Reply To:

Name - Reply Comment

Last Updated : 2024-04-23 12:32:00

A cryptocurrency is a digital or virtual currency. What is so special about it is that it uses cryptography to make its transactions secure. It has no physical form and exists only in a computer network. It has no intrinsic value. There are a few international vendors who accept cryptocurrencies as a mode of payment for goods supplied by them. The first cryptocurrency was bitcoin. It was launched in 2009 by an anonymous individual adopting the name Satoshi Nakamoto. As of now, there are over 16 million bitcoins in circulation. Today’s market cap for all bitcoins in circulation is about US $ 75 billion. The total supply of bitcoin is limited to 21 million and it is expected to reach this amount in about the year 2140. In Germany, bitcoin is recognised as a legal tender.

A cryptocurrency is a digital or virtual currency. What is so special about it is that it uses cryptography to make its transactions secure. It has no physical form and exists only in a computer network. It has no intrinsic value. There are a few international vendors who accept cryptocurrencies as a mode of payment for goods supplied by them. The first cryptocurrency was bitcoin. It was launched in 2009 by an anonymous individual adopting the name Satoshi Nakamoto. As of now, there are over 16 million bitcoins in circulation. Today’s market cap for all bitcoins in circulation is about US $ 75 billion. The total supply of bitcoin is limited to 21 million and it is expected to reach this amount in about the year 2140. In Germany, bitcoin is recognised as a legal tender.

Since bitcoin was launched in 2009, about 100 different competing cryptocurrencies are now known to exist. However, bitcoin’s success and recent surge in values is without parallel. Some of the other better known cryptocurrencies are litecoin, ripple and ethereum. Altcoins is the general name given to other cryptocurrencies other than bitcoin. Bitcoin accounts for about 50 percent of the market capitalisation of the cryptocurrency industry. In what follows in this article, the references will be limited mostly to bitcoin.

Public and private keys

The bitcoin makes fund transfers between parties easier than otherwise, essentially because transaction costs are minimal. Companies such as Circle make use of bitcoin to transfer funds at low cost when compared to traditional channels of fund transfers. These transfers are secured by the use of cryptography by what are known as the use of public and private keys.

The public and private keys consist of a long string of numbers and letters (about 30) linked by the use of mathematical encryption algorithm. The public key is similar to the number of a bank account. It serves as the recipient address to which others may transfer bitcoin. The private key is similar to the private identification number (PIN) to be used in the operation of an automated teller machine (ATM). The private key is meant to be kept as a secret by its owner.

Blockchain technology

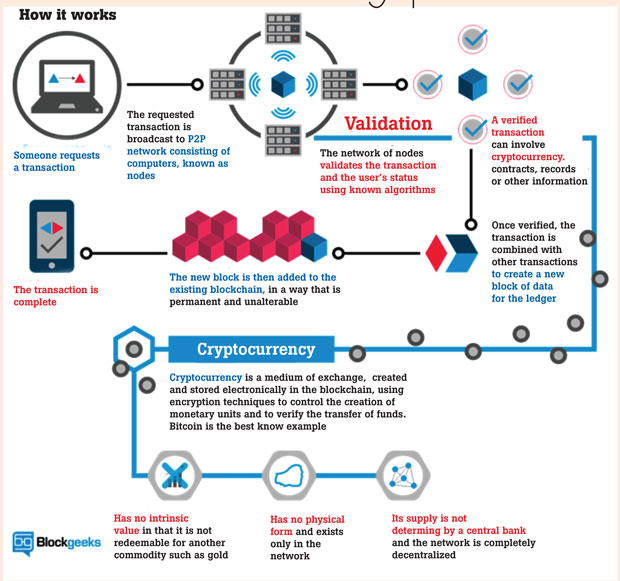

The key to the ingenuity and success of bitcoin is the use of blockchain technology. The block chain technology is used to store an online ledger. This ledger contains a historical record of all the transactions done using bitcoin. Every new transaction has to be validated and is the result of an addition of a new block to the blockchain.

Bitcoin uses what is known as ‘peer-to-peer technology’ to facilitate transfers. Peer-to-peer technology does not have a central server and is in effect totally decentralised. If the peers of the network disagree about even a single minor balance on the blockchain, then the entire network will cease to function. Consensus among all peers is the key. These peers are known as ‘nodes’ in the computer network. There is no central authority such as a central bank or a stock exchange to intervene in the event of a dispute among peers. Every node (peer) has access to the bitcoin blockchain.

