Originally scheduled to commence operations in April, the facility now faces an uncertain timeline for opening to the public, primarily due to unexpected legislative hurdles.

While concerns have been raised regarding the potential impact of the duty-free mall on local businesses and Sri Lanka’s taxation framework, CHEC Port City Colombo Deputy Managing Director Thulchi Aluwihare has asserted that the facility will not have the negative effects perceived by some in the political and business communities.

“The aim is not to cannibalise but to expand the market and promote economic growth. The broader objective of Port City is to increase footfall and benefit the entire Colombo ecosystem,” Aluwihare told Mirror Business.

He stressed that adequate measures are in place, serving as effective guardrails to protect against cannibalisation of the local market and ensure there is no leakage of goods into the local market.

“The goal is to attract tourists and create a shopping destination in Sri Lanka, capitalising on the average tourist’s stay of seven to 10 days, with an average spending day in Colombo being just one day,” added Aluwihare.

Pointing out that the delays are sending a negative message to investors, existing and potential, he stressed it is imperative for authorities to understand the importance of having investor-friendly processes.

“As a country facing a balance of payment crisis, we are actively seeking foreign direct investment and capital. Therefore, it is essential to ensure that the experience for investors in Sri Lanka is positive and encourages further investment,” added Aluwihare.

]]>

]]>Originally scheduled to commence operations in April, the facility now faces an uncertain timeline for opening to the public, primarily due to unexpected legislative hurdles.

While concerns have been raised regarding the potential impact of the duty-free mall on local businesses and Sri Lanka’s taxation framework, CHEC Port City Colombo Deputy Managing Director Thulchi Aluwihare has asserted that the facility will not have the negative effects perceived by some in the political and business communities.

“The aim is not to cannibalise but to expand the market and promote economic growth. The broader objective of Port City is to increase footfall and benefit the entire Colombo ecosystem,” Aluwihare told Mirror Business.

He stressed that adequate measures are in place, serving as effective guardrails to protect against cannibalisation of the local market and ensure there is no leakage of goods into the local market.

“The goal is to attract tourists and create a shopping destination in Sri Lanka, capitalising on the average tourist’s stay of seven to 10 days, with an average spending day in Colombo being just one day,” added Aluwihare.

Pointing out that the delays are sending a negative message to investors, existing and potential, he stressed it is imperative for authorities to understand the importance of having investor-friendly processes.

“As a country facing a balance of payment crisis, we are actively seeking foreign direct investment and capital. Therefore, it is essential to ensure that the experience for investors in Sri Lanka is positive and encourages further investment,” added Aluwihare.

]]>

]]>

A review of data published by Sri Lanka Customs analyzed by Siyaka Research confirms that the country shipped 62 Mnkg during the period January – March 2024, up 15% on last year’s figure of 54 Mnkg.

A review of data published by Sri Lanka Customs analyzed by Siyaka Research confirms that the country shipped 62 Mnkg during the period January – March 2024, up 15% on last year’s figure of 54 Mnkg.

Due to steady strengthening of the Sri Lankan Rupee against US$ YoY and lower auction prices, Rupee earnings show only a nominal change with an increase from Rs. 36 bln to Rs. 38 bln.

In USD however, the approximate value is $ 354 Mn is 13% more on the 2023 figure of $ 314 Mn.

This year’s Dollar earnings are the highest since 2018; however the country exported 68.8 Mnkg in Q1 of that year compared with 62.3 Mnkg in 2024.

A review of major destinations has Iraq topping the list with a quantity of 8.4 Mnkg amounting to 14% of all shipments in 2024. The UAE follows with 7 Mnkg up 56% on last year. Shipments to Russia have grown 14% YoY 6.4 Mnkg.

Turkey follows but quantities have declined a sharp 40% to 4 Mnkg. Iran has increased 166% YoY from 1.3 Mnkg to 3.4 Mnkg this year.

Saudi Arabia has increased 39% YoY 2.5 Mnkg and is followed by China up 8% to 2.4 Mnkg.

]]>

]]> A review of data published by Sri Lanka Customs analyzed by Siyaka Research confirms that the country shipped 62 Mnkg during the period January – March 2024, up 15% on last year’s figure of 54 Mnkg.

A review of data published by Sri Lanka Customs analyzed by Siyaka Research confirms that the country shipped 62 Mnkg during the period January – March 2024, up 15% on last year’s figure of 54 Mnkg.

Due to steady strengthening of the Sri Lankan Rupee against US$ YoY and lower auction prices, Rupee earnings show only a nominal change with an increase from Rs. 36 bln to Rs. 38 bln.

In USD however, the approximate value is $ 354 Mn is 13% more on the 2023 figure of $ 314 Mn.

This year’s Dollar earnings are the highest since 2018; however the country exported 68.8 Mnkg in Q1 of that year compared with 62.3 Mnkg in 2024.

A review of major destinations has Iraq topping the list with a quantity of 8.4 Mnkg amounting to 14% of all shipments in 2024. The UAE follows with 7 Mnkg up 56% on last year. Shipments to Russia have grown 14% YoY 6.4 Mnkg.

Turkey follows but quantities have declined a sharp 40% to 4 Mnkg. Iran has increased 166% YoY from 1.3 Mnkg to 3.4 Mnkg this year.

Saudi Arabia has increased 39% YoY 2.5 Mnkg and is followed by China up 8% to 2.4 Mnkg.

