Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 16:08:00

By Ganeshan Wignaraja

After the collapse of the Doha round of world trade talks last December, trade deals and pacts such as the Trans-Pacific Partnership (TPP) and the Regional Comprehensive Economic Partnership (RCEP) are becoming even more central to the region’s trade architecture and the future of global commerce.

While the TPP and RCEP are often painted as rival trading blocs, how they could fit together is the weighty question facing Asia and the world economy today.

The rivalry between TPP and RCEP stems from several important differences. The TPP and RCEP have different backers with distinct economic interests. The U.S. has led TPP talks and is pivotal to the process.

The People’s Republic of China, the world’s second largest economy and the assembly hub of global value chains is not party to the TPP. Neither is rapidly growing India, which has a comparative advantage in information technology services and is fostering manufacturing development through its “Make in India” program. Supported by China and India, smaller members of the Association of Southeast Asian Nations are driving negotiations for the RCEP, which does not include the U.S.

The difficult TPP negotiations took seven years to reach an agreement that was signed in February 2016. That agreement is now in a two-year ratification period in which at least six members must approve the final text for the deal to be implemented. But U.S. presidential candidates have spared no effort criticizing it, making near-term ratification uncertain.

The RCEP has been under negotiation for three years with the 13th round taking place in Auckland mid-June. Services liberalization and the movement of Indian professionals within RCEP countries is reportedly a sticking point in the talks. Nonetheless, under pressure from the TPP, negotiators are hoping to finalize the RCEP agreement in 2016.

More ambitious than RCEP

The TPP seems more ambitious than the RCEP. The pact has been billed as a 21st-century trade agreement focusing on new market access in goods and services and spreading good regulatory practices. Going beyond most Asian free trade agreements, it sets high standards in labor and environmental rules, competition policy, state-owned enterprises, regulation of intellectual property, rules for the internet and the digital economy.

The RCEP, however, is largely about ensuring order among the more limited and somewhat inconsistent trade rules in ASEAN’s FTAs with major regional economies. At the RCEP’s core is a goods agreement which aims to harmonize tariff schedules and rules of origin for Asia’s sophisticated global supply chains. The partnership also seeks to improve market access in services and investment as well as introduce a dispute settlement procedure.

The RCEP seems more development-friendly than the TPP. It promises special and differential treatment for developing economies which may make it easier for them to join the bloc. This implies gradual tariff liberalization and longer transition times for impoverished countries like Cambodia and Myanmar. The pact also promises development assistance through economic and technical cooperation provisions. The TPP, meanwhile, applies the same high-standard trade rules for developed and developing countries.

While both agreements will generate notable income benefits, larger gains arise from the more ambitious TPP. Projections by the Asian Development Bank, generated from a multi-country, multi-sector computable general equilibrium model, indicate that the RCEP provides global income benefits of about $260 billion. Similar studies of the TPP project larger global income benefits of $320 billion to $400 billion.

Manufacturing, global value chains and services are likely beneficiaries while agriculture and mining may lose out. As differences exist in assumptions and model structure, these studies are indicative, rather than strictly accurate. Furthermore, these projections represent the minimum benefits as CGE models do not incorporate adequately many of the high-standard rules particularly in the TPP in sectors such as investment, intellectual property, labor and environment.

Twin routes

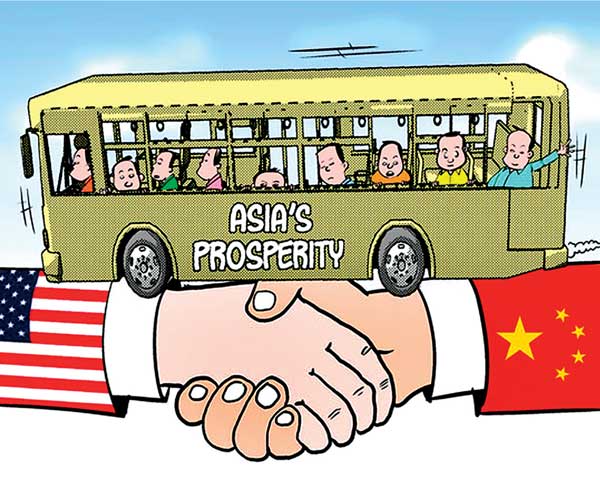

These differences notwithstanding, the TPP and RCEP are better seen as complementary pathways to a rules-based regional trading system in Asia.

First, some Asian economies enjoy certain advantages by being party to both trade pacts. These so-called “overlapping members” include four ASEAN members (Brunei, Malaysia, Singapore and Vietnam) as well as Japan. For instance, their companies could enjoy TPP tariff preferences when selling to the U.S., and also RCEP tariff preferences when sourcing parts and components from China or India. Clearer regional trade rules including those on investment and dispute settlement would also be available. Eliminating tariffs and streamlining business regulations can translate into real cost advantages for companies in global value chains. Moreover, if one agreement were to be derailed, the other could still be available. It seems thus advisable for Asian countries to sign up to both agreements.

Open accession seems to be a feature in both pacts. The number of overlapping members could increase. From Asia, South Korea, Indonesia, the Philippines and Thailand have expressed interest in joining the TPP. For the RCEP, any ASEAN FTA partner that was not a member of the initial negotiations can join later, provided it meets terms agreed with other participating economies.

For example, the U.S. might conclude an FTA with ASEAN as a group and initiate RCEP membership. The hope that China and possibly India might eventually join the TPP would strengthen the coverage and economic benefits of the agreement. After all, China and India are gradually implementing their own long-overdue structural reforms. China has begun reforming its state-owned enterprises though mixed ownership of state firms and efforts to improve their corporate governance. India is loosening its regulations on equity limits for foreign investors.

Second, it is possible that the TPP and RCEP could be merged into a region-wide FTA -- a Free Trade Agreement of Asia and the Pacific. At the Asia-Pacific Economic Cooperation Summit in Beijing in November 2014, leaders launched a collective study on issues related to the realization of the region-wide FTA; the results of the exercise will be reported at the APEC Summit in Peru in November. Interestingly, this collective study is being co-chaired by China and the U.S., which bodes well for the future of Asia-Pacific trade. Negotiations for a China-U.S. bilateral investment treaty are also reportedly nearly complete.

An optimal outcome would be a region-wide agreement that combines high-standard liberalization in the TPP, special and differential treatment for developing countries in the RCEP and open accession. If designed well, such a comprehensive deal could rationalize the region’s trade rules and effectively render the TPP and RCEP redundant.

Trade liberalization

Asia needs the stimulus of trade liberalization to open markets, promote the deepening of global value chains and foster growth in challenging economic times. Worryingly, unilateral and global trade liberalization has stalled. Proliferating bilateral agreements run the risk of an Asian noodle bowl of FTAs, which can raise transaction costs for businesses.

Influenced by panoply of lobby groups, murky non-tariff protectionism has been rising globally and residual tariff barriers in agriculture and sensitive manufacturing sectors stubbornly persist. Discontent about jobs and wages amid widening income inequality and a shrinking middle class have fueled political populism. Complementary national policies -- including social safety nets, retraining workers, finance for small and medium enterprises and rural infrastructure investment -- will help mitigate losers and create domestic constituencies for trade liberalization.

Mega-regional trade agreements like the TPP and RCEP offer the best solution for trade liberalization and to bolster growth in Asia. Supporting open accession, an eventual Asia-Pacific FTA and complementary national policies are important means towards this end. The imaginary campaign trail bluster on the TPP will likely diminish once a new U.S. president takes office and the reality of continuing with a strong economic and political relationship with Asia sinks in. Asian countries should thus drop the “one or the other” mindset and start thinking “both” to the TPP and RCEP.

(Ganeshan Wignaraja is adviser in the economic research and regional cooperation department of the Asian Development Bank)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t