Reply To:

Name - Reply Comment

Last Updated : 2024-04-25 14:54:00

Asia was hit hard by the first wave of the coronavirus, as the sudden stop in activity struck households and firms simultaneously—first in China, then elsewhere in Asia and now globally. Policymakers responded swiftly with aggressive spending to support the medical response and vulnerable households and firms. And central banks took swift actions to expand liquidity.

Asia was hit hard by the first wave of the coronavirus, as the sudden stop in activity struck households and firms simultaneously—first in China, then elsewhere in Asia and now globally. Policymakers responded swiftly with aggressive spending to support the medical response and vulnerable households and firms. And central banks took swift actions to expand liquidity.

While this helped support financial markets and sentiment, we may be on the cusp of a new, more dangerous phase of ‘economic deleveraging’ as firms struggle to repay loans and pay workers in the face of a sudden collapse in cash flow and tighter credit.

Full stop

In Asia and elsewhere, small and mid-sized enterprises are at greater risk in this new deleveraging phase. They are also concentrated in services where the containment and social distancing measures have hit the hardest. Compared to large corporates, small firms have thin cash buffers, are more leveraged and rely mainly on short-term loans and retained earnings. Against this ‘crisis like no other’, small businesses face severe cash flow shortfalls with few financing alternatives.

Banks need to step forward in a major way to provide the working capital but banks too are facing their own pressures, as large firms access credit lines to boost cash reserves. With banks looking to service first their largest customers, smaller firms will be left behind to fend for themselves.

The approach in Asia so far—to encourage loan rollovers through regulatory forbearance and guarantees and provide cheap lending to banks—will help but may not be enough to save small and mid-sized firms, given banks’ capacity and reluctance to take on this risk. Neither step addresses the massive need for new working capital to keep workers employed as cash flows dry up. Some private surveys suggest that small businesses, as the major employers in these economies, may have less than three months of cash left, raising the spectre of a wave of defaults and a surge in unemployment.

To prevent this, smaller firms need a temporary lifeline—an economy-wide ‘working capital bridge loan’—that goes well beyond current policies. Such financial support is essential for maintaining jobs and incomes and preventing the downturn from turning into a prolonged depression that permanently damages the economy. Only the public sector has the means to extend this lifeline in the face of such an unprecedented shock.

Bridging divide

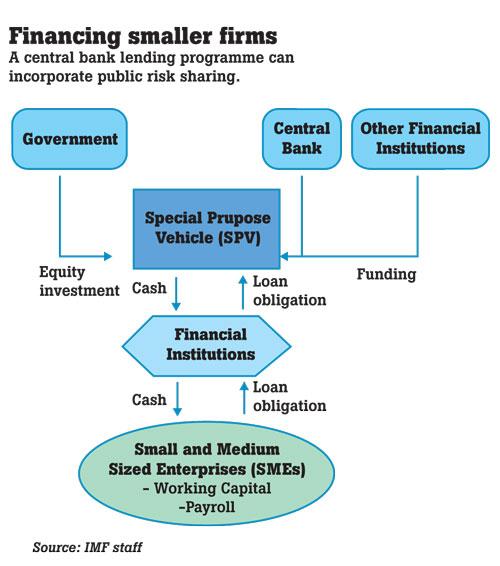

The question then is how best to do this while maintaining the proper incentives. One idea would be for the government to create a special-purpose vehicle—a temporary public entity tasked for a specific purpose, namely to facilitate new working capital loans to small and mid-sized firms.

To address those most in need, only the firms that can show they were sound borrowers last year but are now experiencing significant revenue declines from the virus, would be eligible. They would apply to banks for a new three-year loan covering working capital needs and payments (interest and principal) falling due over the next 12 months. In return, the firms would commit to maintain employment while avoiding dividends or

share buybacks.

On the public side, the central bank would provide funding to the special-purpose vehicle to purchase these new ‘working capital loans’ from the banks, thus freeing up space for banks to lend more now. The central bank would be secured by the assets of the special-purpose vehicle and receive some loss protection from the government’s initial equity investment.

Banks would retain the remaining portion of the loan to keep ‘skin in the game’. To manage the losses, the special-purpose vehicle would look to maximise recovery value and have banks collect on defaulted loans through foreclosure and bankruptcy. While this idea can apply easily to bank-centred economies, it could be extended to those with more-developed capital markets in Asia, such as Japan or Korea, by securitising these loans and selling the tranches to institutional investors for broader risk sharing with the private sector.

Whatever it takes

The alternative is for governments to use their budgets but the difference between the current crisis and past ones is the enormous scale of financing needed to roll over working capital loans for an extended period. Many emerging markets in Asia have limited fiscal space to fill in this gap using credit guarantees or lending but are under immense pressure to do whatever it takes to prevent large layoffs and defaults. Some are considering commercial banks or even the central bank directly financing the extra fiscal spending (i.e. direct monetisation).

For these economies, a risk-sharing mechanism as described above that uses the flexibility of central bank funding can achieve this objective while preserving the hard-earned central bank independence and banking soundness. Fiscal policy, by providing some loss protection, can complement monetary policy and enhance the potential economic benefits through greater lending. Governments and central banks in advanced economies, such as the U.S. Treasury and Federal Reserve with its Main Street Lending Programme, have introduced similar special-purpose vehicles with some public risk sharing to support

distressed companies.

Given the exceptional measures needed in this crisis, emerging markets in Asia could borrow a page from this playbook to do whatever it takes to rescue their economies.

(Kenneth Kang is a Deputy Director in the Asia and Pacific Department of the International Monetary Fund (IMF), covering countries in Northeast Asia, including China, Hong Kong, Korea and Mongolia. Chang Yong Rhee is Director of the IMF’s Asia and Pacific Department)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul