Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 16:08:00

The US Federal Reserve is raising interest rates in response to improving US economic conditions. While the Asian policymakers grapple with the ramifications of rising US interest rates on the stability of their financial systems, they may soon find themselves facing another, no less significant shift in the US monetary policy.

The US Federal Reserve is raising interest rates in response to improving US economic conditions. While the Asian policymakers grapple with the ramifications of rising US interest rates on the stability of their financial systems, they may soon find themselves facing another, no less significant shift in the US monetary policy.

More specifically, on September 20, the Fed announced that it would start to unwind the massive amounts of debt securities that it added to its balance sheet since the global financial crisis. The Fed’s balance sheet normalization may herald tightening global liquidity conditions that, in turn, will affect Asia’s financial systems in the next few years. As an extraordinary response to the global financial crisis, the Fed conducted three rounds of quantitative easing in November 2008, November 2010 and September 2012 by purchasing agency securities, mortgage-backed securities and treasuries.

Between November 2008 and October 2014, when the Fed ended its bonds purchasing programmes, the size of the Federal Reserve’s securities holdings ballooned from US $ 0.48 trillion to US $ 4.2 trillion. These moves were taken to lower the long-term interest rates further after the benchmark policy rate had been brought down to near zero.

As the US economy gradually recovered from the global financial crisis, the Fed started to cautiously normalize its monetary policy. The Fed raised policy rates four times by a total of 100 basis points since December 2015, but kept the size of its securities portfolio stable by reinvesting the principal repayments of maturing securities to keep long-term interest rates down.

While policy rate hikes directly affect short-term interest rates and raise long-term interest rates when economic fundamentals become robust, the Fed’s balance sheet normalization will directly influence liquidity conditions by reducing the supply of money. Financial markets, especially bond markets, may price in the reduction of market liquidity by pushing up the entire yield curve.

Unanticipated announcements that imply tighter liquidity in an economy as large as the US could disrupt global financial stability. The ‘Taper Tantrum’ episode of May 2013, which followed an unanticipated hint by Fed Chairman Ben Bernanke that the Fed may phase out its asset purchase programme, is an example.

Financial markets frantically priced in this information during the second quarter of 2013, well before the Fed started to taper its asset purchases in December 2013. By the end of 2013, the spot yield on 10-year treasury bonds shot up to 3.2 percent and the term spread between one-year and 10-year treasury bonds widened to 3.0 percent.

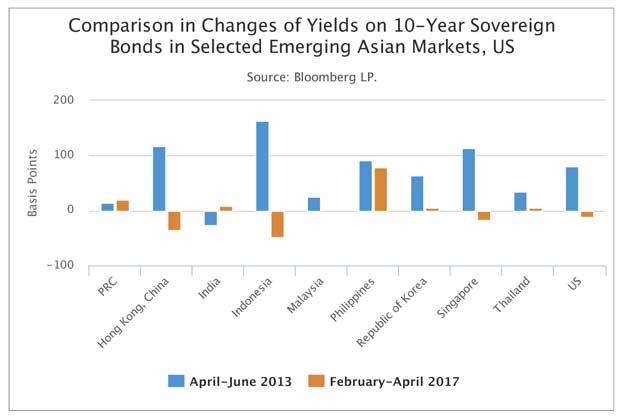

Bond yields in many emerging Asian markets also rose immediately in anticipation of tighter financial conditions during the Taper Tantrum. In contrast, following the Fed’s initial signal of portfolio holding normalization in March 2017, most regional markets remained stable except for few driven by some idiosyncratic shocks (Figure 1).

Unlike the Fed’s May 2013 signal, the Fed’s March 2017 move was widely expected by the markets. Furthermore, the Fed communicated more clearly about the mode of its balance sheet normalization – i.e. it would be based on gradually ceasing reinvestment of principal repayments rather than directly selling securities in the market. The clear signal made the reduction plan of the Fed’s securities holdings more predictable to market participants and thus cushioned the shock to financial markets. Nevertheless, the Fed’s balance sheet normalization could still act as a turning point in the hitherto easy global liquidity environment. Tightening would eventually pressure global and Asian asset prices. More generally, a change in global liquidity conditions may undermine the region’s financial stability through at least three channels.

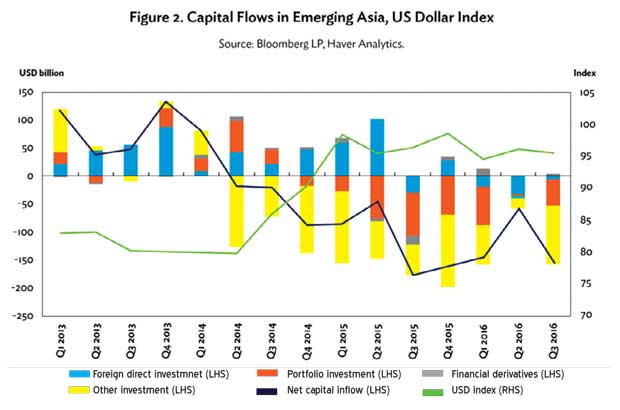

First, US monetary policy tightening would strengthen the US dollar and increase the rate of return on investments in the US and attract capital inflows into the US. This could trigger capital outflows from emerging Asian economies, which are historically sensitive to the US dollar index (Figure 2).

Second, long-term financing costs may rise as the US monetary normalization pushes up bond yields. Given growing global financial integration, higher US bond yields may spill over to emerging Asian bond markets, discouraging financing activities and possibly hurting investment and growth.

Third, the leverage built up in Asia during the recent period of low global interest rates challenges regional financial stability. Currency depreciation increases the repayment burden of borrowers with US dollar-denominated debt.

Tighter liquidity would further pressure valuations and push down asset prices, challenging the balance sheets of financial institutions and corporations with a high degree of leverage and significant debt exposure. In short, although the spillover effects of Fed’s balance sheet normalization plan are likely to be manageable in the short term, the tighter global financial conditions that normalization entails suggests that it is high time for emerging Asia to prepare itself by further strengthening its financial conditions.

(Donghyun Park is Principal Economist, Economic Research and Regional Cooperation Department, ADB. Arief Ramayandi is Senior Economist, Economic Research and Regional Cooperation Department and Economist and Shu Tian is Economic Research and Regional Cooperation Department)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t