]]>

]]>

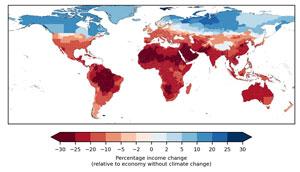

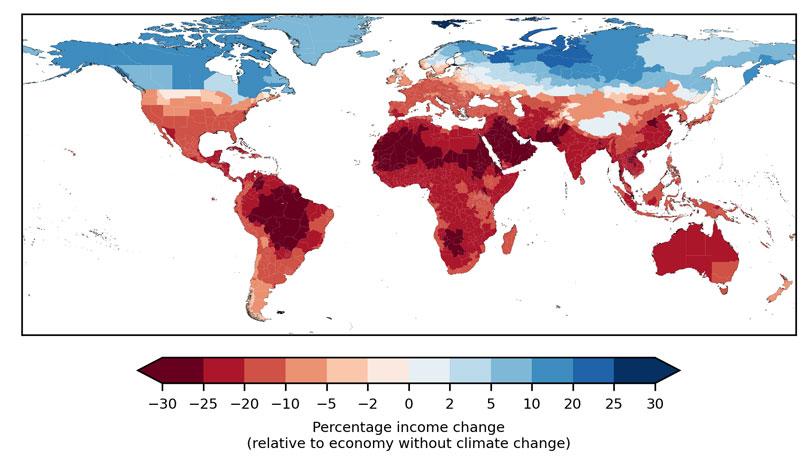

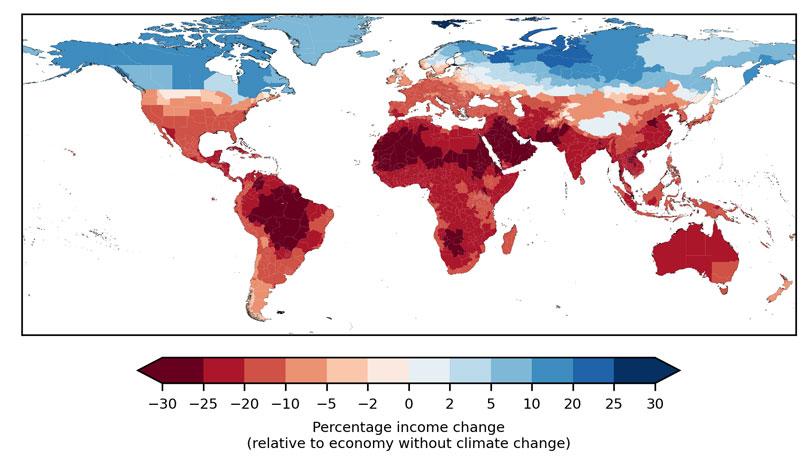

The global annual damage caused by climate change is estimated to be 38 trillion dollars until the year 2050, a study by a German research institute has found.

The global annual damage caused by climate change is estimated to be 38 trillion dollars until the year 2050, a study by a German research institute has found.

According to scientists at the Potsdam Institute for Climate Impact Research (PIK) ‘the world economy is already committed to an income reduction of 19 percent until 2050, even if CO2 emissions were to be drastically cut immediately.

South Asia and Africa are listed as regions that will experience the strongest income reductions due to climate change. The damages will be primarily caused by impacts on agricultural yields, labor productivity or infrastructure, the study further elaborated.

]]>

]]> The global annual damage caused by climate change is estimated to be 38 trillion dollars until the year 2050, a study by a German research institute has found.

The global annual damage caused by climate change is estimated to be 38 trillion dollars until the year 2050, a study by a German research institute has found.

According to scientists at the Potsdam Institute for Climate Impact Research (PIK) ‘the world economy is already committed to an income reduction of 19 percent until 2050, even if CO2 emissions were to be drastically cut immediately.

South Asia and Africa are listed as regions that will experience the strongest income reductions due to climate change. The damages will be primarily caused by impacts on agricultural yields, labor productivity or infrastructure, the study further elaborated.

]]>

]]>

Colombo, April 17 (Daily Mirror) - Fits Air is expanding its wings, adding Colombo-Dhaka direct flights from today, the Airport and Aviation Services (Sri Lanka) (Pvt) Limited announced.

Colombo, April 17 (Daily Mirror) - Fits Air is expanding its wings, adding Colombo-Dhaka direct flights from today, the Airport and Aviation Services (Sri Lanka) (Pvt) Limited announced.

Currently, Fits Air operates to three destinations from Colombo such as Dubai, Chennai and the Maldives.

With this new route expansion, this will increase to four destinations, and it will contribute immensely to the development of the travel, trade, and tourism industries between Sri Lanka and Bangladesh.

]]>

]]> Colombo, April 17 (Daily Mirror) - Fits Air is expanding its wings, adding Colombo-Dhaka direct flights from today, the Airport and Aviation Services (Sri Lanka) (Pvt) Limited announced.

Colombo, April 17 (Daily Mirror) - Fits Air is expanding its wings, adding Colombo-Dhaka direct flights from today, the Airport and Aviation Services (Sri Lanka) (Pvt) Limited announced.

Currently, Fits Air operates to three destinations from Colombo such as Dubai, Chennai and the Maldives.

With this new route expansion, this will increase to four destinations, and it will contribute immensely to the development of the travel, trade, and tourism industries between Sri Lanka and Bangladesh.

