12 Mar 2020 - {{hitsCtrl.values.hits}}

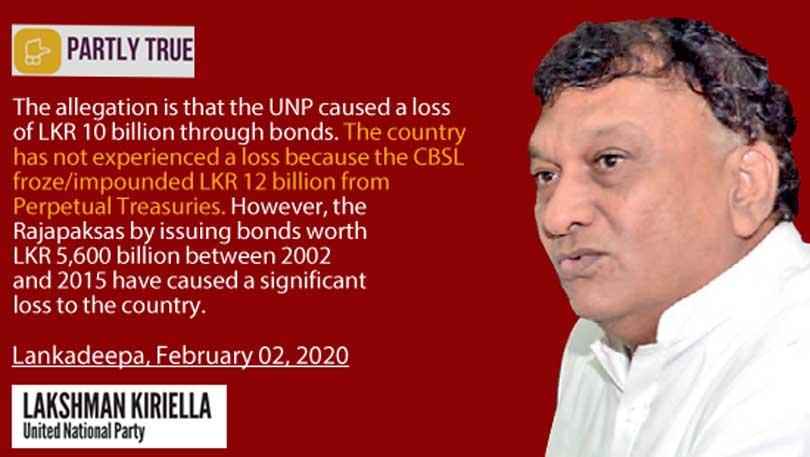

MP Kiriella argues that the estimated loss of LKR 10 billion arising from irregular bond transactions post-January 2015 should not be considered a loss. His argument is based on over LKR 12 billion of counter-party assets being frozen in response to investigations. He contrasts this with the losses estimated for the 2002-2014 period where there is no asset freeze to support the recovery of losses.

MP Kiriella argues that the estimated loss of LKR 10 billion arising from irregular bond transactions post-January 2015 should not be considered a loss. His argument is based on over LKR 12 billion of counter-party assets being frozen in response to investigations. He contrasts this with the losses estimated for the 2002-2014 period where there is no asset freeze to support the recovery of losses.

FactCheck evaluates the MP’s argument at two levels. First, the information presented by the MP; and second, the conclusion he derives from it.

First, we look at the MP’s figures. The LKR 10 billion that the MP cites as the estimated loss appears to be a rounding-up of the estimated maximum loss of LKR 9.68 billion—for post-January 2015 bond transactions—noted in Table 89 of the Central Bank Forensic Report 4.

The MP refers to the issuance of LKR 5,600 billion worth of Treasury bonds, between 2002-2015, which resulted in significant losses. Table 18 of Forensic Report 1 confirms the issuance of LKR 5,600 billion in bonds as direct placements and Table 58 summarises the estimated losses from these issuances as LKR 10.47 billion.

The MP also claimed that the government froze LKR 12 billion of Perpetual Treasuries’ assets. On 7 November 2016, the Central Bank moved to prevent the alienation of funds from Perpetual Treasuries and later froze their bank accounts—with amounts in excess of LKR 12 billion—in relation to the irregular bond transactions which occurred post-January 2015. On 1 February 2018, pursuant to a request by the CID, the Colombo High Court issued an order extending this asset freeze. No such action has been reported regarding the estimated losses from irregular bond transactions in the 2002-2015 period.

Therefore, all of the MP’s claims in relation to bond issuances, estimated losses, and freezing of assets are consistent with what is reported in the Central Bank Forensic Reports and available in public sources.

Second, we look at the conclusion that the MP derives from this information: that there is no experience of loss from the post-January 2015 transactions. The MP’s claim is based on there being an offsetting freeze of assets. However, while the asset freeze could be used to offset the estimated loss, judicial proceedings are ongoing.

The MP is correct in all his claims regarding bond transactions and estimated losses. However, his claim that a loss has not been experienced from the post-January 2015 bond transactions cannot be sustained as final recovery of assets has not yet materialised.

Therefore, we classify the MP’s statement as PARTLY TRUE.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

25 Apr 2024 35 minute ago

25 Apr 2024 51 minute ago

25 Apr 2024 1 hours ago

25 Apr 2024 2 hours ago

25 Apr 2024 2 hours ago