Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 06:03:00

Sri Lanka’s Development Strategy and International Trade Minister Malik Samarawickrama and Singapore’s Trade and Industry Minister S. Iswaran sign the SL-S’pore FTA in the presence of Sri Lankan President Maithripala Sirisena and Singaporean Prime Minister Lee Hsien Loong in Colombo, Tuesday

Sri Lanka’s Development Strategy and International Trade Minister Malik Samarawickrama and Singapore’s Trade and Industry Minister S. Iswaran sign the SL-S’pore FTA in the presence of Sri Lankan President Maithripala Sirisena and Singaporean Prime Minister Lee Hsien Loong in Colombo, Tuesday

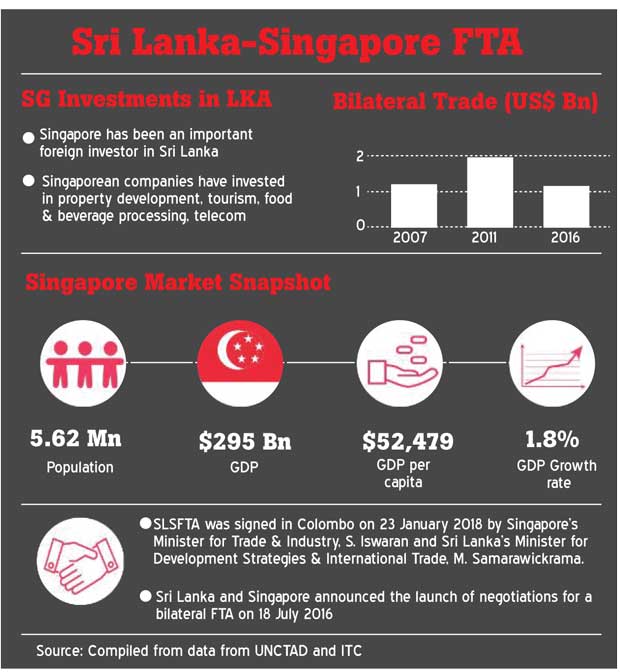

The freshly-signed Sri Lanka-Singapore Free Trade Agreement (SLSFTA) marks a new milestone in the relations between the two island economies. The agreement, signed on January 23, 2018, after almost 18 months of negotiations, is a modern, comprehensive and high-quality agreement.

The freshly-signed Sri Lanka-Singapore Free Trade Agreement (SLSFTA) marks a new milestone in the relations between the two island economies. The agreement, signed on January 23, 2018, after almost 18 months of negotiations, is a modern, comprehensive and high-quality agreement.

It covers a wide range of areas including goods and services, investment, e-commerce, government procurement, intellectual property rights, telecommunication, etc.

While FTAs aim to reduce or eliminate trade barriers and increase trade, more importantly, in the case of the SLSFTA, it demonstrates to the rest of the world that Sri Lanka is open for business, including investments, while complementing each other as hubs – Sri Lanka as a hub for South Asia and Singapore for Southeast Asia. This is in line with Sri Lanka’s Vision 2025, which aims to position the nation as an export-oriented economic hub at the centre of the Indian Ocean.

Trade between Singapore and Sri Lanka has steadily grown, with bilateral trade crossing the US $ 1 billion mark since 2006. In 2016, Singapore was Sri Lanka’s seventh largest trading partner, with total trade in goods amounting to US $ 1.14 billion, accounting for 4 percent of Sri Lanka’s total trade. Sri Lanka imported from Singapore goods amounting to US $ 1.03 billion, comprising of mostly petroleum, gold, machinery and equipment, chemicals, plastics, iron, malt and paper. Sri Lanka’s exports to Singapore during the same period totalled US $ 115 million, comprising of boats, fuel oil, tea, quartz, gems and jewellery, wheat, crabs, electrical capacitors, nuts and rubber tyres.

Singapore has also been an important foreign investor in Sri Lanka for the past two decades; it has consecutively been among the top 10 investors in recent times. Singapore firms have been active in areas such as property development (Overseas Reality Ceylon Ltd), tourism (Shangri-La Hotels), food and beverage processing (Prima Ceylon, Asia Pacific Breweries) and telecommunications (Lanka Bell).

Some of the areas in which investors from Singapore have expressed interest in Sri Lanka include warehousing facilities and logistics, service apartments, furniture manufacturing, training centres, fire safety engineering, solar solutions and retail. Likewise, Sri Lanka has identified infrastructure, BPO/IT and IT-enabled services and educational institutes, tourism, gems and jewellery and hospital and healthcare as targeted sectors for attracting FDI from Singapore.

Key features of SLSFTA

Reasons to sign the agreement

There are two compelling arguments supporting the agreement; at the bilateral level, it provides reciprocal benefits for both countries. It will enhance bilateral trade, improve the economic and investment relationship and provide more secure and open access for goods, services and investments in Sri Lanka and Singapore. But more importantly, it will help Sri Lanka advance the government’s policy of trade liberalisation and signal its commitment to economic reforms, by signing a deal with one of the most liberal economies in the world.

The FTA is also expected to encourage greater investment flows between the two countries. Singapore sees potential in Sri Lanka as a destination for Singaporean investments and a gateway to rest of South Asia, given the proximity to and trade agreements with countries in the South Asian region.

At regional level, the agreement serves Sri Lanka’s broader engagement with one of the fastest growing regions in the world - ASEAN. Stronger relations with Singapore can help Sri Lanka’s standing in Southeast Asia and participation in global value chains.

The SLSFTA is Sri Lanka’s first FTA with a Southeast Asian country – Sri Lanka has expressed an interest in pursuing trade deals with Malaysia, Thailand and Indonesia in the near future with a view to improving economic linkages with the ASEAN and joining the mega trade agreement, the Regional Comprehensive Economic Partnership (RCEP).

Future outlook

Sri Lanka’s overdependence on European and American export markets increases the economy’s vulnerability to external shocks, such as the economic recession in 2008 and the loss of GSP Plus concessions in 2010. Diversification of both export markets and the basket of exports are thus vital to position the Sri Lankan economy on a more sustainable footing. Therefore, the SLSFTA could act as a catalyst towards more proactive engagement with fast-growing economies in East Asia, through exports and investments.

The success of such an agreement, however, would also depend on sustained political will along with domestic institutional and economic policy reforms to facilitate better export sector growth and investment. For instance, Sri Lanka’s complex para-tariff structures and the existence of other non-tariff barriers could severely undermine the success of the SLSFTA.

Economic liberalisation efforts often create pockets of sub-industries that lose out. Therefore, the government should also create adequate safeguards through trade adjustment assistance schemes and ensure that the broader economy does not lose out on potential benefits due to resistance by special interests.

In fact, Sri Lanka could learn from Singapore’s previous experiences in complementing a network of strategically placed FTAs with domestic economic reforms. Therefore, the SLSFTA should be considered, not just in isolation, but as part of a broader strategy to create an economy led by private sector growth and well integrated into regional and global value chains.

(Janaka Wijayasiri is a Research Fellow and Kithmina Hewage is a Research Officer at the Institute of Policy Studies of Sri Lanka (IPS). To share your comments with the authors, please write to janaka@ips.lk/kithmina@ips.lk. For more articles, visit their blog http://www.ips.lk/talkingeconomics/)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t