]]>

]]>

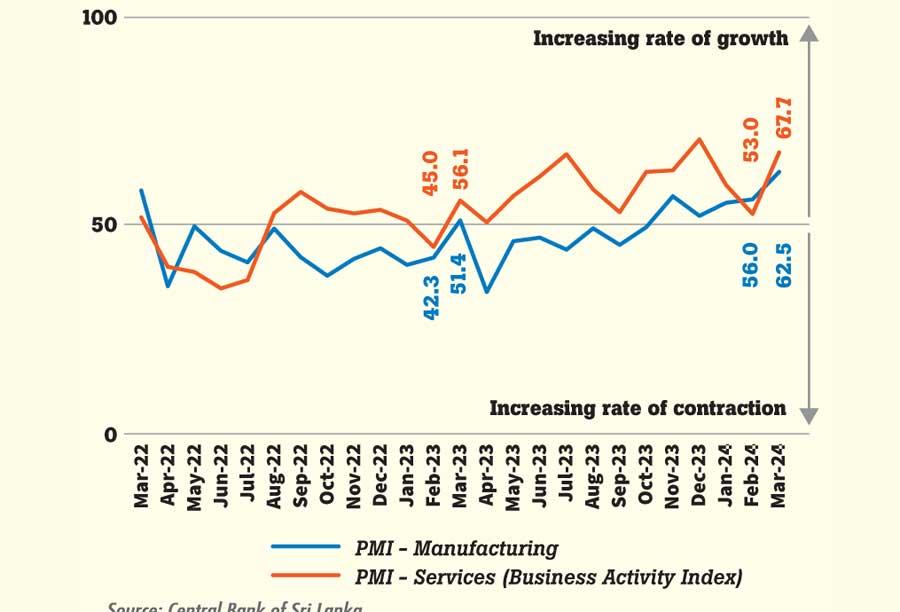

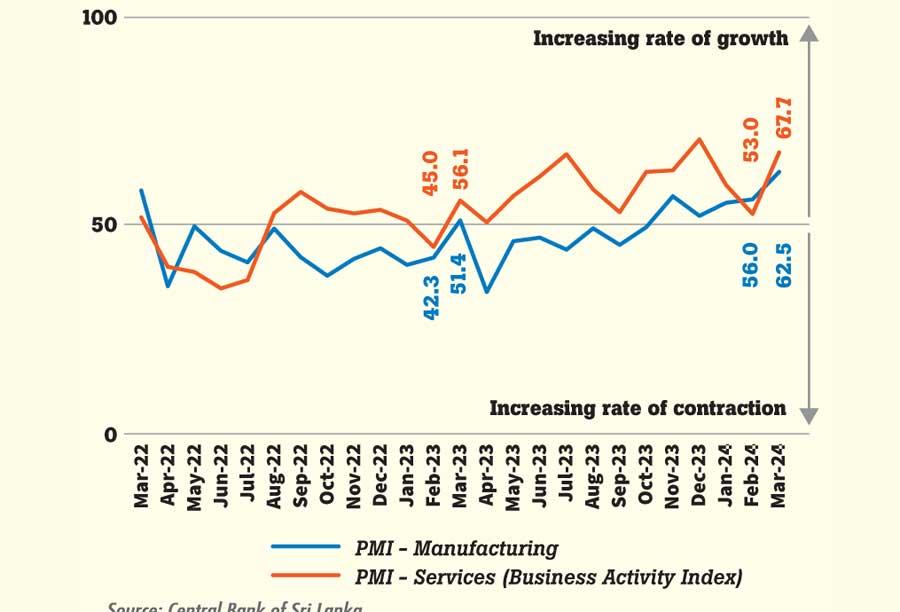

Further strengthening the health of the economy, the Purchasing Managers’ Index (PMI) showed continuous expansion in activities across manufacturing and services sectors, rekindling hopes that the ongoing recovery is going to be durable and solid.

Accordingly, the manufacturing sector PMI recorded an index value of 62.5 in March, from 56.0 index points in February reflecting that the once languishing sector is now expanding at a rapid pace.

In fact March PMI reading is the highest in three years, in a further sign that the economy has unequivocally exited the crisis although some uncertainties remain.

Meanwhile, the services sector PMI recorded an index value of 67.7 in March, logging a significant increase from 53.0 index points in February. PMI is a broadly followed gauge to measure the health of an economy and provides a bellwether for the Gross Domestic Product. A reading above 50.0 in PMI indicates an expansion in activity while a level below that indicates a contraction. The index value of 50.0 reflects a neutral level.

The manufacturing sector PMI has been driven by all sub-indices led by new orders and production coming from manufacturing of food and beverages and textile and apparel.

“Most of the manufacturers, especially in the food & beverage sector, were optimistic about the upcoming festive season”, the Central Bank said citing the latest monthly survey. Meanwhile, the employment segment also improved as firms hired staff to cope up with the new orders and meet the higher production.

Further, the survey has also found that the prices have also declined during the month mirroring the cooler than anticipated inflation in March.

The manufacturing sector broadly has positive expectations for the next three months despite some slowing down during April following the seasonal peak.

Meanwhile, the services sector activity spurt has also been driven by the seasonal pop seen in both wholesale and retail trade due to the festive demand.

Further, the financial services sub-sector continued to be supported by the accommodative monetary policy of the Central Bank as financial conditions were seen easing with the decline in the borrowing rates. Meanwhile, accommodation and food and beverage sub-sectors continued to grow due to robust tourist arrivals while transport and other personal and professional services also saw growth.

New businesses across a wider section of services were also witnessed while the employment sub-index improved as firms hired new staff to meet the elevated festive demand. Meanwhile, expectations for business activities for the next three months continued to rise due to favourable macro-economic conditions.

]]>

]]>

Further strengthening the health of the economy, the Purchasing Managers’ Index (PMI) showed continuous expansion in activities across manufacturing and services sectors, rekindling hopes that the ongoing recovery is going to be durable and solid.

Accordingly, the manufacturing sector PMI recorded an index value of 62.5 in March, from 56.0 index points in February reflecting that the once languishing sector is now expanding at a rapid pace.

In fact March PMI reading is the highest in three years, in a further sign that the economy has unequivocally exited the crisis although some uncertainties remain.

Meanwhile, the services sector PMI recorded an index value of 67.7 in March, logging a significant increase from 53.0 index points in February. PMI is a broadly followed gauge to measure the health of an economy and provides a bellwether for the Gross Domestic Product. A reading above 50.0 in PMI indicates an expansion in activity while a level below that indicates a contraction. The index value of 50.0 reflects a neutral level.

