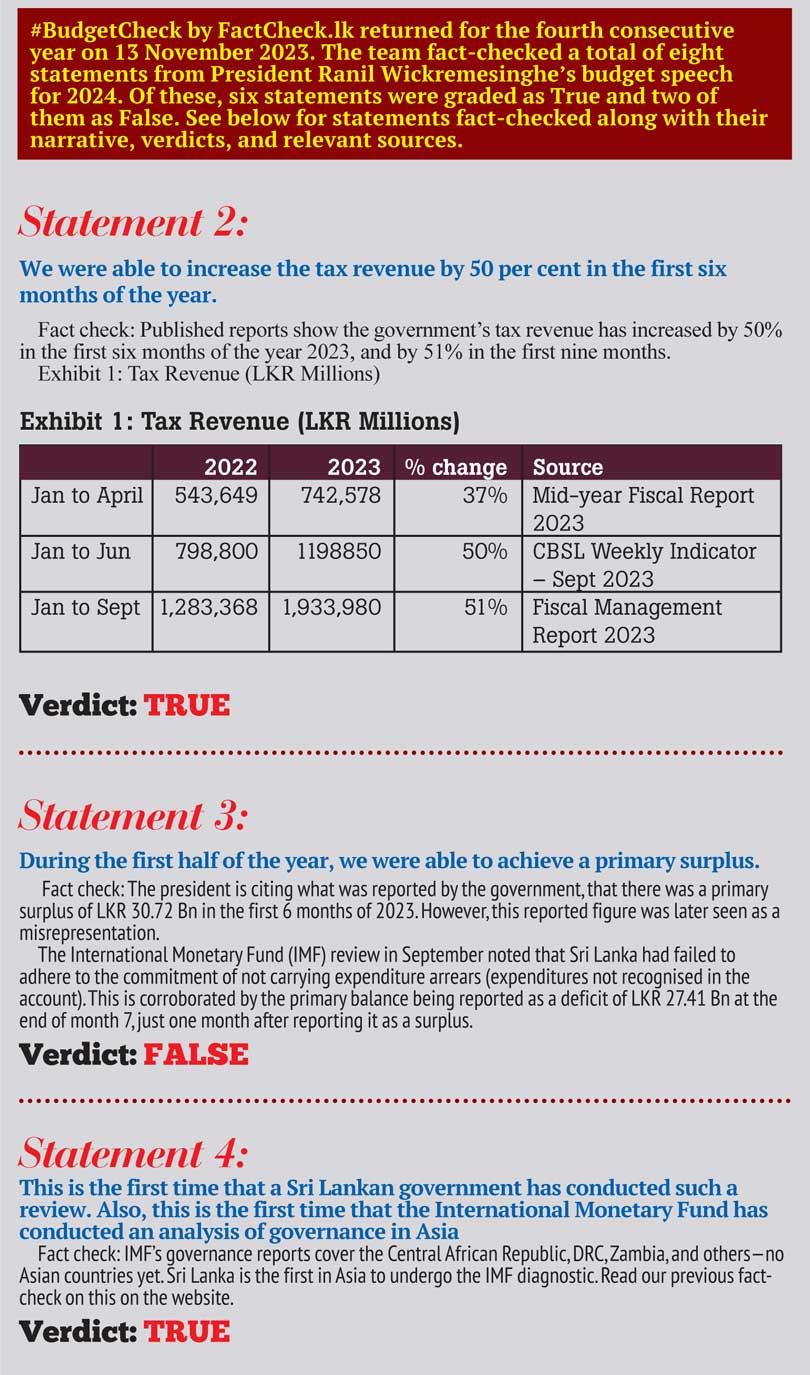

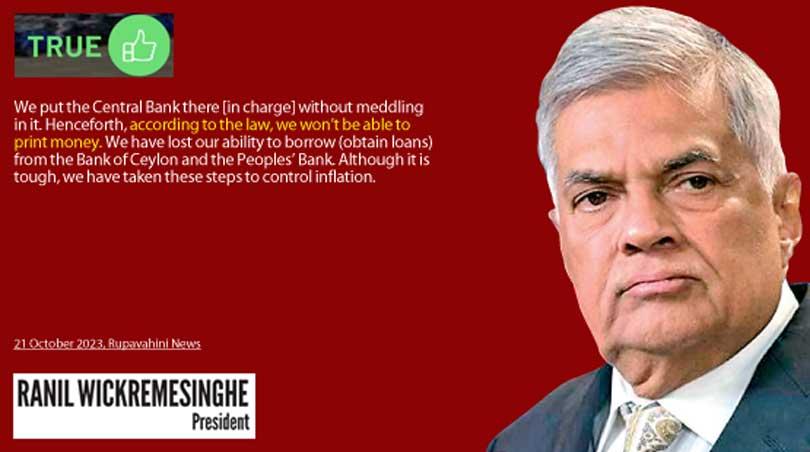

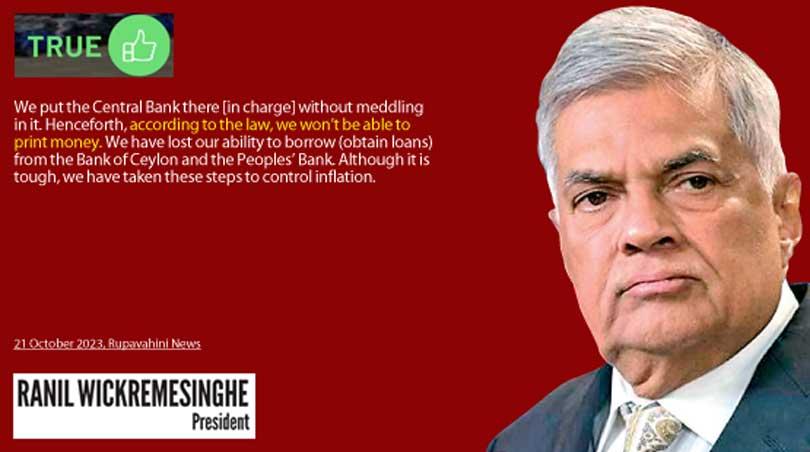

Fact check: The president is correct if the statement is read to mean that it is not possible to secure any more monetary financing until January 2024. Read the full fact-check on the website.

Fact check: The president is correct if the statement is read to mean that it is not possible to secure any more monetary financing until January 2024. Read the full fact-check on the website.

]]>

]]> Fact check: The president is correct if the statement is read to mean that it is not possible to secure any more monetary financing until January 2024. Read the full fact-check on the website.

Fact check: The president is correct if the statement is read to mean that it is not possible to secure any more monetary financing until January 2024. Read the full fact-check on the website.

]]>

]]>

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

In a past fact-check, Central Bank (CBSL) Governor Dr. Nandalal Weerasinghe referred to the amount of “money printed” in the country as being equivalent to the change in the amount of “reserve money”. This statement was verified by FactCheck.lk as correct. In popular media and non-technical usage, however, the term “money printing” is often used to refer to the more limited activity of “monetary financing” of the budget. Monetary financing is one part of the technical definition of “money printing” referred to above. It excludes other means of increasing reserve money, such as lending to the private sector and purchasing foreign assets.

To assess the president’s claim, FactCheck.lk interpreted his use of the term “money printing” in its non-technical sense as referring to “monetary financing”.

Sections 86 and 127 of the recent CBA23 constrains the CBSL from monetary financing in three ways:

(1) prohibits extending credit to the government or government-owned entities (with some exceptions for exigent circumstances)

(2) prohibits purchasing government or government-owned entity securities in the primary market (with secondary market purchases constrained not to circumvent this prohibition)

(3) limits providing provisional advances to the government to the first month of the financial year (up to 10% of the previous year’s revenue)

However, a transitional provision (s.128) in CBA23 allows the CBSL to purchase government securities in the primary market for 18 months from the operational date of the CBA23. Nevertheless, there is a countervailing commitment in the current programme with the IMF, which limits the CBSL from providing net credit to the government to LKR 2,740 billion by December 2023.

Monetary financing is constrained by (a) prohibitions 1 and 2 by CBA23, (b) the limited advances allowed by CBA23 that were only accessible in January, and (c) the transitional provision in monetary financing being nullified by the CBSL already being at the LKR 2.74 trillion IMF programme limit.

