Reply To:

Name - Reply Comment

Last Updated : 2024-04-20 00:00:00

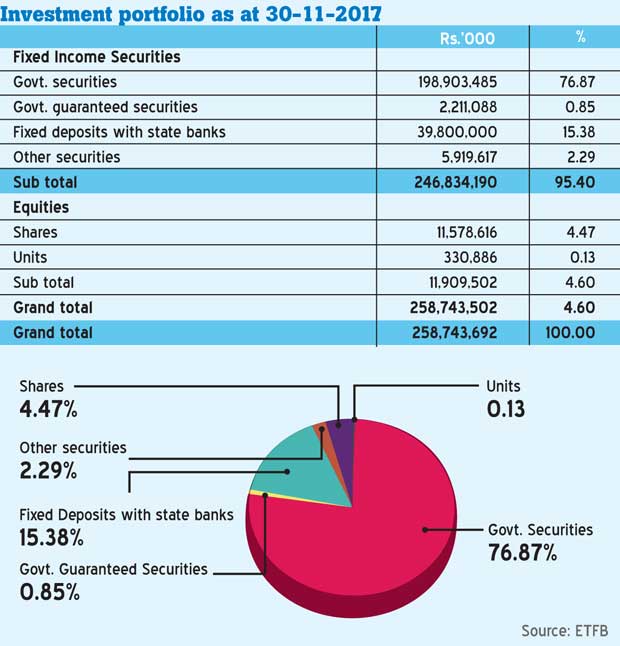

While activities concerning the Employees Provident Fund (EPF) came under much scrutiny in recent times, its sister fund the Employees’ Trust Fund (ETF) has seldom been discussed. Even when discussed, many have pointed to a looming merger of the two social security programmes, followed by fears of the funds being open to abuse and misappropriation.  Substantial portions of the ETF investments are invested in gilt-edged government securities; and yet many have opined that its beneficiaries are not receiving the highest available returns. Established under Act No-46 of 1980, the Employees’ Trust Fund Board (ETFB) initially commenced operations under the Labour Ministry. As of June 2017 the ETFB functions under the Ministry of Development Assignments and covers all private sector employees and all public sector employees who are not entitled to the Government pension scheme. With an estimated 79,000 employers contributing 3 per cent of the gross earnings of their employees to the fund on a monthly basis, the ETFB today boasts of a 270 billion fund.

Substantial portions of the ETF investments are invested in gilt-edged government securities; and yet many have opined that its beneficiaries are not receiving the highest available returns. Established under Act No-46 of 1980, the Employees’ Trust Fund Board (ETFB) initially commenced operations under the Labour Ministry. As of June 2017 the ETFB functions under the Ministry of Development Assignments and covers all private sector employees and all public sector employees who are not entitled to the Government pension scheme. With an estimated 79,000 employers contributing 3 per cent of the gross earnings of their employees to the fund on a monthly basis, the ETFB today boasts of a 270 billion fund.

Benefits Galore

Mahinda Madihahewa - Chairman / Chief Executive Officer, Employees’ Trust Fund Board

The ETFB has three main functions; the collection of funds, investment and member services. Elaborating on these services ETFB Chairman Mahinda Madihahewa speaking to the said that the board spends approximately 500 million per year, under three types of benefit schemes, without levying any charge from its employers. Out of the 10 benefit schemes of the ETFB, six fall under the criteria of health. The heart surgery scheme, kidney transplant scheme, intra-ocular lens implant scheme, disability scheme and death benefit scheme are some of the welfare schemes provided for its active members by the ETFB.

“As this is a voluntary scheme, those who are self-employed can pay Rs. 500 per month and they will be entitled to all the benefit schemes offered by ETFB. This is also valid for foreign employment and benefits can be obtained if a migrant worker pays a fee of $10 or Rs. 1,000. This is the special feature of the ETF, whereas this facility is not provided by the EPF. At the moment we have about 40,000 self employed people contributing to the fund,” Madihahewa said, speaking on the special scheme provided for self employed persons.