The manufacturing sector PMI has been driven by all sub-indices led by new orders and production coming from manufacturing of food and beverages and textile and apparel.

“Most of the manufacturers, especially in the food & beverage sector, were optimistic about the upcoming festive season”, the Central Bank said citing the latest monthly survey. Meanwhile, the employment segment also improved as firms hired staff to cope up with the new orders and meet the higher production.

Further, the survey has also found that the prices have also declined during the month mirroring the cooler than anticipated inflation in March.

The manufacturing sector broadly has positive expectations for the next three months despite some slowing down during April following the seasonal peak.

Meanwhile, the services sector activity spurt has also been driven by the seasonal pop seen in both wholesale and retail trade due to the festive demand.

Further, the financial services sub-sector continued to be supported by the accommodative monetary policy of the Central Bank as financial conditions were seen easing with the decline in the borrowing rates. Meanwhile, accommodation and food and beverage sub-sectors continued to grow due to robust tourist arrivals while transport and other personal and professional services also saw growth.

New businesses across a wider section of services were also witnessed while the employment sub-index improved as firms hired new staff to meet the elevated festive demand. Meanwhile, expectations for business activities for the next three months continued to rise due to favourable macro-economic conditions.

]]>

]]>

Berlin, April 15 (Reuters) - Tesla, opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

Berlin, April 15 (Reuters) - Tesla, opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

"About every five years, we need to reorganize and streamline the company for the next phase of growth," CEO Elon Musk commented in a post on X. Two senior leaders, battery development chief Drew Baglino and vice president for public policy Rohan Patel, also announced their departures, drawing posts of thanks from Musk although some investors were concerned.

Musk last announced a round of job cuts in 2022, after telling executives he had a "super bad feeling" about the economy. Still, Tesla headcount has risen from around 100,000 in late 2021 to over 140,000 in late 2023, according to filings with U.S. regulators.

Baglino was a Tesla veteran and one of four members, along with Musk, of the leadership team listed on the company's investor relations website.

Scott Acheychek, CEO of Rex Shares - which manages ETFs with high exposure to Tesla stock - described the headcount reductions as strategic, but Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, deemed the departures of the senior executives as "the larger negative signal today" that Tesla's growth was in trouble.

Less than a year ago, Tesla's chief financial officer, Zach Kirkhorn, left the company, fueling concerns about succession planning.

Tesla shares closed 5.6% lower at $161.48 on Monday. Shares of EV makers Rivian Automotive, opens new tab, Lucid Group, opens new tab and VinFast Auto also dropped between 2.4% and 9.4%.

"As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity," Musk said in the memo sent to all staff.

"As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally," it said.

Reuters saw an email sent to at least three U.S. employees notifying them their dismissal was effective immediately.

Tesla did not immediately respond to a request for comment.

The layoffs follow an exclusive Reuters report on April 5 that Tesla had cancelled a long-promised inexpensive car, expected to cost $25,000, that investors have been counting on to drive mass-market growth. Musk had said the car, known as the Model 2, would start production in late 2025.

Shortly after the story published, Musk posted "Reuters is lying" on his social media site X, without detailing any inaccuracies. He has not commented on the car since, leaving investors and analysts to speculate on its future.

Tech publication Electrek, which first reported, opens new tab the latest job cuts, said on Monday that the inexpensive car project had been defunded and that many people working on it had been laid off.

Reuters also reported on April 5 that Tesla would shift its focus to self-driving robotaxis built on the same small-car platform. Musk posted on X that evening: "Tesla Robotaxi unveil on 8/8," with no further details.

Tesla could be years away from releasing a fully autonomous vehicle with regulatory approval, according to experts in self-driving cars and regulation.

Tesla shares have fallen about 33% so far this year, underperforming legacy automakers such as Toyota Motor, opens new tab and General Motors, opens new tab, whose shares have rallied 45% and about 20% respectively.

Energy major BP, opens new tab has also cut more than a tenth of the workforce in its EV charging business after a bet on rapid growth in commercial EV fleets did not pay off, Reuters reported on Monday, underscoring the broader impact of slowing EV demand.

A newly elected works council of labour representatives at Tesla's German plant was not informed or consulted ahead of the announcement to staff, said Dirk Schulze, head of the IG Metall union in the region.

"It is the legal obligation of management not only to inform the works council but to consult with it on how jobs can be secured," Schulze said.

Analysts from Gartner and Hargreaves Lansdown said the cuts were a sign of cost pressures as the carmaker invests in new models and artificial intelligence.

Tesla reported this month that its global vehicle deliveries in the first quarter fell for the first time in nearly four years, as price cuts failed to stir demand.

The EV maker has been slow to refresh its aging models as high interest rates have sapped consumer appetite for big-ticket items, while rivals in China, the world's largest auto market, are rolling out cheaper models.

China's BYD opens new tab briefly overtook the U.S. company as the world's largest EV maker in the fourth quarter, and new entrant Xiaomi, opens new tab has garnered substantial positive press.

Tesla is gearing up to start sales in India, the world's third-largest auto market, this year, producing cars in Germany for export to India and scouting locations for showrooms and service hubs in major cities.

Tesla recorded a gross profit margin of 17.6% in the fourth quarter, the lowest in more than four years.

]]>

]]> Berlin, April 15 (Reuters) - Tesla, opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

Berlin, April 15 (Reuters) - Tesla, opens new tab is laying off more than 10% of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles (EVs).

"About every five years, we need to reorganize and streamline the company for the next phase of growth," CEO Elon Musk commented in a post on X. Two senior leaders, battery development chief Drew Baglino and vice president for public policy Rohan Patel, also announced their departures, drawing posts of thanks from Musk although some investors were concerned.

