Reply To:

Name - Reply Comment

Last Updated : 2024-04-20 00:00:00

Despite its natural and human resources, Sri Lanka has been unable to move forward without borrowing from foreign institutes and countries, which have their own terms and conditions, further impoverishing the beneficiary countries. Every government that comes into power and plans to remain in power, has to execute some welfare programmes, most of which are funded by debt taken at a higher interest rate and unfavourable conditions. Therefore, all the governments that ruled the country since independence ought to be equally responsible for such a debt burden put on the public whose income is taxed for settling debt.

Despite its natural and human resources, Sri Lanka has been unable to move forward without borrowing from foreign institutes and countries, which have their own terms and conditions, further impoverishing the beneficiary countries. Every government that comes into power and plans to remain in power, has to execute some welfare programmes, most of which are funded by debt taken at a higher interest rate and unfavourable conditions. Therefore, all the governments that ruled the country since independence ought to be equally responsible for such a debt burden put on the public whose income is taxed for settling debt.

An individual or a government has to go for debt in order to expand the revenue-generating sources, improving living standards and creating employment, most of which can never be done with the prevailing capital. Hence, no one can say that a country should not take loans. Problems arise as to what governments take loans for and within the repayable limit. If an individual takes loans for consumption purposes, he will be in a debt trap. Same is applied even for a country.

Background

It is needless to state that any government highly contributes towards the ever increasing debt mountain, in the sake of development. This has become a so vicious cycle which cannot be broken that the country has to take more loans to settle the previously taken ones. This has given nothing other than making the nation trapped in debt.

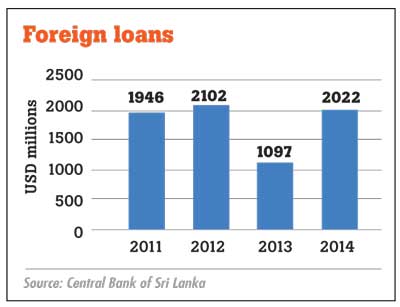

The graph shows how Sri Lanka has taken loans over the past few years. It can be clearly seen that taking loans is going up annually and a sudden decrease in 2013. The main debt sources for the country are the Asian Development Bank, China and Japan.

The government has to take loans when its income is not sufficient. If we look at the figures, the government’s revenue in 2014 was Rs.1,195,206 million, while expenditure and net lending was Rs.1,795,865 million. Furthermore, the central debt outstanding in 2014 was Rs.7,390,899 million. It seems that public debt has been a severe burden on the people.

Public assets

Public assets are owned by people in the country and directly or indirectly managed by the government. When it comes to business, mainly, two types of opinions can be seen. The first is that the government should refrain from running businesses. Their duty is to draft proper policies, making a conducive environment for businesses. The second is that the government must get involved in managing the public assets in order that it can make sure public well-being, creating public sector employment, which eventually leads to a victory at elections.

Public assets can be put into two buckets: commercial assets and non-commercial assets. Commercial assets mean the assets which operate commercially and can be privatized at any time, leaving no harm to the public. Non-commercial assets mean the assets that mainly operate to ensure the well-being and can never be sold to the private sector because they are not interested in. Here, the discussion is on commercially-valued businesses, which are inefficient and underperforming.

It is due to various financial and human factors that many public enterprises are incurring losses but seem to have a potential to blossom in the industry. However, there is a strong public opinion motivated by certain political parties that the public assets should not be privatized under any circumstances. Moreover, the most important question to be asked is not whether privatization is right or not but what will be done with those monies.

Selling assets

Selling public assets cannot be taken as the last resort. Changing their administration and business culture might be the way forward to turn positive. Nevertheless, it seems that the fact that the government is to divest its interests in hotels, hospitals and few other industries is connected with debt settling.

The media reported that Central Bank Governor Dr. Indrajit Coomaraswamy addressing the Fitch Rating’s Sovereign and Banking Forum held recently stated monies from the public asset sale, which will be collected in a separate account maintained under the Central Bank, would be utilized to settle the short-term debt.

When we look at this in an economic perspective, selling assets, which generate cash inflows into a business or an economy, questions its financial position and existence. Generally, it is when a business is closed down that its assets are sold, as it needs assets to operate and generate cash inflows. Furthermore, it doesn’t matter assets generating cash outflows are sold out for the betterment of a business or an economy. If we see a business selling its assets with potential to settle loans, we say it’s facing a threat of bankruptcy because the asset base is very important to continue a business smoothly and generate more and more cash inflows in the future. Hence, selling national assets to settle loans might send some negative signals of the economy. However, it might be better than taking loans at higher rates to settle the existing loans.

(Amila Muthukutti is an economist who has widely published covering the areas of economics and business management)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t