Out of the 10 benefit schemes of the ETFB, six fall under the criteria of health

ETFB has 18 regional offices across the island

“We are also in the process of signing a Memorandum of Understanding (MoU) with the Sri Lanka Bureau of Foreign Employment (SLBFE). We’ve had several rounds of discussions with SLBFE to this end. Our goal is to cover all Sri Lankan foreign employees, including returning migrant workers through our fund, so that they too can benefit from this social security scheme,” he added.

Asked of the awareness initiatives undertaken by the ETFB, Madihahewa said the board has launched mobile service through which employees can seek services. “Last year we implemented the ‘Janapathi Jangama Sewa’ to expand the reach of our services. ETFB has 18 regional offices across the island and one of our key focus areas is the plantation sector, as many workers there do not have an identification number.” He said the ETFB together with the Central Bank, Labour Department and the Department for Registration of Persons, have launched a joint project where such workers receive an identification number.

“We are in the process of introducing something called the ‘Unit Number’. The Unit Number is the identification number given for members of both the EPF and ETF. Following the appointment of a committee by the Prime Minister, to introduce an EPF and ETF tracking system, we have signed a MoU with the Department for Registration of Persons, the Department of Labour as well as the Central Bank. The unit number will therefore facilitate this initiative. Until now, employers had to provide the members with the identification number. We are in the process of converting this system into an employee centric system, where the unit number will replace the identification number,” Madihahewa explained.

Madihahewa took office three years ago and has since overseen many projects, including the restructuring project of the board. The ETF Inspection System Application (EISA) is one such project undertaken by Madihahewa. ETF’s Enforcement Officers have been provided with tabs that possess details of members and employees, in an effort to digitise the field work of the board. The project is carried out with technical assistance of the International Labour Organisation (ILO) together with the Finance Ministry. “All our officers have been trained by the ILO technical officers. A training programme is currently underway for our employees to aid our digitisation efforts. There is also an ICTA project involving Rs. 120 million in funds. Our software is more than 15 years old. Under the restructuring process we are now re-engineering the entire computer system,” Madihahewa said.

The ETFB Chairman is also seeking to improve its human resource management programme under which he aims to make several changes to the board. “Earlier contributors had to wait for long periods of time -- ranging from 3 to 6 months-- to get their monies. But now we have an express service, where an employee, upon requests made during the morning, can obtain his or her money by 2.00 pm. Other services have been expedited to serve members within three to seven days. Our services were decentralised recently. In addition to the ETFB office in Nuwara Eliya, we established one in Vavuniya last year, along with an office in Jaffna, while we are also extending our services to Trincomalee as well.” he said.

Productivity improvement is another goal of the ETFB as officials attempt to reduce the waiting time of members who seek their services. These efforts have been carried out with the help of the National Productivity Secretariat. “ETFB employees owe their services to the working population of this country, which is 8.5 billion. There are 1.4 billion workers in the public sector with the remainder working in the private sector and semi-government sectors. We have only covered 2.6 billion of this workforce, with our limited resources. The ETFB is looking to increase our enforcement cadre, who will be responsible for providing our services to employees without having to come to Colombo,” Madihahewa said of the board’s ambitious future plans.

Adequate Assistance

Anton Marcus, Joint Secretary, Free Trade Zones & General Services Employees’ Union

The also spoke to the Joint Secretary of the Free Trade Zones and General Services Employees Union Anton Marcus to obtain his views on employee awareness on the ETF process and benefits. Speaking on awareness of the ETF among workers, Marcus said in terms of contributions there is no great difference between the EPF and the ETF. “Every employer which contributes to the EPF also contributes to ETF. For us however, the EPF is something we can redeem as a long term reward, when we are looking at retirement. In contrast we are able to claim short term benefits from the ETF. Our members are of the belief that they are able to claim these benefits when required,” he said.

Asked of inconveniences faced when attempting to claim benefits, Marcus noted that there are many members who faced difficulties in filling out forms, which require assistance from the employers. “There are some details which should be filled out by the employers. Since an employee is only able to claim these benefits only once in five years, we have come across instances where employees were not assisted by their employers. In the event where a company has shut down, there are members who have been rendered helpless, as there is no employer to fill this part of the form,” Marcus said.

In the event where a company has shut down, there are members who have been rendered helpless

“Sometimes if a company has not suspended its operations, but are pivoting operations or changing its name, employees are given a new letter of appointment. In such instances the ETF has notified us that this action is recorded as a termination of employment. The board has also arrived at a decision that employees can’t claim benefits if there is such a termination of employment. When one of our members faced such a situation last year, we had to go through great difficulty and claimed benefits through the intervention of the Chairman. As far as I know, almost 50 employees of two factories faced this problem. There may be more people who had to face similar circumstances,” he added.

not easy to misappropriate funds

Wasantha Samarasinghe, JVP Politburo member

While the ETFB boasts of exemplary services to the working population of the country, experts point to several issues in the grand scheme of things. The spoke to JVP Politburo member Wasantha Samarasinghe who in his brief comments noted that while it is not an easy task to misappropriate funds of the ETF due to legal constraints, it is vital that the investments made on behalf of the public be made considering optimum benefits to the contributing members.

