Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 14:00:00

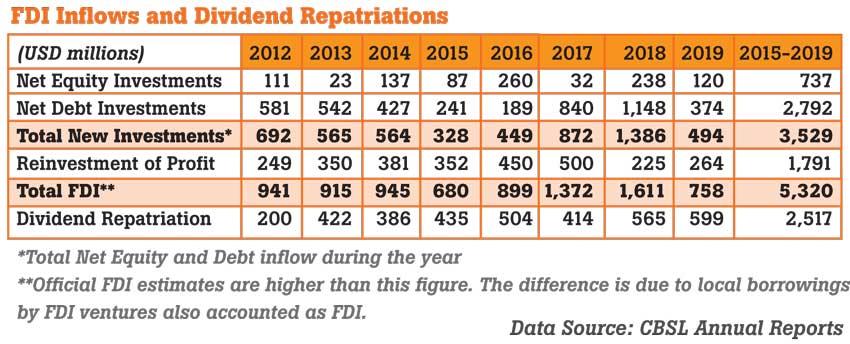

The recently released 2019 Central Bank annual report reveals that repatriation of profit by foreign-owned firms or foreign direct investment (FDI)-backed firms in Sri Lanka continue to increase. Profit repatriation (or dividend outflows) in 2019 has reached US $ 599 million, compared to the US $ 494 million actual new FDI inflow into

The recently released 2019 Central Bank annual report reveals that repatriation of profit by foreign-owned firms or foreign direct investment (FDI)-backed firms in Sri Lanka continue to increase. Profit repatriation (or dividend outflows) in 2019 has reached US $ 599 million, compared to the US $ 494 million actual new FDI inflow into

the country.

As shown in the table, Sri Lanka received US $ 5.3 billion FDI during last five years. Out of this, actual cash inflow into the country was US $ 3.5 billion (in the form of new equity or debt investment). However, during this period, over US $ 2.5 billion cash has been repatriated back to foreign countries as dividends.

In addition, FDI ventures remit funds to repay foreign debt (which were originally accounted as FDI) and as interest payments. We can guesstimate that at least a further US $ 450 million may have been remitted back to foreign countries by FDI ventures as interest payments during the last five years (based on outstanding debt stock and assuming a conservative 2.5 percent cost of debt).

When we sum all above, it is likely that the actual FDI inflow into the country could have been less than half a billion dollars, for the entire five-year period. This picture becomes very bleak, if we exclude (over billion dollar) receipts from the sale of Hambantota Port (which were accounted in 2017 and 2018).

If Sri Lanka did not receive funds from the sale of Hambantota Port, Sri Lanka may have experienced negative investment cash flows from FDI ventures for the entire five-year period.

As highlighted above, Sri Lanka appears to be receiving lesser FDI inflows than the money repatriated by the existing FDI ventures. Increased cash outflows from the country through FDI ventures, combined with the slowdown in new FDI, probably contributed to the sharp slowdown in the gross domestic product (GDP) growth during the last five-year period.

As a capital-starved country, Sri Lanka needs to attract new foreign investment continuously to fuel growth. When actual cash inflows dry up, growth stalls. Although FDI helps in increasing GDP, it could also exert pressure on the external stability. Repatriation of profits, if not earned through foreign income, could also lead to long-term deterioration of the balance of payment as well.

What does high dividend payment indicate?

Increase in profit repatriation indicates several underlying trends taking place in the FDI space. It is an indication of the success of FDI ventures. In fact, equity returns of FDI ventures in Sri Lanka appear to be healthy.

We can guesstimate that majority of the FDI-backed firms may have delivered over 7 percent dividend yield and over 11 percent return on equity in dollar terms, during last five years. Total investor returns were likely to be much higher as investors usually use various additional channels to take out earnings (such as royalties, corporate service fees, etc.)

Increase in dividends means reinvestments are cut down. This is a clear signal that (majority of) FDI-backed firms reaching the third phase of the FDI life cycle, which is the ‘Profit Repatriation phase’. Deterioration of overall investment activities during last few years has probably created an unfavourable mix of fewer ‘Growth phase’ FDI ventures and more ‘Profit Repatriation phase’ ventures in Sri Lanka at present. An influx of FDI into non-tradable sector projects like apartment development during last decade has also contributed for this trend.

As a developing country with a tight external situation, Sri Lanka currently needs FDI-backed companies not only in tradable sectors but also in first (‘Entry/development phase’) and second (‘Growth phase’) phase of the FDI cycle.

Some FDI-backed firms exit after reaching the third stage. This could pose challenges as well as opportunities for smaller host countries like Sri Lanka. The challenge is to attract new FDI to replace older FDI through new programmes. In doing so, it is essential to promote businesses, which could generate high-net foreign income to the country through sustainable businesses.

It is equally important to support the existing firms to enter new life cycles and to make a conducive environment for efficient changes of ownership/management to recycle old businesses.

Selling national assets to fund profit repatriation

If the current trend of low FDI into the tradable sector and high profit repatriation continues without a policy intervention, Sri Lanka may be forced to divest additional national assets to finance profit repatriation of FDI ventures!

Perhaps Sri Lanka now has a great opportunity to boost new FDI by attracting businesses seeking global relocations post-COVID-19 pandemic and other major trade-related disruptions taking place in the world today.

(Indika Hettiarachchi, an independent consultant in project, venture and private market investment, can be reached via Indika.h@jupitercapitalpartners.com)

Nadi Karunaratne Monday, 18 May 2020 06:43 PM

Reduce corruption, eliminate unnecessary bureaucracy, reform the inflexible labour market, r improve transport infrastructure, upgrade English language education and FDI inflows will soon dwarf profit repatriation. Unlock our fantastic potential which has been squandered by an inept political elite. It isn't rocket science but without educated and morally upstanding leaders in place such as those who govern South Korea, Taiwan, New Zealand and Singapore - we have little chance of moving forward.chance of moving forward.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t