Musk last announced a round of job cuts in 2022, after telling executives he had a "super bad feeling" about the economy. Still, Tesla headcount has risen from around 100,000 in late 2021 to over 140,000 in late 2023, according to filings with U.S. regulators.

Baglino was a Tesla veteran and one of four members, along with Musk, of the leadership team listed on the company's investor relations website.

Scott Acheychek, CEO of Rex Shares - which manages ETFs with high exposure to Tesla stock - described the headcount reductions as strategic, but Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, deemed the departures of the senior executives as "the larger negative signal today" that Tesla's growth was in trouble.

Less than a year ago, Tesla's chief financial officer, Zach Kirkhorn, left the company, fueling concerns about succession planning.

Tesla shares closed 5.6% lower at $161.48 on Monday. Shares of EV makers Rivian Automotive, opens new tab, Lucid Group, opens new tab and VinFast Auto also dropped between 2.4% and 9.4%.

"As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity," Musk said in the memo sent to all staff.

"As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally," it said.

Reuters saw an email sent to at least three U.S. employees notifying them their dismissal was effective immediately.

Tesla did not immediately respond to a request for comment.

The layoffs follow an exclusive Reuters report on April 5 that Tesla had cancelled a long-promised inexpensive car, expected to cost $25,000, that investors have been counting on to drive mass-market growth. Musk had said the car, known as the Model 2, would start production in late 2025.

Shortly after the story published, Musk posted "Reuters is lying" on his social media site X, without detailing any inaccuracies. He has not commented on the car since, leaving investors and analysts to speculate on its future.

Tech publication Electrek, which first reported, opens new tab the latest job cuts, said on Monday that the inexpensive car project had been defunded and that many people working on it had been laid off.

Reuters also reported on April 5 that Tesla would shift its focus to self-driving robotaxis built on the same small-car platform. Musk posted on X that evening: "Tesla Robotaxi unveil on 8/8," with no further details.

Tesla could be years away from releasing a fully autonomous vehicle with regulatory approval, according to experts in self-driving cars and regulation.

Tesla shares have fallen about 33% so far this year, underperforming legacy automakers such as Toyota Motor, opens new tab and General Motors, opens new tab, whose shares have rallied 45% and about 20% respectively.

Energy major BP, opens new tab has also cut more than a tenth of the workforce in its EV charging business after a bet on rapid growth in commercial EV fleets did not pay off, Reuters reported on Monday, underscoring the broader impact of slowing EV demand.

A newly elected works council of labour representatives at Tesla's German plant was not informed or consulted ahead of the announcement to staff, said Dirk Schulze, head of the IG Metall union in the region.

"It is the legal obligation of management not only to inform the works council but to consult with it on how jobs can be secured," Schulze said.

Analysts from Gartner and Hargreaves Lansdown said the cuts were a sign of cost pressures as the carmaker invests in new models and artificial intelligence.

Tesla reported this month that its global vehicle deliveries in the first quarter fell for the first time in nearly four years, as price cuts failed to stir demand.

The EV maker has been slow to refresh its aging models as high interest rates have sapped consumer appetite for big-ticket items, while rivals in China, the world's largest auto market, are rolling out cheaper models.

China's BYD opens new tab briefly overtook the U.S. company as the world's largest EV maker in the fourth quarter, and new entrant Xiaomi, opens new tab has garnered substantial positive press.

Tesla is gearing up to start sales in India, the world's third-largest auto market, this year, producing cars in Germany for export to India and scouting locations for showrooms and service hubs in major cities.

Tesla recorded a gross profit margin of 17.6% in the fourth quarter, the lowest in more than four years.

]]>

]]>

By Nishel Fernando

Sri Lanka’s celebrity chocolatier, chef and agriculture enthusiast Gerard Mendis faces an uphill battle in his bid to take single-origin Sri Lankan chocolates global. This is primarily due to the shortage of cocoa beans and absence of active cooperation of authorities.

Sri Lanka’s celebrity chocolatier, chef and agriculture enthusiast Gerard Mendis faces an uphill battle in his bid to take single-origin Sri Lankan chocolates global. This is primarily due to the shortage of cocoa beans and absence of active cooperation of authorities.

“In Sri Lanka, we have our own cocoa beans but we don’t have a sufficient quantity to cater to the demand of the local market. I took some (local) cocoa beans to a factory in Switzerland. Their feedback was that it (Sri Lankan cocoa) was one of the best they had ever tried and were keen on getting more. Unfortunately, we don’t have the quantity,” Mendis told Mirror Business.

Mendis shared that the authorities are yet to show any indications of active cooperation in reviving the domestic coca supply, to tap into the export potential. “I went and spoke to the Export Development Board. We had a meeting with all of their directors. I requested them to share the database of all growers, so we can approach them. Up to date, we haven’t heard anything from them on this,” he added.

While Sri Lanka once boasted about the thriving cocoa estates, many have disappeared over the years. As a result, the local producers, even those serving the domestic market, are compelled to import part of their supply from Africa and Southeast Asia. “I am a chocolatier; I have to import the base, to make my chocolates, from Switzerland or Belgium. All those countries get their cocoa beans from Ghana, Madagascar and Java, as Europe doesn’t grow cocoa,” noted Mendis.

With the rising prices and limited availability, Mendis highlighted that the Sri Lankan growers stand to gain higher prices.

“Chocolate is considered to be one of the most consumed products at the moment. They can’t cope with the global demand. If we have enough beans, there will be people fighting to buy them,” he added.

President Ranil Wickremesinghe early this year urged the stakeholders to explore inter-cropping with cocoa, particularly in identified areas such as Matale, Kandy, Mawathagama and Dodangaslanda and encouraged collaboration with the smallholders.