Errors and Misconceptions

Sunil G Wijesinha, Former Chairman of ETFB

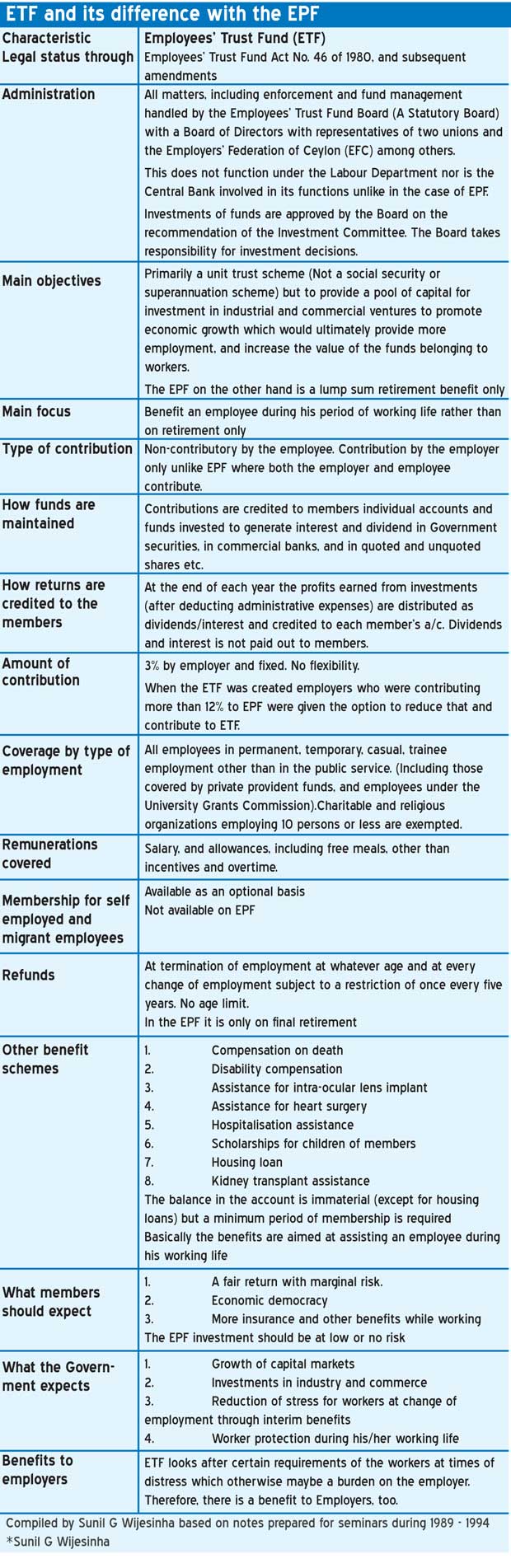

Echoing his sentiments is a former Chairman of ETFB Sunil G Wijesinha, who subsequently served on the Board of Directors on three other occasions. He believes there is much confusion about the respective objectives of the two funds and rationale for setting up the ETF. Speaking to the Wijesinha said having participated in panel discussions as both a panellist and a participant where EPF and ETF have been discussed; he is appalled by misconceptions on the two funds, highlighting the need to have informed discussion on the matter.

The ETFB ignoring the fundamental philosophy behind each scheme

During the establishment of the ETF in 1980, the purpose of the Act was to ensure a gratuity to all employees

“Some officials have admitted that new schemes have been introduced by the ETFB ignoring the fundamental philosophy behind each scheme,” he said. Explaining further Wijesinha said the EPF was created as a superannuation scheme, an organizational pension program created for the benefit of employees. “The ETF on the other hand is widely accepted as the idea of late Lalith Athulathdmudali who wanted to create a fund which could be partly used to finance industrial and commercial ventures and thereby benefit the working population by creating more employment. At that time worker participation in management was a popular concept and therefore the concept included economic democracy and worker participation in management through equity investment as objectives,” Wijesinha noted.

As per the broad outline of the ETF scheme announced during the establishment of the ETF in 1980, the purpose of the Act was to ensure a gratuity to all employees and to enable the investment of monies in the fund for purposes beneficial to the employees. This was in contrast to the case of EPF from which there is state borrowing. However Wijesinha notes that these fundamentals have been ignored by authorities in the recent past.

“Why would the Government create two funds for the same purpose if the purpose was to endorse state borrowing?” he questioned. “This is the reason why, when attempts were made to amalgamate the EPF and ETF funds, I pointed out the error in deliberating this course of action without understanding the fundamental purposes of the two funds. I have notified the Premier in this regard in writing, to which I have not received a response. We need elaborate public understanding and discussion on this matter, so that the positive objectives of setting up these funds would not be lost,” Wijesinha stressed. Responding to a query on the security of the funds, Wijesinha noted that there exists an unfounded fear among many uninformed members that their savings are not actually available. The reason for this fear has been attributed to assumptions that the Government has appropriated them. “Even educated private sector managers have expressed this fear. More communication is required to educate employees that their funds are safe. With over 95 per cent investments in Government securities there should be no doubt that the funds are safe,” he said, stressing however that this was not the desired objective of the establishment of the fund.

Speaking on the objects of the ETFB and the clause on promotion of employee participation in management through the acquisition of equity interest in enterprises, Wijesinha said it is his belief that this dangerous object should be removed.

“There were clear instances when the ETF acquired significant stakes in companies which were being privatised, thus completely defeating the objective of privatisation. In one instance the ETF acquired 90% of the equity of a company being privatised. By and large the objects for which the ETF was formed has been achieved, but it was only in the early 1990s that a clear identification of what ETF stands for, and the difference between EPF and ETF, was made. This enabled many who argued that the ETF was a mere duplication of EPF to realise the difference,” Wijesinha opined.

The former ETFB Chairman underscored that it is imperative the authorities re-visit this and re-define the objectives in line with current requirements, without deviating from the objects specified in the ETF Act. “The Board should not be callous in its equity investment policy. Every investment however small must be transparent and justified. The investment in shares is grossly insufficient and defeats the purpose for which this fund was set up,” Wijesinha underscored. He added a separate study is required to determine whether the EPF and ETF have provided a fair return at least equivalent to the savings interest rate of the National Savings Bank.

“I hope the policy makers would not lose sight of the useful objects of ETF and would formulate two funds to be managed by one body and continue the programmes that would benefit employees during their working life and continue to promote those techniques which would provide a safer workplace and create healthier workers,” he reiterated.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t