Reply To:

Name - Reply Comment

Last Updated : 2024-04-26 02:12:00

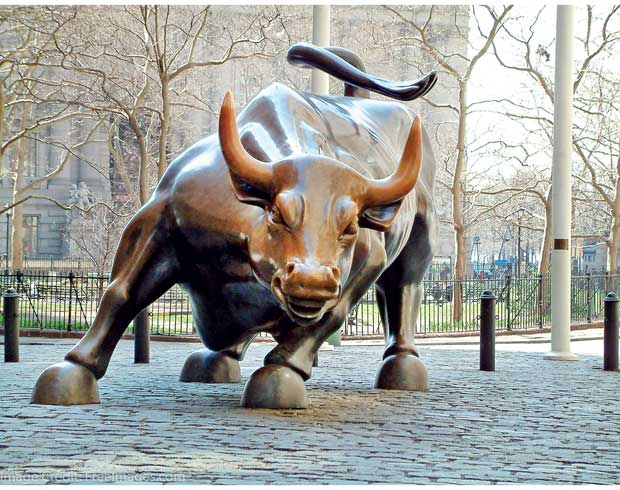

Global stock markets had a good spurt in 2017. But as the old saying goes, every party has to end sometime. That’s the troubling thought that’s been nagging at many investors this year, even as they’ve continued to profit from global stock markets. Positive economic trends and transformative changes in technology are helping many companies deliver standout returns.

As we roll into 2018, analysts believe that global stock markets will continue to remain lucrative and they don’t expect a correction by any means. The article gives us the case for why the good times should continue to roll. The following factors support the 2018 bullish investment thesis.

Global economic expansion – No US recession in sight

The global stock market (as represented by the MSCI AC World Index) has posted a gain for 12 consecutive months (a record) and is on track for every single month in a year for the first time in the 30-year history of the index. Every one of the world’s 45 largest economies tracked by the Organisation for Economic Cooperation and Development is expanding. Economists are forecasting acceleration in world gross domestic product (GDP) in 2018 from 2017 levels.

In the US (the global economic giant), the Leading Economic Index and Treasury Yield Curve, are showing no signs of an impending recession. For the yield curve, if short-term yields are higher than long, that often signals a problem. That’s not the case now.

China stable and growing

In late 2015 and early 2016, concerns about decelerating growth in China caused investors to fear a global recession. China did not economically fall apart. Chinese GDP rose 6.8 percent in the third quarter year-over-year, September retail sales were up 10.2 percent, industrial production advanced by 6.6 percent and fixed-asset investment climbed 7.5 percent in the first nine months of 2017. The feared slowdown morphed into a stable growth environment.

Global easy money – Public and private credit markets pro-growth

Europe and Japan continue with quantitative easing. In the US, corporate debt issuance is at new highs. Money raised in the corporate debt market is bullish for equities as these funds are used for stock buybacks, dividends, capital expenditures, mergers and acquisitions and retirement of more expensive debt. Corporate balance sheets are in excellent shape.

Earnings at all-time highs and rising

The ‘earnings per share’ for the MSCI AC World Index (ACWI) is above US $ 30. In the US, the S&P 500 consensus earnings estimate is expected to advance by about 11 percent year-over-year (YoY) on revenue growth of about 5 percent, off record levels reached in 2017.

Market shift to technology – Strong secular growth drivers

From the top 10 largest corporations in the world in 2009, only one was a technology company – Microsoft. Today, seven of the 10 largest companies worldwide are technology companies. The shift to a technology dominated economy provides a boost to earnings growth rates.

Equity fund flows are positive but below historic highs. Globally, investors are putting money into stocks at a decent clip, up over 40 percent this year. This shows an optimistic sentiment but hardly a frothy one. The previous high was in 2013, when the market was rebounding from the financial crisis.

Prospects for local investors

There’s good reason for a positive outlook for local investors as we go into a new year. The Colombo Stock Exchange (CSE) was in line with the upward trend recorded in global markets as the All Share Price Index (ASPI) recorded a growth of 2.1 percent during 2017. It was a clear deviation from the negative growth of 9.6 percent and 5.5 percent experienced in 2016 and 2015, respectively. Furthermore, the net foreign inflow stood at an impressive rate of Rs.17.5 billion and was the key driver of market growth during last year.

As our local investors step into a new year, it is important for them to think deeply about the global trends and adjust their portfolios accordingly. The following tips will enable you to maximize returns in 2018.

Smart moves for 2018 and beyond

To be contrarian in this context means that when most people are euphoric about stocks, you’re becoming cautious for rational, mathematical reasons. And when most people are afraid due to recently losing money in a downturn, you’re becoming optimistic because you see how undervalued many businesses are.

To be contrarian in this context means that when most people are euphoric about stocks, you’re becoming cautious for rational, mathematical reasons. And when most people are afraid due to recently losing money in a downturn, you’re becoming optimistic because you see how undervalued many businesses are.

Most of histories incredibly successful stock investors – the ones that went on to manage billions of dollars – were value investors; by extension it means they were contrarian. They saw value where others did not and they avoided expensive companies that everyone else was enamoured with.

Sometimes, an otherwise good, wide-moat company has a low valuation because it has too much debt. This can result in a good value situation, where a contrarian investor realizes that the company is undervalued and that although it’s risky to invest, the probability is in his or her favour.

If you’re taking a more conservative approach, though, avoid high-debt companies. Pretty much the only thing that can sink a wide-moat company quickly is mismanaged debt.

Having your portfolio allocated to several different sectors, companies, countries and asset classes vastly reduces the probability of losing a major amount of capital in a short time period.

It is best to keep your portfolio debt-free. That takes the pressure off and allows you to ride out long market downturns.

(Source: Forbes)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul