Reply To:

Name - Reply Comment

Last Updated : 2024-04-23 18:28:00

By Jayani Ratnayake and Anushka Wijesinha

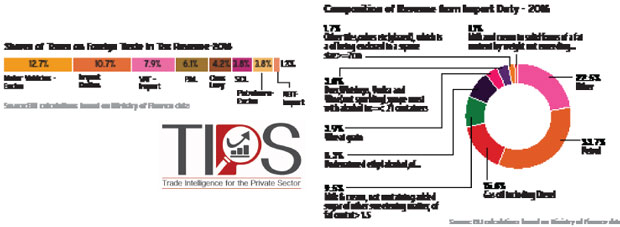

Year after year, Sri Lanka continues to rely heavily on foreign trade taxes as a key source of government revenue and the latest fiscal numbers for 2016 show that this trend has not abated. Taxes on foreign trade accounted for 50.5 percent of the total tax revenue generated in 2016 and a handful of import tariff lines contributed the bulk of import duties.

Revenue from fuel imports high in 2016

Revenue from import duties grew by 18.4 percent to Rs.156.5 billion in 2016 supported by the significant increase in revenue from two major revenue categories, petrol and gas oil (including diesel).

Petrol imports contributed to 85.8 percent of the increase in revenue from import duty in 2016, consequently playing a bigger role in total import duty revenues, from one-fourth in 2015 to one-third in 2016.

Additionally, the import duty from ‘gas oil (including diesel)’ grew by a sharp 155.6 percent and doubled its share in import duty revenue from 7.2 percent in 2015 to 15.6 percent in 2016.

Few items contribute most import revenue

Even within Sri Lanka’s heavy reliance on foreign trade taxes, there is a high concentration in a narrow number of tariff lines. Just eleven HS codes (at six digit level) contributed to 77.5 percent of import duty revenues in 2016 (see Figure 2) and is a sharp rise from 50.3 percent a year earlier.

Two products, petrol and gas oil (including diesel), collectively brought an increased revenue of Rs.35.7 billion in 2016. The share of these two products in import duty improved from 31.3 percent in 2015 to 49.2 percent in 2016.

Four products classified as beverages and spirits accounted for 12.1 percent in 2016 compared to 6.4 percent share recorded in 2015. This increase was driven by the significant increase in import duty collected from import of beer, which grew by 4351.4 percent YoY in 2016 (likely due to the exception granted to imports, following the flood damage to local producers).

VAT, PAL, CESS also higher in 2016

The value-added tax (VAT) on imports rebounded from the negative growth of 34.1 percent recorded in 2015 and contributed to 24.3 percent of the growth in tax revenue in 2016. Meanwhile, revenue from Port and Airport Development Levy (PAL) increased by 51.5 percent to Rs.88.8 billion, aided by the upward revision of the PAL rate from 5 percent to 7.5 percent.

Meanwhile, revenue from cess grew by 33.4 percent to Rs.61.7 billion in 2016 aided by the increase in revenue from import cess by Rs.16.6 billion. Revenue from cess on exports contracted marginally by 1.5 percent on year-on-year terms in 2016.

Policy changes in 2016

In 2016, a three-band tariff structure was introduced to customs duty consisting of 0 percent, 15 percent and 30 percent with a view of achieving a simplified duty structure. The standard PAL rate was revised to lower rate of 2.5 percent for certain plant and machinery used in construction, agriculture and dairy industry and raw material used in the pharmaceutical industry.

2017 performance so far

Looking at this year’s revenue performance so far, 1Q generated 22.4 percent of the import duty revenue estimate for 2017, marginally lower compared to the same period last year, of 24.9 percent. Import duties are forecasted to contribute to 9.1 percent of the tax revenue in 2017.

Reforming trade tax reliance?

The heavy reliance on trade taxes as a key source of revenue needs to become a critical focus area of trade and fiscal policy reforms. This no doubt course becomes challenging when the majority of trade tax revenue comes from a handful of import lines. Yet, it becomes easier to make substantial reforms to non-sensitive import lines – ones that would have a minimal revenue impact but disproportionately high impact on spurring international trade.

For a small trade-dependent economy, Sri Lanka must structure a sensible trade tax structure, one that promotes import and export trade, does not unduly burden large numbers of consumers in favour of a small number of producers, does not create uneven playing field for domestic producers vis-à-vis importers and most importantly, spurs Sri Lanka’s participation in global production sharing (‘networked trade’) and international logistics.

(Jayani Ratnayake and Anushka Wijesinha are economists at the Economic Intelligence Unit of the Ceylon Chamber of Commerce. This article is part of the chamber’s ‘Trade Intelligence for the Private Sector’ (TIPS) initiative. Write to eiu@chamber.lk to engage)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t