He shared that the government plans to collaborate with the smallholders and discussions with the governments of Ghana and Ivory Coast, for access to cocoa. However, no progress has been made in this regard as yet.

Addressing the Lanka Confectionary Manufacturers Association Annual General Meeting in January, Wickremesinghe called on the industry to actively look at exporting chocolates and expressed confidence in Sri Lanka delivering a world-class product.

]]>

]]>By Nishel Fernando

Sri Lanka’s celebrity chocolatier, chef and agriculture enthusiast Gerard Mendis faces an uphill battle in his bid to take single-origin Sri Lankan chocolates global. This is primarily due to the shortage of cocoa beans and absence of active cooperation of authorities.

Sri Lanka’s celebrity chocolatier, chef and agriculture enthusiast Gerard Mendis faces an uphill battle in his bid to take single-origin Sri Lankan chocolates global. This is primarily due to the shortage of cocoa beans and absence of active cooperation of authorities.

“In Sri Lanka, we have our own cocoa beans but we don’t have a sufficient quantity to cater to the demand of the local market. I took some (local) cocoa beans to a factory in Switzerland. Their feedback was that it (Sri Lankan cocoa) was one of the best they had ever tried and were keen on getting more. Unfortunately, we don’t have the quantity,” Mendis told Mirror Business.

Mendis shared that the authorities are yet to show any indications of active cooperation in reviving the domestic coca supply, to tap into the export potential. “I went and spoke to the Export Development Board. We had a meeting with all of their directors. I requested them to share the database of all growers, so we can approach them. Up to date, we haven’t heard anything from them on this,” he added.

While Sri Lanka once boasted about the thriving cocoa estates, many have disappeared over the years. As a result, the local producers, even those serving the domestic market, are compelled to import part of their supply from Africa and Southeast Asia. “I am a chocolatier; I have to import the base, to make my chocolates, from Switzerland or Belgium. All those countries get their cocoa beans from Ghana, Madagascar and Java, as Europe doesn’t grow cocoa,” noted Mendis.

With the rising prices and limited availability, Mendis highlighted that the Sri Lankan growers stand to gain higher prices.

“Chocolate is considered to be one of the most consumed products at the moment. They can’t cope with the global demand. If we have enough beans, there will be people fighting to buy them,” he added.

President Ranil Wickremesinghe early this year urged the stakeholders to explore inter-cropping with cocoa, particularly in identified areas such as Matale, Kandy, Mawathagama and Dodangaslanda and encouraged collaboration with the smallholders.

He shared that the government plans to collaborate with the smallholders and discussions with the governments of Ghana and Ivory Coast, for access to cocoa. However, no progress has been made in this regard as yet.

Addressing the Lanka Confectionary Manufacturers Association Annual General Meeting in January, Wickremesinghe called on the industry to actively look at exporting chocolates and expressed confidence in Sri Lanka delivering a world-class product.

]]>

]]>

The Central Bank has purchased the most amount of dollars for a single month in March, a sign that the country is currently in a very comfortable position in its foreign currency liquidity, after two years into the worst currency crisis in the country.

The Central Bank has purchased the most amount of dollars for a single month in March, a sign that the country is currently in a very comfortable position in its foreign currency liquidity, after two years into the worst currency crisis in the country.

According to the data released last week, the Central Bank purchased US $ 715.1 million in March, which is the highest ever in the last decade. While the monetary watchdog sold none, the dollar purchase is a sharp increase from the roughly US $ 240 million purchased from the banking system in February, on a net basis.

In January, the Central Bank purchased US $ 245.3 million and thus, the March net absorptions brought the first three months’ purchases to US $ 1,199.0 million.

The Central Bank later last month said it would intervene in the foreign currency market to prevent excessive volatility, as the rupee has in recent times appreciated quite significantly after it plunged to its lowest levels in 2022.

For instance, the rupee gained in value by 8.5 percent year-to-date, to trade at Rs.298.51 to a dollar on April 10, on the close of trading for the traditional New Year holiday last week. This was on top of the roughly 12 percent gain in the rupee in 2023.

As a result, the rupee has also emerged as the best-performing currency in the emerging markets in the first quarter.

These large purchases have been possible as tourism has once again returned to become a bright spot in the country’s economy, while the remittances have been pretty strong.

In the first quarter, the two generated US $ 1,025.9 million and US $ 1,536.1 million, respectively.

Besides, Sri Lanka now doesn’t pay most of its foreign currency loans and personal vehicle imports have remained suspended for four years now.

These things have provided much breathing room for the officials to rebuild the reserves, which depleted to near zero levels two years ago, to a level just shy of US $ 5.0 billion.

Sri Lanka fell into an economic crisis in 2022, after running out of foreign currency to bring down fuel, gas and most other essential items, as tourism trade was nearly decimated in the preceding years, due to the pandemic while the remittances reached a low while the exports were less than potential.

]]>

]]> The Central Bank has purchased the most amount of dollars for a single month in March, a sign that the country is currently in a very comfortable position in its foreign currency liquidity, after two years into the worst currency crisis in the country.

The Central Bank has purchased the most amount of dollars for a single month in March, a sign that the country is currently in a very comfortable position in its foreign currency liquidity, after two years into the worst currency crisis in the country.

According to the data released last week, the Central Bank purchased US $ 715.1 million in March, which is the highest ever in the last decade. While the monetary watchdog sold none, the dollar purchase is a sharp increase from the roughly US $ 240 million purchased from the banking system in February, on a net basis.

In January, the Central Bank purchased US $ 245.3 million and thus, the March net absorptions brought the first three months’ purchases to US $ 1,199.0 million.

The Central Bank later last month said it would intervene in the foreign currency market to prevent excessive volatility, as the rupee has in recent times appreciated quite significantly after it plunged to its lowest levels in 2022.