Mining

Bitcoin mining is the process through which new bitcoin is created. Mining involves solving a computationally difficult puzzle to create a new block. Following creation of a new block it is added to the blockchain. This is known as Proof of Work and receives a reward in the form of bitcoin. The difficulty of the mining progresses with the passage of time.

Recent developments

There is concern as regards the ability of bitcoin to handle a growing number of transactions. This limits the growth of bitcoin making it slow and expensive. There is a possibility that a change to the software of the digital currency that creates two separate versions of the blockchain (fork) with a shared history of the blockchain may take place in November. It will be known as SegWit2x. A similar fork was created on August 1, 2017, with the creation of bitcoin cash.

Risks in investing in bitcoin

Investing in bitcoin is not for those who are averse to risk. Bitcoin investors face the following risks:

Bitcoin exchanges are entirely digital and have been at risk from computer hackers and forms of malware. If an authorised person gains access to a bitcoin owner’s computer hard drive, he/she can steal the private key of the bitcoin owner. By doing so, he/she can fraudulently transfer the stolen bitcoin to another account.

Hackers can also target bitcoin exchanges, gaining access to thousands of accounts where bitcoin is stored. Mt Gox, a bitcoin exchange, which handled the bulk of bitcoin trades, has had to close operations and file for bankruptcy protection in 2014 due to a fraud resulting in bitcoins being stolen in 2011.

All bitcoin transactions are permanent and irreversible and this could be a problem. Any transaction carried out with bitcoin can only be reversed if the person who has received the bitcoin agrees to refund the bitcoin. There is no central authority and hence no protection or source to appeal should there is a problem. Bitcoin values fluctuate wildly. Bitcoin fell from US $ 4,800 at the start of September 2017 to as low as US $ 3,300 by the middle of the month. That is a loss of over 30 percent in just two weeks. On May 1, 2017, the bitcoin value was US $ 1400 and bitcoin was traded at US $ 5700 on October 16, 2017. This is an increase in value of 300 percent in a period of just under six months.

The World Bank President Jim Yong Kim, while praising blockchain technology, was sceptic of the current price of bitcoin. Brazil Central Bank President Ilan Goldfajn has taken a dismissive stance against bitcoin referring it to a bubble or a pyramid (scheme).

For reasons of volatility and also for other reasons, if fewer investors invest in bitcoin, it may lose its value. Although at present bitcoin is the undisputed market leader among all other competing cryptocurrencies, a technological innovation of a new cryptocurrency that poses less risk cannot be ruled out and is always a threat to bitcoin. As an example, Bank of Tokyo-Mitsubishi, which is the largest bank in Japan, has indicated the possibility of issuing its own digital currency known as MUFG Coin, which is expected to be less volatile than the bitcoin. It will have a fixed conversion rate of on one MUFG Coin to one Japanese yen.

Regulation

Because of its anonymous nature, bitcoin can be used for black market transactions, illegal activity such as money laundering and even for tax evasion purposes. It poses a challenge for those countries which have exchange control laws. For this reason, the governments of some countries have shown concern. Some have banned bitcoin. China banned cryptocurrency exchanges from operations in the first week of September 2017. Some countries have issued warnings but have stopped short of banning bitcoin. Most governments of developed nations recognise bitcoin as being legal but the mode of regulation tends to vary among nations.

The problem about regulating cryptocurrency is the lack of understanding of the underlying technology without which there can be no proper regulation. The regulators who have traditionally regulated well-defined entities will now have to horn their regulatory skills and be experts in assessing the soundness and security offered by mathematical encryption alogarithms as stated by International Monetary Fund Managing Director Christine Lagarde at the Bank of England Conference held in London in September 2017.

Conclusion

Cryptocurrencies may not pose a risk to central banks as yet. This is because of the high volatility and resultant risk, which are inherent in such currencies which limit their value as a savings and investment tool. However, they should not be dismissed lightly. Cryptocurrencies may pose a challenge to central banks as regards the management of the monetary policy and on matters related to exchange control in countries where exchange control restrictions exist.

The inland revenue authorities may want to consider avenues of possible tax evasion by the investments made in cryptocurrencies. These developments should also be of concern to anti-money laundering and counter- terrorist financing agencies. Cryptocurrencies provide a fast and economical mode for transfer of funds and this is where their popularity lies. The author of this article is not aware of any initiatives undertaken in Sri Lanka to study the significance of cryptocurrencies on the Sri Lanka economy but perhaps the time is right for us to take note of cryptocurrencies.

(Rohan Fernando [LLM (London) FCMA (Sri Lanka) ACMA (United Kingdom) CGMA] is an international expert on capital market regulation)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t