Therefore, the president is correct in asserting that it is not possible to secure any further monetary financing (until January 2024).

Therefore, we classify the above statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

President Wickremesinghe claimed that “money printing” is currently prevented by enacting the Central Bank of Sri Lanka Act No. 16 of 2023 (CBA23). To verify this claim, FactCheck.lk consulted the CBA23 and the repealed Monetary Law Act (Chapter 422).

In a past fact-check, Central Bank (CBSL) Governor Dr. Nandalal Weerasinghe referred to the amount of “money printed” in the country as being equivalent to the change in the amount of “reserve money”. This statement was verified by FactCheck.lk as correct. In popular media and non-technical usage, however, the term “money printing” is often used to refer to the more limited activity of “monetary financing” of the budget. Monetary financing is one part of the technical definition of “money printing” referred to above. It excludes other means of increasing reserve money, such as lending to the private sector and purchasing foreign assets.

To assess the president’s claim, FactCheck.lk interpreted his use of the term “money printing” in its non-technical sense as referring to “monetary financing”.

Sections 86 and 127 of the recent CBA23 constrains the CBSL from monetary financing in three ways:

(1) prohibits extending credit to the government or government-owned entities (with some exceptions for exigent circumstances)

(2) prohibits purchasing government or government-owned entity securities in the primary market (with secondary market purchases constrained not to circumvent this prohibition)

(3) limits providing provisional advances to the government to the first month of the financial year (up to 10% of the previous year’s revenue)

However, a transitional provision (s.128) in CBA23 allows the CBSL to purchase government securities in the primary market for 18 months from the operational date of the CBA23. Nevertheless, there is a countervailing commitment in the current programme with the IMF, which limits the CBSL from providing net credit to the government to LKR 2,740 billion by December 2023.

Monetary financing is constrained by (a) prohibitions 1 and 2 by CBA23, (b) the limited advances allowed by CBA23 that were only accessible in January, and (c) the transitional provision in monetary financing being nullified by the CBSL already being at the LKR 2.74 trillion IMF programme limit.

Therefore, the president is correct in asserting that it is not possible to secure any further monetary financing (until January 2024).

Therefore, we classify the above statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

]]>

]]>