For instance, the rupee gained in value by 8.5 percent year-to-date, to trade at Rs.298.51 to a dollar on April 10, on the close of trading for the traditional New Year holiday last week. This was on top of the roughly 12 percent gain in the rupee in 2023.

As a result, the rupee has also emerged as the best-performing currency in the emerging markets in the first quarter.

These large purchases have been possible as tourism has once again returned to become a bright spot in the country’s economy, while the remittances have been pretty strong.

In the first quarter, the two generated US $ 1,025.9 million and US $ 1,536.1 million, respectively.

Besides, Sri Lanka now doesn’t pay most of its foreign currency loans and personal vehicle imports have remained suspended for four years now.

These things have provided much breathing room for the officials to rebuild the reserves, which depleted to near zero levels two years ago, to a level just shy of US $ 5.0 billion.

Sri Lanka fell into an economic crisis in 2022, after running out of foreign currency to bring down fuel, gas and most other essential items, as tourism trade was nearly decimated in the preceding years, due to the pandemic while the remittances reached a low while the exports were less than potential.

]]>

]]>

Men push cartloads in Pettah - Pic by Pradeep Pathirana

The Asian Development Bank (ADB) stressed that for Sri Lanka, the near-term priority during economic recovery is to lay institutional and structural frameworks for an inclusive social protection system.

In the absence of a cohesive social protection strategy and governance mechanism, programmes in the past have been fragmented, with low coverage, poor targeting, high inclusion and exclusion errors and low payments, the ADB said in its annual flagship economic publication, the Asian Development Outlook (ADO) April 2024.

In 2023, the government introduced the Aswesuma programme to consolidate over 25 state-sponsored cash-transfer programmes that were previously managed by several government agencies.

The ADB asserted that this programme could be further strengthened with increased individual support, better forward planning and an effective graduation mechanism with technical and life skill training, better financial literacy education and enhanced social and financial inclusion.

“The government must establish a comprehensive long-term strategy for poverty eradication that monitors progress and incorporates regular social dialogue to ensure the representation and participation of all stakeholders,” it said.

The Manila-based lender further stressed that the government should enhance access to public services to mitigate inequalities and better target poverty alleviation efforts.

The integration of social protection programmes with other public services such as education and healthcare would ensure universal access to essential services, improve targeting and coverage and expand social inclusion.

“In this regard, the government efforts to revamp education policy with updated curricula, improved teacher training and digitalisation are welcome.

While the state-sponsored universal healthcare coverage and subsidised medicine provide considerable support to the poor, the government can better leverage the healthcare system for more targeted measures and promote health insurance programmes to protect the poor and vulnerable,” it said.

The ADB elaborated that the government should intensify efforts to train and retain health and care staff, particularly considering the significant outmigration by professionals.

Given the fiscal constraints, the ADB said expanding access to services could be achieved by enabling greater private sector participation in essential services. Meanwhile, investments in infrastructure for water supply, road connectivity and energy are needed to address inequality in income and opportunity and in access to resources.

The ADB, in the ADO, forecasts Sri Lanka’s economy to record a moderate growth of 1.9 percent in 2024 and 2.5 percent in 2025, following two consecutive years of contractions.

]]>

]]>

Men push cartloads in Pettah - Pic by Pradeep Pathirana

The Asian Development Bank (ADB) stressed that for Sri Lanka, the near-term priority during economic recovery is to lay institutional and structural frameworks for an inclusive social protection system.

In the absence of a cohesive social protection strategy and governance mechanism, programmes in the past have been fragmented, with low coverage, poor targeting, high inclusion and exclusion errors and low payments, the ADB said in its annual flagship economic publication, the Asian Development Outlook (ADO) April 2024.

In 2023, the government introduced the Aswesuma programme to consolidate over 25 state-sponsored cash-transfer programmes that were previously managed by several government agencies.

The ADB asserted that this programme could be further strengthened with increased individual support, better forward planning and an effective graduation mechanism with technical and life skill training, better financial literacy education and enhanced social and financial inclusion.

“The government must establish a comprehensive long-term strategy for poverty eradication that monitors progress and incorporates regular social dialogue to ensure the representation and participation of all stakeholders,” it said.

The Manila-based lender further stressed that the government should enhance access to public services to mitigate inequalities and better target poverty alleviation efforts.

The integration of social protection programmes with other public services such as education and healthcare would ensure universal access to essential services, improve targeting and coverage and expand social inclusion.

“In this regard, the government efforts to revamp education policy with updated curricula, improved teacher training and digitalisation are welcome.

While the state-sponsored universal healthcare coverage and subsidised medicine provide considerable support to the poor, the government can better leverage the healthcare system for more targeted measures and promote health insurance programmes to protect the poor and vulnerable,” it said.

The ADB elaborated that the government should intensify efforts to train and retain health and care staff, particularly considering the significant outmigration by professionals.

Given the fiscal constraints, the ADB said expanding access to services could be achieved by enabling greater private sector participation in essential services. Meanwhile, investments in infrastructure for water supply, road connectivity and energy are needed to address inequality in income and opportunity and in access to resources.

The ADB, in the ADO, forecasts Sri Lanka’s economy to record a moderate growth of 1.9 percent in 2024 and 2.5 percent in 2025, following two consecutive years of contractions.

]]>

]]>

The Board arrived at this decision following a comprehensive assessment of current and expected domestic and international economic developments, to maintain inflation at the targeted level of 5 per cent over the medium term, while enabling the economy to reach its potential, the Central Bank said in a statement.

In arriving at this decision, the Board took note of, among others, subdued aggregate demand conditions, the lesser-than-expected impact of the recent changes to the tax structure on inflation, favourable near-term inflation dynamics due to the recent adjustment to electricity tariffs, well-anchored inflation expectations, the absence of excessive external sector pressures and the need to continue the downward trajectory in market interest rates.

