21 Jul 2020 - {{hitsCtrl.values.hits}}

Fitch Ratings Lanka yesterday reminded that the operating conditions for the banking sector have weakened, exerting further pressure on banks’ ratings, after the rating agency downgraded the country rating in April, citing heightened public and external debt sustainability challenges caused by the pandemic-induced economic difficulties and the tax cuts late last year.

Fitch Ratings in May revised down the Operating Environment (OE) score for Sri Lankan banks to ‘b-’, from ‘b’, with a Negative outlook, after the sovereign rating was downgraded to ‘B-’, with a Negative outlook in April, as “there is a strong link between the sovereign credit profile and the operating conditions for

banks in Sri Lanka”.

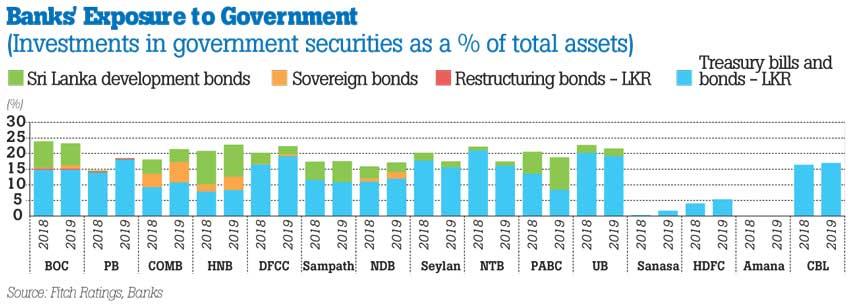

This strong link is built mostly through the banks’ significant exposure to the government securities, which was over 25 percent by end-2019, Fitch’s

estimates showed.

“We believe that should the sovereign credit profile deteriorate further, the operating environment will also worsen, including weakening of public and private sector balance sheets, funding market dislocations and macroeconomic volatility,” the rating agency said.

The weakened OE score for the banking sector stems from Fitch’s expectation that the Sri Lankan economy to contract by 1.3 percent in 2020, constraining the banks’ growth and recovery prospects, causing deterioration in the actual non-performing loans, as opposed to the reported ones.

“We expect the accumulation of potential credit stress, even though the banks are likely to report a lower stock of NPLs and Stage 3 loans in the near term than might otherwise have been the case due to the relief measures,” Fitch said. In a special report last week, ICRA Lanka, part of Moody’s Investors Service, said Sri Lanka should strike a balance between credit growth, which is imperative to support the economic revival and financial system stability, at a time when certain rules are relaxed.

According to Fitch, Sri Lanka’s bank credit is not excessive and remains at modest levels, equivalent to 54 percent of GDP at end-2019, close to some of the Asia-Pacific peers. However, the private credit, which was at 49.8 percent of GDP, was the highest among ‘B’-rated Asia-Pacific peers.

While commending the broadly effective role of the Central Bank as a regulator and a supervisor, Fitch Ratings took a swipe at the instances of forbearance by the financial sector regulator, in relation to enforcement of regulations.

“However, the CBSL has recently been more proactive, particularly in addressing the weaknesses among the licensed finance companies by cancelling the licences of failed finance companies,” the rating agency added.

Fitch also expects the increased risk of sovereign debt distress to limit banks’ access to foreign funding and their costs.

However, a few Sri Lankan banks have already secured low-cost dollar funding from several development financiers, to support lending to small businesses affected by the pandemic, at very competitive rates.

18 Apr 2024 1 hours ago

18 Apr 2024 2 hours ago

18 Apr 2024 2 hours ago

18 Apr 2024 2 hours ago

18 Apr 2024 4 hours ago