“The Board observed that the possible upside risks to inflation in the near term would not materially change the medium-term inflation outlook, as economic activity is projected to remain below par for an extended period,” the Central Bank said.

The Monetary Policy Board underscored the need for a swift and full pass-through of monetary easing measures to market interest rates, particularly lending rates, by the financial institutions, thereby accelerating the normalisation of market interest rates in the period ahead.

]]>

]]>The Board arrived at this decision following a comprehensive assessment of current and expected domestic and international economic developments, to maintain inflation at the targeted level of 5 per cent over the medium term, while enabling the economy to reach its potential, the Central Bank said in a statement.

In arriving at this decision, the Board took note of, among others, subdued aggregate demand conditions, the lesser-than-expected impact of the recent changes to the tax structure on inflation, favourable near-term inflation dynamics due to the recent adjustment to electricity tariffs, well-anchored inflation expectations, the absence of excessive external sector pressures and the need to continue the downward trajectory in market interest rates.

“The Board observed that the possible upside risks to inflation in the near term would not materially change the medium-term inflation outlook, as economic activity is projected to remain below par for an extended period,” the Central Bank said.

The Monetary Policy Board underscored the need for a swift and full pass-through of monetary easing measures to market interest rates, particularly lending rates, by the financial institutions, thereby accelerating the normalisation of market interest rates in the period ahead.

]]>

]]>

Established in 1839, initially to cater to the needs of the plantation industry, primarily rubber and coconut, it has evolved into an institution representing a wide sector of industry and commerce. Today, boasting a membership of over 500 members, including some of the largest corporations in Sri Lanka the CCC stands as a pillar of support for businesses across various sectors.

Reflecting on the journey, CCC Chairman Duminda Hulangamuwa said the Chamber has always placed the 'Country First' in its endeavours.

“Over the years, we have actively engaged with stakeholders, both domestically and internationally, to promote economic stability and growth. As we celebrate this milestone, we reaffirm our commitment to continue playing a significant role in shaping the economy, promoting trade and investment, and facilitating policy advocacy,” he said in a statement to the media.

Operating on three pillars - Policy Advocacy, Engagement, and Market Access - the Chamber’s activities run a wide gamut. From engaging with stakeholders to advocate sustainable economic policies, engaging with government bodies, private sector entities, trade associations, and foreign missions to foster collaboration and address challenges and resolve issues faced by its members, and facilitating trade events and investment opportunities, the Ceylon Chamber actively engages with stakeholders to ensure a conducive environment that benefits trade and business while serving the people at large.

As the Ceylon Chamber commemorates 185 years of service, it reaffirms its commitment to advancing the collective interests of the nation and its people, driving economic growth and prosperity for Sri Lanka.

]]>

]]>Established in 1839, initially to cater to the needs of the plantation industry, primarily rubber and coconut, it has evolved into an institution representing a wide sector of industry and commerce. Today, boasting a membership of over 500 members, including some of the largest corporations in Sri Lanka the CCC stands as a pillar of support for businesses across various sectors.

Reflecting on the journey, CCC Chairman Duminda Hulangamuwa said the Chamber has always placed the 'Country First' in its endeavours.

“Over the years, we have actively engaged with stakeholders, both domestically and internationally, to promote economic stability and growth. As we celebrate this milestone, we reaffirm our commitment to continue playing a significant role in shaping the economy, promoting trade and investment, and facilitating policy advocacy,” he said in a statement to the media.

Operating on three pillars - Policy Advocacy, Engagement, and Market Access - the Chamber’s activities run a wide gamut. From engaging with stakeholders to advocate sustainable economic policies, engaging with government bodies, private sector entities, trade associations, and foreign missions to foster collaboration and address challenges and resolve issues faced by its members, and facilitating trade events and investment opportunities, the Ceylon Chamber actively engages with stakeholders to ensure a conducive environment that benefits trade and business while serving the people at large.

As the Ceylon Chamber commemorates 185 years of service, it reaffirms its commitment to advancing the collective interests of the nation and its people, driving economic growth and prosperity for Sri Lanka.

]]>

]]>

Addressing the media, IMF Senior Mission Chief Peter Breuer said the staff-level agreement is subject to the approval by IMF management and the IMF Executive Board in the period ahead.

The approval will depend on the implementation by the authorities of prior actions, the completion of financing assurances review, which will focus on confirming multilateral partners’ committed financing contributions, and whether adequate progress has been made with the debt restructuring to give confidence that the restructuring will be concluded in a timely manner and in line with the program’s debt targets.

“Upon completion of the Executive Board review, Sri Lanka would have access to SDR 254 million (about US$337 million), bringing the total IMF financial support disbursed under the arrangement to SDR 762 million (about US$1 billion),” said Breuer.

The EFF arrangement was approved by the IMF Executive Board for a total amount of SDR 2.3 billion (about US$3 billion) on March 20, 2023.

]]>

]]>Addressing the media, IMF Senior Mission Chief Peter Breuer said the staff-level agreement is subject to the approval by IMF management and the IMF Executive Board in the period ahead.

The approval will depend on the implementation by the authorities of prior actions, the completion of financing assurances review, which will focus on confirming multilateral partners’ committed financing contributions, and whether adequate progress has been made with the debt restructuring to give confidence that the restructuring will be concluded in a timely manner and in line with the program’s debt targets.

“Upon completion of the Executive Board review, Sri Lanka would have access to SDR 254 million (about US$337 million), bringing the total IMF financial support disbursed under the arrangement to SDR 762 million (about US$1 billion),” said Breuer.

The EFF arrangement was approved by the IMF Executive Board for a total amount of SDR 2.3 billion (about US$3 billion) on March 20, 2023.

]]>

]]>